We hope you enjoyed your Memorial Day Holiday!

Welcome to the unofficial start of summer 2022!

Our keen readers will notice that this edition of the Bits & Pieces was delivered during the first few days of June. Our intention was to give everyone a chance to get back in the swing of things after the Memorial Holiday.

Memorial Day is observed each May, but how many of us know what Memorial Day is truly about—or its history? Memorial Day is considered a federal holiday in the United States in which we honor and mourn members of the military who have passed while serving in the United States Armed Forces.

On a side note, we would also like to thank everyone that attended the MCIEF Western Conference May 19th & 20th. It was great to see everyone, and we look forward to seeing additional folks at the Annual Conference in October in Orlando.

We hope everyone has a great summer!

CAB Live Training Sessions

Tuesday, June 14 @ 12p EST: Chad Krueger will present on Chameleon Carriers and Interrelated Entities. This session will cover the concept of a chameleon carrier, interrelated entities and the features CAB provides to identify and understand the relationships that may exist between motor carriers. Do not miss out on this opportunity to learn about this powerful CAB feature. Click here to register.

Tuesday, June 21st @ 12p EST: Mike Sevret will present on The CAB Report®. This training session will provide a detailed page by page overview of the CAB Report®, the data contained within, and the features available. This is a great session for newer and experienced users. Click here to register.

Don’t forget, you can explore all of our previously recorded live webinar sessions on our website!

Follow us at the CAB Linkedin page and the CAB Facebook page.

CAB’s Tips & Tricks: CAB Express Report trial has ended.

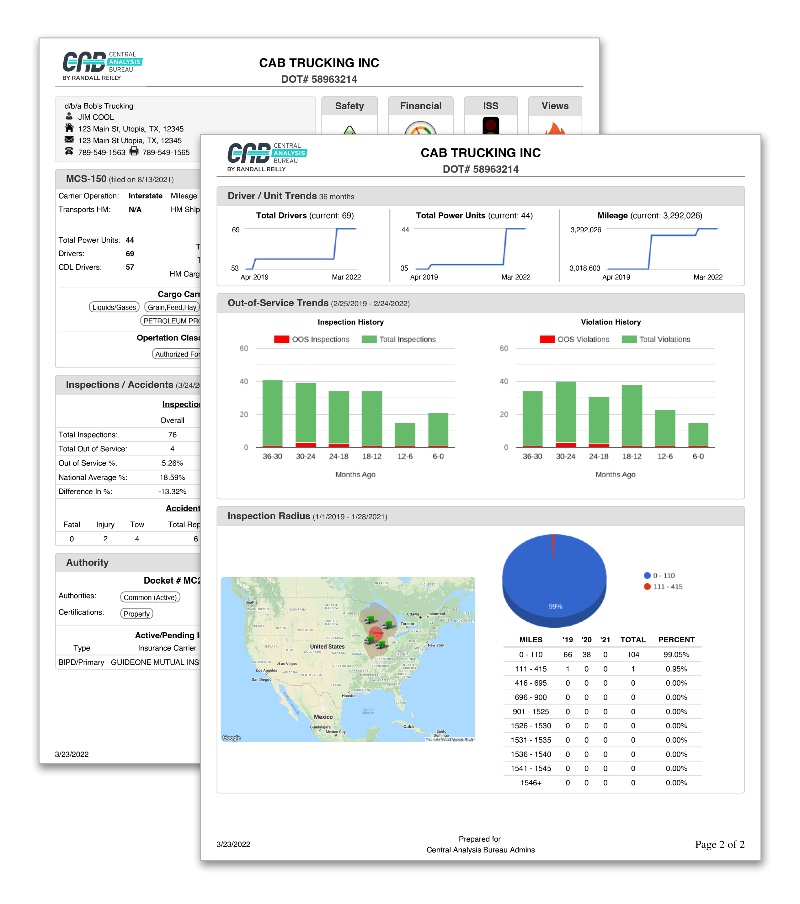

We hope you had an opportunity to try our new CAB Express Report. Thus far, it has turned out to be very popular with a number of organizations adding the CAB Express Report to their current service.

The concise summary provided by the CAB Express report perfectly complements the in-depth analysis of the full CAB Report® to provide the best set of tools needed for the risk selection process.

The CAB Express Report can be added to your annual service immediately. To learn about pricing, please reach out to your CAB Representative at 212.244.6575 or via “Contact Us” link which is available in the “My Account” tab within your CAB access.

