Spring is upon us!

March Madness is almost complete, and Spring (Astronomical) officially kicked off on March 20th! In some areas it may not feel like Spring, but rest assured, it will be here soon. This is an exciting time of year. Regardless, if we’re looking forward to the start of the baseball season or other warm weather activities, we hope everyone gets a chance to enjoy the nicer weather!

We hope to see a number of you in person at the IMUA Annual Meeting the last week of April.

Have a great month!

CAB Live Training Sessions

Tuesday, April 12h @ 12p EST: Sean Gardner will present an overview of CAB’s MC Advantage resource. During this presentation, he will review and discuss the various tools specifically available to motor carriers. This CAB offering is picking up steam and we encourage you to learn about it by attending this session. Click here to register.

Tuesday, April 19th @ 12p EST: Mike Sevret will present on CAB Customization. There are numerous areas within CAB where you can customize content to your individual needs. CAB Report settings and features, profile settings, violation tracking, radius buckets, & much more! An overview of all the settings and preferences within CAB. Click here to register.

Don’t forget, you can explore all of our previously recorded live webinar sessions on our website!

Follow us at CAB Linkedin Page CAB Facebook Page

CAB’s Tips & Tricks: What is a Severe Violation?

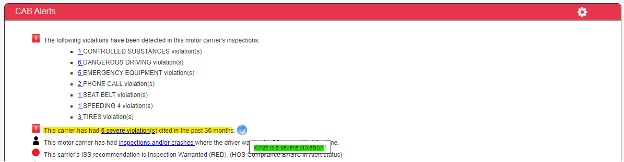

Occasionally, we’re asked what exactly constitues a Severe Violation as detailed in the CAB Report®? Severe violations are listed toward the top of the CAB Alerts section on the CAB Report® landing page or General Tab (see screen grab below).

With the example below, this motor carrier has 6 severe violations in the prior 36 months. If you want to see the 6 severe volations specific to this motor carrier, click on the words and a Detail Report will pop up. If you want to see the list of potential severe violtions, you can click on the blue question mark to the right and it will open the list of roughly 55 volations that are considered severe. That list of 55 severe violations has been developed over the years in conjunction with our users to identify the violations that our insurance carrier clients want to be made aware of. Anything from Operating without proper motor carrier authority to operating a CMV while texting to speeding in a construction/work zone to reckless driving to operating an out-of-service vehicle is contained in the severe violations list.

As noted previously, this list has been developed over the years via input by our users. If you come across a violation you feel should be included in this list, please send an email to cab_customer_service@cabadvantage.com including the violation code and description. The CAB team will consider its incorporation and it may be included in the future.

You are encouraged to reach out via phone, email or via the “Contact Us” button in the My Account area of the menu.

THIS MONTH WE REPORT

FMCSA Updates Electronic Logging Device Frequently Asked Questions: To provide additional guidance on the ELD regulations, the Federal Motor Carrier Safety Administration provided a number of new FAQs and updated the answers to a number of others. For the latest answers to the most common ELD FAQs, click here.

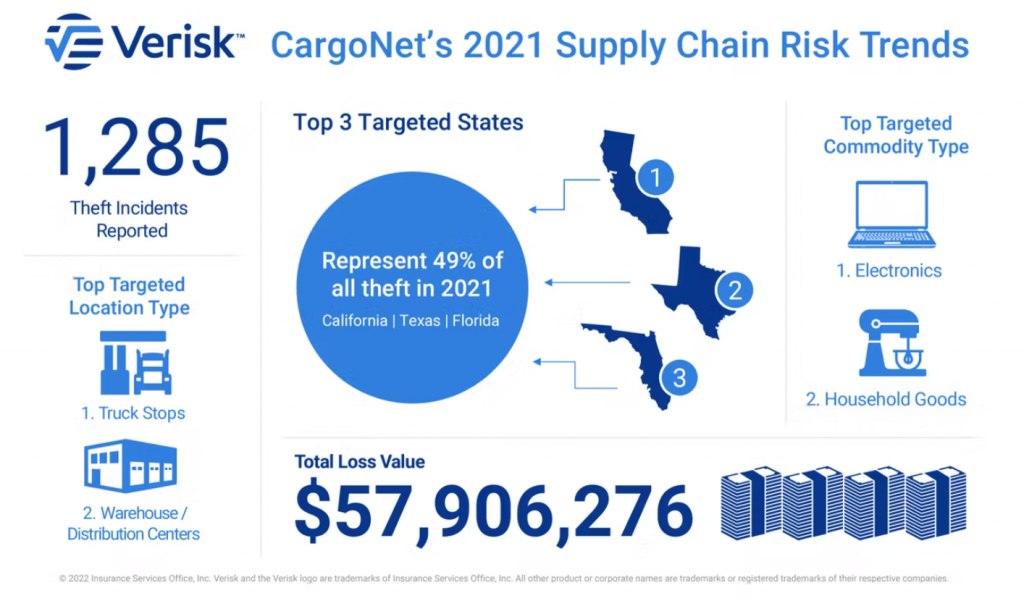

CargoNet: 2021 cargo theft numbers down 15%: Cargo theft across the United States and Canada for 2021 down by 15%, compared to year-over-year activity. CargoNet reported 1,285 supply chain risk events across the United States and Canada in 2021, a 15% decrease in activity year-over-year. The average value stolen per theft was $172,340, and the total value stolen was $57.9 million. California is the sate with the most reported cargo thefts, with a 13% year-over-year increase. Fifty-five percent of thefts involved at least one heavy commercial motor vehicle, and there was a 34% year-over-year increase in electronic thefts and attempted thefts. Read the full article here.

