Hello all and welcome to the unofficial start of the school year. Hopefully your kids have those first day of smiles all ready as we embark on another year. And for the rest of us, back to a traditional work life balance as summer ends and we move into fall. This also means conference season is back on. Join us at an upcoming event to chat in person.

Chad Krueger and Pam Jones

CAB Events

- CVSA, Commercial Vehicle Safety Alliance Conference

September 8-12, Big Sky, MT

- WI Motor Carriers Association Annual Convention

September 12-13, Elkhart Lake, WI

CAB Webinars

Tuesday, September 10th | 12p EST

Chameleon Carriers and Interrelated Entities | J Slaughter and special guest Shuie Yankelewitz

Learn more about the concept of a chameleon carrier, interrelated entities, and the features CAB provides to identify and understand the relationships that may exist between motor carriers.

Tuesday, September 17th | 12p EST

Motor Carrier Identification Details & Credentials | Pam Jones

Join Pam to hear solutions for common questions CAB receives around the motor carrier’s details from the MCS-150, data posting timing, and latest on Login.gov and CAB access to FMCSA Portal.

To register for the webinars, click the button below to sign into your CAB account. Then click live training at the top of the page to access the webinar registration.

Explore all of our previously recorded live webinar sessions in our webinar library.

Follow us on the CAB LinkedIn page and Facebook.

CAB’s Tips & Tricks

VITAL & VITAL+

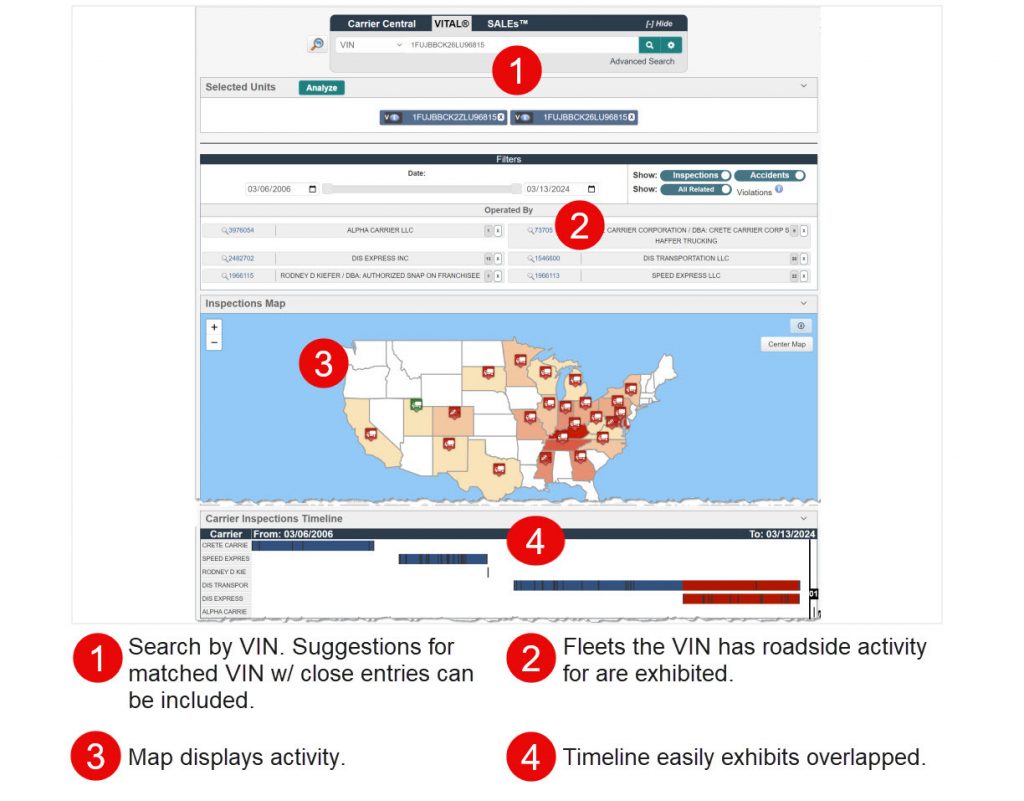

CAB’s VITAL, Vehicle Inspection Tracker and Locator tool allows the user to search the inspection, crash, and violation history by the vehicle identification number (VIN). Our tool allows this data to be exported into a spreadsheet.

The enhanced version, VITAL+, allows for deeper use of the program and is an add-on feature.