THIS MONTH WE REPORT:

FMCSA amending household goods regs for carriers: The Federal Motor Carrier Safety Administration will be incorporating certain recommendations from the Household Goods Consumer Protection Working Group into the Transportation of Household Goods regulations. These changes to 49 CFR part 375 are intended to streamline documentation requirements, increase efficiency for the transportation of household goods and documentation requirements, improve consumer education and protection for individual shippers, and combat fraud. Read more here.

After March decline, truck transportation jobs up sharply in April: Though the March report showed a drop in job compared to February, the report for April showed an additional 13,000 truck transportation jobs, bringing the total of 1,564,100. This is the largest jump since April 2013, which had an increase of 15,800 jobs. Read more here.

CVSA announces Roadcheck inspection blitz dates, OOS criteria changes: This year’s International Roadcheck inspection blitz was help May 17-19 and focused on wheel ends. The Commercial Vehicle Safety Alliance chose to focus on wheel ends this year because related violations normally account for a quarter of vehicle out-of-service violations discovered during International and are one of the top 10 vehicle violations. Read more here.

Best practices for controlling CSA maintenance violations: To avoid CSA maintenance violations, always inspect your truck before your trip. Fleet owners an encourage this by making the inspection process as easy as possible for drivers by making forms electronic and easier to fill out. The same applies for post-trip inspections. Always make necessary repairs as quickly as possible, as well. Learn more tips here.

ATA, OOIDA ask for speed limiter comment period extension: The American Trucking Association (ATA) and the Owner-Operator Independent Drivers Association (OOIDA) both asked the Federal Motor Carrier Safety Administration (FMCSA) for additional time to comment on the proposal to require speed limiters on all heavy-duty trucks. Both organizations believe an extension will allow them enough time to develop meaningful feedback for the public comments. Read more here.

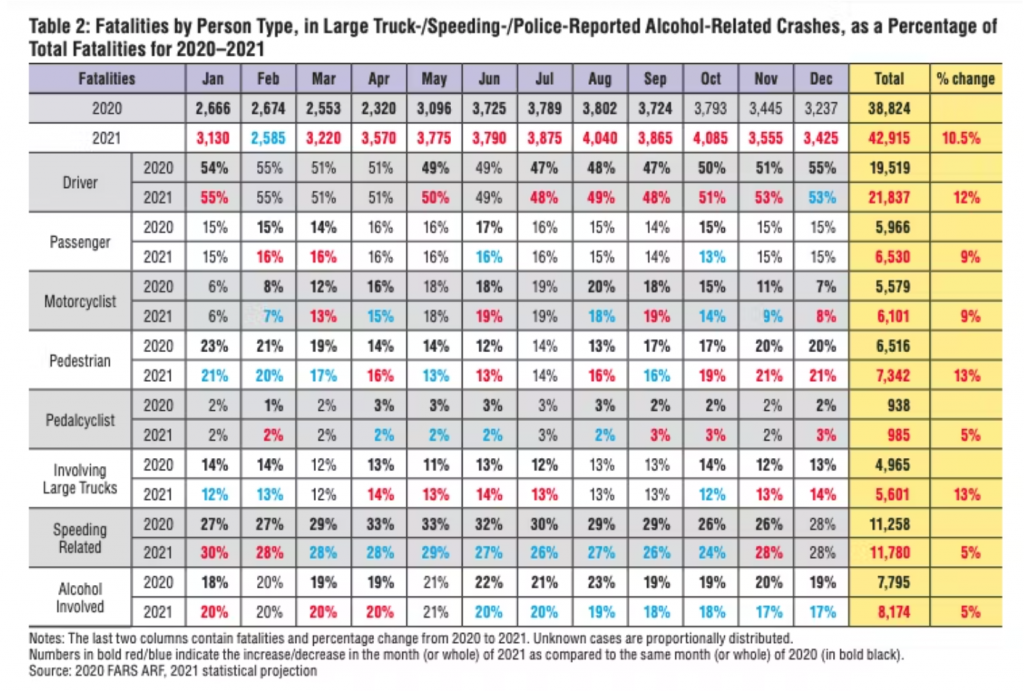

Traffic deaths reach 16-year high, NHTSA estimates: Traffic deaths in 2021 increased by 10.5% from 2020 according to data from the national Highway Traffic Safety Administration (NHTSA), rising from 38,824 to 42,915 fatalities. This projected number is the highest since 2005, and the largest annual percentage increase in the history of the Fatality Analysis Reporting System. Read more here.

Top fleets’ Q1 earnings dispute freight recession narrative: Though the beginning of the year was marked with worries for freight recession, Q1’s earnings for top fleets put those fears to rest. Many fleets are even predicted conditions to remain good through Q2 and even throughout the rest of the year. Read more here.

