Hello Everyone and Happy Spring!

The sunshine (at least that we are getting here in the Midwest) sure makes everyone much happier! Hopefully you too are experiencing some refreshing spring weather. The S&P is on the upswing.

Convention season is starting up again. Chad and Pam are speaking at the Mid-America Trucking Show (MATS). Stop in to hear our educational session and visit our team at our booth. More details are below.

Thank you,

Chad Krueger and Pam Jones

CAB Live Training Sessions

Tuesday, March 12th | 12p EST – Grow Your Business with SALEs – Targeted Leads Generator, Connor Harper

Target companies within your specific appetite with over 100+ filters. Search by insurance renewals, fleet size, commodities, and many other options.

Tuesday, March 19th | 12p EST – CAB for Agents & Brokers, Sean Gardner

Learn about enhancements to the CAB ecosystem that can help drive growth and save time. Identify ways to use CAB data to change the conversation with markets and advocate for motor carrier customers and prospects. Use CAB List™ to monitor customers

CAB Events

MATS – Mid-America Trucking Show Booth #13008

Join Chad & Pam on Thursday, March 21st at 1:15p for “Don’t Gamble with Fleet Safety: Secure Your Bottom Line with Data-Driven Excellence.” The presentation will be held in B104 – ProTalks Theater following the “FMCSA Registration Update and Fraud Prevention” presentation.

To register for the webinars, sign into your CAB account. Then click live training at the top of the page to access the webinar registration.

Explore all of our previously recorded live webinar sessions in our webinar library.

Follow us on the CAB LinkedIn page and Facebook.

CAB’s Tips & Tricks

Not the first time nor the last the criminals are hitting fleets! This is the first we’ve seen the phishing attempt be focused on audits though. A recent FMCSA alert pushed notice out to motor carriers about this nefarious activity. Motor carrier representations while always vigilant, need to confirm who they communicate with and that sites really are legitimate. Insurance partners, please share this with you clients if you haven’t yet. Here’s the link to the Overdrive article on the topic as well.

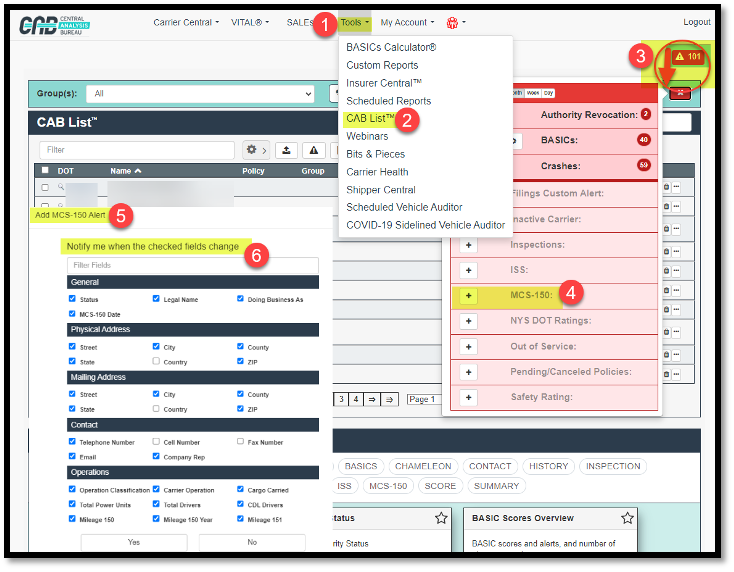

CAB users can set alerts to be notified when activity on an authority changes. Follow the 6-steps in the below image to get your notifications specifically for MCS-150 changes updated.

Additional Resources

Please see Barclay Damon’s Transportation Annual Year in Review. The review share developments in transportation law. This year’s publication looks at cases decided in 2023 by courts around the country and other critical occurrences.

Moseley Marcinack Law Group LLP is hosting a webinar on March 8th at 12p EST. They will be presenting on issues and hot topics surrounding the world of independent contractors in the transportation industry.

THIS MONTH WE REPORT

Trucking executives point to potential for 2024 market recovery. Trucking executives noted signs of potential freight market improvement this year… [citing] a relatively strong labor market, sustained consumer spending, cooling inflation and potential interest rate cuts are putting the U.S. on track for recovery. Read more…

FTR’s February trucking outlook shows slow, steady growth. Active truck utilization bottomed out over the summer, Avery Vise, vice president of trucking says, and remains in line with 2019, pre-pandemic levels. “One answer is that if you can survive today,” with bottomed out rates and declining diesel prices, Vise says, “There’s no particular reason for you to go out of business.” Read more….

