Hello and Happy Summer Everyone!

Enjoy summer while it’s here. Hopefully you got a nice reset and recharge over the Independence Day holiday!

Busy times in your firms and here in our space too! You may have heard about our new company Fusable that CAB, Price Digest, CCJ and other sister brands are now a part of through the strategic separation Randall Reilly did earlier this year. This transition includes responsibility adjustments on our end. Chad is leading our Underwriting segment and Pam is point on the motor carrier portfolio. Our team you know are still here and we’ve added to it again.

We are thrilled to announce that Jasmine Slaughter will be leading our Insurance Brokerage portfolio as Senior Director. With extensive experience in both consulting and the insurance industries, Jasmine brings a wealth of knowledge and expertise to our team. Her strategic insights are set to drive innovation for our Agents and Brokers.

Learn more about Jasmine and connect with her here: Linkedin.

CAB Webinars

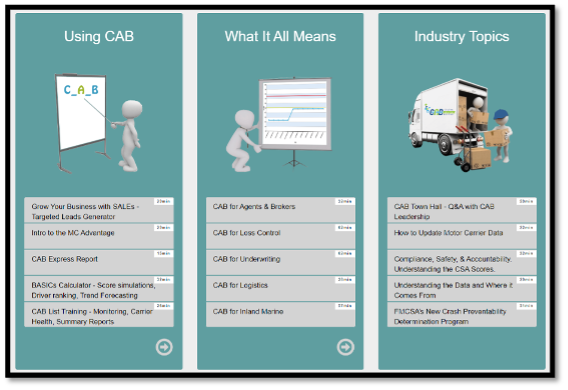

Like many of you, summer is busy with the holiday and time off. We will be taking the month of July off from our live training sessions. Keep in mind, all our great training content is still available via our webinars page.

Follow us on the CAB LinkedIn page and Facebook.

CAB’s Tips & Tricks

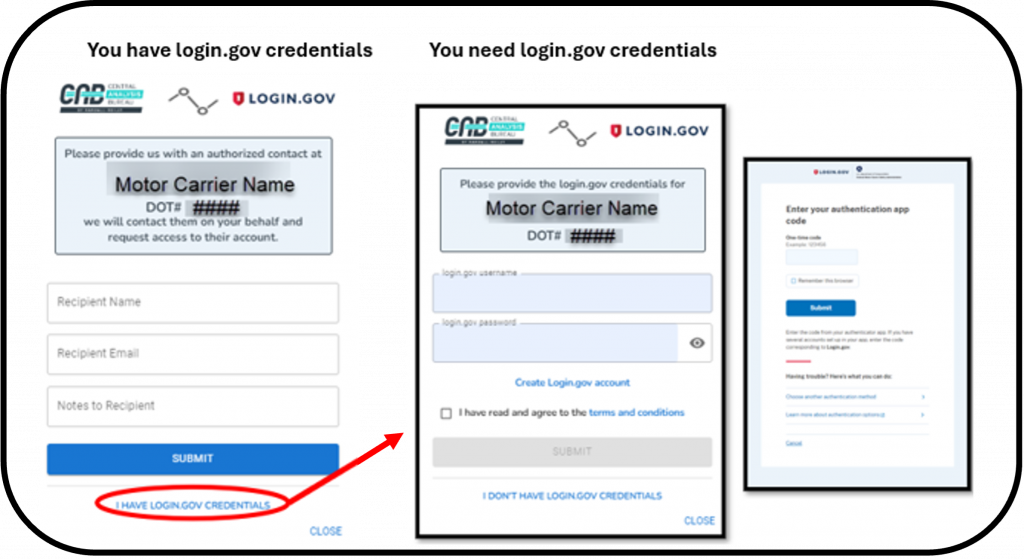

The FMCSA’s transition from motor carrier login utilizing DOT # & PIN to Login.gov has been than a less smooth process. The FMCSA’s modernization listening session at the end of May included numerous attendees referencing the struggle with this new procedure. Last month’s Bits & Pieces included the login screens from the CAB platform to Login.gov’s site for the motor carrier credential connection to CAB.

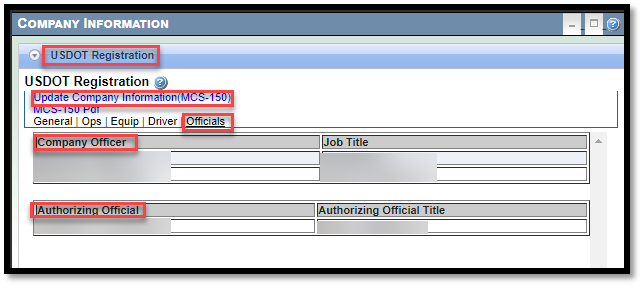

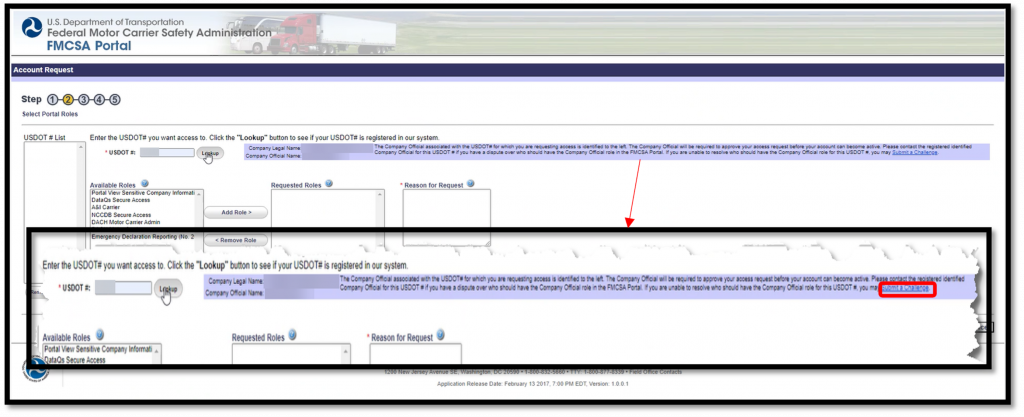

This month let’s cover a related frequently asked question. Perhaps this will help your motor carrier(s) with this government program. In FMCSA’s terminology there are “Company Officer(s)” listed on the MCS-150 shown in the Company Information section under Officials. Specially, these can be seen in the FMCSA Portal Home section in the middle of the screen in the Company Information section.