Example use cases include:

CMVs’, commercial motor vehicles, roadside activity can be viewed in VITAL+. While no BASIC scores exist for this activity, insurance companies and motor carriers can see the exposure of a CMV. This option is especially useful when reviewing an intrastate CMV.

Further, a partial VIN and multiple VINs can be uploaded into VITAL+. The system will also give you “close” VIN data to choose if it makes sense to include within your search. A few of these and other features are exhibited below.

THIS MONTH WE REPORT

New Study Analyzes Impacts of Nuclear Verdicts A recent study by the U.S. Chamber of Commerce Institute for Legal Reform examined nuclear verdicts—verdicts exceeding $10 million—and their growing impact on the trucking industry from 2013 to 2022. These unpredictable, high-dollar verdicts are particularly harmful to small and medium-sized businesses. Read more…

Senate Committee Approves DOT Funding Bill with Truck Parking, Predatory Towing Provisions The U.S. Senate’s Committee on Appropriations approved a 2025 funding bill for the Department of Transportation, including truck parking expansion, predatory towing regulations, and cargo theft strategies. Key provisions mirror those in the House bill, though the Senate version lacks a ban on speed limiters and stricter hours of service rules. Read more…

Stronger Freight Demand May be Around the Corner, Broker Survey Says A recent survey by Bloomberg and Truckstop reveals optimism among freight brokers, with 49% expecting volume increases by the end of 2024. While 76% predict stable or rising spot rates, concerns remain over gross margins, with 44% of brokers reporting lower margins in the first half of 2024. Read more…

Pride Group Closing Could Affect Freight Rates, Driver Market The liquidation of Pride Group, one of Canada’s largest trucking and leasing companies, is set to impact freight rates and the driver market. With over 20,000 trucks in North America, Pride Group’s shutdown could put upward pressure on rates, particularly since the company aggressively lowered prices. The closure may also displace thousands of employees, including drivers. Read more…

Owner of Trucking Company in Crash That Killed 7 Motorcyclists Pleads Guilty Dunyadar Gasanov, co-owner of Westfield Transport, pleaded guilty to falsifying driver logbooks after a 2019 crash that killed seven motorcyclists. Gasanov admitted to instructing employees to falsify records and exceed driving hours, and he also lied to federal inspectors about his knowledge of the driver involved in the crash. Read more…

Hard Reinsurance Prices Likely to Last Longer Than in Previous Market Cycles: Report A recent AM Best report highlights that hard reinsurance pricing conditions are expected to persist for several years due to ongoing claims activity from medium-sized disaster losses and secondary perils. Despite strong technical results, reinsurers face challenges from an unpredictable risk environment. Read more…

OODIA’s AB 5 Appeal Focuses on Discrimination Against Interstate Truckers The Owner-Operator Independent Drivers Association (OOIDA) filed an appeal challenging California’s AB 5 law, which restricts the leased owner-operator model. While the California Trucking Association dropped its appeal, OOIDA argues that the law unfairly burdens interstate commerce and violates the dormant Commerce Clause. Read more…

Appeal of Werner Nuclear Verdict Will Be Heard by Texas Supreme Court The Texas Supreme Court will hear Werner Enterprises’ appeal of a $100 million nuclear verdict related to a 2014 fatal crash. The case centers on a 2018 jury decision that found Werner liable for 70% of the damages, citing failure to train the driver for winter conditions. Read more…

September 2024 CAB Case Summaries

These case summaries are prepared by Robert “Rocky” C. Rogers, a Partner at Moseley Marcinak Law Group LLP.