E-commerce driving job growth in transportation and warehousing. The surge in e-commerce from 0.6% of retail sales in 1996 to 15.6% today, and increased consumer demand for rapid and reliable shipping, have been a driving force for job growth in the warehouse and transportation sector. Read more…

The United States Treasury’s Financial Crimes Enforcement Network (FinCEN) new reporting requirement hits owner-operators, small fleets. Since the first of this year, any newly established LLC, corporation, LLP and some other business types, including any owner-operator or small fleet who’s filed with their Secretary of State to establish the business, have 90 days to report Beneficial Ownership Information (BOI) to FinCen and the Treasury. Read more…

Trucking authority correction accelerates. Since the start of November, net active truckload operating authorities have dropped by 9,000 — an approximately 12% increase over the same period last year, according to Carrier Details’ analysis of Federal Motor Carrier Safety Administration data. Read more..

Illinois Bill to Copy California Emission Regs Draws Heat. A wave of opposition is mounting in the Illinois General Assembly to a bill that would have the state follow California’s lead in adoption of strict emissions laws that would eventually prohibit sales of diesel-powered trucks in favor of zero-emission options such as electric vehicles. Read more…

FMCSA Planning New Study on Detention Time. Federal trucking regulators are planning an in-depth research study that will collect and provide 12 months of data toward an end of helping provide strategies to mitigate driver detention time, according to the Federal Motor Carrier Safety Administration. Read more…

March 2024 CAB Case Summaries

These case summaries are prepared by Robert “Rocky” C. Rogers, a Partner at Moseley Marcinack Law Group LLP.

AUTO

Taylor v. Dupree, 2024 WL 388113, No. 1:23-cv-00298 (M.D. Pa. Feb. 1, 2024). In this action arising from a motor vehicle accident between two tractor-trailers, the court denied a commercial driver’s and a carrier’s motion to dismiss and motion to strike punitive damages claims. Both commercial drivers were traveling in snowy conditions at the time of the accident when the defendant driver lost control of his vehicle and became perpendicular to the highway. To avoid hitting a passenger vehicle, the plaintiff collided with the defendant driver and sustained injuries. After the plaintiff filed suit, the defendant driver and carrier moved to dismiss the punitive damages claim, arguing the allegations failed to rise to the requisite mental state warranting punitive damages. The plaintiff opposed the motion, arguing that he only had to generally aver as to the defendant’s state of mind at the pleadings stage. The court noted that it was rare to dismiss punitive damages at the pleadings stage, and because additional discovery was needed to ascertain the defendant driver’s mental state, it denied the motions.

Pagan v. Dent, 2024 WL 345485, No. 21-cv-01621 (M.D. Pa. Jan. 30, 2024). In this action arising from a motor vehicle accident, the court declined to grant a motor carrier’s motion for summary judgment on punitive damages. The carrier’s driver was operating a commercial vehicle in snowy conditions when he lost control of the vehicle, jackknifed, and landed on top of the plaintiffs’ vehicle. The driver testified that he had some training on space management, visual surroundings, ice and snow, and speed reduction in snowy conditions, but that he did not have training in extreme driving conditions. The carrier moved for summary judgment, arguing that the driver’s conduct did not warrant punitive damages because there was no subjective appreciation which was ignored. The plaintiffs opposed the motion, arguing the driver was aware of the weather and chose to drive in it despite being trained to pull over. The plaintiffs also argued the driver was traveling above the tier 1 reduced speed limit of 45 mph, and the defendants conceded this point. However, they argued the driver was not aware of the warning. The defendants also argued the driver was not fatigued nor distracted and that he had tried to stop at an earlier truck stop, which was fully occupied. The carrier also argued that it had told its driver to get to a safe place in the event of bad weather. The plaintiffs proffered expert witness testimony to argue that the driver failed to reduce his speed, which violated the CDL manual and that his failure to park violated Part 392.14 of the FMCSRs, among other arguments. The plaintiffs also argued the carrier failed to provide a road test to the driver or adequate training on driving in adverse weather conditions. The court ultimately decided that questions of fact remained, and it denied summary judgment, finding that a jury could conclude the driver operated the vehicle in a reckless manner and that the carrier failed to properly train or supervise the driver.

