Hello and Happy Holidays!

How in the world is it December already! Many clients have shared they are just as busy as we are. Productive busy is good though and hopefully your year is ending on a positive note. CAB rounds out 2023 with more collaboration with our sister companies, especially Price Digests. If you haven’t heard about the Truck Blue Book™, TruckBody IQ™ and VIN verification service, check them out at www.pricedigests.com.

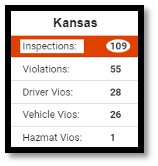

There are no new December webinars. We take this time off as we know how calendar-year closeouts, holiday schedules, and aforementioned year-end projects fill our December days. Should you have some time available, you can always check out our archived webinars in the library.

Over the year we have shared our enhancements and new offerings. Join us in January’s webinar to get a recap and hear these discussed in more detail.

Central Analysis Bureau truly values every one of you and our partnerships. We are appreciative that through collaboration with our clients our tools and resources allow us to support your goals and CAB’s mission to help our partners “Make Better Decisions”.

Stay warm! Enjoy relaxation time as the year winds down.

May your 2024 be safe, healthy, and prosperous.

Chad Krueger & Pam Jones

CAB Live Training Sessions

Tuesday, January 9th | 12p EST – CAB Program New Offerings and Enhancements

Join us for a recap of various updates we’ve made to the system over the last year like Express Reports, Salesforce integrations, and API capabilities. Plus, hear the advancements we’ve made on the MC Advantage platform.

Tuesday, January 16th | 12p EST – New Heat Map

We recently released a new heat map on the CAB Report’s Radius of Operations. More details are included in the below in the Tips & Tricks section. This webinar will cover even more details of this new mapping feature

To register for the webinars, sign into your CAB account. Then click live training at the top of the page to access the webinar registration.

Explore all of our previously recorded live webinar sessions in our webinar library.

Follow us on the CAB LinkedIn page and Facebook.

CAB’s Tips & Tricks

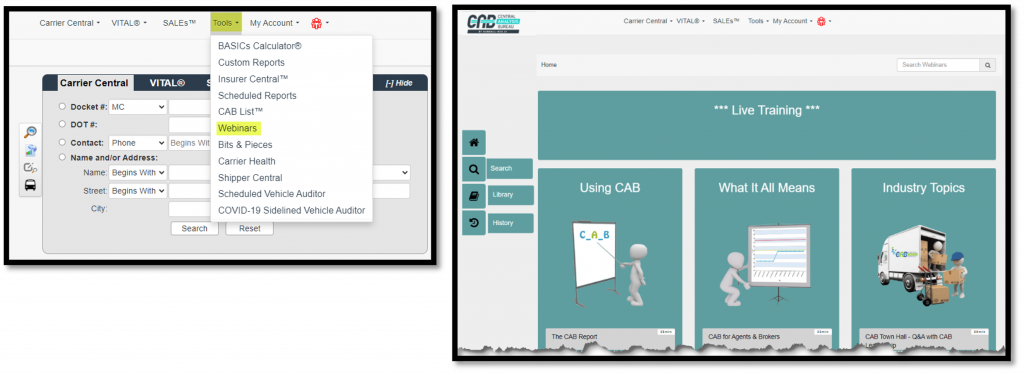

Introducing our new heat map feature. You never know what the developers will surprise you with. Most recently, our mapping options were updated to bring in a heat map for inspection details that go back three years for the latest inspection we have in the system.

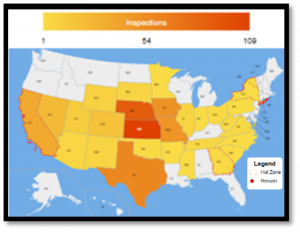

First off, you can see the radiant scale above the map with 1 to 109 inspections in this example. Then at-a-glance, you can see the various colors corresponding to the inspection volume by state.

Further, there are two drop-downs.

One defaults to inspections, can be changed to meet your needs for additional data point breakdowns. The second dropdown for the calendar icon allows you to see all inspections for the full history of this vehicle in this fleet’s operation or select by year.