Trucking in 2022: Driver hours, new entrants “surge”: The same high consumer demand and shuffling driver supply that shaped the freight market in the last half of 2021 are still notable themes in 2022. Uber Freight’s “Market Insights Report” also records a huge number of new trucking registrations and many drivers shifting from long haul to local trucking. Read more here.

FMCSA removes convicted violations reporting requirement for drivers: The FMCSA is set to remove the requirement that truck drivers submit an annual list of their traffic violation convictions to their employers. This rule is being removed due to its repetitiveness of another FMCSA requirement that motor carrier to make an annual inquiry to obtain the motor vehicle record (MVR) for each driver it employs from every state in which the driver holds or has held. This change is set to take place on May 8. Read more here.

Accident reporting: change to regulatory guidance concerning the use of the term “medical treatment”: The FMCSA revises its regulatory guidance for the use of the term “medical treatment” for the purpose of accident reporting. The change states that an x-ray examination is a diagnostic procedure and should no longer be considered “medical treatment” in determining whether a crash should be included on a motor carrier’s accident register. For more information, click here.

DTO proposes oral fluid drug testing method: The U.S. Department of Transportation is proposing an amendment of the transportation industry drug testing program procedures regulation that will add oral fluid testing to the program. According to the DOT, this move is designed to “give employers a choice that will help combat employee cheating on urine drug tests and provide a more economical, less intrusive means of achieving the safety goals of the program. Read the full list of proposed changes here. The federal register is also available here.

Canada further delays its ELD mandate enforcement: Canada has postponed the implementation of its electronic logging device mandate to Jan.1, 2023. This is not the first delay for the enforcement, which was originally set to start in June 2021. This delay is meant to give fleets more time to choose an implement a certified ELD. Read more here.

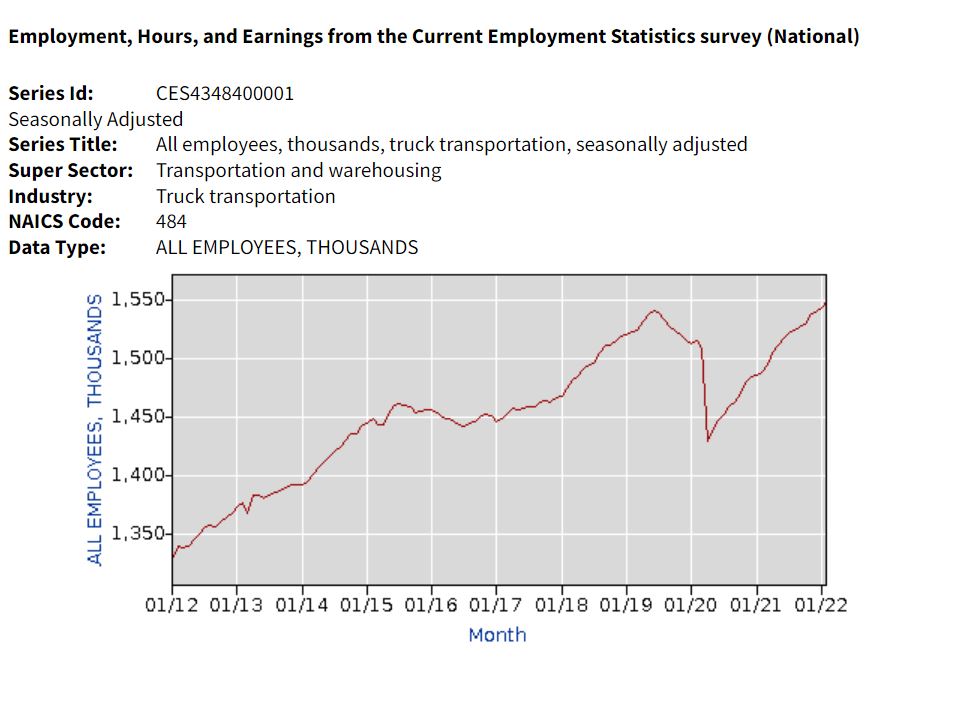

US job growth includes trucking industry: A robust 678,000 jobs were added to the job market in February, and the trucking industry has a total of 1,549,100 jobs. The industry has added around 5,400 jobs a month since the start of 2021. Read more here.