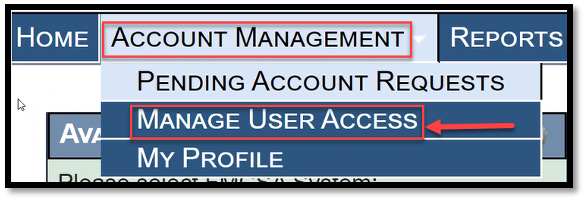

Separately, the fleet’s FMCSA Portal Official (portal user approver) is listed under Account Management section Account Request as shown here. If there isn’t a company official named you can identify one here. If you need to change it, use this “Submit a Challenge” option. In order for CAB to be connected to a fleet’s FMCSA Portal, the motor carrier must grant CAB access.

Note: Pam Jones had been an FMCSA Portal user for years. While the FMCSA Portal instructions mention and allow an alternate company official to be identified, Pam has never had success in fleets utilizing the alternate company official for user approval.

THIS MONTH WE REPORT

New ATRI Research Identifies Strategies for Mitigating Women Truck Driver Challenges The American Transportation Research Institute (ATRI) released a study to develop approaches for increasing the number of women truck drivers. It highlights six major challenges, including industry perception, training, parking, and harassment. Input from thousands of drivers and carriers was used to develop strategies for addressing these issues. Read more…

ATRI, American Transportation Research Institute, always a great resource to the industry, recently released another report on annual operational costs report and their work delving into female driver challenges, now available for download direct from their website. Read More…

Commercial Auto Insurance Market Outlook for 2024 The commercial auto insurance market is facing ongoing challenges with underwriting losses, increasing rates, and declining profitability. Factors such as driver shortages, nuclear verdicts, inflation, and distracted driving are contributing to these issues. Rate hikes averaged 8% in early 2023 and are expected to continue rising into 2024, particularly for large fleets or those with poor loss history. Read more…

FMCSA Approves 25% Fee Increase for Carriers, Brokers The Federal Motor Carrier Safety Administration (FMCSA) has approved a 25% increase in Unified Carrier Registration (UCR) fees for motor carriers, brokers, and leasing companies starting in 2025. This adjustment, the first significant increase since 2010, raises fees by $9 to $9,000 depending on fleet size. Read more…

Is Cyber Security Insurance Trucking’s Next Big Premium? Candace Marley, an Iowa owner-operator, sees cybersecurity as a low priority despite the increasing digitalization of trucks. However, NMFTA COO Joe Ohr highlights the benefits of cybersecurity insurance, especially for small fleets, citing the risk of office-based hacks over in-cab vulnerabilities. Read more…

Congress Eyes Creation of Anti-Fraud/Cargo Theft Task Force The U.S. House Appropriations Committee approved a funding bill for the Department of Homeland Security, including $2 million for a Supply Chain Fraud and Theft Task Force (SCFTTF). This task force aims to combat rising supply chain fraud and cargo theft in interstate commerce. Read more…

Chicago-Area Freight Thief Steals $9.5M in Goods: Courts Aivaras Zigmantas, 39, a Lithuanian national, has been indicted for stealing over $9.5 million in goods using fake names, carrier entities, and broker entities. His scheme involved diverting freight shipments, including liquor and copper, through false representations and fake identities. Read more…

ATA Tonnage Rises in May The American Trucking Associations reported a 1.5% year-over-year increase in the For-Hire Truck Tonnage Index for May, reaching 115.9. This marks the first year-over-year gain since February 2023 and a 3.6% rise from April. While this increase hints at a potential recovery in the truck freight market, experts urge caution, noting mixed economic indicators and ongoing challenges. Read more…

Vinn White Named FMCSA Deputy Administrator Vinn White has been appointed as the Deputy Administrator of the Federal Motor Carrier Safety Administration (FMCSA) and will also serve as the acting administrator. White replaces former Administrator Robin Hutchinson and brings extensive experience in transportation policy. He has been a member of the Biden-Harris Administration since 2021, working on emerging transportation technologies. Read more…

How New Jersey State Government Created Chaos with New $1.5 Million Liability Insurance Requirement New Jersey’s new law requires commercial vehicles to carry $1.5 million in liability insurance, surpassing federal minimums. This affects all vehicles registered in the state, including those under the International Registration Plan (IRP). Read more…

July 2024 CAB Case Summaries

These case summaries are prepared by Robert “Rocky” C. Rogers, a Partner at Moseley Marcinak Law Group LLP.