Plus, there’s now more emphasis on your own selected Hot Zone states. While on this Radius of Operations map, the border of your Hot Zone states is continuously moving in varying colors to standout. See our friends of California, Georgia, and New York. You can also still break this map and the hot zones by county. Remember, this “Radius of Operations” is of the inspections. It doesn’t reflect everywhere the fleet may operate. You still have the option to set the radius to your liking. Now, you can quickly increase or decrease the radius circle with the red dot on the edge of your radius.

This version allows the more options in the data disseminations plus it offers easier visibility to the differences in states. The hot zone identification allows the user to have those right out in front of you. This enhanced version still allows view by county. The heat map better identifies the main office, radiuses, hot spots, and heavy inspection states along with the option to break up the data into more than just inspections but drilling down to violation categories (driver, vehicle, hazmat).

The original version is still accessible with the Legacy toggle until you get more familiar with the new version.

Express Report

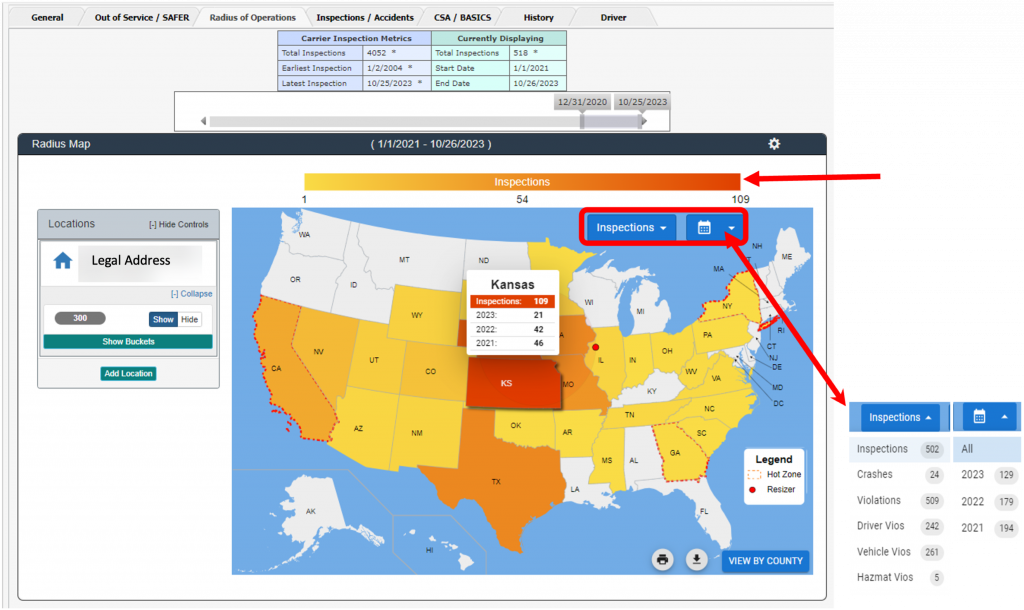

The heat map also transitioned to the Express Report to include the individual state’s details.

THIS MONTH WE REPORT

2023 CCJ Top 250: What goes up… Every year, Commercial Carrier Journal ranks the largest for-hire carriers in North America — the CCJ Top 250 takes into consideration the entire scope of a fleet’s freight-related business operation. See who has moved up and who has moved down the list. Read more…

Diesel Price Drops 7.2¢ a Gallon to Reach $4.294. The average diesel price fell in all 10 regions in EIA’s weekly survey. That’s 41.3 cents less than it cost at this time in 2022. Read more…

Record Fleet of Ships Coming to Load Oil in US Keeps Growing. The record number of supertankers sailing toward the shores of the U.S. is getting ever larger. The growing volume comes after U.S. crude exports surged this year to a record. Overseas shipments have averaged 4.1 million barrels a day. Read more…

FMCSA tightens screws on brokers who ‘do not intend to pay’ carriers. The FMSCA has finalized a rule that will change the financial responsibility requirements for brokers and freight forwarders. Read more

Administration Convenes New Supply Chain Council. The government aims to monitor supply chains through the sharing of data. The Commerce Department has developed new tools to assess risks to the supply chain. Shipping companies are beginning to use new data resources from the Transportation Department on freight logistics. Read more…

