Back to school, but not back to normal…

This weird summer is coming to an end for many of us. A few of us may even be trying to sneak in a final stay-cation before the kids head back to school. While it does not seem like we will be together in person any time soon, we are glad that everyone keeps in touch. On a whole, many of us would probably give 2020 one out of five stars. Hopefully things are on an upward swing. Enjoy your Labor Day holiday and say safe.

This month we’d like to bring attention to a couple industry training opportunities. CAB has been a long time contributor and supporter of the IMUA and the MCIEF. We feel strongly that education is a key to success in this industry. For those of us who have been around forever -you are never too old to learn about new issues in the industry. For those just getting on board, these organizations provide excellent presentations to teach you the nuances of this challenging field.

The Inland Marine Underwriters Association (IMUA) is presenting Risk Management & Insurance Challenges in the Trucking Industry on September 10th at 10a EST. This class will discuss the challenges encountered by brokers, underwriters, claim adjusters and loss control in helping clients to develop a comprehensive and cost-effective risk management and insurance profile. This is a follow-up to the presentation Chad Krueger, CAB’s Sr. Vice President participated in with Steve Silverman back on June 25th called Underwriting Trucking Risks: Cutting Through The Data Noise And Identifying Trends. Registration is available by clicking this link.

The Motor Carrier Insurance Education Foundation (MCIEF) continues final planning for the 2020 virtual conference scheduled for November 9th through the 12th. The MCIEF is finalizing the conference interactive webpage with an active date of 9/1.

MCIEF knows committing 4 hours for 4 consecutive days is difficult in our current environment so they will be airing a repeat of each four-hour session post-conference on the following dates: Session 1 – Tuesday November 17, Session 2 – Monday November 23 (Thanksgiving Week), Session 3 – Tuesday December 1 and Session 4 – Tuesday December 8

Anyone interested in registering or getting information on registration can contact Beth Medina at Beth@mcief.org or by phone at 239-997-4084.

CAB Live Training Sessions

Our live training sessions continue to garner great interest from our users. If you missed either of these webinars, they are available in the Tools menu under Webinars or by clicking here. This month we will present two new live training sessions:

Tuesday, September 8th @ 12p EST: Mike Sevret will present Using CAB: Flow & Navigation. This will be an overview of Carrier Central and the CAB Report®. Perfect for newer users or current users looking for refresher or an update on enhancements.

Tuesday, September 15th @ 12p EST: Chad Krueger will be providing additional insight during our focused training, Chameleon Carriers and Interrelated Entities. Chameleon carriers/interrelated entities are very important to understand. CAB provides numerous features to identify and understand the relationships that may exist between motor carriers.

Our focused training will be shorter and last 30 minutes, as we know your time is important. CAB subscribers can register for either session from our Webinars page or by logging in and clicking this link https://subscriber.cabadvantage.com/webinars.cfm

Please feel free to suggest focused training topics that you would like to see. We are looking forward to connecting with you during these sessions so don’t hesitate to ask questions!

Follow us at: CAB Linkedin Page CAB Facebook Page

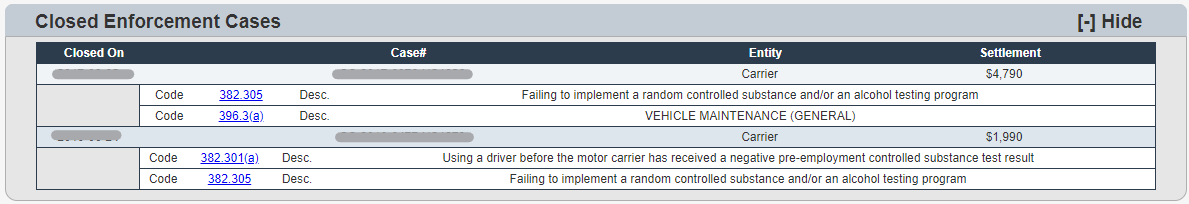

CAB’s Tips & Tricks: Closed Enforcement Cases Added

Some of you may have noticed that we very recently added a section to the History Tab in the CAB Report® that lists the enforcement cases (if any) for the motor carrier. We have also added the information from the last 6 years in the CAB Alerts section of the General Tab of the CAB Report. As a quick background, FMCSA enforcement cases are initiated following compliance reviews, complaint investigations, terminal audits, roadside inspections, or other investigations. We will be providing the full history of closed enforcement cases. Why is this information important? CAB users can use this information to better understand if a motor carrier has a closed enforcement case and engage with the motor carrier to understand what caused the enforcement action and how it was resolved.