AUTO

Rodriguez v. Vaniperen, 2024 U.S. Dist. LEXIS 101901, 2024 WL 2831837, C.A. No. 4:23-CV-4006-KES (D.S.D. June 4, 2024). This case arises out of a motor vehicle accident near Brookings, South Dakota, when defendant CMV driver crashed into the rear of plaintiff’s decedent’s car, which was stationary in the right most lane of the highway. Based on evidence gathered from calls Kelly made to AAA prior to the collision, plaintiff’s decedent ran out of gas while driving on the interstate in a rental vehicle and was not able to make it to the shoulder of the highway, and instead stopped in the lane of travel. As she was stopped on the interstate, she was struck by the CMV, whose driver, in the moments before the crash had been using his phone to make online purchases and scroll TikTok. Defendants moved for summary judgment on the grounds that plaintiff’s decedent was contributorily negligent and assumed the risk, and thus barred from recovery, and alternately moved for summary judgment on plaintiff’s survival claim and partial summary judgment as to plaintiff’s punitive damages claim. The court held that there was a genuine issue of material fact as to whether plaintiff’s decedent was contributorily negligent and assumed the risk of accident, and denied Defendants’ motion for summary judgment on those issues.

Plaintiff also argued that the court should delay its summary judgment determination as to plaintiff’s survival claim, and filed an affidavit pursuant to Fed. R. Civ. P. 56(d) to show that more time was necessary in discovery to obtain evidence in support of its survival claim. However, the court ruled that plaintiff’s Fed. R. Civ. P. 56(d) Affidavit fell short of the requirement necessary to avoid summary judgment on the issue of plaintiff’s survival claim, noting that there was no additional evidence available to prove that plaintiff’s decedent survived the initial impact to experience pain and suffering as a result of this collision, and that defendants presented enough evidence in the form of plaintiff’s decedent’s death certificate and evidence of the car’s condition to show that she died instantly.

Additionally, the Court rejected defendant’s argument that punitive damages were not available in this case because South Dakota statutory law excludes punitive damages from wrongful death claims. The Court disagreed, holding that punitive damages are available in any action for the breach of an obligation not arising from contract.

Salas v. VRP Transportation, Inc., 2024 U.S. Dist. LEXIS 99219, 2024 WL 2794964, C.A. No. EP-24-CV-82-KC(W.D. Tex., May 31, 2024). In this action arising from a motor vehicle accident, the court remanded the action to state court, finding there was not complete diversity between Plaintiff Salas and Defendant VRP Transportation, as both were citizens of Texas. This case was originally filed in County Court at Law Number 3 for El Paso County, Texas by Salas against defendant driver Torres, VRP Transportation Mexico, and VRP Transportation USA. VRP Mexico moved to remove the case to Federal Court citing diversity jurisdiction and improper joinder of VRP USA as defendant driver Torres was only operating as an employee of VRP Mexico at the time of the accident. To establish a claim for improper joinder, the removing defendant must establish either “(1) actual fraud in the pleading of jurisdictional facts, or (2) inability of the plaintiff to establish a cause of action against the nondiverse party in state court.” VRP USA did not argue that Plaintiff’s joinder of VRP USA was actually fraudulent and could not establish that plaintiff did not have a cause of action against VRP USA and VRP Mexico because both entities owned the vehicle Torres was driving at the time of the accident and Torres was operating within the scope of his employment. Therefore, the court found VRP USA was not improperly joined, that there was not complete diversity of the parties, and remanded the case back to County Court in El Paso County, Texas.

Sandifer v. Doe, 2024 U.S. Dist. LEXIS 95897, 2024 WL 2784742, C.A. No. 23-280-M (E.D. Louisiana, May 30, 2024). This case arose out of a motor vehicle accident wherein a Pilot Travel Centers employee, Sandifer, was delivering fuel to the Walmart Distribution Center in Robert, Louisiana, and was struck while outside of his truck by a tractor-trailer owned by U.S. Xpress. Sandifer filed suit against the unknown driver, Walmart and U.S. Xpress, alleging negligence claims and seeking recovery for the personal injuries he sustained. Sandifer then filed an amended complaint, alleging Walmart had a duty to “regulate the movement of 18-wheelers on its property” and devise policies and procedures to protect pedestrians on its premises and make sure those operating tractor-trailers and other dangerous machinery are sufficiently trained on those policies and procedures. Walmart moved for summary judgment, alleging that Sandifer failed to identify any rule of law establishing that they had a duty to train individuals making deliveries on a third-party’s behalf. US Xpress argued that Walmart’s motion should be denied due to disputed issues of material facts regarding the condition of Walmart’s premises that contributed to the accident. However, the court found that Walmart successfully showed that Sandifer was in a well-lit and well-marked area of its premises when the incident occurred, and Sandifer confirmed as much. The court held that there was no evidence that Walmart breached a duty it owed to Sandifer and granted Walmart’s motion for summary judgment.

Mendez v. Summit Hous. Transp., LLC, 2024 U.S. Dist. LEXIS 94312, C.A. No. 1:22-cv-00125-MPM-DAS (N.D. Miss. May 28, 2024). In this personal injury case, the court granted defendants’ motions for summary judgment in part as to punitive damages. Factually, the accident occurred when a vehicle in which plaintiff was a passenger veered from its lane and ran into the back of a newly manufactured mobile home stopped alongside the highway. Defendants were the manufacturer, transportation company, and truck driver. The truck was stopped alongside the highway due to a failure of the tow hitch used to connect the mobil home to the truck. The defendant truck driver was not able to pull as far onto the shoulder as he normally would due to rainy weather, which made the driver concerned of getting stuck in the mud. Plaintiffs argued that the driver’s decision not to pull the truck over as far as he could placed his concern of getting stuck over concerns for the public’s safety. However, the court found that while that decision may have been negligent it did not rise to the necessary standard for an award for punitive damage—i.e., the decision was not sufficiently reckless or outrageous. Accordingly, the court granted defendants’ motion for summary judgment as to punitive damages.