Dash Cams in Fleet Vehicles are Key to Avoiding Nuclear Verdicts, Risk Managers Say. Risk improvement is possible, even in the accident and injury-prone commercial construction world, so said Louise Vallee, Crum & Forster’s vice president for risk engineering, at the International Risk Management Institute’s Annual Construction Risk Conference. Read more…

Federal agency recommends steps to limit the speeds of new cars. The National Transportation Safety Board recently said its investigation into a multi-vehicle collision in North Las Vegas, Nevada, last year that resulted in nine fatalities has led the board to recommend a requirement for intelligent speed assistance technology in all new cars. Read more…

December 2023 CAB Case Summaries

These case summaries are prepared by Robert “Rocky” C. Rogers, a Partner at Moseley Marcinack Law Group LLP.

AUTO

Eagle Express Lines, Inc. v. U.S., 2023 WL 7630294, No.: 22-cv-03747 (N.D. Ill. Nov. 14, 2023). In this matter arising from a fatal accident, the Illinois District Court granted in part and denied in part the Federal Government’s Motion to Dismiss. The Plaintiff, Eagle, was a licensed for hire motor carrier. An individual applied to be a driver with Eagle in 2016, and, unbeknownst to Eagle, the applicant had previously had heart bypass surgery in 2010. However, the applicant provided a medical certificate from a licensed physician which did not disclose that he had any prior cardiovascular issues. Eagle hired the applicant as a driver, and, two years later, the individual underwent a subsequent medical examination and again failed to disclose the prior cardiovascular issues. The medical examiner who signed off on the driver’s medical certificate renewal did not adequately examine the driver, as a thorough examination would have revealed the driver’s medical history and the scar on his chest from his bypass surgery. A regulatory review conducted by the FMCSA found that from 2014-16, the examiner “submitted approximately 4 times Medical Examiner Certificates than the next highest FMCSA certified Medical Examiner in the State of Florida” and from 2016-2017 to have conducted “10 times more medical examinations than the national average.” An undercover officer visited the examiner’s office and discovered that an examination by the examiner consisted of nothing more “than placing a stethoscope on the undercover officer’s chest and asking him to breathe in and out.” Despite only performing this measure, the examiner certified that the exam was performed in accordance with FMCSA Regulations and that the information on the certificate was accurate. Following this discovery, the examiner was indicted for falsifying medical certificates, but the Government did not announce the indictment until over a year after the undercover investigation. Meanwhile, the Eagle driver suffered a fatal heart attack while driving one of Eagle’s tractor-trailers and crashed into multiple vehicles, resulting in the deaths of five children and another tractor-trailer driver. Following the accident, Eagle sued the Government under the Federal Tort Claims Act, arguing that the Government was negligent in failing to warn it and other motor carriers of unqualified drivers who had received medical certificates from the examiner as well as for indemnification and contribution for any judgment issued against it resulting from the accident. The Government moved to dismiss all counts, arguing that the circumstances did not give rise to liability under the Tort Claims Act. The Court first found that Florida law applied, as that was where the examiner’s office was located and where the Government’s investigation took place. The Court next denied the Government’s motion to dismiss as to Eagle’s negligence claims, finding that, while there is generally no duty to prevent misconduct by third parties, such a duty does arise when the Government undertakes some action which could create a duty to protect third parties. The Court found that Eagle had properly alleged that the Government had undertaken the review of medical examiners to ensure compliance with federal regulations, all of which were designed to protect the public from harm. The Government argued that the unpredictable nature of the investigation made any resulting harm unforeseeable, but the Court rejected this argument. As such, the Court allowed Eagle’s negligence claims to proceed. The Court did dismiss Eagle’s indemnification claim, finding that Eagle had failed to allege a requisite “special relationship” between it and the Government or a breach of duty under contract or implied by the parties’ conduct. However, the Court also allowed Eagle’s contribution claim to proceed since it found that Eagle had properly alleged a failure to warn claim.