William Fulp Wrecker Serv., Inc. v. Miller Transfer & Rigging, Co., 2024 WL 406575, No. 1:23cv368 (M.D.N.C. Feb. 2, 2024). In this action involving a towing and cleanup dispute, the magistrate judge recommended the motor carrier’s motion for judgment on the pleadings be denied. The motor carrier was involved in an accident, and the towing company plaintiff alleged it was called to the scene by law enforcement to “contain, clean-up, and remediate the impacted areas.” The towing company alleged that it arrived on the day of the accident to minimize contamination and that it returned three days later to complete the clean-up. It invoiced the carrier $77,852.78 on Invoice 2111 for hazardous material cleanup and remediation services as well as emergency response and remediation for the work on April 7 and 10 and later filed suit against the carrier for unjust enrichment after it claimed it did not get paid. In its answer, the carrier argued that it had reached a negotiated settlement with the towing company related to a separate Invoice 2108. The carrier referenced a settlement agreement and release in which it disputed the charges of $185,377.50 related to the removal of the tractor-trailer, cargo, and storage of the same but agreed to fully settle and compromise the controversies among the terms provided in the release. The release specifically contained a mutual release provision for Invoice 2108, which listed charges of price per pound and for a super load recovery related to the towing of the vehicle. The court noted that the invoice did not detail what date the work reflected in it was performed but that it was dated April 9, one day prior to the alleged additional work on April 10. The defendant carrier moved for judgment on the pleadings, arguing that the release applied not only to Invoice 2108, but also Invoice 2111. In opposing the motion, the towing company argued the release only contemplated Invoice 2108, not Invoice 2111, while the carrier argued that it applied to any claim related to Invoice 2108, which contemplated the work outlined in Invoice 2111. In analyzing the release, the court noted that it did not include language releasing the carrier from any and all past, present, or future claims, demands, obligations, actions, or causes of action which have or might accrue but that it was specifically tailored to claims related to Invoice 2108. The court also found that the work outlined in Invoice 2111 could be considered as separate work despite arising from the same accident as Invoice 2108 and that the release was silent as to Invoice 2111. While the court stated that the release language did not wholly support nor preclude the carrier’s contention that it covered Invoice 2111, it recommended the district court deny the motion for judgment on the pleadings, allowing the case to proceed through discovery.

Thompson’s Transport, LLC v. Lisi’s Towing Serv., Inc., 2024 WL 623708, No. 7:23-cv-2385 (S.D.N.Y. Feb. 13, 2024). In this dispute between a carrier and towing company, the district court granted the carrier’s motion to dismiss the towing company’s counterclaim but allowed the towing company the opportunity to amend to add a claim under contract law. The carrier was involved in an accident which resulted in the overturning of its tractor-trailer and spill of 45,000 pounds of frozen French fries. The towing company was called to the scene to assist with the tow and cleanup. The carrier later sued the towing company, arguing it had damaged its trailer and refrigerator unit, failed to salvage French fries, and improperly placed a lien on the vehicle based on excessive fees of $150,000. The towing company counterclaimed, asserting its lien was proper and that the carrier owed more than $130,000 for “fair and reasonable costs of its services and storage fees.” The carrier moved to dismiss the counterclaim, arguing that the New York Lien Law did not provide for such relief as alleged by the towing company, but instead any claim was only provided for by contract law. The court agreed, finding that the law did not provide an independent claim for payment, only a right against the property over which the lien was exerted. However, the court noted that the towing company might be able to assert contract or quasi-contract claims against the carrier, so it granted the tow company leave to amend its complaint to add such a claim.

Hernandez v. Ventura Sys LLC, 2024 WL 583500, No. 3:23-cv-2244 (N.D. Tex. Feb. 13, 2024). In this action involving a fatal accident, the court granted a motor carrier’s motion to dismiss plaintiff’s direct claims for negligence, negligent entrustment, negligent hiring, negligent training, negligent supervision, negligent retention, and gross negligence while allowing the plaintiffs the opportunity to replead. The carrier’s driver was transporting goods for the carrier and parked the tractor-trailer on the shoulder of the interstate to inspect a mechanical failure. The plaintiff’s decedent then veered out of his lane and collided with the tractor-trailer, dying as a result of the collision. Plaintiffs then sued under the aforementioned causes of action. In analyzing the negligent entrustment claim, the court found the plaintiffs had failed to plausibly allege that the driver was unlicensed, incompetent, or reckless at the time of entrustment. The court found that the plaintiffs did not rebut that the driver was properly licensed. As to negligent hiring and retention claims, the court found that the complaint was silent as to how the carrier was inadequate in its investigation of the driver or that said investigation revealed unfitness to drive. The court specifically found that the plaintiffs had not pled that a background check by a reasonable employer would have revealed anything to prevent an employer from hiring the driver or maintaining the driver in the position of driver. As for negligent training, the court found that the plaintiffs failed to allege how the carrier had not trained the driver to drive in a safe and prudent manner or inspect the vehicle. Similarly, the court found that, assuming the carrier had a duty to supervise the driver, there were no allegations to support how the carrier was negligent in its supervision of the driver because nothing in the complaint stated how any alleged failure to supervise constituted a breach of the carrier’s duty or proximately caused the accident. Finally, the court found that the plaintiffs had failed to allege negligence and gross negligence based upon the factual allegations in the complaint. However, the court allowed the plaintiffs 28 days to file an amended complaint setting forth more detailed factual allegations.