Manson v. B&S Trucking of Jackson, LLC, 2024 U.S. Dist. LEXIS 94790, C.A. No. SA-21-CV-01181-XR (W.D. Tex. May 28, 2024). In this personal injury action, the court denied the plaintiff’s motion to reconsider the court’s grant of summary judgment for a claim of gross negligence against the defendant trucking company. Plaintiff was struck by the defendant truck driver driving for the defendant truck company, B&S Trucking, around 3:00 AM. The court granted the defendant truck company’s motion for summary judgment as to gross negligence, and plaintiff filed a motion to reconsider after obtaining driver logs that allegedly showed a pattern of the defendant driver falsifying her drivers’ logs in order to drive over her legal hours of service. Plaintiff alleged that the defendant truck company approved, authorized, and ratified the driver’s conduct. Plaintiff’s expert testified that the defendant truck company had a legal obligation to ensure drivers complied with the hours-of-service requirements. The defendants’ expert testified that the drivers’ logs evidenced that a second driver was driving the vehicle, which accounted for the hours-of-service record discrepancies. Further, the defendants’ expert testified that the applicable data logging system would have triggered a warning if there was a violation of the hours-of-service requirements. Defendants contended that the system warnings negated the need for manual drivers’ log audits. Ultimately, the court noted in denying the plaintiff’s motion to reconsider that there was no evidence in the record that the defendant trucking company had any knowledge of the defendant driver’s hours-of-service violations.

Bubba’s Towing & Recovery, LLC v. Big Eagle Transp., Inc., 2024 U.S. Dist. LEXIS 94826, 2024 WL 2748472, C.A. No. 3:23 CV 2025(N.D. Ohio May 29, 2024). The court granted defendant Vista Food Exchange, Inc’s (“Vista”) Motion to Dismiss all claims against it for lack of personal jurisdiction in this breach of contract/unjust enrichment matter without leave for plaintiff to amend its complaint. Plaintiff is a vehicle towing service and sued a motor carrier and defendant Vista, a food distribution corporation. Factually, the defendant motor carrier, a Michigan motor carrier, had a tractor trailer involved in an accident in Ohio, resulting in the cargo being strewn around the accident scene. Vista, a New York corporation, owned the cargo. Plaintiff provided towing and recovery services after the accident. Plaintiff moved the cargo and tractor trailer to its storage facility. Plaintiff filed the lawsuit to collect on unpaid services and storage fees. Vista filed the motion to dismiss thereafter, arguing that plaintiff could not establish personal jurisdiction over it. The court agreed, finding that under the Sixth Circuit’s three-part test to determine the proper exercise of specific personal jurisdiction, Vista did not purposefully avail itself of the privilege of operating in Ohio, but rather, merely placed its product in the stream of commerce. It did not own the tractor or trailer. Further, the court found plaintiff’s contention that Vista had a national and world-wide reach along with prior legal activity in Ohio were unavailing as it did not constitute an act by Vista purposefully directed toward Ohio such as advertising or designing a product to market in Ohio. Further, the plaintiff’s claim against Vista did not arise out of any Vista activity in Ohio. Finally, the court found that the third prong of the test was not met as there was not a connection between Vista and Ohio substantial enough for the court to exercise personal jurisdiction.

Lidstrom v. Scotlynn Commodities Inc., 2024 U.S. Dist. LEXIS 101988, 2024 WL 2886570, C.A. No. 4:23-CV-05144-MKD (E.D. Wash. June 6, 2024). In this personal injury case, the court granted in part Defendant Scotlynn’s motion for summary judgment. Under applicable Washington state law, a plaintiff cannot recover under both a theory of vicarious liability and negligent hiring, training, supervising, etc. because allowing such recovery would be “redundant.” Thus, if there is no evidence that an employee acted outside of the scope of his/her employment, then a plaintiff cannot maintain such direct liability causes of action against an employer. In this case, defendant Scotlynn was the employer of the defendant driver and owned the subject truck. The court found there was no evidence establishing the driver acted outside the scope of his employment during the time in question. As such, the court granted summary judgment in favor of Scotlynn on the negligent training cause of action. Likewise, the court granted summary judgment on plaintiff’s negligent entrustment claim for factual insufficiency. Plaintiff alleged that the driver may have been distracted or tired while operating the truck but failed to allege facts that Scotlynn knew or should have known that the driver was reckless or incompetent. The court also granted summary judgment on plaintiff’s negligent maintenance claim, noting plaintiff failed to support its claim with any factual allegations regarding maintenance.

Galovich v. Morrissette, 2024 U.S. Dist. LEXIS 104646, 2024 WL 2962843, C.A.No. 3:21-CV-1532 (M.D. Pa. June 12, 2024). In Galovich, the court granted Defendants’ motion for partial summary judgment. The defendants included: (1) two truck drivers; and(2) defendant company (“FAF”) for whom the drivers ran a dedicated route. The action arose out of a motor vehicle accident whereby plaintiffs’ vehicle rearended FAF’s tractor trailer, which was stopped on the shoulder of a highway around 4:00 AM. One of the defendant drivers was driving on an unfamiliar stretch of highway when a brake warning light illuminated. The driver pulled the tractor trailer fully off the road onto the shoulder to check the brake issue. The other driver was in the sleeper berth at the time. Defendants moved for summary judgment on plaintiffs’ claims for punitive damages as to all defendants and corporate liability and negligence as to FAF. Defendants argued that plaintiffs failed to proffer sufficient evidence through discovery to show that defendants acted in an outrageous manner or in reckless indifference to plaintiffs’ rights. Plaintiffs countered, arguing that the defendant driver could have stopped at multiple exits instead of pulling off the road onto the shoulder. The court held that Plaintiffs failed to show any evidence that pointed to the drivers having a culpable state of mind as to why the drivers pulled to the side of the road when they did. The court dismissed the punitive damages claim as to FAF on the basis of vicarious liability because the defendant drivers’ actions did not give rise to an award of punitive damages. The court also granted summary judgment on plaintiffs’ negligence and corporate liability claims because defendants admitted an agency relationship and punitive damages were not warranted. Further, the court found plaintiffs did not provide sufficient evidence for their claim of negligence and corporate liability as to FAF beyond mere conclusory allegations.