FreightWaves Ratings introduces first-ever truck driver pay guide: The first-of-its-kind FreightWaves Ratings Driver Pay Guide has been introduced, compiling driver compensation and incentive data from nearly 100 fleets. The free guide states that $58,000 for brand-new CDL holders, with an average sign on bonus of $3,000. This data can be filtered by U.S. region, as well. Read more here.

White House Requests Budget Increase for FMCSA: The White House’s proposed $5.8 trillion fiscal 2023 budget seeks to increase funding for federal truck drivers. The White House is requesting $367.5 million for the FMCSA’s safety operations programs, and the budget proposal for the agency’s safety grants division is $506.1 million. For the 2022 fiscal year, the safety operations and programs received $360 million and the safety grants division received $496 million. Read the full story here.

March 2022 CAB Case Summaries

These case summaries are prepared by Robert “Rocky” C. Rogers, a Partner at Moseley Marcinack Law Group LLP.

AUTO:

Handley v. Werner Enters., 2022 U.S. Dist. LEXIS 47354, C.A. No. 7:20-cv-00235 (M.D. Ga. Mar. 17, 2022). A motor carrier’s motion for summary judgment in a case involving a rear-end collision into the back of the CMV was denied because the court found fact issues remained on whether the driver of the CMV operated the CMV in a negligent or unsafe fashion causing the accident. There was a factual dispute as to whether: (1) the CMV had its turn signal on; (2) what portion of the CMV was in the center (turning) lane versus the left-most lane of travel; and (3) whether the CMV was moving or parked. Viewing the evidence most favorably to the non-moving party (the plaintiff), the court found there was sufficient evidence from which a jury could find the CMV driver failed to exercise due care in operating the CMV. This was despite the investigating officer finding the plaintiff was following too closely, undisputed evidence that the plaintiff was exceeding the speed limit, and undisputed evidence that plaintiff had just swapped lanes before the collision, could not see around the vehicle she was passing, and did not apply her brakes or make any evasive maneuver before the collision. Any contributory negligence by the plaintiff was determined to be a question of fact for the jury to decide.

Gibson v. AMGUARD Ins. Co., 2022 U.S. Dist. LEXIS 45747, C.A. No. 3:21-cv-03249 (W.D. La. Mar. 14, 2022). The Louisiana federal court granted partial summary judgment to a motor carrier and its insurer, dismissing the claims of negligent hiring, training, supervision, retention, and entrustment of the driver where the motor carrier stipulated that the driver was, as the time of the accident, in the course and scope of his employment with the motor carrier. Citing prior rulings, the court explained “[w]hen the employer stipulates that the employee is in the course and scope of employment with the employer at the time of the accident, the employer becomes vicariously liable for the employee’s fault, and the allocation of fault to the employer no longer matters. The employer will be made to pay for plaintiff’s damages regardless of whether it is found liable vicariously or directly. No matter how much the employer is at fault in hiring, training, or supervising an employee, the employer does not proximately cause damage to plaintiff unless the employee is at fault.”

Woods v. Wal-Mart Transp., 2022 U.S. Dist. LEXIS 43767, C.A. No. 1:20-cv-3977 (N.D. Ga. Mar. 11, 2022). A motor carrier and its driver were granted summary judgment on the claim for litigation expenses in plaintiff’s personal injury tort action. Under the applicable Georgia statute, a party may recover litigation expenses where the defendant has acted in bad faith, been stubbornly litigious, or has caused the plaintiff unnecessary trouble and expense. The plaintiff maintained it was entitled to recovery of litigation expenses because there was no bona fide controversy as to the defendant’s liability for the collision. The plaintiff pointed to the police report taken immediately after the incident in which the operator of the tractor-trailer indicated he missed his turn, started backing up, did not see the plaintiff’s car and “hit him.” However, the court noted photographs taken immediately after the incident, as well as the tractor-trailer driver’s testimony in which he disputed he struck the plaintiff’s vehicle, created a fact issue. In light of this evidence, the court found there was a legitimate dispute as to liability and therefore an award of litigation expenses under the statute was not appropriate.

Houck v. WLX, LLC, 2022 U.S. Dist. LEXIS 43185, C.A. No. 3:19-cv-275 (M.D. Pa. Mar. 10, 2022). A motor carrier’s motion for summary judgment was denied on the basis there were numerous factual disputes for resolution by the jury at trial. The decedent was struck in the head with a ratchet/winch that crashed through his windshield while driving. After the accident, a flatbed trailer ratchet/winch was located in the cab of the decedent’s truck. Video surveillance depicted the motor carrier’s truck being driven on the same road as the decedent’s vehicle around the time of the accident. It was undisputed there was no witness to support the estate’s theory of events or that the ratchet/winch fell from the motor carrier’s trailer. The testimony further indicated there were no records of repairs to the at-issue trailer for missing or damaged winches/ratchets/stops, though no deponent could say how many were on the trailer at any given time. An investigating officer as well as a retained expert for the estate determined the ratchet/winch/stop was the same the kind used on the motor carrier’s flatbed trailer. The officer surmised that the ratchet/strap fell from the motor carrier’s trailer and bounced along the highway before crashing through the windshield of the decedent’s vehicle. On this record, the court found there was a jury question on whether the winch/ratchet/stop came from the motor carrier’s trailer. Specifically, it found the credibility of the evidence was for jury consideration, but the record was sufficient to create a triable issue of fact.