An enforcement case is deemed “closed” once FMCSA issues a carrier a “Notice of Claim” (NOC) and the carrier has (1) paid the penalty in full, (2) signed a settlement agreement, or (3) defaulted on the NOC, upon which a “Final Agency Order” was issued.

As with all of our tools & enhancements, we strive to present the data in a manner that will help provide additional clarity. We at CAB are constantly striving to improve our tools and resources to create value for our users. Please feel free to contact us directly if you have any suggestions as to how we can enhance our services. We are customer driven. Our goal is to help you Make Better Decisions!

THIS MONTH WE REPORT:

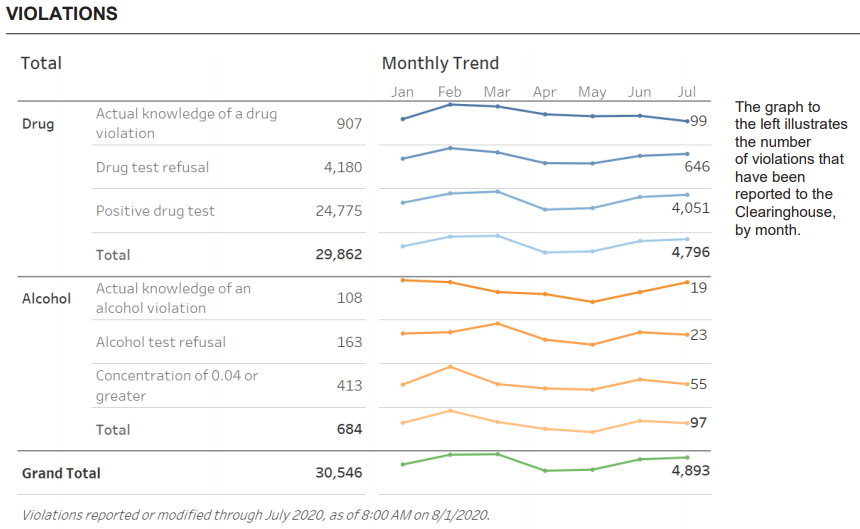

FMCSA Releases July 2020 Drug & Alcohol Clearinghouse Summary Report: The most recent summary report released August 10th, 2020 reveals 4,893 violations during the month of July. There have been a total of 30,546 violations since the program started in January 2020. Positive drug tests account for 81% of the total reported violations. Marijuana Metabolite represents half of the 30,531 positive drug tests. Cocaine Metabolite (4544), Methamphetamine (2979) and Amphetamine (2828) are the distant 2nd, 3rd and 4th place when it comes to the positive drug tests. This report is generated monthly and they can be found at this link.

Regional Emergency Declaration Issued for Alabama, Louisiana, Mississippi and Texas: Declaration and an exemption from Parts 390 through 399 of the Federal Motor Carrier Safety Regulations (FMCSRs), except as otherwise restricted in this Emergency Declaration. The declaration is in response to Hurricanes or Tropical Storms Laura and Marco, and the current and anticipated effects on people and property, including immediate threat to human life or public welfare from heavy rains, high surf, flooding and high winds. This Declaration addresses the emergency conditions creating a need for immediate transportation of supplies, goods, equipment, fuel and persons and provides necessary relief. See the full Emergency Declaration here.

FMCSA’s Emergency Declaration still in Place, Extended to September 14th 2020, adds Emergency Restocking of Distribution Centers and Stores: On August 12th, the FMCSA extended the Emergency Declaration. The order had been set to expire on July 14th. Previous declarations exempted Food, Fuel, Paper Products, Raw Materials, Liquified Gases and others. The current declaration is only for +Livestock and livestock feed +Medical supplies and equipment related to the testing, diagnosis and treatment of COVID-19 and +Supplies and equipment necessary for community safety, sanitation, and prevention of community transmission of COVID-19 such as masks, gloves, hand sanitizer, soap and disinfectants. This declaration had the addition of food, paper products and other groceries for emergency restocking of distribution centers or stores. For more information on the most recent Emergency Declaration click here.