Leyman v. Amazon Logistics, Inc., 2024 U.S. Dist. LEXIS 104466, 2024 WL 2962784, C.A. No. 1:23-cv-828, (S.D. Ohio June 12, 2024). In this personal injury action arising from a motor vehicle accident, the Amazon Defendants prevailed on their Motion to Dismiss Complaint for Lack of Personal Jurisdiction and/or Forum Non Conveniens. Plaintiff Jurnee Scott Leyman filed this suit for personal injury and wrongful death on behalf of herself and as the administratrix of the estate of her deceased husband, Noah M. Leyman, against the Amazon Defendants, Defendant Timur Trucking, LLC (“Timur Trucking”), and Defendants Firdavs Kubaev, Ergash Annakukov, and Kamiloddin Adilov (collectively, “the Timur Agents”). Ms. Leyman alleges that her husband died when a tractor-trailer operated by Kubaev and Annakukov and under the direction and control of Timur Trucking and the Amazon Defendants, struck their vehicle on a divided highway in Texas. The Amazon Defendants are each incorporated in Delaware with a principal place of business in Washington. Two of the Amazon Defendants are registered to do business in Ohio and have a registered agent in Ohio. All Amazon Defendants engage in business in Ohio through the warehousing of goods and products, the delivery and transportation of goods and products, and “solicitation activities . . . to promote the sale, consumption, and uses of its services. Timur Trucking is incorporated in Ohio and has its principal place of business in Warren County, Ohio. The Amazon Defendants use the “Amazon Delivery Partner” website to solicit and contract with delivery partners to transport Amazon goods. At some point before the collision that took Mr. Leyman’s life, Timur Trucking contracted with the Amazon Defendants through the Amazon Relay application or similar Amazon program to deliver Amazon products. The Amazon Defendants had engaged Timur Trucking to deliver goods interstate and on Ohio roadways. On an unspecified date, Amazon Logistics, Inc. provided a 2021 blue Hyundai Ttranslead trailer, with Amazon labeling on the exterior, to Timur Trucking to deliver Amazon products. On June 4, 2023, Kubaev and Annakukov, acting in the scope of their agency and employment with the Amazon Defendants and with Timur Trucking, and driving a Freightliner Cascadia with the 2021 blue Hyundai Translead trailer, drove down the wrong side of a divided highway on U.S. 287 in Potter County, Texas. They struck a motor vehicle in which Mr. Leyman was the driver and Ms. Leyman was a passenger, killing Mr. Leyman and causing injury to Ms. Leyman. Neither party disputed the jurisdictional facts asserted by Ms. Leyman in the Complaint nor by Ryan Sandefur in his sworn Declaration on behalf of the Amazon Defendants. The Court reviewed whether the exercise of personal jurisdiction over the Amazon Defendants comported with Ohio’s long-arm statute and was consistent with due process. The court found that the Ohio long-arm statute requires a proximate cause relationship between the defendant’s act and the plaintiff’s cause of action. It further found that Amazon Defendants’ conduct in Ohio did not proximately cause the collision in Texas. Ultimately the Court determined that the Plaintiff’s claim did not arise out of Amazon Defendant’s conduct in Ohio and that no strong relationship exists among the Amazon Defendants, the Ohio forum, and the litigation. Thus, exercising personal jurisdiction over the Amazon Defendants would be unreasonable. On that basis the Court granted the Amazon Defendants’ Motion to Dismiss Complaint for Lack of Personal Jurisdiction and/or Forum Non Conveniens. However, in lieu of dismissal, the Court transferred the case to the Northern District of Texas.

BROKER

Ritchey v. Tanager Logistics, LLC, 2024 U.S. Dist. LEXIS 101504, C.A. No. 5:24-CV-23 (S.D. Tex., June 6, 2024). In this personal injury action arising out of a motor vehicle accident, the freight broker sued under a negligent brokering theory of liability removed the case to federal court based upon federal question jurisdiction. Plaintiffs thereafter moved to remand the case to state court, contending FAAAA preemption, as argued by the defendant broker, did not confer federal question jurisdiction. The court agreed and granted Plaintiffs’ petition for remand after Defendants were unable to show that a federal question arose in this case under the FAAAA. In so holding, the court pointed to Fifth Circuit cases addressing the scope of preemption under the Airline Deregulation Act. It rejected the broker’s attempts to distinguish the cases addressing the ADA on the basis that it, as a freight broker, was not in the same position as an airline carrier or motor carrier. The court further distinguished cases from other Texas federal courts and other jurisdictions. The court rejected that FAAAA was complete preemption sufficient to sustain federal jurisdiction and the FAAAA defense did not present a federal question sufficient to establish independent federal question jurisdiction.