Rivera v. Transam Trucking, 2022 Cal. App. Unpub. LEXIS 1376, C.A. No. E075289 (Ca. Ct. App. Mar. 8, 2022). In an unpublished opinion, the Court of Appeal of California largely affirmed the trial court’s grant of summary judgment to a motor carrier on respondeat superior and negligent hiring, supervision, and entrustment causes of action. The court held the undisputed evidence established at the time of the accident the driver had been “off duty” for two days and was on a purely personal errand to/from a grocery store. As to the negligent hiring, supervision, and entrustment claims, the undisputed evidence established the motor carrier investigated the driver’s background and driving record prior to hiring him and found no reason to believe he was unqualified, unfit, incompetent or otherwise posed a particular risk of harm to the public while driving a CMV. However, the appellate court found the trial court failed to address the owner/permissive user claim under California state law—i.e. that as the owner of the involved CMV the motor carrier could be held liable pursuant to statutory limits—and accordingly, complete dismissal of the plaintiff’s complaint was improper.

Golden Peanut Co. v. Miller, 2022 Ga. App. LEXIS 116, C.A. No. A21A1269, A21A1270 (Ga. Ct. App. Mar. 4, 2022). Court of Appeals of Georgia reversed the trial court’s denial of trailer owner and its parent company’s motion for summary judgment in a personal injury lawsuit involving shipper liability claims. Golden Peanut contracted with a motor carrier/broker (Larry Wood Trucking) to broker loads of peanuts for Golden Peanut during the harvest season. Larry Wood Trucking contracted with Lloyd White Trucking to haul peanuts. A representative of Golden Peanut gave White information on farmers who had peanuts ready for pick up each day. White, in turn, would coordinate the pick-up and deliveries each day with the individual farmers. Golden Peanut did not provide specific routes for White or White’s drivers to use when delivering the peanuts. After picking up the peanuts at the farm, White would transport them using Golden Peanut’s specialty trailer to Golden Peanut’s facility. Occasionally, Golden Peanut would provide White with specific pick up/drop off times, but otherwise did not control White’s work schedule. Under these facts, the Georgia appellate court held there was no basis for vicarious liability of Golden Peanut for the alleged negligence of White. Further, since no lease agreement existed between Golden Peanut or its parent company and White, neither could be the statutory employer of White under the FMCSRs so as to make them vicariously liable.

Lewis v. Hirschbach Motor Lines, Inc., 2022 U.S. Dist. LEXIS 39945, C.A. No. 3:20-cv-1355 (S.D. Ill. Mar. 7, 2022). Motor carrier obtained summary judgment on negligent hiring, training, supervision, retention and/or entrustment causes of action where the motor carrier admitted the driver was acting within the scope of his employment rendering the motor carrier vicariously liable for the negligence of the driver. Under Illinois law, the normal rule is that a plaintiff injured in a motor vehicle accident cannot maintain a claim for negligent hiring, negligent retention, or negligent entrustment against an employer where the employer admits responsibility for the conduct of the employee under respondeat superior. However, an exception exists for situations in which the employer’s culpability is greater than that of the employee (i.e. willful and wanton conduct by the employer). The court found the plaintiff alleged and submitted no proof of willful or wanton conduct by the motor carrier employer. Similarly, the court dismissed the plaintiff’s claim for gross negligence and punitive damages on the same basis.

Whittley v. Kellum, 2022 U.S. Dist. LEXIS 42749, C.A. No. 4:20-cv-00929 (E.D. Tex. Mar. 10, 2022). Negligence, negligent entrustment, and respondeat superior claims against a lessor of a tractor-trailer were dismissed on summary judgment. The court found that “mere ownership of a vehicle is not conclusive to demonstrate entrustment” and that plaintiff came forward with no evidence giving rise to genuine issue of material fact that the lessor exercised control over the location of or driver of the tractor-trailer at the time of the accident. As such, the negligent entrustment claim was dismissed. Similarly, since the lessor exercised no control over the manner and method by which the driver performed his work, there was no basis for vicarious liability. Last, with respect to the negligence claim, the court held it would be unreasonable to require the owner/lessor of a vehicle to train and supervise its lessee’s employees. The court did not mention the Graves Amendment in its analysis.

Clark v. Whaley, 2022 U.S. Dist. LEXIS 42381, C.A. No. 1:20-cv-300 (S.D. Ohio Mar. 10, 2022). Motor carrier and its driver were granted summary judgment in CMV on pedestrian accident where the undisputed evidence established: (1) decedent was walking in the lane of travel on an Interstate at night, while wearing all black clothes; (2) CMV driver was not speeding: (3) CMV driver was lawfully in her lane of travel; (4) decedent had consumed four alcoholic drinks some time before the accident; and (5) there was no evidence to suggest CMV driver had time to avoid striking pedestrian. In so holding, the court rejected that the plaintiff’s retained accident reconstructionist report created any material issue of disputed fact.