Finley v. Mora, 2023 U.S. App. LEXIS 30407, 2023 WL 7550447, C.A. No. 22-1886 (6th Cir. Nov. 14, 2023). In this appeal of a ruling granting Defendant’s Motion for Summary Judgment, the Sixth Circuit Court of Appeals found that the district court did not abuse its discretion in excluding expert opinion from Plaintiff’s physician on injuries sustained from a truck accident. The trial court held that the expert’s review of Plaintiff’s medical records was an insufficient basis from which to draw conclusions of causation, and without such opinion, Plaintiff failed to create a triable issue of causation. On appeal, the Sixth Circuit explained that “the ability to diagnose medical conditions is not remotely the same… as the ability to deduce… in a scientifically reliable manner, the causes of those medical conditions,” and found that summary judgment was properly granted in favor of the Defendant.

Jones v. Silver Creek Transp., LLC, 2023 U.S. Dist. LEXIS 198505, 2023 WL 7301076, C.A. No. 2:23-cv-01461 (W.D. Pa. Nov. 6, 2023). In this action arising from an accident between a motorhome and a tractor-trailer, the Pennsylvania District Court granted Defendant’s Motion to Dismiss Plaintiff’s claim for punitive damages. Plaintiff based its punitive damages claim on the argument that Defendant’s conduct was outrageous “in that it willfully ignored the known safety hazards” that caused harm and damages. The court explained that punitive damages may be awarded for conduct that is outrageous “as to demonstrate intentional, willful, wanton or reckless conduct,” and that mere allegations that a defendant failed to comply with traffic laws are not sufficient to justify punitive damages. Without requiring “something more” for punitive damages, the court asserted that almost any liable driver who violated a traffic law or regulation would face punitive claims. Thus, the court granted Defendant’s Motion to Dismiss and dismissed the claim for punitive damages.

Younger v. J&CT, LLC, 2023 U.S. Dist. LEXIS 200667, 2023 WL 7386673, C.A. No. 3:22-cv-00143 (E.D. Ark. Nov. 8, 2023). In this negligence action, the Arkansas District Court granted Defendants’ Motion for Summary Judgment on Plaintiff’s request for punitive damages and all direct negligence claims, except for the claim that Defendants failed to adopt the policies or procedures necessary to ensure its vehicles and equipment were properly inspected, maintained, and operated. Plaintiff was working on a bridge in a highway construction zone when the driver of a tractor-trailer failed to slow down for traffic and was unable to stop due to allegedly defective brakes. To avoid being struck, Plaintiff jumped over the bridge’s guardrail and fell. In the two months preceding the accident, the tractor-trailer received multiple citations from driver and vehicle inspections, including one for a leak in the truck’s brake connection, but did not receive an out-of-service violation. The post-accident inspection, however, did result in an out-of-service violation for defective brakes. The court weighed the following facts in favor of granting the Motion for Summary Judgment for punitive damages: (1) the brake violations cited in the post-accident examination were not the same as the brake connection air leak cited prior to the accident; (2) the air leak citation was not an out-of-service violation; and (3) the record failed to show that the brake connection air leak caused or contributed to the accident. Thus, Plaintiff failed to show that the defendants acted with the “wanton or willful conduct” required for punitive damages under state law. Additionally, because Defendant Motor Carrier admitted vicarious liability for the actions of its driver, Plaintiff was limited to proceeding on its vicarious liability claim.

Paz v. Reggie’s Pallets Co., 2023 IL App (1st) 221093-U, 2023 Ill. App. Unpub. LEXIS 1802, C.A. No. 1-22-1093 (Ill. App. Ct. Nov. 9, 2023). This case arose from a fatal collision, in which a vehicle collided into a tractor-trailer parked near a road construction project. On behalf of the decedents’ estate, Plaintiff brought negligence claims based, in part, on the defective underride protection system on the involved tractor-trailer. Defendants filed a Motion to Dismiss and a Motion for Summary Judgment, arguing that they had no duty to design or maintain a vehicle with which it is safe to collide. The trial court granted the motions, finding that Defendants owed no common law duty to design or maintain a vehicle with which it is safe to collide. The Illinois Court of Appeals agreed, affirming the lower court’s decision.