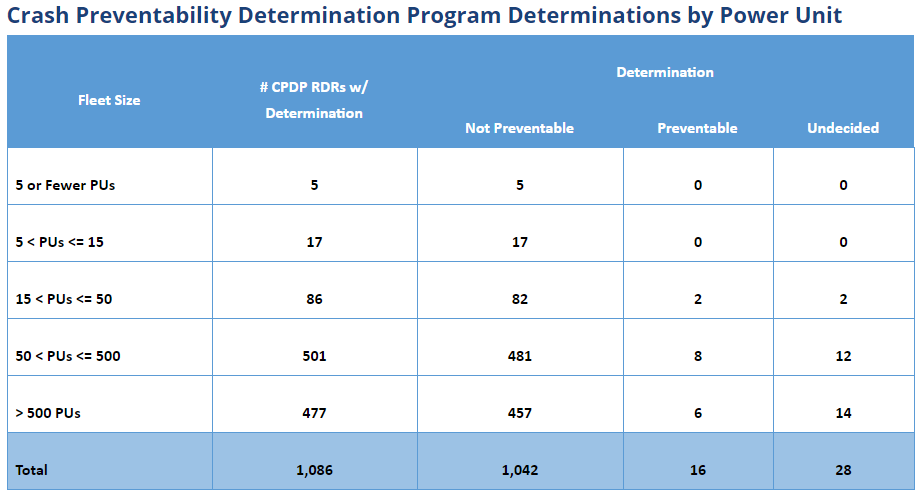

Crash Prevention Determination Program Releases Quarterly Statistics: Since the CPDP program was released in early May, 4,700 Requests for Data Reviews (RDRs) have been submitted by 1,274 unique motor carriers. Crashes occurring on or after August 1, 2019 and fitting within the 16 criteria are eligible. 637 carriers submitted 1 RDR, 661 carriers submitted between 2 and 9 RDRs and 76 carriers submitted 10+ RDRs. The highest number of RDRs submitted by 1 carrier is 253 RDRs. We can see that many motor carriers of different sizes are taking advantage of CPDP. Make sure your customer and prospects know about this program so they can take steps to remove eligible crash weighting from their Crash BASIC percentile score. These results will be reflected in the CAB Report®, including the Crash BASICs weighting when the determinations have been made. For additional summary information, click here.

Trucking Seems to be Outpacing the Overall Economy: The Department of Labor states there were 2000 jobs added in the trucking industry based on the August 7th report. In July, a leading freight and analytics firm detailed van rates were $2.04 a mile, up 24 cents compared with June. Flatbed rates reached $2.20 per mile, up 13 cents, and reefer rates were $2.30 per mile, a 15-cent increase. The average spot van rate last month was 10.6% higher compared with July 2019. Entering August, van and reefer rates were much higher than the year-ago July averages at $2.20 and $2.42 per mile, respectively.

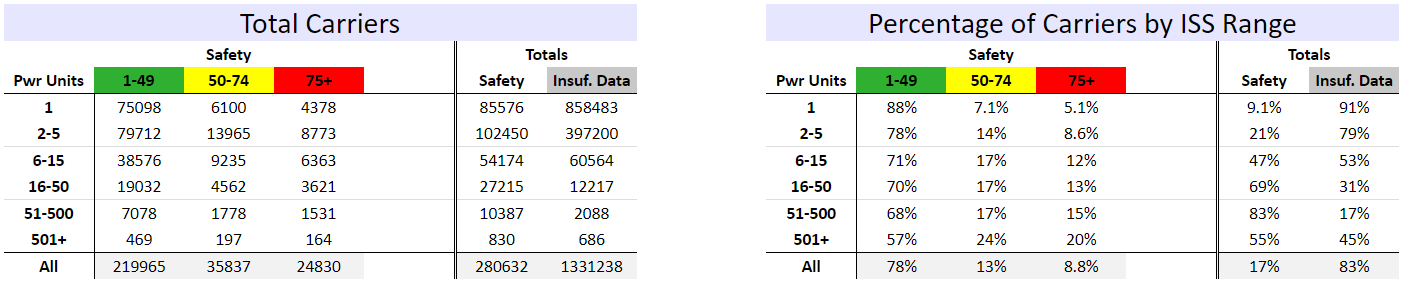

CAB Calculates Inspection Selection System (ISS-CAB) Values for Motor Carrier Ecosystem: The first table shows, for each power unit range; the number of carriers with values in the green, yellow, and red ranges, and the total number of carriers with an ISS-CAB value or an “insufficient data” score. The second table shows the data as percentages, out of carriers with ISS-CAB values or out of all carriers as appropriate. ISS-CAB values are as of the snapshot date of 8/11/20. A carrier’s number of power units is from the most recent data we have for that carrier. Carriers with no or unknown number of power units are not included.