Daniels v. A.E.N. Asphalt, Inc., 2024 WL 445773, No. KNL-CV23-6060505-8 (Conn. Super. Ct. Jan. 30, 2024). In this negligence action arising from a motor vehicle accident, the court granted a motion to strike a cause of action for alleged violations of the Federal Motor Carrier Safety Regulations (FMCSRs). The plaintiff filed suit after a rearend collision and alleged a cause of action against the carrier for the commercial driver’s alleged violation of the FMCSRs. The carrier moved to dismiss the cause of action, arguing the FMCSRs do not create a private right of action for personal injury suits. In examining Connecticut caselaw, the court concurred, finding that the FMCSRs did not create a private right of action. The plaintiff argued that a violation of the FMCSRs would constitute evidence of negligence, but the court found the authority cited by the plaintiff distinguishable from the facts of this case.

Lengacher v. Wayne, 2024 WL 728050, No. 3:23-cv-547 (N.D. Ind. Feb. 22, 2024). In this action arising from a motor vehicle accident, the court granted in part a motor carrier’s motion to dismiss negligent hiring, supervision, and punitive damages claims. The carrier’s driver admitted he was driving 60 mph in a 40-mph zone at the time of the collision. The plaintiff asserted a punitive damages claim on the basis that the driver failed to comply with applicable laws and regulations based on his speeding and failure to keep a proper lookout. The plaintiff also sought punitive damages against the carrier, arguing it was vicariously liable for the driver’s conduct and also that it failed to comply with applicable regulations regarding the inspection, maintenance, and safe operation of its vehicles. However, the court found that the driver was not out of service at the time of the accident and that there were no allegations to support a conscious disregard on the part of the carrier that the driver was a danger to others on the road. Thus, the court granted the motion to dismiss the punitive damages claim against the carrier but converted it to a request for punitive damages under the plaintiff’s prayer for relief.

Whaley v. Amazon.com, Inc., 2024 WL 385019, No. 2:23-cv-04317 (D.S.C. Feb. 1, 2024). In this action arising from an accident between tractor trailer and a passenger vehicle, the court granted in part and denied in part the defendants’ motion to dismiss and separately denied their motion to strike. The commercial motor vehicle driver was involved in a collision with the plaintiff after allegedly turning in front of him. The driver was operating under the authority of a carrier, which had entered into an agreement with Amazon as part of its Relay Program. The plaintiff filed his complaint, alleging fourteen causes of action, predominately based in state law negligence. Amazon moved to dismiss or, in the alternative, to strike portions of the complaint regarding the Amazon Relay Program. The plaintiff opposed the motion, contending that the allegations regarding the Relay Program were necessary to demonstrate the exercise of control over the carrier and the driver, as well as to allege a claim for vicarious liability against Amazon. In a thorough analysis of the pleadings and the arguments, the court granted the motion to dismiss the claims for direct negligence against Amazon but found that the plaintiff had properly alleged sufficient control by Amazon over the driver to support an agency claim and also sufficient facts to support a vicarious liability claim. In allowing the agency claim to remain, the court noted that the Relay Program app generated invoices to pay the truck drivers, while other agency factors were factually plausible to support a claim at the pleading stage. The court also denied the motion to dismiss the negligent entrustment claim, finding that the plaintiff had alleged that the commercial driver was a poor driver and that the trucking company had entrusted its tractor to him and Amazon its trailer to him despite this knowledge. As to negligent hiring, training, retention, and supervision, the court noted that the parties did not provide direct arguments as to these claims but that it was enough to survive the motion to dismiss phase. The court did grant the motion as to negligent maintenance, finding that there was no allegation of a duty imposed on Amazon to inspect the tractor and no allegation of any defect in the trailer. As to the negligent selection of a subcontractor claim against Amazon, the court found the allegations sufficient to survive a motion to dismiss. The court also allowed joint venture/enterprise liability claims to survive, finding that the allegations, taken as true, were sufficient to support such claims. The court also denied Amazon’s motion to strike the allegations of the complaint regarding the relay program, as the court found the requirements of the program could potentially be relevant to support the plaintiff’s causes of action.