Cox v. Total Quality Logistics, Inc., 2024 U.S. Dist. LEXIS 104456, 2024 WL 2962783, C.A. No. 1:22-cv-00026 (S.D. Ohio, June 12, 2024). In this personal injury action against a freight broker arising out of a fatal motor vehicle accident involving the motor carrier to whom the broker brokered the load, the court granted the broker’s motion to dismiss plaintiff’s complaint, holding the negligent hiring and supervision claims were preempted by FAAAA. In so holding, the court rejected that FAAAA’s safety exception precluded preemption.

CARGO

Arnold v. Allied Van Lines, 2024 WL 3063113, 2024 U.S. Dist. LEXIS 106701, C.A. No. SA-21-CV-438 (W.D. Tex., June 14, 2024). In this case arising from damage to household goods in the care of Allied Van Lines during Plaintiffs’ interstate move, Plaintiffs rejected Allied’s offer of judgment for $32,500 and elected to proceed to trial, where they were awarded $31,909 in damages. As a result, Plaintiffs filed an application for attorney’s fees under 49 USC § 14708 and Allied filed a motion to award costs based on Plaintiffs’ alleged failure to obtain a judgment more favorable than the unaccepted offer. The court held Plaintiffs’ ability to recover attorney’s fees hinged on two questions: (1) whether the transaction between Plaintiffs and Allied was a collect-on-delivery (“COD”) transaction and (2) whether Plaintiffs’ were the prevailing party. The court found that the transaction was not COD. Despite the fact that both the Bill of Lading and Freight bill signed by both parties were clearly marked as payment type “COD,” Plaintiffs paid Allied a deposit prior to shipment and their remaining bill balance the day before their goods were delivered. Accordingly, since Plaintiffs paid Allied before delivery, the move was not a COD transaction. Because Plaintiffs failed the first prong, the Court did not rule on whether Plaintiffs were the prevailing party. The Court then ruled that Allied was entitled to costs under Fed. R. Civ. P. 68 because Plaintiffs failed to obtain a judgment at trial greater than the rejected offer of judgment. The court then assessed the reasonableness of each of the requested costs by Allied, ultimately granting some and denying some.

PCS Wireless LLC v. Rxo Capacity Sols., LLC, 2024 U.S. Dist. LEXIS 105480, 2024 WL 2981188, C.A. No. 3:23-CV-00572-KDB-SCR,(W.D.N.C. June 13, 2024). In this action, plaintiff purchased approximately 54,000 wireless devices and hired RXO to transport the shipment from Texas to Florida by truck. RXO subcontracted the shipment to Wizard Equipment Corp. The shipment was ultimately stolen from a truck yard in Florida while en route to its final destination. Plaintiff sued defendants to recoup uninsured losses in state court and Defendant RXO removed the case and filed a motion to dismiss, which was referred to a federal magistrate judge, who recommended granting RXO’smotion to dismiss. The plaintiff only objected to the federal magistrate’s recommendation to dismiss the negligent brokering claim. The district court ultimately adopted the magistrate’s recommendation, dismissing the broker negligence claim. RXO argued that the Federal Aviation Administration Authorization Act (“FAAAA”) preempted the claim. Plaintiffs argued that a negligence claim against a freight broker does not regulate or affect the prices, routes, or services of motor carrier and should not be preempted. Plaintiffs argued that RXO had a duty to properly select any third party it hired to transport the shipment and breached that duty when it hired Wizard. The court noted that the selection of a motor vehicle is a broker’s core service, and plaintiffs’ state law negligence claim was attempting to impermissibly regulate brokers in the performance of their core services and was thus, was preempted.

COVERAGE

Clark v. Progressive Cnty. Mut. Ins. Co., 2024 U.S. Dist. LEXIS 96604, C.A. No. 6:23-CV-625 (W.D. La. May 30, 2024). In this personal injury action arising from a motor vehicle accident involving a CMV, the plaintiff included direct-action claims against the commercial auto liability insurer, as is permitted under Louisiana law. Nevertheless, the court granted defendant Progressive’s motion for summary judgment on all claims alleged against it on the ground that the defendant trucking company’s policy was cancelled prior to the subject motor vehicle accident. The court found that the defendant trucking company was not an insured under defendant Progressive’s policy at the time of the accident and therefore did not have a duty to defend the defendant trucking company or driver. The defendant trucking company applied for an insurance policy with Progressive before the accident and listed a Texas address. Progressive issued a Texas commercial auto insurance policy, that contained a Form MCS-90 endorsement. Progressive issued a new Policy Declarations page two months later, including a new Texas address for the trucking company. Progressive mailed a Notice of Cancellation to the new Texas address with an effective date of July 13, 2022, for nonpayment of the premium. The accident occurred the next day. Progressive contended the policy was cancelled before the accident, and accordingly it owed no duty to defend or indemnify, and had no obligation to pay for plaintiff’s damages, except to the extent Plaintiff proved the MCS-90 endorsement was in effect and triggered by the accident. Plaintiff argued that summary judgment could not be granted due to two questions of fact: 1) Progressive offered no evidence that it sent the cancellation letter to the proper address; and 2) the cancellation documentation with the Texas DMV and FMCSA showed an effective date after the accident. The court disagreed, finding that Progressive satisfied any burden upon it as it related to the mailing of the Notice of Cancellation when it presented evidence showing that it sent the cancellation letter to the last known address or the motor carrier based on the new Policy Declarations page mailed two months after the issuance of the policy. The court also held that the effective date of a cancellation of a policy is not based on when confirmations of the cancellations of motor carrier-specific endorsements (i.e., MCS 90 and/or Form E/F endorsements) are received by the respective state or federal agencies.