BROKER

Montgomery v. Caribe Transport II, LLC, 2023 WL 7280899, No. 19-CV-1300 (S.D. Ill. Nov. 3, 2023). In this broker liability action, the Illinois District Court granted the freight broker’s Motion for Summary Judgment, finding that it was not vicariously liable for the actions of the motor carrier. The freight broker and Caribe, the motor carrier, entered into a Carrier Agreement in which the parties agreed that Caribe was an independent contractor, and that Caribe shall exercise “exclusive control, supervision, and direction over (i) the manner in which transportation services are provided; (ii) the persons engaged in providing transportation services; and (iii) the equipment selected and used to provide transportation services.” The freight broker paid a factoring company which took a percentage and then paid Caribe. If Caribe wanted to deliver a load, it would ask for pickup and drop off times from the freight broker along with rate confirmations. The freight broker did not provide truck driver training or review any logbooks or driver records. It also did not obtain insurance for Caribe or pay any fuel expenses, tolls, or any maintenance or repair costs for Caribe’s vehicles. Caribe’s drivers did not wear any freight broker clothing or uniforms, and Caribe never held itself out as having the ability to enter into a contract on the freight broker’s behalf. In this instance, the freight broker brokered a load to Caribe, and Caribe’s driver was subsequently involved in an accident. The tort plaintiff subsequently filed a lawsuit against Caribe and the freight broker, and the freight broker moved for summary judgment as to the vicarious liability claim against it, arguing that Caribe was only an independent contractor. The plaintiff argued that the freight broker maintained control over certain aspects of the transportation process, including maintaining regular communications and tracking the location of the shipment, providing requirements for how to store the load, providing troubleshooting features to Caribe and its drivers, and by including certain items on various bills of lading. The court rejected the plaintiff’s argument, finding that these activities “do not demonstrate a retained right to control the manner of delivery that is tantamount to a principal-agent relationship.” The Court found that the freight broker and Caribe had an “arm’s length relationship” which did not rise to the level of the freight broker exerting control over Caribe. Therefore, the Court dismissed the vicarious liability claim against the freight broker.

Piquion v. Amerifreight Sys. LLC, 2023 U.S. Dist. LEXIS 209009, 2023 WL 8113379, C.A. No. 22-C-5690 (N.D. Ill. Nov. 21, 2023). In this Truth-in-Leasing Act (TILA) action, Plaintiffs, truck owner-operators, each contracted with Defendants, motor carriers Amerifreight Systems and AF Systems, to haul shipments under Amerifreight’s motor-carrier license in exchange for a percentage of Amerifreight’s gross revenue from the shipments hauled and exclusive use of their semi-trucks. Plaintiffs allege that Amerifreight underreported the gross revenue of its shipments and paid based on underreported amounts, in violation of TILA and a number of state statutes. Defendants moved to dismiss. In response to Defendants’ arguments, the court held the following: (1) the section 376.12 leasing requirements of TILA apply regardless of whether the owner-lessor is a driver; (2) Plaintiff adequately alleged that one of the owner-operators was an “owner” under TILA because it had the right to exclusive use of its truck during its dealings with Amerifreight; and (3) Plaintiffs allegations permit a plausible inference that Amerifreight paid less than promised. The court also held that despite Amerifreight’s contention, the Equipment Lease’s 30-day dispute window does not prevent Plaintiffs from pleading damages. The court distinguished Seventh Circuit cases Mervyn v. Atlas Van Lines, Inc. and Stampley v. Altom Transport, Inc., in which the Court of Appeals held that contractual 30-day dispute windows warranted summary judgment for defendant-carriers on plaintiff-owner-operators’ claims for breach of contract and violations of TILA. The court noted that in Mervyn, the 30-day clause created an “irrebuttable presumption” by stating that “Financial entries made by [carrier] on payment documents shall be conclusively presumed correct if not disputed by [owner-operator] within 30 days after distribution.” 882 F.3d 680, 684 (7th Cir. 2018) (emphasis added). Likewise, the language of the clause in Stampley left no room for rebuttal. 958 F.3d 580, 587 (7th Cir. 2020). However, in this case, the court found that the 30-day clause created an “affirmative presumption,” which was rebuttable and did not waive Plaintiffs’ rights. Additionally, unlike the owner-operators in Mervyn and Stampley, Plaintiffs allege that they did not receive the necessary information from Amerifreight in time to dispute any underpayment. Thus, the district court declined the Defendants’ expansive reading of Mervyn and Stampley and denied its Motion to Dismiss the TILA claim.