FMCSA Publishes Rule Eliminating No-Defect Driver Vehicle Inspection Reports: The Federal Motor Carrier Safety Administration published the rule that harmonizes the post-trip vehicle inspection requirements for bus and truck drivers. The rule removes the need for bus and motorcoach drivers to document a post-trip inspection report on days when there are no vehicle defects identified. The revisions become effective September 17, 2020. The FMCSA previously revised §396.11 in December 2014 to remove the requirement that drivers of property-carrying vehicles fill out “no-defect” DVIRs. For additional information on the rule, please click here.

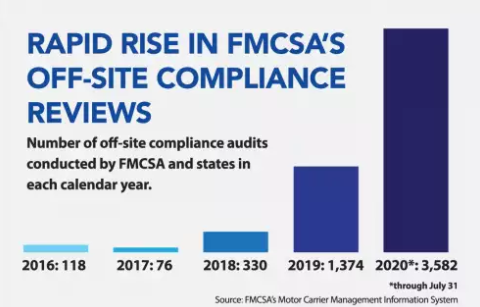

Off-Site Compliance Reviews Rise Dramatically Amid Pandemic: According to data from the FMCSA’s Motor Carrier Management Information System, the agency and state enforcement conducted almost 3,600 offsite compliance reviews through the end of July. That is almost three times the number of off site safety audits conducted in the full 2019 calendar year. In 2017, only 76 offsite compliance reviews were conducted, and 330 were conducted in 2018.

CASES

AUTO

The Western District in Virginia dismissed a claim for vicarious liability based upon an alleged joint venture with a trucking company. Despite the many facts which would seem to indicate a relationship, such as using the carrier’s name, insurance, USDOT number, and federal operating authority to transport loads, the court held that the plaintiff failed to show that the defendant had equal rights to direct and govern the operations and accordingly dismissed the cause of action. McKeown v. Rahim, 2020 WL 4587526

The trial court decision granting judgment to the non-trucking use insurer, and the tractor owner, was upheld in the Court of Appeals in Michigan. The court agreed that the “non-trucking use endorsement” and lack of collision coverage was not void as against public policy. The court also held the the tractor owner, who had leased the vehicle to the motor carrier, did not have a duty to maintain, inspect, and repair the tractor when it had no control over the vehicle. Estate of Altaye v. SA&R Trucking, 2020 WL 4915426

Make sure you have real support for the amount of damages that a plaintiff has suffered before removing a case to federal court. The Middle District in Louisiana remanded a suit for injuries suffered in a truck accident when the motor carrier and its insurer could not establish that the potential damages suffered by the plaintiff were valued at more than $75,000. Autin v. Cherokee Insurance Co. 2020 WL 4876857

A motor carrier was successful in getting a defense verdict upheld in Missouri Court of Appeals. The plaintiff had argued that a truck operated by the motor carrier had caused another vehicle to strike her. Without identifying the specific vehicle she could only base liability on the logo-liability doctrine. The court agreed that the doctrine only applied to carrier-lessees and the record revealed no evidence that the motor carrier operated as a carrier-lessee. Hearn v. ABF Freight System, 2020 WL 450171

Same was true in the Court of Appeals in Kentucky where a defense verdict was upheld for a trucking company. Plaintiff’s argument that the court should have instructed the jury that the motor carrier was required to use extreme caution under federal regulations because the sun was glaring was unavailing. In addition the court noted that driver manuals and CDL handbooks do not establish a duty but can only be used to inform the jury as to the standard of care. Spencer v. Arnold, 2020 WL 4500589

A claim of negligent brokering was not preempted under Missouri law said the Eastern District in Missouri. While the court agreed that Plaintiffs’ negligent brokering claims relate to the services of the broker and fall within the scope of 49 USC 14501(c)(1), the cause of action was subject to the safety regulation exception and therefore not preempted. Uhrhan v. B&B Cargo, Inc., 2020 WL 4501104