United Specialty Ins. Co. v. Alra Logistics, LLC, No. 3:23-cv-00049-TES, 2024 U.S. Dist. LEXIS 94717 (M.D. Ga. May 28, 2024). In this insurance coverage declaratory judgement action, the Court found that United Specialty Insurance Company (“USIC”) owed a duty to defend its named insured, Alra Logistics, LLC, and Alra’s alleged employee/contractor driver, Xavier Downer, in connection with a personal injury tort action pending in Georgia state court (the “Underlying Action”). As such, the court denied summary judgment in favor of USIC.

The accident giving rise to the underlying tort action occurred in Georgia when Downer drove an Enterprise-owned, but Alra-leased, box truck into Jamela Smith’s residence. The operative pleading in the underlying tort case alleged Downer was operating on behalf of Alra at the time of the Accident, driving an Alra truck, and was carrying Alra-owned property. In both the declaratory judgment and underlying tort action, USIC disputed certain of the allegations of the underlying tort complaint, including but not limited to Downer’s permissive use of the box truck and whether he was acting within the course and scope of his employment with Alra at the time of the Accident.

In the insurance coverage declaratory judgment action, USIC argued the policy’s Unlisted Driver Exclusion and the Radius Exclusion excluded coverage for the claims against Alra and Downer. USIC also argued Downer did not qualify as an “insured” under the policy and/or that Downer’s failure to cooperate excluded coverage in his favor under the policy. In addressing each of these arguments, the court conducted an extended analysis of the current state of Georgia insurance coverage law for motor carriers.

As a first matter, the court addressed choice of law to apply for the interpretation of the insurance policy. Under Georgia’s choice of law rules, the court explained “[i]f the law to be applied to a contract dispute by a Georgia court or a federal court in Georgia is . . . created by judges, then ‘the common law as expounded by the courts of Georgia’ must govern.” It then found that while the policy was issued by a Delaware-incorporated insurer with its principal place of business in Texas to a Pennsylvania-based insured, nevertheless “no out-of-state statute governs this case” and accordingly Georgia law applied to the interpretation of the insurance policy because the declaratory judgment action was pending in Georgia federal court.

With respect to the duty to defend, the court explained that under Georgia law, an insurance company’s duty is determined by comparing the allegations of the complaint with the provisions of the policy. If the allegations of the complaint against the insured are “ambiguous or incomplete with respect to the issue of insurance coverage,” the insurer is bound to afford a defense. The court further explained, however, “[t]he general rule is that ‘in making a determination of whether to provide a defense, an insurer is entitled to base its decision on the complaint and the facts presented by its insured.’” “A different rule, however, applies when the complaint on its face shows no coverage, but the insured notifies the insurer of factual contentions that would place the claim within the policy coverage. In such a situation, Georgia law says that ‘the insurer has an obligation to give due consideration to its insured’s factual contentions and to base its decision on ‘true facts.'”

Turning to the particular facts and arguments of the case before it, the court generally agreed with USIC that Georgia law will typically allow exclusions from coverage from an unlisted driver unless public policy disfavors such. It confirmed “[i]nsurance companies may reject coverage for an individual expressly excluded from a policy so long as the exclusion is supported by consideration.” The court, however, distinguished a prior Georgia case enforcing an unlisted driver exclusion because in that instance, the policy at issue was a personal lines auto liability policy, whereas Alra “is an interstate carrier.” In the court’s assessment, such “is a notable distinction[,]” given the specific federal and Georgia requirements for insurance policies issued to interstate and Georgia intrastate motor carriers, which the court seemingly equates with “public policy, and which it discusses in detail later in its decision.

As for the “radius of operation” exclusion, while the policy’s language attempted to limit coverage within 300 miles of Pittston, Pennsylvania—the reported primary place of the Named Insured’s operation—the court noted the policy included Additional Insured endorsements for states other than Pennsylvania, including Georgia, and further, listed the principal garaging location of two specifically-described vehicles on the policy in Missouri. The court surmised from all of this that the insurer knew, or reasonably should have known, the insured required insurance beyond the 300 miles from Pittston, Pennsylvania. The court then reasoned “[s]ince United Specialty is in the business of offering insurance to motor carriers and because Alra Logistics plainly included states outside of Pennsylvania, that is enough to say that Alra Logistics fulfilled its ‘responsibility to inform its insurer of its need for interstate coverage,’ and put United Specialty on notice of Alra Logistics’ status as a motor carrier. That would, of course, invoke protections provided by the Motor Carrier Act of 1980, 49 U.S.C. § 10101, et seq., and Georgia’s Motor Carrier Act, O.C.G.A § 46-7-1, et seq.” In so ruling, the court distinguished a prior Middle District of Georgia case that placed the onus upon the insurer to notify the insurer that it required coverage as an interstate motor carrier. The court held “[i]n the absence of evidence showing that the insured informed the insurer of its need for interstate coverage, Waters recognized that courts refuse to engraft statutorily required endorsements onto insurance policies as a matter of law. That’s not at all what happened here.” The court stressed that Alra’s application listed states other than Pennsylvania; the policy itself mentioned other states; and “more importantly than that, the policy that United Specialty issued contained the very endorsement at issue in Waters.” In the court’s view, “[t]he simple inclusion of that all-important endorsement in Alra Logistics’ policy along with . . . unrebutted testimony that United Specialty ‘kn[ew] exactly what [Alra was] do[ing]’ when it came to the nature of [Alra’s] business is sufficient to say that United Specialty knew it insured an interstate motor carrier and that the endorsement—if the underlying facts are there—could defeat the purpose of its own Radius Exclusion.”