Lee v. Golf Transp., Inc., 2023 WL 7329523, No. 3:21-CV-01948 (M.D. Pa. Nov. 7, 2023). In this broker liability action, the Pennsylvania District Court granted summary judgment to the freight broker on the ground that the Plaintiff’s state law claims against it for vicarious liability, negligent hiring/supervision/retention/selection/entrustment and for joint venture were all preempted by the FAAAA. The freight broker contracted with co-defendant Golf, a motor carrier. At the request of the consignee, the freight broker arranged for the transportation of a load and brokered it to Golf. The rate confirmation for the load provided that the load was not to be double brokered. The load was picked up and signed by “Victor Bordo GOLF,” but Golf did not know who this individual was and did not know what motor carrier picked up the load. Golf’s corporate representative did testify that he would have another carrier pick up loads and sign the bills of lading for Golf and that this was done without the freight broker’s knowledge. The Golf representative testified that he thought double brokering was common in the industry and that he was not sure whether the broker was aware that Golf was double brokering certain loads. As to this subject load, Golf permitted it to be delivered by O’Connor Trucking. The O’Connor independent contractor driver was involved in an accident while transporting the subject load, resulting in the deaths of two individuals, the Plaintiffs’ decedents. The truck involved in the accident was owned by O’Connor, Golf was listed as the motor carrier on the bill of lading, and the owner of the trailer was listed as JP Logistics. The Plaintiffs brought claims against each of these entities, and the freight brokre eventually moved for summary judgment arguing for FAAAA preemption. The Court looked to the split of authority among the federal circuits but reasoned under a Third Circuit decision that state laws having a “direct” and “significant” effect on the “price, route, or service” of interstate transportation fell squarely within the preemptive effect of FAAAA. The Court agreed with Coyote that the Plaintiffs’ common law tort claims related to its services as a broker. The Court then looked to the recent Seventh Circuit and Eleventh Circuit decisions in Ye v. GlobalTranz Enters., Inc., 74 F.4th 453 (7th Cir. 2023) and Aspen Am. Ins. Co. v. Landstar Ranger, Inc., 65 F.4th 1261 (11th Cir. 2023) to support its holding that the Plaintiffs’ state law claims fall within FAAAA preemption. The Court found the claims were preempted “because they focus on the output of services provided by Coyote as a broker, namely the process of arranging for transportation of the Subject Load by a motor carrier.” The Court also found that the FAAAA’s Safety Exception did not apply because the state law claims were not exercised with respect to brokers because the state law claims required a direct link between a state’s law and motor vehicle safety, which was not applicable to the freight broker. As such, the Court granted the freight broker’s motion for summary judgment as to the Plaintiff’s state law claims.

Poston v. Velox Transp., LLC, 2023 WL 8003510, No. CV 23-28-M-DWM (D. Mont. Nov. 17, 2023). In this action arising from a multi-vehicle collision, the Montana District Court denied Uber Freight LLC’s Motion to Dismiss a Third-Party Complaint. The Plaintiffs’ son was involved in a collision with a Velox Transport Solutions tractor-trailer, which was delivering cargo for which CES Hospitality and Almo Distributing Pennsylvania, Inc. had contracted to dropship. The plaintiffs sued Velox, Velox’s driver, CES, and Almo, basing their theories of liability against CES and Almo on a negligent selection cause of action for the selection of Velox. Almo denied liability and filed a third-party complaint against Uber Freight, a broker, for negligence, contribution, and indemnity, arguing that Uber Freight failed to properly investigate Velox’s hiring and training practices and its safety record. Uber Freight moved to dismiss based on FAAAA preemption. The Court disagreed, finding that Almo’s claims fell within the FAAAA’s safety exception. While the Court acknowledged that the state claims would affect Uber Freight’s relationships with its motor carriers, it found that the claims were directly related to the safety and welfare of the general public, and, thus, were carved out of FAAAA preemption under the safety exception. The Court further found that Almo had sufficiently alleged negligence on Uber Freight’s selection of Velox as a carrier and denied Uber Freight’s motion for failure to state a claim.