McEntyre v. Sam’s East, Inc., 2022 Ga. LEXIS 52, C.A. No. S21Q0909 (Ga. Mar. 8, 2022). The Supreme Court of Georgia, answering certified questions from the federal district court, held that a Georgia statute relating to load securement could form the basis of tort liability of anyone assisting with the loading of items into or onto a vehicle. A customer purchased a mattress and box springs from Sam’s Club and two Sam’s Club employees assisted the customer in placing the two items in the bed of the plaintiff’s truck. A factual dispute existed as to whether the Sam’s Club employees also tied down the items. After leaving the store, one of the mattresses fell from the truck bed and onto the roadway. The plaintiff’s vehicle then struck the mattress while still in the roadway, resulting in alleged personal injuries. The court clarified that ordinary negligence principles, as opposed to strict liability principles, applied in determining whether the loader exercised appropriate care (i.e. there could be situations where an items comes loose, but does not create a basis for tort liability). In the instance of someone assisting the operator of a vehicle in loading or securing an item, but who is not themselves operating the vehicle, the court explained “a defendant who is not an operator of the vehicle but assists in loading can only be liable for failing to securely fasten the load in light of the reasonable foreseeable ways in which the load will be transported on public road.”

Lara v. Power of Grace Trucking, LLC, 2022 U.S. Dist. LEXIS 35821, C.A. No. 20-cv-00010 (W.D. Tex. Jan. 4, 2022). The trial court granted summary judgment to motor carrier on negligent hiring, training, supervision, retention and monitoring and dismissed the plaintiff’s claims for gross negligence and punitive damages. In support of their claim, the plaintiffs alleged the motor carrier hired the driver despite him not having a valid driver’s license and failing to verify driver qualifications or experience. The court explained “[i]n Texas, however, the law is clear that a gross negligence claim in the context of negligent hiring or entrustment must be supported by more than a finding that the driver was unlicensed or inexperienced.” Similarly, a failure to inquire into the employee’s driving history is insufficient to establish entitlement to punitive damages. Finding that the motor carrier did not have any knowledge of the driver’s incompetence or habitual recklessness, punitive damages were not recoverable.

BROKER:

Miller v. Costco Wholesale Corp., 2022 U.S. Dist. LEXIS 30504, C.A. No. 3:17-cv-00408 (D. Nev. Feb. 22, 2022). A Nevada federal court denied a broker’s motion for summary judgment on a negligent hiring cause of action. Here, the broker contracted with an unrated motor carrier and the motor carrier’s driver was subsequently involved in a rollover accident resulting in the plaintiff striking the overturned tractor-trailer. The court found that a reasonable jury could determine the broker should have identified and considered several “red flags” concerning the motor carrier requiring additional investigation and vetting, including: (1) the broker previously contracted with a prior motor carrier owned by the same individual, who had its authority permanently revoked by the FMCSA several years prior; (2) the FMCSA application for the new company was in the owner’s father’s name, which shared the same last name as the owner of the former company; (3) phone numbers and email addresses were the same between the two companies in the broker’s database; and (4) both individuals associated with the two companies were listed as points of contact in the broker’s database. The court went on to hold that a reasonable factfinder could conclude the accident was reasonably foreseeable harm of the broker’s unreasonable screening measures. Finding these fact issues, summary judgment was denied. It is worth noting that this is the underlying tort case in the matter currently before the United States Supreme Court on a Petition for Writ of Certiorari wherein the broker requests the United States Supreme Court reverse a Ninth Circuit Court of Appeals decision and hold FAAAA preempts this theory of broker liability.

CARGO:

BMW Auto Sales, Inc. v. Red Wolf Logistics, LLC, 2022 U.S. Dist. LEXIS 36493, C.A. No. 1:21-cv-14647 (D.N.J. Mar. 2, 2022). A New Jersey federal court remanded a case stemming from alleged cargo damage, finding it lacked subject matter jurisdiction over the dispute. The plaintiff purchased a vehicle from an auto auction in Grand Prairie, Texas and contracted with a motor carrier to ship the vehicle from the auction to Houston, Texas. The vehicle allegedly sustained $3,266.99 in damages while being transported. The plaintiff filed suit against the motor carrier in New Jersey state court alleging professional negligence, breach of contract, and consumer fraud under New Jersey’s Consumer Fraud Act. The defendant motor carrier removed the case to federal court, alleging it had jurisdiction pursuant to the Carmack Amendment and FAAAA. The court rejected Carmack formed a basis for federal court jurisdiction because: (1) the transport was purely intrastate; and (2) even if Carmack applied, then all non-Carmack claims would be preempted and the amount alleged was below the $10,000 jurisdictional threshold under 28 U.S.C. § 1337(a). As for potential preemption under FAAAA, the court noted there was no authority establishing FAAAA completely preempted state law causes of action, and therefore was not a basis for federal jurisdiction standing alone.