The Middle District in Pennsylvania also rejected a broker’s claim of preemption for a personal injury loss. The court concluded that the FAAAA does not preempt general tort law that does not significantly impact the broker’s prices, routes, and service. The court also denied summary judgment to the plaintiff, concluding that whether the broker should be held to the liability of a motor carrier was one to be left to the jury. Ciotola v. Star Transportation & Trucking, LLC, 2020 WL 4934592

Truck broker liability was also considered by the District Court in Massachusetts. The court held that the portion of Plaintiff’s negligence claim premised on the breach of the duty to comply with the rules and regulations promulgated by the Federal Motor Carrier Safety Administration or the Moving Ahead for Progress in the 21st Century Act would be dismissed. However the negligent hiring portion of the claim was not preempted, concluding that the negligent hiring claim seeks to impose a duty on the service of the broker rather than regulate motor vehicles and therefore was not subject to the preemptive effect of FAAAA. Skowron v C.H. Robinson 2020 WL 4736070

Summary judgement was not in order for a motor carrier involved in an accident when he was rear ended by the plaintiff. The plaintiff claimed that the manner in which the driver entered the highway from the rest stop and his slow speed in the driving lanes of the highway was the proximate cause of the accident. The Eastern District of Missouri held that was enough to raise a question of fact. Holt v. Qualified Trucking Service, Inc., 2020 WL 4533794

When vicarious liability was admitted the trucking company could not be held liable for direct negligence claims according to the Western District in Texas. The fact that the driver could be considered an independent contractor did not change the fact that the motor carrier could be vicariously liable for his actions, and would not negate the fact that direct claims were prohibited when vicarious liability was admitted. Frazier v. U.S. Express, Inc., 2020 WL 4353175

Who is first in line to pay PIP benefits when a truck driver is injured in a single vehicle accident? The Court of Appeals in Michigan concluded that when all of the relevant factors are considered, the economic reality test clearly showed that an employee-employer relationship existed between plaintiff and the motor carrier for purposes of the no-fault act. Because the plaintiff was an employee under MCL 500.3114(3), the motor carrier’s insurer was first in line to pay PIP benefits to the plaintiff. Duckworth v. Cherokee Insurance Co. 2020 WL 4555036

A shipper was found liable for the injuries to the plaintiff which occurred when a truck carrying the shippers heavy equipment caused a bridge beam to hit the plaintiff. The Court of Appeals in Texas found that a shipper who knew or should have known of a defective loading condition had a duty to protect the public. The court upheld the multimillion dollar verdict. United Rentals North America, Inc. v. Evans, 2020 WL 4783190

Producing two occasions in which a defendant was operating a tractor trailer in the state of Maryland was insufficient to show that the company was systematically operating in the state. With only those two instances, a moving violation and an inspection plaintiff could not even support a claim for limited discovery on the issue. The complaint was dismissed. Tarpley v. Chung, 2020 WL 4903882

Interesting case came out of the Court of Appeals in Michigan addressing the indemnity obligations undertaken by a broker for the actions of the shipper. After the shipper was found 95% at fault for the death of a truck driver, the shipper sought indemnity from the broker and the motor carrier. The court reversed the trial court ruling, concluding that the trial court erroneously found no question of material fact as to whether the equipment that caused the decedent’s injuries was “attached” to the truck, which could implicate the motor carrier’s policy. The trial court also erred in concluding that the broker and motor carrier were entirely excused from indemnifying plaintiff under the contract, insofar as plaintiff was not found to be 100% at fault, and that Motor Carrier anti-indemnity statute did not apply. Ford Motor Company v. Centra, Inc., 2020 WL 4248471

Plaintiff was permitted to continue a cause of action for punitive damages when his tractor-trailer was struck from behind by the defendant’s tractor-trailer. The Eastern District of North Carolina held that when the plaintiff alleged that the defendant knew or should have known of the incompetence of the driver it was premature to dismiss the punitive damages claim. Davis v. G. Allen Equipment Corp., 2020 WL 4451169