CARGO

England Logistics, Inc. v. GV Champlines, 2023 U.S. Dist. LEXIS 201209, 2023 WL 7387258, C.A. No. 2:22-cv-00742 (D. Utah Nov. 8, 2023). In this action alleging claims for breach of contract and violation of the Carmack Amendment, the Utah District Court granted Defendant’s Motion to Dismiss the contract claim, finding that it was preempted by the Carmack Amendment. Here, Plaintiff, a freight broker, and Defendant, a motor carrier, entered into a written agreement for Plaintiff to arrange for Defendant to transport loads of freight for Plaintiff’s customers. Plaintiff alleged that Defendant delivered damaged cargo. Defendant moved to dismiss, arguing that (1) the parties waived any rights and remedies under the Carmack Agreement in the general waiver of their agreement and (2) the eighteen-month limitation in the parties’ agreement should govern because contractual parties may stipulate to stricter limitations than those allowed by statutes, such as statutes of limitations. In contrast, Plaintiff argued that despite the waiver of rights contained in the agreement, it did not waive the Carmack Amendment, but instead expressly referred to and incorporated it in regard to claims for loss or damage to goods, and thus the Carmack Amendment’s two-year statute of limitation applies. The Utah District Court found that because the provision applying the Carmack Amendment to liability for cargo damage is more specific than the provision expressly waiving rights under the Carmack Amendment, the Carmack Amendment and its two-year statute of limitations applied.

Chillz Vending, LLC v. Greenwood Motor Lines, Inc., 2023 WL 7135152, No. 4:23-cv-00065 (D. Utah Oct. 30, 2023). In this cargo claim, the Plaintiff, Chillz Vending, purchased two ice and water vending machines from Everest Ice & Water Systems, Inc. Unishippers, Everest’s shipping and storage partner, agreed to manage the transportation of the products. Unishippers then contracted with Greenwood, d/b/a R+L Carriers, to transport the machines. Upon delivery, Chillz noticed that the machines were damaged. It subsequently filed a Carmack claim against Unishippers, along with alternative claims for state law breach of contract, promissory estoppel, and negligence. Unishippers sought dismissal, arguing it was not a carrier under the Carmack Amendment and that the state law claims were preempted by the Carmack Amendment. The Court found there was conflicting evidence as to whether Unishippers was acting as a carrier or a broker. Unishippers was licensed as a broker, and the bill of lading listed R+L as the carrier. However, Unishippers indicated that it was “serving as a freight and shipment consolidator,” and Everest represented that Unishippers was its “partner shipping and storage company.” The Plaintiffs also provided a declaration indicating their belief that Unishippers was acting as a carrier. Thus, the Court declined to find that Unishippers was acting only as a broker and denied its motion to dismiss the Carmack claim, indicating that discovery first needed to take place. The Court did find that, if Unishippers was deemed to be a carrier, the state law claims would be preempted but that, if Unishippers acted only as a broker, the state law claims would not be preempted. As to Unishippers arguments that it was not responsible for any alleged damage, the court found that dismissal was also premature.

King Ocean Servs. v. CI Mistic SAS Fruits & Vegetables, LLC, 2023 U.S. Dist. LEXIS 211051, 2023 WL 8234567, C.A. No. 23-22227 (S.D. Fla. Nov. 28, 2023). In this case, Defendants raised a counterclaim asserting four causes of action: (1) damage to cargo under the Carriage of Goods by Sea Act (“COGSA”); (2) damage to cargo under the Harter Act; (3) breach of warranties and nondelegable cargo worthiness duties; and (4) negligence. King Ocean sought dismissal of the counterclaim. When evaluating the Motion to Dismiss, the Florida District Court explained that COGSA, when it applies, supersedes other laws. Because the parties agreed that COGSA applied to each claim, the court dismissed counts two through four, allowing only the COGSA claim to proceed forward in litigation.