Thompson Tractor Co. v. Daily Express, Inc., 2022 U.S. Dist. LEXIS 33409, C.A. No. 2:20-cv-02210 (C.D. Ill. Feb. 25, 2022). Plaintiff purchased and agreed to deliver an industrial-grade generator manufactured by Caterpillar, to a third-party purchaser. Plaintiff then contracted with a motor carrier to transport the generator from the Caterpillar facility in Illinois to the third-party purchaser’s jobsite in Alabama. The generator was delivered to the motor carrier in good working order and condition as evidenced by the motor carrier driver’s signature on the bill of lading issued by Caterpillar. While en route, the tractor-trailer left the roadway requiring a tow truck to assist in placing the tractor-trailer back onto the roadway. While the consignee/third-party purchaser did not initially note any damage to the generator upon delivery, damage to the generator’s fuel tank was noted three days later. The generator was subsequently transported back to the Caterpillar for repairs and returned at a cost exceeding $200,000. Plaintiff filed a complaint against the motor carrier alleging a single Carmack Amendment claim. The motor carrier challenged that plaintiff had standing to sue under the Carmack Amendment, but the court rejected this argument under the line of cases interpreting “person entitled to recover under the bill of lading.” The court also rejected the motor carrier’s argument for dismissal because plaintiff’s insurer had already paid for the loss and therefore was the real party in interest; the court held that a Rule 17 objection was required before dismissing a complaint on these grounds, which the motor carrier was now time-barred from raising.

Barker v. EAN Holdings LLC, 2022 N.Y. Misc. LEXIS 524, C.A. No. 159482/2018 (N.Y. Sup. Ct. Feb. 4, 2022). A tort plaintiff was not permitted to amend his complaint to add a claim of negligent entrustment against a lessor of a motor vehicle. Plaintiff contended the lessor should have inquired into the status of the driver’s restricted license before renting it the vehicle. After citing the principle behind the Graves Amendment, the court agreed with the lessor that the proposed amendment lacked merit because the plaintiff set forth no legal duty upon on the lessor other than to check for a facially-valid driver’s license, which the driver presented. Further, to the extent the employees of the lessor did not inquire about the specific restriction, the court held a violation of internal policies, standing alone, does not constitute actionable negligence. Last, the plaintiff failed to present any other evidence establishing the lessor knew or should have known the driver was incapable of operating a motor vehicle in a safe and careful manner.

COVERAGE:

Liberty Mut. Fire Ins. Co. v. Vafi, 2022 Cal. App. Unpub. LEXIS 1565, C.A. No. B312094 (Cal. Ct. App. Mar. 15, 2022). In an unpublished opinion, a California appellate court affirmed a lower court’s affirmance of an arbitration UIM award despite there being a dispute as to the amount of UIM coverage available. Under the terms of the policy, arbitration was limited to determining the amount of UIM damages the insured could recover. Expressly omitted from the arbitration’s consideration was the scope of the insurer’s UIM coverage under the policy. Ultimately, the arbitrator awarded $335,983.42 in UIM benefits to the insured. The insurer tendered a check to the insured for $271,335.66, which reflected the arbitrator’s award minus certain offsets the insurer maintained it was entitled to for payments previously made for medical benefits and for the amount recovered by the at-fault’s liability coverage. The insurer filed a petition in the trial court to correct and confirm the arbitration award, accounting for the offsets. The trial court denied the insurer’s request and confirmed the arbitration award in judgment, finding the insurer had not provided any authority for the trial court’s power to modify an arbitration award on an issue that was not actually arbitrated. The appellate court affirmed the trial court’s determination it lacked authority under the applicable state statute to weigh in on the issue of coverage and offsets, which was not adjudicated during the arbitration.

Wesco Ins. Co. v. Prime Prop. & Cas. Ins., Inc., 2022 U.S. Dist. LEXIS 43516, C.A. No. 20-cv-9067 (S.D.N.Y. Mar. 11, 2022). A New York federal court declined under the federal abstention doctrine to weigh in on an insurance coverage declaratory judgment action involving a dispute between an insurer having an MCS 90 endorsement on its policy (Prime) and a UIM insurer (Wesco). Prime initially brought a declaratory judgment action against Wesco in Utah state court seeking a declaration the Prime policy provided no coverage for the accident or alternatively that the motor carrier was required to reimburse Prime for any payments made. Following that, the plaintiff brought a personal injury action against Prime’s insured in New York state court. Thereafter, Wesco brought its own declaratory judgment action in New York federal court seeking a declaration that Prime’s denial of coverage was invalid and violates New York traffic law and that Prime’s duty to defend and indemnify is primary to that of Wesco. Citing the pending Utah state court declaratory judgment action initiated by Prime and the risk of inconsistent judgments between the two declaratory judgment actions, the New York federal court refused to entertain jurisdiction to hear Wesco’s declaratory judgment action. The court also referenced the fact that Wesco had not named the motor carrier as a party to its declaratory judgment action, which would be affected by the ruling and its addition would defeat diversity.