The Southern District in Ohio agreed to give a plaintiff an opportunity to voluntarily dismiss its action and refile a suit against the defendants after an extended litigation. The Court expressed concern that the plaintiff would be unable to obtain redress for the serious, traumatic injuries that he suffered allegedly due to defendants’ actions if he was not given an opportunity to dismiss and refile his suit. While defendants, who the court noted had professionally and diligently defended this action, would be inconvenienced, that inconvenience does not rise to the level of plain legal prejudice. Moran v. Ruan Logistics, 2020 WL 4732991

When the plaintiff failed to take any substantive action to complete service for more than two years the Eastern District in Kentucky held that the plaintiff had technically not complied with the statute of limitations. Summary judgment was granted to the motor carrier. Wilson v Butzin, 2020 WL 4810117

The Northern District of Georgia held that while a plaintiff could not assert a claim for punitive damages against the driver, it could assert that claim against the motor carrier. The plaintiff was able to introduce evidence of numerous violations and issues with the driver which perhaps should have caused the motor carrier to consider whether the driver was eligible to drive. Ferguson v. Garkusha, 2020 WL 4732187

Plaintiff was not entitled to reconsideration of the trial court’s grant of judgment to defendant where the plaintiff was unable to establish evidence to support that he had no fault insurance in place at the time of the single vehicle truck accident and had suffered a serious injury. Singh v. Baryski, 2020 WL 4723303

The District Court in Colorado agreed that plaintiff’s negligent entrustment, negligent hiring and retention, and negligent training and supervision claims must be dismissed because the motor carrier admitted to vicarious liability. The court held that an employer’s negligent act in hiring, supervision and retention, or entrustment was not a wholly independent cause of the plaintiff’s injuries. DeLisa v Walker 2020 WL 4925905

The same was true in the Southern District in Mississippi where the court held that independent claims of negligence would not stand against the motor carrier when it admitted vicarious liability. The court also held that there was no basis for a claim for punitive damages under the facts of the case. Crechale v Carroll Fulmer Logistics Corp., 2020 WL 4927508

It was too premature to dismiss a complaint against an insurer who was defending the plaintiff in a suit arising from a truck accident. The Northern District of Georgia held that while the insurer was defending under a reservation of rights, there was a potential for the plaintiff to suffer damages and concluded that the case should proceed further before decisions were made on whether there was a valid claim. Teamone Contract Services, llc v American Guarantee & Liability Insurance Co., 2020 WL 4724759

CARGO

The shipper was entitled to dispose of a shipment which was delivered without the seal intact and the motor carrier could not claim an off-set for the salvage value. The Northern District in Georgia agreed that the contract gave the right to determine whether the cargo was worthless to the shipper when a shipment was delivered without a seal. Coyote Logistics v. Mera Trucking, LLC, 2020 WL 4815902

A cross-claims for contribution was held subject to the preemptive effect of the Carmack Amendment in the Middle District of Florida. When a marina sued a motor carrier for damages allegedly caused by delays in picking up a boat for transport, the court held that it could not seek contribution under the Carmack Amendment because the marina was not a connecting carrier and was also precluded from seeking contribution under common law because the only available claim against the trucker was one under the Carmack Amendment. Razipour v. Joule Yacht Transport, 2020 WL 4904456

TOW

Want to see what happens when there is push back against a tow company for improper billing and/or withholding cargo.? The Court of Appeals in South Carolina upheld the judgment of the Administrative Law Court on the limited suspension of the tow company from the rotation for approved carriers. Wayne’s Automotive Center, Inc. v. South Carolina Department of Public Safety, 2020 WL 4660975

WORKER’S COMPENSATION

The Court of Appeals in Iowa reversed a trial court ruling overturning the decision of the worker’s compensation board. The court agreed that the workers’ compensation commissioner’s decision that the employee suffered a work-related injury and sustained a forty-five percent industrial disability was supported by evidence. They agreed that the commissioner’s finding that the plaintiff had “failed to carry his burden of proof that he is permanently and totally disabled as a result of the work injury under either an industrial disability analysis or under an odd-lot analysis” was correct. Pruismann v. Iowa Tanklines, Inc., 2020 WL 4498131

The Court of Appeals in Maryland held that a truck driver was collaterally estopped from asserting that his condition from an earlier injury had worsened and he was entitled to additional benefits. Plaintiffs had been given reasonable opportunities to present new evidence, had not done so and had already received a finding that the additional injuries were not causally connected. Lyons v. Chesapeake Spice Company, 2020 WL 4283965

Thanks for joining us,

Jean & Chad