Liability insurance increase held back by lack of insurance data: The FMCSA sent a report to Congress in May explaining that the organization in reluctant to get behind an increase in a carrier’s $750,000 liability insurance requirement, despite admitting that catastrophic crashes—though rare—”can significantly exceed the minimum level of financial responsibility.” However, the FMCSA said that the insurance industry’s lack of transparency is preventing the organization from supporting increases. Read more here.

Freight volumes down as chances of freight recession rise: The Cass Transportation Index report for April 2022 showed that U.S. freight volumes fell in April from March and the year-ago period. With more difficult comparisons in the next few months, Cass predicts more softness is coming as disruptions continue and possibly increase in the global supply chain. Read more here.

May 2022 CAB Case Summaries

These case summaries are prepared by Robert “Rocky” C. Rogers, a Partner at Moseley Marcinack Law Group LLP.

AUTO

Reilly v. Jones, 2022 U.S. Dist. LEXIS 86458, C.A. No. 3:21-cv-1521 (M.D. Pa. May 12, 2022). A motor carrier’s motion to dismiss on a punitive damages claim was denied where the trial court found the complaint alleged conduct sufficient to rise to the level of recklessness to support the punitive damages claim under Pennsylvania law. The court intimated the motor carrier may have success at the summary judgment phase, however.

Davis v. Adeoye, 2022 Conn. Super. LEXIS 547, Dkt. No. CV 20-6109798 (Conn. Super. Ct. May 10, 2022). A defendant’s Graves Amendment defense was stricken where the trial court found the defendant had failed to sufficiently pled facts giving rise to the applicability of the defense.

Johnson v. Valenzuela Acosta, 2022 U.S. Dist. LEXIS 90240, C.A. No. 3:22-cv-82 (W.D. Ky. May 19, 2022). A federal court remanded a removed case arising from a tractor-trailer accident, finding defendants’ removal was untimely. The original complaint merely alleged negligence and did not include any specific monetary demand. However, the plaintiff subsequently issued a settlement demand letter, demanding $445,000. The court held the demand constituted an “other paper” sufficient to provide “solid and unambiguous information that the case is removable” under 28 U.S.C. § 1443(b)(3) (i.e. amount in controversy exceeded $75,000) and under the applicable Sixth Circuit precedent. Since the removal did not occur within 30 days of the receipt of the demand letter, the removal was deemed untimely, and the case remanded to state court.

Morga v. FedEx Ground Package Sys., 2022 N.M. LEXIS 19, No. S-1-SC-36918 (N.M. May 19, 2022). The Supreme Court of New Mexico denied defendants’ motion for a new trial in a case in which the jury award totaled more than $165 million to four plaintiffs. The court found that the verdict was supported by substantial evidence and the record did not reflect the verdict was tainted by passion or prejudice. In the accident, a tractor pulling a double set of trailers crashed into the rear of a small pickup truck that had its flashers on and was either stopped or was moving very slowing in the right-hand lane of travel. A witness indicated the tractor-trailer never slowed and was traveling at sixty-five miles an hour at the moment of impact. The evidence established the tractor-trailer driver was distracted and never braked. Two occupants of the pickup were killed and another occupant sustained significant injuries. The trial judge denied the defendants’ post-verdict motion for a new trial, which was affirmed on appeal by the Court of Appeals under an abuse of discretion standard. The Supreme Court of New Mexico confirmed this was the appropriate standard for review of the denial of a new trial, not de novo review as the defendants argued. However, the de novo standard did apply to the issue of whether the verdict was excessive. Under this standard, the court held the award of noneconomic damages was not excessive and was supported by substantial evidence. The court also questioned whether the defendants’ comparison of other verdicts approach was useful in determining the excessiveness given the uniqueness of the facts of each case. The court also rejected comparison of economic and noneconomic damages as a measure of excessiveness. The court likewise rejected defendants’ claims that aspects of the trial stoked the passion or prejudice of the jury.