BROKER

Mays v. Uber Freight, LLC, 2024 WL 332917, No. 5:23-cv-00073 (W.D.N.C. Jan. 29, 2024). In this broker liability action involving a fatal accident, the District Court granted a motion to dismiss negligence, negligent hiring, training, supervision, retention, and wrongful death claims asserted against a freight broker. Following the accident with a carrier selected by the broker, the tort plaintiffs asserted the aforementioned causes of action against the broker. In moving to dismiss, Uber Freight argued that, as a broker, FAAAA preemption applied to all the plaintiffs’ causes of action asserted against it. The court agreed, finding that the allegations of the plaintiffs were related to Uber Freight’s rates, prices, or services so as to be preempted under FAAAA. In so ruling, the court looked to the Ye and Aspen decisions of the Seventh and Eleventh Circuits, respectively, to find that all claims, including the basic negligence claims were preempted. The court also found that a vicarious liability claim could not be established against Uber Freight as the mere broker to the transaction, finding that “the relationship between brokers and motor vehicle safety will [generally] be indirect, at most.” The court also found that the plaintiffs’ allegations of control by Uber Freight over the carrier did not have factual support, and it, therefore, dismissed all of the plaintiffs’ claims.

Golibart v. Complete Oilfield Servs., LLC, 2024 WL 379909, No. 1:24-cv-00020 (W.D. Tex. Jan. 31, 2024). In this broker liability action, the federal magistrate recommended that the matter be remanded back to state court after the defendants removed the case to federal court based solely upon FAAAA preemption. Plaintiffs filed suit against a broker and carrier after the carrier was involved in a collision that killed a cyclist. The broker removed the case to federal court, arguing that FAAAA created federal question jurisdiction. The Plaintiffs moved to remand the case back to state court, arguing the removal was not timely and that their state law claims were not completely preempted under FAAAA. The broker argued it had timely removed the case, that the Plaintiffs were attempting to create a new standard of care to apply to freight brokers, and that FAAAA gave rise to federal jurisdiction. The court found that the broker had not shown that it could not have timely removed the case after receiving the original complaint, which had substantially similar allegations as the amended complaint. Thus, the court recommended remand to state court without reaching the question of whether FAAAA would have given rise to federal jurisdiction.

CARGO

Starr Indem. & Liab. Co. v. Expeditors Int’l of Wash., Inc., 2024 WL 358901, No. 2:23-cv-00621 (W.D. Wash. Jan. 31, 2024). In this cargo claim brought by a subrogated insurer of a shipper, the District Court granted a railway’s and logistics company’s motions to dismiss under the Carmack Amendment while allowing the subrogated insurer to amend its Carmack claim. The suit arose after the subrogee’s insured purchased several items of clothing to be shipped from several Asian countries to its customers in Ohio. A non-vessel owning common carrier (“NVOCC”) issued two sea waybills for the transportation of the goods in four containers to the State of Washington, and a freight forwarder would handle the transportation of the goods from Washington to Ohio. Once the goods arrived in Washington, the freight forwarder had the goods consolidated into two cargo trailers and issued two “bookings” to transport the trailers overland from Washington to Ohio. The freight forwarder contracted with a carrier to pick up the goods and physically transport them to Ohio. This carrier, Max Trans, then picked up the goods and took them to a container yard. Max Trans then subcontracted some or all of the carriage to another carrier, Delta. At the container yard, Max Trans and/or Delta erroneously believed the goods were to be transported by rail to Ohio, so one or both of them took the goods to the railway’s yard where they loaded the goods onto the railway’s trailer on flat car “TOFC.” They did so despite the shipper requesting overland carriage by truck. The train on which the goods were loaded derailed and caught fire, and the goods were destroyed. The insured shipper then submitted its claim to the Plaintiff subrogated insurer, who in turn filed suit against the railway and the carriers. The railway and Max Trans argued the Plaintiff’s claims were preempted under Carmack and COGSA. The Court agreed as to Carmack, finding that the Plaintiff agreed “in principle” that Carmack applied, despite also suggesting it did not apply due to the mistake in the shipping process. The court found that at least one of the carriers had to issue a Carmack-compliant bill of lading under the facts, and while the Plaintiff argued there was no evidence that the railway issued a bill of lading, the court noted that this did not matter, as the relevant question was whether a carrier was required to issue a bill of lading. The court also rejected the Plaintiff’s argument that its insured did not purposefully avail itself of the railway’s services, instead finding that Carmack applied to treat the several carriers as one system. The court also found that the Plaintiff failed to state facts sufficient to constitute a Carmack claim, but it allowed the Plaintiff the opportunity to amend the complaint to sufficiently allege such a claim. The court also rejected the railway’s argument for dismissal on the ground that the Plaintiff failed to provide written notice under the uniform bill of lading requirements, given that the allegations showed a bill of lading was not issued.