AUTO

Rivera v. Convoy, Inc., 2024 WL 3791183, 2024 U.S. Dist. LEXIS 144068, C.A. No. 3:23-cv-01353 (D. Conn. Aug. 13, 2024). This case involves application of the Graves Amendment in the context of a motion to dismiss. The underlying accident giving rise to the lawsuit involved a disabled vehicle that was struck by a tractor trailer driven by Defendant Estrada resulting in the death of one of the occupants of the disabled vehicle. Estrada was the owner of Prowheeler, a one-truck/one-driver trucking company. On the morning of the collision, Estrada was operating Prowheeler’s truck while pulling a trailer leased from Premier. Plaintiff subsequently brought suit against Estrada, Prowheeler, and Premier, among others. Plaintiff’s allegations against Premier center around a theory of negligent entrustment. Premier moved to dismiss that claim as being barred by the Graves Amendment. The court explained that the Graves Amendment preempts state law vicarious liability claims against owners of motor vehicles under certain circumstances. To avoid the bar under the Graves Amendment, it must be shown that the owner/lessor of the motor vehicle acted criminally or negligently in some respect and such criminality or negligence was a proximate cause of the alleged damages. In this instance, the court found that to prevail, Plaintiff would have to show that Premier negligently entrusted the Trailer to Prowheeler under Connecticut law. The court agreed with Premier that it entrusted the Trailer to Prowheeler, as opposed to Estrada directly. Additionally, the court rejected Plaintiff’s argument that Premier should have known, in light of Prowheeler’s one-truck/one-driver status, that Estrada would be using the Trailer, specifically finding there was no allegation that Premier knew or should have known of Prowheeler’s one-truck/one-driver operation at the time it leased the Trailer to Prowheeler. The court went on to find that the pleading failed to allege Premier knew or should have known the entrustee would likely use the Trailer in a manner that involves unreasonable risk of physical harm. The court found there were no allegations that Premier knew or should have known of Estrada’s past driving violations by virtue of its leasing the Trailer to Prowheeler. As such, the court granted Premier’s motion to dismiss with leave for Plaintiff to file an Amended Complaint.

Stephens v. Swift Transp. Co. of Ariz., LLC, No. 1:22-CV-01403-JPB, 2024 WL 3626635, 2024 U.S. Dist. LEXIS 136041 (N.D. Ga. Aug. 1, 2024). In this hit-and-run accident personal injury case, Plaintiff filed a lawsuit against several defendants including Defendant Swift Transportation Company of Arizona, LLC (“Swift”). Regarding the accident, Plaintiff was a passenger in a vehicle struck by a tractor trailer. The tractor trailer kept going but Plaintiff noted the trailer’s license plate number, which was a Swift trailer. The day before, a Swift driver delivered a load to an Amazon facility pulling the same Swift trailer. The Swift driver unhooked from the Swift trailer at the Amazon facility and left with a different empty trailer. It was undisputed that no Swift tractors or drivers were involved in the subject accident or knew, authorized, or approved for anyone else to pull the Swift trailer from the Amazon facility the day of the subject accident. Swift filed a motion for summary judgment which the court granted, with the Court holding that Plaintiff failed to show Swift had any involvement in the subject accident beyond its trailer being pulled at the time.

Sweigart v. Voyager Trucking Corp., No. 23-2397, 2024 WL 3565306, 2024 U.S. App. LEXIS 18609 (3rd Cir. July 29, 2024). This opinion arises out trial resulting from a motor vehicle accident involving a tractor trailer and a motorcycle. Plaintiff suffered serious injuries when his motorcycle crashed into a tractor trailer. A jury awarded him $25 million in damages. Defendants (the driver and truck company) challenged five discretionary rulings of the District Court (“trial court”). The Third Circuit Court of Appeals (“COA”) ultimately affirmed the jury verdict, ruling the trial court did not abuse its discretion.

Regarding the accident, the driver was driving a fully loaded tractor trailer on an on ramp while on his phone early in the morning. At the end of the ramp the driver saw Plaintiff’s motorcycle headlights approximately three football fields away. The driver thought he had enough time to turn left before the motorcycle reached him. Plaintiff did not realize the truck was turning left in front of him until it was too late to avoid a collision, and he applied his brakes and lost control of the motorcycle, colliding with the truck. Plaintiff suffered a severe pelvic fracture as a result. Defendants moved to bifurcate the liability and damages portion of the trail based on their concern of the jury’s reaction to Plaintiff’s horrific injuries. During the trial, a juror fainted as a result of hearing testimony regarding Plaintiff’s injury and Plaintiff’s physician witness rendered aid. Defendants moved for a mistrial which was denied. The jury ultimately returned a verdict in Plaintiff’s favor for $25 million.

Defendant appealed the denial of the motion to bifurcate, contending that the severity of Plaintiff’s injuries made it impossible for a jury to impartially separate issues of damages and liability. The COA disagreed, noting bifurcation was the exception and not the rule. It opined that Defendants did not offer a persuasive reason to bifurcate given the case involved serious injuries like many personal injury cases. To rule otherwise would require courts to grant bifurcation every time a case involved serious personal injuries. Finally, the COA noted the trial court had instructed the jury that the issue of liability and damages were separate and sympathy could not play a part in determining whether Plaintiff met his burden of proof regarding liability and damages. Finally, Defendants did not cite a case where a trial court was found to have abused its discretion in denying a bifurcation motion.