Holland v. Cypress Ins. Co., 2022 U.S. App. LEXIS 12842, C.A. No. 20-13538 (11th Cir. May 12, 2022). A jury verdict arising out of a tractor-trailer accident was affirmed on appeal. The appellate court ruled that the trial court properly denied the defendants’ motion for directed verdict because the evidence of negligence was overwhelming, specifically finding it established the truck driver was driving erratically before the crash, the truck driver lied on his DOT medical history form, and the jury could have concluded from the evidence presented the truck driver was taking hydrocodone while driving. The court further held the defendants failed to establish proof to support an Act of God defense as alleged. The court further affirmed the $2 million pain and suffering award because there was evidence to support pre-impact pain and suffering, including a video from a nearby business’s security camera showing the accident victim saw the trailer approaching him before impact. Last, the court held the trial court properly denied defendants’ motion for a mistrial, because even assuming the plaintiff’s counsel misstated the law in closing arguments, the trial judge provided a curative instruction. Gilbert v. Zablauskas, 2022 Conn. Super. LEXIS 518, Dkt. No. UWY CV 18 6041805 (Conn. Super. Ct. Apr. 29, 2022). The trial court dismissed a tort plaintiff’s unfair trade practices act claim, which alleged the motor carrier failed to adhere to federal and state law pertaining to the hiring, training, and supervision of their drivers and the way routes should be chosen. She further alleged these failures contributed to the accident involving one of the motor carrier’s drivers and equipment. The court stressed the UTPA was not enacted for the purpose of regulating motor vehicle safety and the FMCSA/FMCSRs do not create a private right of action for personal injury suits. As such, the court held the plaintiff lacked standing to allege a UTPA claim under these facts.

Johnson v. Ortiz Transp., LLC, 2022 N.Y. App. Div. LEXIS 2940, C.A. No. 2018-14263 (N.Y. App. Div. May 4, 2022). The New York appellate court affirmed the trial court’s denial of a motion to amend to add the owners of a trucking company as tort defendants. The proposed amended pleading lacked the necessary factual allegations to support piercing the corporate veil.

Vaccaro v. Francolopez, 2022 N.Y. App. Div. LEXIS 2900, C.A. No. 2020-02824 (N.Y. App. Div. May 4, 2022). The New York appellate court affirmed the trial court’s dismissal of a personal injury action against Ryder Truck Rental, Inc. under the Graves Amendment.

Resser v. J.B. Hunt Transp., Inc., 2022 U.S. Dist. LEXIS 76884, C.A. No. 1:21-cv-01041 (M.D. Pa. Apr. 27, 2022). In a personal injury action arising from a motor vehicle accident involving a motor carrier, the tort plaintiff sought in discovery the following materials: (1) DQ file; (2) driver investigation history file: (3) all documents pertaining to the annual inquiry of the driver’s driving record; (4) all documents relating to any audit of the DQ file performed by DOT; (5) all documents required to be maintained related to the driver in the event of an audit by DOT; (6) all records related to the driver’s job performance; and (7) all documents relating to the motor carrier’s commencement and/or termination—voluntary or involuntary—of employment with the motor carrier. Motor carrier raised multiple objections including that the request was vague, overly broad, not proportional to the needs of the case, and sought disclosure of subsequent remedial measures. The court, while agreeing with the motor carrier, that the relevant focus was what happened at the time of the accident, held some of the records were nevertheless relevant insofar as they related to the safety record of the driver. However, since the tort plaintiff had not alleged a negligent hiring cause of action, the court held the 49 CFR 391.53 records—the driver investigation history file—were not relevant and therefore not discoverable. The court also held tort plaintiff had not satisfied its burden to establish the relevance of any documents subject to audit by DOT and all documents relating to the driver’s performance (other than the termination notification). The court carefully noted that for those materials it ordered produced, it was withholding judgment on ultimate admissibility, which could be challenged via a subsequent motion in limine.

Sanchez v. S&H Transp., Inc., 2022 U.S. Dist. LEXIS 74480, C.A. No. 20-cv-0374 (N.D. Ok. Apr. 25, 2022). A motor carrier was granted summary judgment on negligent entrustment and negligent hiring, training, supervision, and retention causes of action. The driver/owner-operator was involved in an accident while pulling a trailer belonging to a motor carrier while operating under that motor carrier’s DOT authority. The owner/operator had worked for the motor carrier for nearly 30 years and had worked as a truck driver for almost 40 years. The motor carrier submitted proof of all pre-employment background checks and annual driving history checks. The driver had no significant prior moving violations or accident history. On the negligent entrustment claim, the tort plaintiff—faced with the fact that the owner/operator owned the truck he was driving at the time of the accident—argued that the motor carrier negligently entrusted its DOT authority to the owner/operator. The court was skeptical whether such a theory supports a negligent entrustment cause of action, but nevertheless held even it the entrustment of DOT authority could form the basis for this claim, there was no evidence to support the motor carrier knew or should have known entrusting its DOT authority to the owner/operator was dangerous and likely to harm others. With respect to the remaining claims, the court held the undisputed evidence established there was nothing to give the motor carrier notice that hiring or retaining the owner/operator was likely to cause an undue risk of harm. As such, the motor carrier was entitled to summary judgment on each of these claims.