Stillwell v. Topa Ins. Co., 2022 Ga. App. LEXIS 130, C.A. No. A21A1752 (Ga. Ct. App. Mar. 9, 2022). The Court of Appeals of Georgia reversed the trial court’s dismissal of a direct action against an insurer on lack of subject matter jurisdiction, finding that whether or not the insurer was subject to Georgia’s direct-action statute against motor carrier insurers is not “jurisdictional” for purposes of subject matter jurisdiction. Accordingly, dismissal under 12(b)(1) was inappropriate.

Knight Specialty Ins. Co. v. Day Express, LLC, 2022 U.S. Dist. LEXIS 40392, C.A. No. 3:21-cv-00227 (N.D. Tex. Mar. 7, 2022). A federal court refused to grant default judgment in an insurance coverage declaratory judgment action where certain defendants were minor children not represented by a general guardian, conservator, or other like fiduciary. As such, default judgment was not permitted under FRCP 55(b)(2). As to the remaining non-minor defendants, the court explained entering judgment against them but not all defendants could result in inconsistent judgments and therefore it denied the requested relief.

Young v. USAA Gen. Indem. Co., 2022 S.C. App. LEXIS 35, C.A. No. 5899 (S.C. Ct. App. Mar. 9, 2022). USAA issued two separate insurance policies to a military household family. The vehicle involved in the accident was taxed and titled in South Carolina and the policy indicated the vehicle was principally garaged in South Carolina. The accident occurred in South Carolina. The policy was written on South Carolina forms. At the time of the accident, the family’s other vehicle was in Guam with the husband who was stationed there with the military. That other vehicle was insured under a separate USAA policy, which listed the vehicle as principally garaged in California, where the family had lived prior to the husband’s deployment. The husband and wife were both residents of South Carolina and paid South Carolina taxes. The wife and their children were living in South Carolina at the time of the Accident. The California policy did not contain UIM coverage in a form that South Carolina would recognize. After the accident, USAA paid the Youngs UIM benefits under the South Carolina policy, but declined any benefits under the separate California policy. The family brought a declaratory judgment action seeking declaration that the California policy insured property, lives, or interests in South Carolina and therefore must be reformed consistent with South Carolina law, including its version of UIM benefits which may have the effect of allowing the family to obtain additional UIM benefits under the California policy. The court agreed with the family, holding that the California policy insured property, lives, and interests located in South Carolina and therefore was required to comply with South Carolina UIM requirements.

Progressive Mountain Ins. Co. v. Yaobin Chen & Season Seafood Trading, 2022 U.S. Dist. LEXIS 34859 (N.D. Ga. Feb. 28, 2022). Motor carrier insurer, in response to receiving a pre-suit time-limited policy limits demand, instituted a declaratory judgment action seeking a declaration of non-coverage under the policy and that the MCS 90 endorsement on the policy was not triggered under the facts of the loss. The personal injury claimant/declaratory judgment defendant challenged the jurisdiction of the federal court to issue a declaratory judgment, contending that such would constitute an impermissible advisory opinion. The federal court rejected this argument, emphasizing the longstanding rule that “[i]n the insurance context, even if it is unclear whether the injured party will sue or obtain a judgment against the insured, there is held to be sufficient controversy between the insurer and the injured person that a declaratory judgment is permissible.” It went on to explain that mandating that the insurer wait until suit is filed to seek clarity about its rights and obligations under the insurance policy runs contrary to the purposes of the Declaratory Judgment Act. Moreover, the court found the policy limits demand created a “substantial likelihood” that the insurer would suffer future injury. Accordingly, the court held the insurer had standing under the Declaratory Judgment Act to bring the action.

Progressive Southeastern Ins. Co. v. Brown, 2022 Ind. LEXIS 131, C.A. No. 21S-CT-496 (Ind. Feb. 25, 2022). The Supreme Court of Indiana reversed the lower appellate court’s ruling regarding the scope of the MCS 90 endorsement pursuant to the Motor Carrier Act of 1980. The lower appellate court had previously held that the insurer’s obligation under the MCS 90 endorsement applied to solely intrastate transportation by virtue of the state’s incorporation by reference of the FMCSRs. The Supreme Court of Indiana disagreed, finding the MCS 90 only applies in two situations: (1) when a motor carrier transports property in foreign or interstate commerce; or (2) when a motor carrier transports hazardous materials in foreign, interstate, or intrastate commerce. Since the at-issue transportation was purely intrastate under either the trip specific or the fixed intent of the shipper approaches and did not involve hazardous materials, the MCS 90 was not triggered. The state’s incorporation of the FMCSRs likewise incorporated the limitations of Part 387, including that for the MCS 90 endorsement to be triggered on a purely intrastate trip the load must contain hazardous materials. In so holding, the court also explicitly overruled a prior inconsistent Supreme Court of Indiana opinion.