AXA XL Ins. Co UK Ltd. v. Exel Inc., 2024 WL 639327, No. 2:23-cv-21874 (D.N.J. Feb. 15, 2024). In this action filed by a subrogated insurer, the District Court granted in part and denied in part the Defendant logistics company’s motion to dismiss. The Defendant had received three shipments of champagne for transport from New Jersey to the consignee in Florida. Three bills of lading were issued to the logistics company’s carrier, but the carrier was involved in an accident in South Carolina while transporting the champagne. While some of the bottles of champagne were salvaged, the subrogated insurer sought reimbursement for the remainder of the loss. The Plaintiff insurer alleged that the logistics company had operated as a carrier and a broker and brought claims under the Carmack Amendment and for breach of contract. The logistics company moved to dismiss for failure to state a claim, but the court found the Plaintiff had properly alleged a Carmack claim. As for the breach of contract claim, the court found that it would not be preempted under FAAAA and further that it would not be preempted under Carmack if the logistics company operated as a broker, which the complaint alternatively alleged. The court found the plaintiff could properly plead in the alternative that the logistics company operated as a broker or a carrier. However, the court did dismiss the Plaintiff’s claim that the logistics company failed to comply with “industry guidelines and applicable law,” finding that such allegations could not form the basis of a breach of contract claim. The court also denied the Defendant’s motion to dismiss for improper venue, finding that the suit could be filed in South Carolina where the accident occurred but also in New Jersey where the cargo was shipped.

Julsonnet v. Tophills Inc., 2024 WL 583541, No. 22-10767 (D. Mass. Feb. 13, 2024). In this cargo claim action, the district court granted in part and denied in part a carrier’s motion for summary judgment. The plaintiffs hired a logistics company to arrange for the moving and storage of their belongings across the country, and the logistics company hired the defendant carrier. The plaintiffs paid a 25% deposit and alleged the carrier loaded part of their belongings, left, and never returned to load the remainder of their goods. They also alleged the carrier refused to return the goods that had been loaded. The plaintiffs sued the logistics company, the carrier, and the owners of each company under violations of the Federal Motor Carrier Safety Act, civil RICO, the FTC Act, and several other state law claims. The carrier counterclaimed, alleging the plaintiffs failed to pay it for the moving and packing services that had been done. It was alleged that when the carrier’s foreman initially arrived to pick up the goods, he demanded that the plaintiffs sign a new bill of lading before the movers began loading the truck. The plaintiffs refused, but the loading commenced. When the plaintiffs communicated that they would not pay 65% of the balance due until the truck was fully loaded, the carrier allegedly took what it had loaded, left, and never returned to load the remainder of the goods. While the plaintiffs were finally reunited with their belongings after contacting the police, they still filed suit. The carrier and its owner, the only remaining defendants, argued that the state law claims were preempted under Carmack. The plaintiffs argued Carmack did not apply because the carrier never took their goods outside the State of Massachusetts. Ultimately, the court found that some of the claims were not preempted because the plaintiffs had alleged harms apart from the loss or damage of the goods but that other claims alleging the damage or destruction of the goods were preempted. The court also denied summary judgment with respect to the Federal Motor Carrier Safety Act claim, granted summary judgment as to the carrier but not the owner for the civil RICO claim, denied it as to the breach of contract claim, granted it as to the unfair or deceptive business practice claim (as the decision to hire the carrier was for personal rather than business reasons), and denied summary judgment as to the plaintiffs misrepresentation claims.