Jiang v. Z&D Tour, 2022 NYLJ 412, C.A. No. 152331/2021 (N.Y. Sup. Ct. Apr. 28, 2022). Multiple defendants were granted motions to dismiss for lack of personal jurisdiction. This lawsuit arose out of multi-vehicle accident that occurred in Pennsylvania. The tort plaintiff filed suit in New York, which she lived. The tort plaintiff was a passenger on a bus operated by Defendant Z&D. The driver of the bus lost control and rolled the bus, which was subsequently struck while standing askew across the roadway by two tractor-trailers owned and/or operated by defendants FedEx Ground Package, Penske Truck Leasing, and UPS. Z&D had its principal place of business in New Jersey but had registered with the State of New York as an out-of-state business authorized to do business in the State of New York. Z&D also owned and operated a brick-and-mortar storefront in New York City from which it sold tickets for and chartered buses from New York to Ohio. FedEx Ground is incorporated under the laws of the State of Delaware with its principal place of business in Pennsylvania. The FedEx tractor-trailer involved in the accident did not travel through and neither departed from nor was headed to New York. Penske is a Delaware business corporation with its principal place of business in Pennsylvania. UPS is a corporation under Ohio law with its principal place of business in Georgia. Under these facts, the court held it had general personal jurisdiction and specific personal jurisdiction over Z&D but lacked either general or specific personal jurisdiction over the other defendants.

Mata v. Argos USA, LLC, 2022 Tex.App. LEXIS 2639 (Tex. Ct. App. Apr. 22, 2022). The Court of Appeals of Texas affirmed the trial court’s grant of summary judgment in favor of a shipper on claims that: (1) it was vicariously liable for the negligence of the motor carrier and driver transporting its cargo; (2) negligent hiring of the motor carrier and driver; (3) it violated its duty, under its own internal safety policies, to ensure the safety of the motor carrier’s tractor-trailer; (4) violations of the FMCSRs; and (5) negligence per se. In affirming summary judgment, the court held there was no evidence to establish the shipper exerted any control over either the freight broker who hired the motor carrier or the motor carrier/driver. Further, the FMCSRs and equivalent state statutes/regulations did not apply to the shipper—they only apply to motor carriers. Finding the shipper exerted no control over either the freight broker or the motor carrier/driver, there was no basis for liability against the shipper under common law, even if the shipper did not follow its own “internal best practices” for selecting independent contractor motor carriers.

Monk v. Luna, 2022 N.Y. Misc. LEXIS 1604, Index No. 450721/2021 (N.Y. Sup. Ct. Mar 29, 2022). The owner/lessor of a motor vehicle involved in an accident was entitled to summary judgment on claims of vicarious liability for the negligence of the operator of the motor vehicle under the Graves Amendment where the undisputed evidence established there was no mechanical defect with respect to the leased auto.

Price v. Austin, 2022 Mich. LEXIS 791 C.A. No. SC 161655 (Mich. Apr. 22, 2022). The Supreme Court of Michigan reversed summary judgment in favor of a tractor-trailer operator who alleged as a defense to the negligence claims the sudden emergency doctrine. The driver presented his own testimony, testimony from his treating physicians, medical records, testimony from the responding officer, GPS records, and the evidence of a lack of braking before the accident. However, the court held credibility of the driver’s account was in issue, and accordingly summary judgment was inappropriate.

BROKER

Mata v. Allupick, Inc., 2022 U.S. Dist. LEXIS 87656, C.A. No. 4:21-cv-00865 (N.D. Ala. May 16, 2022). In a personal injury lawsuit arising from a motor vehicle accident involving a tractor-trailer, the freight broker’s motion for judgment on the pleadings under FAAAA preemption was denied. The court held while the tort plaintiff’s claims related to a freight broker’s services, the safety regulatory exception applied to prevent the claims from being preempted.

CARGO

Swenson v. Storage, LLC, 2022 U.S. Dist. LEXIS 86466, C.A. No. 21-cv-01968 (D. Co. Apr. 26, 2022). At the motion to dismiss stage, the Colorado federal court held it was premature to determine whether the Carmack applied to a company who offered/marketed interstate moving services to consumers, but who ultimately contracted with other interstate household goods movers to perform the moves. As such, the court denied the defendant’s motion to dismiss the Carmack Amendment claim and further denied the defendant’s motion to dismiss the state law claims for disgorgement of profits, breach of contract, violation of the Colorado Consumer Protection Act, and injunctive relief because if ultimately the defendant acted as a freight broker only, then there would be no Carmack preemption for these causes of action. However, the court did hold that FAAAA preempted the Consumer Protection Act claim.