The insurer also attempted to avoid the duty to defend the driver, claiming he was an non-permissive user. However, the court pointed to the insurer’s own Reservation of Rights notification in which it indicated Downer was “at best, a ‘permissive user’ as opposed to an insured.” The same Reservation of Rights notification also indicated, to the extent Downer was a permissive user, he would only be entitled to state-minimum required coverage. So, the court reasoned that the insurer itself acknowledged both permissive user status and minimum coverage requirements, which would include the requisite duty to defend.

As for the non-cooperation of Downer as a basis to deny coverage, the court acknowledged the insurer’s efforts to secure cooperation by Downer, including but not limited to attempting service at three separate addresses and hiring a private investigator to locate him, albeit unsuccessfully. Turning to the law on the topic, the court summarized the current status of Georgia law as follows: to justifiably deny coverage for an insured’s failure to cooperate an insurance company must show three things: (1) first, the insurance company had to reasonably request the insured’s cooperation in connection with an asserted claim; (2) second, the insured must have willfully and intentionally failed to cooperate; and (3) and third, the insurance company must demonstrate that the insured’s failure to cooperate prejudiced its defense of the claim. From the court’s recitation of the facts, it appears it took no issue that the insurer satisfied the first two prongs of the test. However, it found that it was premature to determine what, if any, prejudice might befall the insurer because despite Downer’s prior “absence” from assisting with the underlying tort action to date, Downer might nevertheless be located and/or appear and assist with the defense at trial, which might negate any prejudice to the insurer.

In conclusion, with respect to the duty to defend, the Court explained “since a claim could potentially come within the policy and since there is so much uncertainty as to whether Downer was permissive user of the Enterprise box truck, United Specialty’s Motion for Summary Judgment regarding its duty to defend Downer is DENIED. Notwithstanding Downer’s lack of appearance in this action, the ambiguous nature of the underlying complaint compels United Specialty to press on in providing him a defense.”

With respect to the insurer’s duty to indemnify under the terms of the policy, the court stressed “[i]f there is no duty to defend, there is no duty to indemnify.” That said, the court found the insurer’s request for a declaration that it does not have a duty to indemnify was not ripe because there had been no determination on liability in the underlying action.

The Court next turned to address the MCS 90 endorsement on the policy and what impact, if any, the Georgia Motor Carrier Act may have on the foregoing analysis. With respect to the MCS 90 endorsement, the court acknowledged Georgia adheres to the “trip specific” approach, which holds “that the MCS-90 endorsement is not applicable when an interstate carrier is engaged solely in intrastate commerce of nonhazardous materials during the specific trip it was engaged in at the time of the accident.” The court therefore reasoned “[i]f Downer was not ‘presently engaged in the transportation of property in interstate commerce,’ then the MCS-90 endorsement will not apply to provide coverage.” But critically, the court surmised “[i]f an item in the box truck was supposed to go to South Carolina, for example, then that specific trip would be interstate.” The court found there was a fact question as to whether Downer was even engaged in commerce, much less interstate commerce, at the time of the Accident, but nevertheless held such fact issues should be left to be resolved in the underlying tort action. As such, the court held it was premature to determine whether USIC might owe any duty to defend or indemnify Alra Logistics under the MCS 90 endorsement.

Last, with respect to the impact of the Georgia Motor Carrier Act on the outcome of the declaratory judgment action, the court stressed the overarching purpose of the Act was “to protect members of the general public against injuries caused by the negligence of a Georgia motor carrier.” It went on to explain “motor carrier,” under the Act, is defined as “[e]very person owning, controlling, operating, or managing any motor vehicle, including the lessees, receivers, or trustees of such persons or receivers appointed by any court, used in the business of transporting for hire persons, household goods, or property or engaged in the activity of nonconsensual towing pursuant to O.C.G.A. § 44-1-13 for hire over any public highway in this state.” Georgia law defines “for hire” to mean “an activity relating to a person engaged in the transportation of goods or passengers for compensation.” And finally, “carrier” is “a person who undertakes the transporting of goods or passengers for compensation.” The court then turned to the allegations of the complaint in the underlying tort action, which alleged Downer was working on behalf of his Alra in a truck provided by Alra, carrying goods belonging to Alra, at the time of the Accident. Finding that the allegations with respect to the “for hire” component were, at best, ambiguous, the court stressed the insurer had an obligation to defend its insured under the obligations of the Act. In summarizing the impact of the Georgia Motor Carrier Act upon the duty to defend, the court explained as follows:

When Georgia’s Motor Carrier Act applies, as it very well could in this case, the important takeaway from Sapp is a simple one: “any provisions in [an] insurance policy . . . that would serve to reduce or negate [an insurance company’s] obligations to the motoring public . . . are void and of no effect.” 706 S.E.2d at 649 (citing Great Am. Indem. Co. v. Vickers, 183 Ga. 233, 188 S.E. 24, 26 (Ga. 1936) (“any provision in the policy of insurance, in so far as it may conflict with the plain provisions of the [motor carrier] statute, must give way, and is superseded by the statutory provisions”)). The Georgia Supreme Court invalidated a radius-of-use limitation in Sapp and held that it must give way to Georgia’s Motor Carrier Act and its purpose of protecting the motoring public. Id. at 648-49. Consequently, the extremely similar provisions from the policy United Specialty issued to Alra Logistics—the Unlisted Driver Exclusion and the Radius Exclusion—are unenforceable, and because there is an ambiguity presented by allegations from the underlying complaint, the required resolution, or end result, is to find in favor of a duty to defend. Id. Therefore, the Court cannot declare that United Specialty does not have a duty to defend Alra Logistics.

WORKERS COMPENSATION

No cases of note to report this month.