COVERAGE

Progressive Mountain Ins. Co. v. Chen, 2024 WL 476962, No. 1:22-cv-1913 (N.D. Ga. Feb. 7, 2024). In this declaratory judgment action, the court granted summary judgment and a default judgment in favor of the insurer. Regarding the facts, the tort plaintiff/driver was an employee of the defendant carrier and had been tasked with picking up a load of fish from Arkansas and delivering it to Atlanta. On his return trip, the tort plaintiff/driver was involved in an accident when he lost control of his vehicle, crossed a median, and hit another tractor-trailer. The insurer insured the vehicle being operated by the tort plaintiff/driver, and the policy contained several exclusions and an MCS-90 Endorsement. One of the exclusions stated “insurance . . . does not apply to injury to or death of the insured’s employees while engaged in the course of their employment.” The policy also contained an exclusion for bodily injury to the insured’s employees and for injuries that would be covered under workers’ compensation. The policy also contained a UM endorsement, which read that the insurer would “pay for damages, other than punitive or exemplary damages, which an insured is legally entitled to recover from the owner or operator of an uninsured auto because of bodily injury or property damage,” and the endorsement applied when (1) an injury was sustained by an insured; (2) the injury was caused by an accident; and (3) the events leading to the injury arose “out of the ownership, maintenance, or use of an uninsured auto.” The endorsement also stated that “an ‘uninsured auto’ does not include any vehicle or equipment . . . shown on the declarations page of this policy.” The vehicle driven by the tort plaintiff/driver was listed on the declarations page. The insurer argued that the claims for coverage by the tort plaintiff/driver were barred because of the exclusionary language in the policy and the language contained in the MCS-90 Endorsement. The insurer also argued that the tort plaintiff/driver was not entitled to UM coverage because the vehicle he was driving did not meet the definition of an uninsured auto. The tort plaintiff/driver argued that enforcement of the exclusions would violate public policy. In analyzing the insurer’s claim for declaratory relief, the court viewed the uncontroverted evidence that the tort plaintiff/driver was an employee within the course and scope of his employment and that the covered auto was not an uninsured vehicle. Finding that the exclusion was unambiguous, it found that the insurer had no obligation under the policy to the tort plaintiff/driver. In analyzing the tort plaintiff/driver’s public policy argument, the court found that the employer had failed to procure requisite workers’ compensation insurance but that the employer would be personally obligated to cover the injuries. Thus, because the driver was not unprotected, the court did not invalidate the exclusions as against public policy. The court also granted default judgment against the employer, which had failed to timely answer.

Prime Ins. Co. v. Cordova, 2024 WL 513706, No. 22C-04-086, (Del. Feb. 9, 2024). In this appeal by the insurer of an interlocutory order, the Delaware Supreme Court declined to hear the interlocutory appeal. A commercial driver was involved in an accident and struck another vehicle, injuring the occupant. The injured driver sued the commercial driver and his employer, and the Superior Court entered a default judgment after they failed to respond. Prime, the insurer of the commercial driver’s employer, insured a different vehicle under the employer’s policy, which included an MCS-90 Endorsement. Following the entry of the default judgment, Prime moved to intervene in the tort suit, but the Superior Court denied the motion because Prime was unwilling to confirm that the MCS-90 Endorsement would apply to the accident and because its application was untimely. Prime moved for an interlocutory appeal, but the Supreme Court refused the appeal, finding the application was not timely filed.

New York Marine & Gen. Ins. Co. v. ST Freight LLC, 2024 WL 343230, No. 23-C-1268 (E.D. Wis. Jan. 30, 2024). In this declaratory judgment action, the district court granted the insured’s motion to dismiss. The insured operated as a freight broker, and the insurer issued a policy contained general liability coverage, an umbrella policy, and a commercial auto policy. The insured was named as one of several defendants in a lawsuit arising from an accident in New Mexico that resulted in two fatalities. The insured sought coverage under its policy, but the insurer responded that it owed no obligations to defend or indemnify the freight broker. The insurer then filed this declaratory judgment in the Eastern District of Washington, seeking to confirm the same with respect to the New Mexico lawsuit. The freight broker filed a third-party complaint in the New Mexico action against the insurer, seeking a ruling regarding the insurer’s coverage obligations. The broker then moved to dismiss or stay this declaratory judgment action, pending the disposition of the New Mexico claim. The Wisconsin court agreed, finding that dismissal of the declaratory judgment was appropriate, given that both parties were also parties in the New Mexico action and that allowing the declaratory judgment to proceed would not serve a useful purpose but be duplicative. Thus, the court abstained from proceeding further and granted the motion to dismiss.