Gold Town Corp. v. United Parcel Servs., Inc., 2022 N.Y. Misc. LEXIS 2063, C.A. No. 570230/21 (N.Y. App. Div. May 18, 2022). The New York appellate court affirmed the lower trial court’s grant of UPS’s motion to dismiss a tort plaintiff’s negligence, conversion, and fraud causes of action for UPS’s alleged failure to deliver or return a package. The court held the FAAAA preempted those causes of action because they related to the “price, route, or service of motor carriers of property” and directly related to UPS’s alleged failure to deliver the package as agreed.

Dillard v. Smith, 2022 U.S. Dist. LEXIS 83706, C.A. No. 1:19-cv-821 (N.D. Ga. May 9, 2022). A trucking company was granted summary judgment on a punitive damages claim premised upon its driver’s alleged negligence, but its summary judgment motion on the negligent hiring, training, and entrustment claim was denied. The facts revealed that the driver of the tractor-trailer had not previously encountered any issues with his brakes. As he approached a red light, he determined it took more pressure than normal to get the brakes engaged and the tractor-trailer stopped. Realizing that it was dark outside and there was no room for him to safely pull over, and that he was very near his destination, he opted to continue toward his destination and address the brake issue at that time. Unfortunately, as he approached another stop light, he was unable to stop at all and ran through the light, causing a collision. The driver was driving 55 mph prior to attempting to stop. Under this record, the court held there was not sufficient evidence to support a punitive damages award based upon the driver’s actions. With respect to negligent hiring, retention, supervision, and entrustment claim, the court held the record before it was insufficient under the applicable rules to establish no question of material fact existed and therefore that aspect of the motion was denied. Chubb Seguros Arg. S.A. v. UPS, 2022 U.S. Dist. LEXIS 80352, C.A. No. 20-cv-3074 (S.D.N.Y. May 3, 2022). At issue in this case were both standing and the effectiveness of a limitation of liability under the Carmack Amendment. AMX purchased a piece of telecommunications equipment from a supplier. AMX then contracted with a freight forwarder to arrange for the total transportation of the cargo from Tempe, Arizona to Argentina. The freight forwarder subcontracted with its USA-based affiliate, who in turn subcontracted with a carrier (GLT), who in turn subcontracted with UPS to transport the cargo by truck from Tempe, Arizona to Miami, Florida. AMX had no contact with any of the subcontractors prior to the cargo’s departure from Arizona. AMX was familiar that overland carriers sometimes impose limitations of liability and itself had an entire in-house department whose job was to process and consider whether to declare excess values or increase limitations of liability; however, in this instance AMX did not seek to increase the limits of liability because it already had an existing cargo loss insurance policy covering the loss. The agreement between GLT and UPS was private and confidential and offered no option for full Carmack liability. GLT drafted the bill of lading based upon information provided by the freight forwarder and UPS issued the bill of lading. The freight forwarder did not include a declared value for the cargo. UPS was listed as the carrier, the supplier in the “Ship From” box and the freight forwarder in the “Ship To” box on the bill of lading. The cargo was damaged while in transit from Arizona to Miami. Chubb, as the insurer, for AMX paid the cargo loss claim and was subrogated to AMX’s rights. Chubb then sued the freight forwarder’s USA affiliate, GLT, and UPS. The court rejected UPS’s arguments that Chubb lacked standing to sue under Carmack because it was not listed on the bill of lading. It explained Carmack “allows suits by anyone entitled to recover in the receipt or bill of lading, including the buyer who was to receive the goods.” Under traditional agency theories, and because UPS knew the freight forwarder’s USA affiliate was not the ultimate consignee and was not the “real party in interest”, the court held AMX had standing to sue under Carmack, and Chubb, who was subrogated to AMX’s rights, likewise had standing to sue under Carmack. The court further ruled there was a material disputed fact whether UPS properly limited its liability. The court did hold that the freight forwarder could have effectively agreed to UPS’s limitation of liability, even if the consignee or shipper themselves were not offered the fair opportunity to select a higher or lower limit of liability in exchange for differing shipping rates. However, on the record before the court there was insufficient evidence of the negotiations between GLT and the freight forwarder or the freight forwarder’s knowledge of the private agreement between GLT and UPS to decide the fair opportunity issue.