Defendants also appealed the denial of their motion for a mistrial. The COA affirmed the denial of the motion for mistrial, holding that the trial court questioned the jury regarding whether they could remain impartial after the incident. In the COA’s view, the trial court did not abuse its discretion because it determined that each juror was sincere in affirming they could remain impartial after the incident.

BROKER

Bailey v. Progressive Cnty. Mut.. Ins. Co., 2024 WL 3845966, 2024 U.S. Dist. LEXIS 146269, C.A. No. 22-5161 (E.D. La. Aug. 16, 2024). This case arises from a motor vehicle collision wherein Plaintiff Bailey’s motor vehicle was struck by a tractor trailer, which she alleged “improperly turned and struck the side” of her vehicle. In addition to the driver of the tractor trailer, she also brought suit against Mascar Group, LLC and Hector Cordies Toreres, the alleged owners of the vehicle, US Foods, for whom the driver was making a delivery, and DCL, who served as the broker between US Foods and Mascar. DCL moved to dismiss for failure to state a claim on the basis that the claim against it was barred by FAAAA. The parties agreed that FAAAA bars state law negligence claims against brokers like DCL, but Plaintiff contended that her state law claims survive preemption under the “Safety Regulatory Exception” set forth in 49 U.S.C. § 14501(c)(2)(A). The court, citing Ye v. GlobalTranz Enterprises, Inc., 74 F. 4th 453 (7th Cir. 2023) and Aspen Am. Ins. Co. v. Landstar Ranger, Inc., 65 F.4th 1261 (11th Cir. 2023), found that “there is no direct link between motor vehicle safety and DCL’s alleged negligent hiring by failing to properly screen Mascar and/or Mr. Perez in its capacity as a transportation broker” and therefore “the Safety Regulatory Exception does not exempt the claim in this case from the FAAAA Preemption Provision.” Additionally, the court found “the relationship between DCL’s alleged negligence and any motor vehicle is simply too attenuated to fall within the Safety Regulatory Exception.” Finding Plaintiff’s state law negligent hiring claims were not exempted from preemption by the “Safety Regulatory Exception,” the Court granted defendant DCL’s motion to dismiss for failure to state a claim.

Schriner v. Gerard, 2024 WL 3824800, 2024 U.S. Dist. LEXIS 145154, C.A. No. 23-206-D (W.D. Okla. Aug. 14, 2024). This case arises from a motor vehicle collision in which Plaintiff’s vehicle was struck while parked on the shoulder of the road after Defendant’s tractor trailer left the roadway. Plaintiff filed action against several defendants, including RXO, against which Plaintiff asserted two claims; vicarious liability and negligence in selecting the motor carrier for the shipment. RXO moved to dismiss the claims against it. Reviewing the allegations of the Complaint, the Court found that RXO was a broker, not a motor carrier. Therefore, Plaintiff’s state negligence claims were preempted by FAAAA. The Court then turned to the Safety Regulatory Exception, and, as many others have done before, examined the issue in light of Ye v. GlobalTranz Enterprises, Inc., 74 F. 4th 453 (7th Cir. 2023) and Aspen Am. Ins. Co. v. Landstar Ranger, Inc., 65 F.4th 1261 (11th Cir. 2023. The Court found that “the connection here-between a broker hiring standard and motor vehicles is – too attenuated to be saved” by the Safety Regulatory Exception. As such, Plaintiff’s claims were expressly preempted by FAAAA and not subject to the safety exception. Additionally, the Court found even if the claims weren’t preempted, Plaintiff failed to plead sufficient factual allegations to state a claim against RXO. Therefore, the Court granted RXO’s Motion to Dismiss with prejudice.