AmGUARD Ins. Co. v. Hansen, 2024 WL 665649, No. 1:22-cv-197 (M.D. Ala. Feb. 16, 2024). In this declaratory judgment action, the court denied several moving parties’ motion for a judgment on the pleadings. The matter stemmed from a car wreck involving a Donald Schulman Wrecking Service (“DSW”) vehicle. AmGUARD was the insurer of the DSW vehicle, and it alleged that the former DSW owner misrepresented to law enforcement that he was the driver of the vehicle when it was in fact his son. The insurer also alleged that the DSW owner misrepresented on his policy application that there would be no other drivers for the business apart from himself, despite knowing that his son would drive and the policy requiring DSW to report all possible drivers to the insurer for approval prior to hiring as a driver. The tort claimants, who had been named as defendants in the declaratory judgment action, moved for judgment on the pleadings. It appeared undisputed that the coverage form preconditioned coverage on DSW’s compliance with its duties to provide notice of how, when and where the accident occurred and to assist with investigation of the claim. The coverage form also contained a clause stating it was void in the event that there was any fraud or misrepresentations of material fact on the part of the insured. It also contained an MCS-90 endorsement. The insurer sought a declaration that the policy was void based on DSW’s alleged misrepresentations, that it had no obligations to provide coverage due to DSW’s failure to cooperate with the investigation, and that it had no duty under the MCS-90 Endorsement because the vehicle was not engaged in interstate commerce at the time of the accident and that the endorsement was void due to the alleged misrepresentations. The court found that the pleadings did not allege that the insurer knew that the son was driving vehicles when it issued the policy and denied the individuals’ motion on those grounds. With respect to the notice requirement, the individuals claimed that the lack of notice was immaterial because the son would have been a permissive user, but the court disagreed, finding that whether the son was covered was a separate issue from whether the insured complied with the notice obligations. The court was also unpersuaded by the individuals’ argument that the insurer eventually found out who was operating the vehicle, thus negating the notice requirement, instead finding that the insured could still have failed to meet its obligations under the policy. The court also rejected the individuals’ argument that the misrepresentation was not prejudicial to the insurer’s defense of the case, finding that a failure to cooperate by the insured relieves an insurer of its duty to cover and defend. Finally, the court withheld judgment on the MCS-90 issue, finding that there were questions of fact with respect to whether the vehicle was engaged in interstate commerce as well as the vehicle’s weight.

Brad Hall & Assocs., Inc. v. RSUI Indem. Co., 2024 WL 325278, No. 2:23-cv-00213 (D. Nev. Jan. 26, 2024). In this declaratory judgment action, the court granted in part dueling motions for summary judgment between an insured and its excess insurer. The insured’s driver was involved in an accident that resulted in property damage, bodily injuries, and two separate fuel spills. The Nevada DOT dispatched an emergency response contractor to perform pollution mitigation work. The insured also hired its own contractor to perform pollution mitigation efforts, and it claimed it did so prior to hearing from the Nevada DOT. The insured had three policies relevant to the accident, one which provided coverage for pollution, another which provided business automobile coverage, and the excess policy which applied to the business auto policy. The first level insurer on the business auto policy paid for the property damage, personal injuries, and remediation costs for the fuel spilled from the tractor, but not for the fuel spilled from the trailers, and its policy limit was exhausted. The excess insurer accepted coverage for the injuries and property damage, but not for the environmental remediation, arguing the primary insurer’s policy did not provide coverage for the trailer spills and that the excess policy had a pollution exclusion. The insured sued the excess insurer for breach of contract, bad faith, unfair claims practices, and for a declaratory judgment. The excess insurer also filed for declaratory relief. In examining the policy, the court found that the excess insurer would “pay those sums in excess of the [primary insurer’s policy] that [the insured] become[s] legally obligated to pay as damages because of injury to which this insurance applies, providing that [the primary insurer’s policy] also applies, or would apply but for the exhaustion of its applicable Limits of Insurance.” The excess policy was subject to the same terms as the primary policy, except for any provisions to the contrary. Turning to the primary policy, the court found there was no question the tractor was a covered auto and that it covered pollution costs or expenses. The court also found the policy contained a valid exclusion for fuel spill from the trailers. However, the court found that the excess policy would apply to cover fuel spilled from the tractor if the costs for the cleanup arose from a statutory or regulatory obligation but not if the costs arose from a request, demand, or order to clean up based on the plain unambiguous language of the policy.

Am. Sentinel Ins. Co. v. Nat’l Fire & Marine Ins. Co., 2024 WL 545708, No. 23-55175 (9th Cir. Feb. 12, 2024). In this appeal from a grant of summary judgment and denial of a motion for judgment on the pleadings, the Ninth Circuit affirmed the district court. The insured had leased a trailer to a separate carrier, which attached the trailer to its tractor. The court found the trailer to be a covered auto under the policy, as it defined an insured as “the owner or anyone else from whom you hire or borrow a covered auto that is a trailer while the trailer is connected to another covered auto that is a power unit.” The question for the court was whether any exceptions applied to the definition of an insured. National contended that the Truckers Exception, which provides that a trucker is not an insured “if the trucker is not insured for hired autos under an auto liability insurance form that insures on a primary basis the owners of the autos . . . while the autos are being used exclusively in the trucker’s business and pursuant to operating rights granted to the trucker by a public authority.” However, the court found the exception did not apply, as it covered only a loan or lease by the separate carrier to another trucker. The court also found the exception did not apply because the initial carrier had requisite reciprocal hired auto coverage. Thus, the court affirmed the lower court’s ruling.

WORKERS COMPENSATION

No cases of note to report this month.