COVERAGE

James River Ins. Co. v. Rich Bon Corp., 2022 U.S. App. LEXIS 13851, C.A. No. 20-11617 (11th Cir. May 23, 2022). The Eleventh Circuit Court of Appeals reversed the district court and remanded the insurance coverage declaratory judgment action to the district court for further proceedings. The district court, weighing its discretion to hear the federal coverage action under the federal Declaratory Judgment Act (“DJA”), considered: (1) whether the two lawsuits were parallel enough to compare at all, which it determined they were because both involved Florida’s workers compensation law and there was a continuity of parties between the two suits; and (2) whether federalism concerns outweighed the efficiency of resolving the claims in federal court. Ultimately, the district court dismissed the federal coverage action in favor of the state tort suit. On appeal, the Eleventh Circuit reversed the district court and explained the usefulness of insurance coverage declaratory judgment suits generally. The Eleventh Circuit then re-affirmed its “non-exhaustive” list of nine factors under Ameritas Variable Life Ins Co. v. Roach, 411 F.3d 1328 (11th Cir. 2005) for federal courts to weigh when considering whether to exercise their discretionary jurisdiction under the DJA. It explained that the district court should not have considered whether the two actions were parallel before applying the Ameritas factors. The Eleventh Circuit also held the district court, in its analysis, focused almost exclusively on federalism concerns under the Ameritas factors to the exclusions of all others. Further, it found the court had misapplied one of the factors, mistakenly concluding the issues between the state tort suit and federal coverage action were the same, whereas the Eleventh Circuit noted that insurance coverage was not at all in issue in the tort action. In sum, the Eleventh Circuit held the district court did not properly consider the efficiency created by having the federal coverage action decided under the “totality-of-the-circumstances” analysis.

Yuncker v. Dodds Logistics, LLC, 2022 Mo.App. LEXIS 300, WD84645 (Mo. Ct. App. May 17, 2022). A commercial insurer’s post-judgment attempts to intervene and set aside an arbitration award turned judgment against a motor carrier failed. The motor carrier tendered the defense of the personal injury claims to multiple insurers and requested written confirmation within 14 days if the insurer(s) would provide a defense and indemnification. The insurer responded, indicating it could not confirm a valid policy number or alleged insured based upon the information provided and that it accordingly “cancelled the claim.” The motor carrier defendants and tort plaintiffs agreed to arbitrate the claims, with the arbitrator ultimately awarding the tort plaintiffs $13,500,197.25 and $7,500,000, respectively. The arbitration award was confirmed on appeal to the circuit court and the court entered judgment consistent with the award. Two days after the judgment was entered, the insurer filed a motion to intervene, which included a request to vacate and set aside the judgment. Because the insurer did not file a motion to intervene before entry of judgment, the applicable procedural rule required the trial court to act on the post-judgment motion within 30 days or the judgment became final. Where the motion to intervene is not ruled upon within that timeframe, the movant remains a non-party to the judgment. Accordingly, the court held the insurer lacked statutory authority to challenge the judgment. Since the insurer could litigate the coverage issues (i.e. whether its policy obligated it to provide a defense and/or indemnification with respect to the judgment) in a separate declaratory judgment proceeding, the insurer’s constitutional complaints were held to be misplaced.

Knightbrook Ins. Co. v. Sanchez, 2022 N.J. Super. LEXIS 65, Dkt. No. A-1115-20 (N.J. Super. Ct. App. Div. May 16, 2022). The appellate court reversed a lower court’s ruling, which had found that an insurer had no duty to indemnify its insured on account of the insured’s failure to cooperate in the investigation and defense of the claim. The insurance policy contained a standard duty to cooperate provision. After the accident, the insurer received notification (source unknown) of the accident. Claim notes indicated the insurer was provided with some basic information regarding the accident and possible claim value, sufficient for it to reserve some amount of money on account of the claim. The plaintiff ultimately filed suit and the complaint was served upon the insured’s father. The insured never notified the insurer she had been served and did not provide a copy of the complaint to the insurer. However, one way or another (presumably from plaintiff’s counsel), the insurer received a copy of the complaint as evidenced by a letter requesting the insured to contact the insurer and the fact that the insurer assigned counsel to represent the insured in the tort action. Slightly over a year after the complaint was filed, the insurer issued a reservation of rights to the insured raising the insured’s failure to cooperate. No other coverage issues were addressed in the ROR. The insurer ultimately withdrew the defense of the tort suit and instituted a separate insurance coverage declaratory judgment action. On appeal in the declaratory judgment action, the appellate court held the insurer failed to establish it was materially prejudiced by the insured’s failure to cooperate. The court held that to disclaim coverage for non-cooperation, the insurer must establish either: (1) irretrievable loss of substantial rights to coverage determinations based on the insured’s breach of the insurance policy; or (2) the likelihood of success of the insurer in defending against the accident victim’s claim is less than had there been no breach. Since there was no coverage issue (other than the non-cooperation), the court held the first prong was not met. With respect to the second variable, the court held there was ample evidence in the record establishing the insurer could defend the tort action based upon evidence available to it even absent cooperation of the insured. As such, the court held the denial of coverage was not appropriate.