Coverage

Great West Cas. Co. v. Kirsch Transp. Servs., Inc., 1:18-cv-00012-SHL-SBJ (S.D. Iowa Nov. 7, 2023). In this coverage matter arising from an underlying broker liability action, an Iowa District Court ruled that a freight broker’s secondary insurer did not have to provide coverage for the underlying tort suit. Kirsch, the freight broker, had brokered a load to Natex, a motor carrier. Natex was subsequently involved in an accident, and an underlying personal injury action was filed against Natex, Kirsch, and other parties. The underlying personal injury suit alleged claims against Kirsch for vicarious liability premised upon the motor carrier driver’s negligence as well as direct negligence claims. As part of its Broker-Carrier Agreement with Natex, Kirsch required Natex to list it as an additional insured on Natex’s policy with its insurer, Artisan Truckers and Casualty Insurance Company (“Artisan”). However, Kirsch also had a separate policy with Great West for “contingent” coverage, that included Commercial Auto liability coverage and a “Brokerage Concerns—Broadened Contingent Coverage” endorsement.. Kirsch tendered its defense in the suit to both Artisan and Great West. Artisan accepted the tender for the vicarious liability claims asserted against Kirsch, but Great West denied Kirsch’s tender. The parties further agreed that there would not be any coverage in favor of Kirsch under the Artisan Policy for the direct liability claims against it. Great West initially filed a declaratory judgment and obtained a ruling that it did not have to provide Kirsch and another co-defendant, Walmart, coverage under a Great West commercial general liability policy. Artisan also filed an interpleader action arguing that the Natex vehicle involved in the accident was not an insured automobile at the time of the accident and that the only available coverage was that under the MCS-90 Endorsement, which only extended to Natex and no other individual or entity. Ultimately, however, Artisan paid its policy limits of $1,000,000 (not just the $750,000 under the MCS 90 endorsement) in connection with the underlying litigation and/or the Interpleader Action. In the underlying action, the vicarious liability claims against Kirsch were dismissed, resulting in Artisan withdrawing its defense of Kirsch because it had only accepted the tender with respect to the vicarious liability claims. Thereafter, Kirsch agreed to pay the tort plaintiffs $350,000 and agree to a judgment being entered against Kirsch in connection with the underlying tort action in an amount to be determined by a neutral mediator. Ultimately, the mediator awarded over $10,000,000 judgment against Kirsch. Kirsch assigned its rights under the Great West policy to the tort plaintiffs in exchange for the tort plaintiffs foregoing any attempts to collect the $10,000,000+ judgment from Kirsch directly. Kirsch thereafter moved, unopposed, for summary judgment in the Interpleader Action that the Artisan Policy did not afford coverage for the direct negligence claims against Kirsch in the underlying personal injury action, which the Interpleader court granted. In the separate Great West declaratory judgment action, the court read the Great West policy o provide insurance coverage for Kirsch when it brokers the hauling of freight by motor carriers such as Natex, but only where there is a deficiency in coverage in favor of Kirsch under the motor carrier’s insurance policies. The court then held the “contingent” nature of the Great West policy means it only kicked in when the underlying motor carrier’s coverage in favor of Kirsch was “not collectible.” The tort plaintiffs argued the term “is not collectible” meant that Kirsch was simply not a named insured under the motor carrier’s policy. Conversely, Great West argued the term meant the motor carrier’s insurance was not collectible at all in connection with the underlying accident and that, because the Artisan policy was eventually “collectible” inasmuch as Artisan paid its policy limits, the Brokerage Endorsement under its policy did not apply. The Court agreed with Great West, finding that the Artisan policy was “collectible” since Artisan paid its fully policy limits and finding that the phrase “is not collectible” was meant to address a situation in which the primary insurance coverage failed for some other reason. Thus, the Court held that the secondary coverage for Kirsch under the Great West policy was never triggered, and it granted summary judgment in favor of Great West.

WORKERS COMPENSATION

No cases of note to report.