CARGO

Lotte Global Logistics Co., Ltd. v. One Way Only Trans, Inc., 2024 WL 3886092, 2024 U.S. Dist. LEXIS 147767, C.A. No. 2:23-cv-03558-ODW (C.D. Cal. Aug. 19, 2024). This case involves liability under the Carmack Amendment for goods stolen during shipment and involving various different entities along the logistics chain. Samsung contracted with Lotte Global Logistics Co., Ltd. (“Lotte”), Korean corporation that provides a “domestic and international trade logistics services”, to arrange transportation of seventeen cargo containers loaded with lithium ion batteries from Busan, Korea via ocean carrier to the Port of Los Angeles, California, where it would then continue on to Nextera Energy Constructors in Kingsman, Arizona via motor carrier. On November 3, 2022, Lotte Global Logistics, North America (“LGLNA”), Lotte’s wholly owned subsidiary in the United States and a licensed FMCSA property broker, entered into an agreement with One Way Only Trans., Inc. (“OWOT”), a FMCSA “registered motor carrier”, to transport the shipment from the Port of Los Angeles to its final destination in Kingman, Arizona. Under the agreement, OWOT, was required to comply with all state, federal, and local hazmat licensing requirements. OWOT had only one tractor and no hazmat permit. Additionally, OWOT did not possess an FMCSA property broker license. STPW, Inc., a separate FMCSA-licensed motor carrier did have hazmat authority and additional equipment capacity. The president of OWOT was also a driver for STPW. LGLNA sent a delivery order and dangerous goods declaration from Samsung to OWOT. The president of OWOT thereafter requested from the president of STPW if STPW could transport the shipment, which STPW agreed to do. OWOT forwarded the delivery orders to STPW, which noted the hazmat requirements and special instructions. Upon arrival of the containers at the Port of Los Angeles, OWOT “arranged” for four of the containers to be picked up from the terminal. The next day, the remaining containers were picked up by STPW drivers. After delivery to a cargo storage yard, a driver in a tractor bearing STPW placards presented a forged PD on STPW letterhead to the cargo storage yard’s personnel and left with one of the containers. Later that day, the container was found, having been emptied of its cargo. The remaining sixteen containers were delivered to the consignee in Arizona without incident. Upon presentation of a claim for the missing cargo, Lotte paid the full amount in exchange for an assignment of Samsung’s rights. Thereafter, Lotte filed suit against OWOT, STPW, and the container storage yard alleging: (1) a Carmack Amendment claim; (2) violation of 49 U.S.C. §§ 13902, 14707, and 14916; (3) negligence; and (4) breach of bailment. Lotte moved for summary judgment against OWOT and STPW on the Carmack Amendment claim.

In ruling on the MSJ, the Court found that OWOT held itself out as a motor carrier, not as a broker, when contracting with LGLNA. Specifically the court noted: (1) OWOT held motor carrier authority, but not broker authority; (2) OWOT signed a Motor Carrier Agreement identifying OWOT as the motor carrier; (3) OWOT never disclosed itself to LGLNA as “arranging” for the shipment; (4) there was no evidence supporting OWOT ever notified LGLNA that STPW would be transporting the shipment or that LGLNA approved such arrangement; (5) OWOT accepted LGLNA’s delivery order and Hazmat declaration and agreed to transport the shipment; (6) all communications for pickup and delivery of the shipment, including notification of the stolen cargo, were between LGLNA and OWOT; and (7) OWOT sent invoices and proofs of delivery to LGLNA for each container. Further, OWOT lacked brokerage authority. Therefore, it found OWOT was liable under Carmack as a motor carrier. Turning to STPW, the Court found that STPW was definitionally a motor carrier based on its actions related to the transportation of this shipment. The court rejected STPW’s attempts to claim the president of OWOT, using a STPW truck, was acting outside the scope of his contractor status with STPW. The court specifically noted that no motor carrier without hazmat authority (which STPW held whereas OWOT did not) could have moved the shipments. As such, the court granted summary judgment in favor of Lotte and against OWOT and STPW on the Carmack claim.

Godonou v. Allied Transp. Grp. LLC, No. 24-CV-80239, 2024 U.S. Dist. LEXIS 142980, at *1 (S.D. Fla. Aug. 12, 2024). In this cargo claim, the District Court granted in part Defendant Allied Transportation Group’s (“Allied”) motion to dismiss Plaintiff’s claim that it was strictly liable under the Carmack Amendment. According to the operative complaint, Plaintiff entered into an agreement with Allied whereby Allied agreed to transport Plaintiff’s belongings. Plaintiff alleges he and Allied were the only parties to the agreement. Plaintiff alleges Allied picked up the property. The complaint further claims that Allied contends Defendant SSA was supposed to deliver the property. It appears undisputed neither Defendant ever made delivery. Plaintiff denies ever signing any document/agreement with SSA and SSA was not mentioned in the agreement he signed with Allied. Allied produced a Bill of Lading between Allied and SSA, but Plaintiff contends he was never provided with such document by either Defendant before filing suit and that his purported signature on the bill of lading was fraudulent. Plaintiff claims Allied invoiced him and he paid 50% of the invoice following Allied picking up the shipment, but never re-invoiced him for the remaining balance, refused to deliver his goods, and indicated his goods were to be auctioned.