Argonaut Ins. Co. v. Atl. Specialty Ins. Co., 2022 U.S. Dist. LEXIS 83078, C.A. No. 21-1602 (E.D. La. May 9, 2022). In a coverage dispute between a commercial auto liability insurer and the non-trucking liability insurer, the court held the NTL policy did not apply. The driver of a tractor-trailer had completed his final load of the day and was bobtailing. He first considered going to a grocery store before realizing he needed money from his residence to make the contemplated purchases. While en route home, he changed his mind and decided to first go by a convenience store to buy cigarettes. This required a U-turn away from the route to his residence. The truck was normally garaged at his residence. While making said U-turn to go buy cigarettes, he was involved in a motor vehicle accident. The NTL policy provided for coverage when the truck is subject to an active permanent lease with a government regulated motor carrier and is either bobtail or deadhead and is operating solely for personal use unrelated to the business of the Motor Carrier. The policy further provided it was “not Non-trucking” when the truck is returning to the truck’s primary garage location subsequent to delivering a load—“the home parking base for a truck or the terminal from which the truck customarily obtains hauling assignments.” Noting that under the relevant policy language, the truck could be simultaneously being used for personal and motor carrier business, and further, that the NTL coverage exception for returning to the primary garage does not require the most direct route, the court found the excursion was a “minor personal detour” from returning the truck to its principal garage location—the driver’s residence. As such the NTL policy did not apply.

Bufkin v. Geico Ins. Agency, Inc., 2022 Miss. LEXIS 127, C.A. No. 2021-CA-00251 (Miss. May 12, 2022). The Supreme Court of Mississippi ruled that an employee, injured by her employer in an automobile accident, may not recover UM benefits under the employee’s own UM policy. Citing the prior case of Medders v. U.S. Fidelity & Guaranty Co., 623 So.2d 979 (Miss. 1993) as determinative of the issue, the court explained the UM claim could not be maintained because under Mississippi’s workers compensation exclusivity rules the employee could not sue the employer.

Wesco Ins. Co. v. Rich, 2022 U.S. Dist. LEXIS 78036, C.A. No. 1:20-cv-305 (S.D. Miss. Apr. 29, 2022). In this insurance coverage declaratory judgment action, the court denied the defendant/tort plaintiff’s motion to reconsider the order holding the insurer’s obligations to satisfy any judgment entered against the motor carrier was limited to $750,000 under the MCS 90 endorsement, not the $1,000,000 in liability limits under the policy. The insurance policy was a scheduled auto policy, and the involved tractor-trailer was not listed on the policy. The insurance policy contained a MCS 90 endorsement. The court affirmed there was no prohibition for an insurer providing a limit of liability for an MCS 90 endorsement different from (i.e. less than) the limit of liability for the underlying policy. The only requirement is that the insurer provide a minimum of $750,000 in surety obligation under the MCS 90. As such, only the $750,000 under the MCS 90 was potentially at play to satisfy any judgment, not the higher $1,000,000 limits of liability under the policy.

Travelers Indem. Co. v. Johnson, 2022 U.S. Dist. LEXIS 81635, C.A. No. 4:17-cv-86 (N.D. Ind. May 5, 2022). In this insurance bad faith action, the parties’ respective cross-motions for summary judgment were denied. The court found whether the insurer “had a rational, principled basis” for valuing the case in the manner it did and in incorrectly assuming an agreed to limitation relating to the motor carrier’s bankruptcy limiting exposure to $1,000,000 also extended to the tort defendant driver both presented jury questions. The court similarly held whether the insurer acted in a grossly negligent manner so as to expose it to punitive damages was likewise a jury question.

WORKERS COMPENSATION

Chenevert v. Constellium Muscle Shoals, LLC, 2022 U.S. Dist. LEXIS 87660, 2022 U.S. Dist. LEXIS 87650 (N.D. Ala. May 16, 2022). In this personal injury tort lawsuit arising from a truck driver’s injuries while on a shipper’s premises, the truck driver alleged the shipper provided faulty instructions, maintained an unsafe work area, and designed and maintained a faulty catwalk, all of which combined to cause him to fall and sustain injuries. The premises owner alleged in its answer a defense premised upon special employee, which it argued meant the truck driver’s exclusive remedy was via workers compensation. Thereafter, the truck driver amended his complaint to add an alternative workers compensation claim and sought remand. The Alabama district court, explaining that federal courts lack jurisdiction to resolve matters involve state workers compensation laws, remanded the case to state court for further proceedings.