Great Am. Assur. Co. v. Acuity, 2022-Ohio-501, C.A. No. CA2021-08-097 (Ohio Ct. App. 2022). Summary judgment in favor of Non-Trucking Liability insurer upheld on appeal. The driver signed an independent contractor agreement with the motor carrier to serve as a driver for the motor carrier. The motor carrier was insured by Acuity via a Commercial Auto and Commercial Excess Liability Policy. The independent contractor agreement required the driver to obtain a Non-Trucking Liability and Physical Damage Policy while the tractor was not being operated on behalf of the motor carrier. Great American issued the NTL policy, which contained a trucking or business-use exclusion. On the day of the accident, a Friday, after a delivery, the driver advised dispatch he still had a chassis belonging to the motor carrier and dispatch instructed him to return it to the motor carrier’s shipping yard. After returning the chassis to the shipping yard, as was his customary practice, the driver began driving the tractor to his home from where he would be dispatched the following Monday. Along the way to his house, he performed several personal errands, though he took his normal and customary route home from the shipping yard save for a half-mile detour. The trial court ruled in favor of the NTL insurer, finding that the NTL insurer’s business or trucking use exclusion applied to remove the accident from coverage. Relying upon precedent and Ohio law, the court held that the driver remained in the business of the motor carrier until the driver “returns to the point where the haul originated, to the terminal from which the haul was assigned, or to the [driver’s] home terminal from which he customarily obtained his next assignment.”

Howell v. Peoples Coverage, 2022 Ky. App. Unpub. LEXIS 91, C.A. No. 2020-CA-1344 (Ky. Ct. App. Feb. 18, 2022). In an unpublished opinion, the Court of Appeals of Kentucky addressed a declaratory judgment action stemming from a motor vehicle accident involving a tow truck. After the tort plaintiff obtained a $4.5 million consent judgment, he then took by assignment any claims the tort defendant had against its insurance agent and insurer. The tort plaintiff then filed a lawsuit alleging negligence against the insurer and the agent, including allegations they failed to properly advise their insured, failed to properly insure the vehicle, and failed to comply with Kentucky state law on insurance requirements. The insurer and the agent filed a separate declaratory judgment action counterclaim in the second action asking the trial court to address the correct amount of coverage under the facts. The trial court’s ruling on the declaratory judgment counterclaim was the sole issue presented on appeal. In essence, the tort plaintiff sought to reform the policy to provide $1 million in coverage on the theory the policy was issued to a motor carrier that hauled hazardous materials in intrastate commerce. The appellate court agreed with the lower trial court that hauling cars would not constitute transporting hazardous materials based upon the specific Kentucky state statutes at play, and therefore $1 million in coverage was not required. The appellate court sidestepped the issue of whether the responsibility upon the motor carrier to comply with the state financial responsibility requirements could be placed upon the insurer or agent, finding that issue was not presently before the court because the trial court determined there were material issues of disputed fact regarding the agent’s duty to advise.

AmTrust Ins. Co. of Kansas v. Best Global Express, 2022 U.S. Dist. LEXIS 30231, C.A. No. 21-12164 (E.D. Mich. Feb. 18, 2022). Cargo insurer was granted default judgment in a declaratory judgment action against its insured seeking a declaration it had no duty to defend or indemnify the insured due to the insured’s lack of cooperation in the investigation of the accident. Despite numerous attempts to contact the insured, before and after the declaratory judgment action was filed, the cargo insurer was unsuccessful in reaching its insured. Applying Illinois law, the court held coverage may validly be denied by an insurer where, after diligent attempts by the insurer to secure cooperation with a claim investigation, the insured has failed or refused to cooperate depriving the insurer of information sufficient to establish coverage and the insurer is substantially prejudiced. Under the facts, the court found the insurer reasonably tried to contact its insured, was unable to do so, and the insured’s failure to respond deprived the insurer of information pertinent to the loss. As such, the insurer could deny coverage for the loss and it had no duty to defend or indemnify its insured with respect to the cargo claim.

WORKERS COMPENSATION:

Caijao v. Arga Transp., Inc., 30 Neb. App. 700, C.A. No. A-21-384 (Neb. Ct. App. Mar. 1, 2022). The Nebraska Court of Appeals affirmed the decision of the Nebraska Workers Compensation Court denying his claim for workers compensation benefits on the basis that he was an independent contractor, not an employee of the trucking company. In the six months prior to the accident, he only delivered loads for Arga Transportation, using a tractor provided by Arga but that was leased to him by Arga. He was paid by the mile and could receive a discretionary bonus at the end of the year. He received no other benefits through Arga. After noting there were numerous factors bearing on employer versus independent contractor relationship, the court stressed the element of control or the right to control was “the chief factor.” The claimant argued Arga exerted control over him by requiring him to comply with FMCSRs and that the lease agreement provided, as required under the FMCSRs, that Arga had exclusive possession, control, and use of the equipment. The court rejected that the FMCSRs determined whether an employee-employer relationship exists. Under the facts, the appellate court found the workers compensation court properly held Arga exercised control over the result, but not the manner and method, by which the claimant performed the work. Other factors likewise favored an independent contractor relationship.