In the motion to dismiss, Allied argued it was an improper party in the case as it was not a carrier and thus not strictly liable under the Carmack Amendment. Plaintiff countered that Defendant Allied was a proper party because some courts had adopted a more expansive view of a broker and a broker could be exposed to “carrier-like” strict liability. The Court first explained that the determination of whether an entity is a carrier or a broker is “case-specific” though the Eleventh Circuit has held that the key distinction between brokers and carriers is “whether the disputed party has accepted legal responsibility to transport the shipment,” but entities who operate as both brokers and carriers can insulate themselves from strict liability by making clear in writing that the company is “merely acting as a go-between to connect the shipper with a suitable third-party carrier.”

The Court noted that Plaintiff did not allege in the operative pleading any facts that demonstrated that Allied was a carrier. Rather, Plaintiff’s Complaint merely made the conclusory statement that both Defendants “are carriers by law” but without any supporting facts. Insofar as Plaintiff attached the agreement with Allied to the Amended Complaint, the court considered its in connection with the motion to dismiss. The Court noted that the Agreement itself explicitly stated, twice, that Allied was not a carrier, but instead was merely acting to connect the shipper (i.e., Plaintiff) with a motor carrier. Insofar as the court found Allied made it clear in writing that it was not acting in the capacity of a carrier, it could not be held liable under Carmack, thus entitling Allied to dismissal of this claim.

Q1, LLC v. Assembly, No. 6:22-cv-1212-RBD-LHP, 2024 U.S. Dist. LEXIS 132346, at *1 (M.D. Fla. July 26, 2024). In this Carmack Amendment case, Plaintiff contacted a logistics broker, Defendant DSV, to arrange a shipment of cell phones from Florida to Indiana. Defendant broker then contracted with Defendant trucking company, to transport the phones. The broker and trucking company’s business relationship was governed by a Broker-Carrier Agreement, which contained a clause whereby the trucking company would defend, indemnify, and hold DSV harmless from any claims, damages, etc. arising out of its performance under the Agreement and neither party was liable to the other to the extent caused by the negligence or intentional wrongful act of the other party or shipper. The cell phones went missing in transit and Plaintiff sued Defendant trucking company under the Carmack Amendment and Defendant broker for breach of contract. Defendant broker then filed a crossclaim against Defendant trucking company for contractual indemnity under the Broker-Carrier Agreement. Regarding the crossclaim, the trucking company argued that the Carmack Amendment preempted the broker’s crossclaim for fees under the Broker-Carrier Agreement because the fees did not arise from separate and distinct conduct from the cargo loss at issue. The broker argued that the fees are recoverable because they do arise from separate and distinct conduct as they do not bear on liability for the lost phones. The Court agreed with the broker. To decide whether the fees arose from separate and distinct conduct from the cargo loss, it considered whether the claim turned on a party’s liability for lost cargo based on the prevailing law in the 11th Circuit Court of Appeals. The conduct was considered separate and distinct because it included contractual obligations independent from a specific shipment like those in the ongoing business relationship between the broker and trucking company. Accordingly, the Court held that the indemnity clause in the Broker-Carrier Agreement was not impacted by either Defendants’ liability for Plaintiff’s shipment, and the crossclaim under the Agreement was not preempted by the Carmack Amendment.

COVERAGE

Mid-Century Ins. Co. v. Werley, 2024 WL 4049221, C.A. No. 23-1822 (3rd Cir. Sep. 5, 2024). The Third Circuit reversed the trial court’s grant of summary judgment to an insured, accepting the insurer’s argument that a household vehicle exclusion prevented inter-policy stacking of underinsured motorist (UIM) benefits under Pennsylvania law.

Levi Werley was seriously injured while riding an uninsured motorized dirt bike. When the insurance of the driver that struck him did not compensate him fully for his injuries, Levi’s parents, sought to recover underinsured motorist (“UIM”) benefits under their own automobile insurance policies. The Werleys’ insurer paid $250,000 under one policy, but denied the claim under a separate policy. Specifically, the Werleys contended that the policy’s “household vehicle exclusion, which bars payments for bodily injury sustained while occupying an uninsured vehicle” is invalid and unenforceable under state law.

The Third Circuit began its analysis by explaining the two variations of stacking as follows: (1) “intra-policy stacking aggregates the coverage limits on multiple vehicles under a single policy, even though not all the vehicles are involved in the accident or occurrence” and (2) “inter-policy stacking aggregates coverage limits for vehicles insured under separate policies.” The default rule under the state Motor Vehicle Financial Responsibility Law (“MVFRL”) is that UIM coverages are “stacked” but an insured can waive stacked UIM coverage in exchange for a reduced premium. The court went on to analyze a prior Pennsylvania Supreme Court ruling from 2006, holding the statutorily prescribed waiver form under the MVFRL is phrased only in terms of waiving intra-policy stacking rather than inter-policy stacking. Nevertheless, the prior court acknowledged that the stacking waiver language was enforceable as a knowing waiver of inter-policy stacking in the circumstance where a policy covers only one vehicle.

The Werleys had two automobile policies in their household, both underwritten by Defendant insurer. The first (the “Multi-Vehicle Policy”), listed Levi’s parents as named insureds and insured four vehicles. The Multi Vehicle Policy provided UIM coverage equal to the bodily injury limits of $250,000 per person and $500,000 per accident, with intra-policy stacking validly rejected. However, the Werleys could not waive inter-policy stacking because the Multi-Vehicle Policy insured multiple vehicles. The Multi-Vehicle Policy contained a household vehicle exclusion of UIM coverage for “bodily injury sustained by you or any family member while occupying or when struck by any motor vehicle owned by you or any family member which is not insured for this coverage under any similar form.” While the Multi-Vehicle Policy did not define the term “motor vehicle,” Pennsylvania’s Vehicle Code defines a “motor vehicle” as “[a] vehicle which is self-propelled except an electric personal assistive mobility device or a vehicle which is propelled solely by human power.” Thus, Levi’s injuries would not normally be covered due to this exclusion. The second automobile policy insured only one vehicle, a Jeep (the “Jeep Policy”) and had somewhat different language for the household vehicle exclusion. The insurer determined the Jeep Policy’s household vehicle exclusion did not apply, and paid the $250,000 UIM limits available under the Jeep Policy. However, it denied the UIM claim made under the Multi-Vehicle Policy, contending the household vehicle exclusion applied.

On appeal, the Third Circuit disagreed with the trial court, who had accepted the Werleys’ argument that the uninsured status of the dirt bike is irrelevant because the Werley family seeks to collect UIM benefits for Levi, who was undisputedly an insured under the Multi-Vehicle Policy. Essentially, the trial court found “the ability to stack follows the son and not the dirt bike.” However, the Third Circuit held this was inconsistent with prior Pennsylvania authorities holding UIM coverage is not “universally portable and not susceptible to exclusions from coverage” and “[i]f the MVFRL does not require that UIM coverage follow the insured in all circumstances, then the MVFRL cannot be read to prohibit exclusions from UIM coverage.” As such, the Third Circuit found “absent a statutory prohibition . . . exclusions limiting the scope of UIM coverage, like the Multi-Vehicle Policy’s household vehicle exclusion, are generally enforceable . . . unless the exclusion functions as an impermissible de facto waiver of inter-policy stacking.”

On that issue, the court found the Werleys never paid premiums for the dirt bike, let alone UIM coverage on it. Since the dirt bike was never insured, application of the household vehicle exclusion would not deprive the Werleys of something for which they had bargained. Citing another Pennsylvania Supreme Court case finding that policies that “explicitly exclude … UIM coverage for damages sustained while operating an unlisted household vehicle … do not conflict with Section 1738 of the MVFRL.” Thus, when the host vehicle is uninsured, UIM coverage that may have existed under a second-priority policy can properly be excluded.

Concluding that the household vehicle exclusion under the Multi-Vehicle Policy was unambiguous and did not otherwise conflict with Pennsylvania statutory requirements under the MVFRL, the Third Circuit reversed the trial court’s grant of summary judgment in favor of the Werleys and remanded the case to the trial court to enter summary judgment in favor of the insurer.

WORKERS COMPENSATION

No cases of note to report this month.