On to the Holidays!

We’ve made it through Thanksgiving and now we’re on to the Holidays! How have we landed in the last month of the year already. If the old adage is true, time flies when you’re having fun…or at least very busy!

From the CAB team to yours, we want to wish you a Happy Holidays and a blessed New Year!

As a quick note, due to the holiday schedule, we will only be having one webinar in December. That webinar will be on Tuesday, December 13th. More on the topic below!

Have a great December!

Chad Krueger

CAB Live Training Sessions – CAB for Logistics

Tuesday, December 13th, 12p EST: Mike Sevret will provide an opportunity to learn about the plethora of tools and resources available for Logistics and Freight Brokering companies, plus how to use them to identify new opportunities such as motor carriers and shippers. You’ll also learn how to use CAB List to monitor the fleets in your stable to better understand operations, cargo, hauled lanes, and more.

To register for the webinars, click here to sign into your CAB account. Then click live training at the top of the page to access the webinar registration.

You can explore all of our previously recorded live webinar sessions by visiting our webinar library.

Follow us on the CAB LinkedIn page and Facebook.

CAB’s Tips & Tricks: Carrier Health Cargo & Insurance Data Enhancements

Our development team has been busy the last few months working on enhancements to our CAB List and Carrier Health Resources. We’re keenly aware that specific data types are important when evaluating risk and identifying opportunities for business.

We have enhanced Carrier Health to include buttons that will allow you to quickly skip to the section you’d like to view. Additionally, the preferences gear to the right will allow you to arrange the sections to your liking.

As noted below, we have added two sections to Carrier Health. The first is Cargo and the second is Insurance.

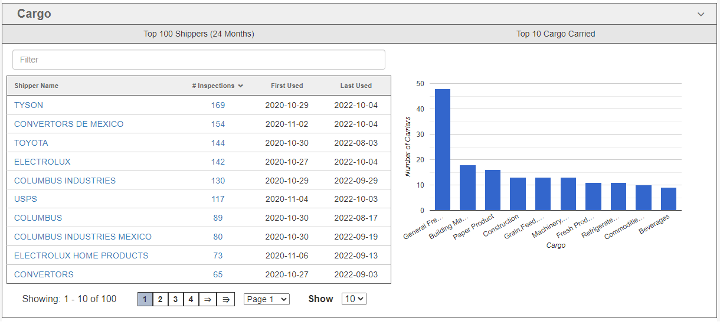

The new Cargo section allows you to view the Top 100 shippers, # of inspections and first/last used in the Group you are reviewing. Additionally, you can quickly view the Top 10 Cargo Carried.

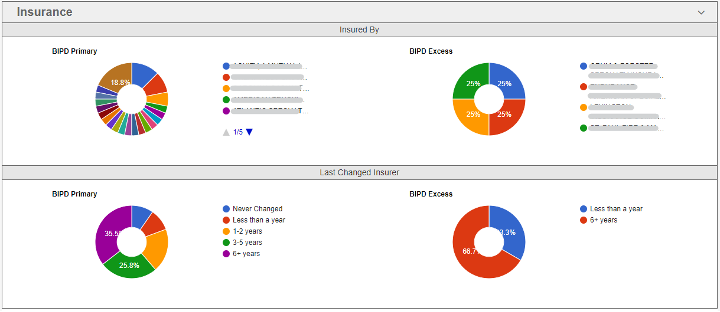

The Insurance section allows you to quickly see the top insurers for both BIPD Primary and Excess. As you can see, one Insurance carrier has 18.8% of the primary coverage for the motor carriers in this group. Additionally, the section will let you know when the last time the motor carriers in the group changed insurers. Based on the example below, 35.5% of the motor carriers in this group have not changed primary insurance carriers in the last 6+ years.

Valuable insights can be garnered when in-depth analysis of the data is available. We at CAB strive to provide that insight wherever we can. We encourage you to use these new sections and their associated functionality to better understand your current book and work to create opportunities for your prospective customers as well.

THIS MONTH WE REPORT:

Economy: End of the year economic predictions are coming out, and there are several that point to better things for the trucking industry in 2023.

- We’ll start at the top. Three logistics experts predict that the holiday season will be smooth sailing for the trucking industry. More

- As for 2023, a mild recession may be coming, but trucking should weather it well. Chief economist for the American Trucking Association, Bob Costello, looks at 2023. More

- Michigan State University economist and trucking industry expert Jason Miller is also looking ahead to 2023, and he says that recession is not inevitable. More

- Meanwhile, pent up demand is driving fleets to expand even as a freight slowdown looms. Experts discuss the forces impacting today’s truckers. More

Safety: Making our roads safer for everyone.

- The third Sunday in November marks the World Day of Remembrance for Road Traffic Victims. This year, US Transportation Secretary Pete Buttigieg marks the occasion by touting several efforts to reduce traffic fatalities. More

- The Arkansas Trucking Association comes out against an initiative that would have legalized marijuana in the state. More. The initiative was defeated in November.

Other:

- Federal regulators are clarifying differences between brokers, bona fide agents and dispatch services in new interim guidelines issued in mid-November by the Federal Motor Carrier Safety Administration. More

- The public perception of trucking is at an all-time high, according to a new poll by Trucking Moves America Forward. According to the poll, most Americans believe the trucking industry plays a vital role in the nation’s economy and have a “favorable impression” of trucking. More

December 2022 CAB Case Summaries

These case summaries are prepared by Robert “Rocky” C. Rogers, a Partner at Moseley Marcinack Law Group LLP.

AUTO

Aburto v. Espy, 2022 U.S. Dist. LEXIS 192655, C.A. No. 3:20-cv-12-ECM (M.D. Ala. Oct. 21, 2022). A defendant was granted partial summary judgment on a claim of wantonness. The tort plaintiff was the operator of a tractor-trailer, which was struck/side-swiped by defendant’s decedent as the decedent was merging onto the interstate in foggy, rainy weather. The court noted the tractor-trailer sustained minimal damage and was able to drive away from the scene with no mechanical issues. Explaining the high standard to sustain a wantonness claim under Alabama law, the court found the evidence presented was insufficient to establish the defendant’s decedent “acted with conscious or reckless disregard for the safety of others.” Rather, the court held it was a case in which “a driver commits an error in judgment” which would not support a wantonness cause of action under Alabama law.

Garcia v. S&F Logistics, 2022 U.S. Dist. LEXIS 193305, C.A. No. 5:21-cv-04062 (E.D. Pa. Oct. 24, 2022). A Pennsylvania federal court granted default judgment on the issue of liability as a sanction where the driver and a representative of the motor carrier failed to appear for depositions and failed to supplement discovery responses, despite a court Order requiring them to do so.

Estate of Mergl v. Lee, 2022 U.S. Dist. LEXIS 197807, C.A. No. 5:22-cv-218 (E.D.N.C. Oct. 31, 2022). On a motion to remand, the court held FAAAA did not confer federal question jurisdiction sufficient for removal. Insofar as the removing party had not obtained the consent of all other defendants to the removal, the court held remand was warranted.

Ligon v. Adriance, 2022 U.S. Dist. LEXIS 196573, C.A. No. 6:22-cv-00961 (N.D. Ala. Oct. 28, 2022). The federal court remanded the action to state court, finding the removal was not timely. Specifically, it held the tort plaintiff’s deposition testimony, in which he testified he needed a total knee replacement and would require anti-inflammatory medication for the foreseeable future, constituted an “other paper” sufficient to giving rise to the 30-day timeframe during which to remove a case to federal court. The defendant, having waited until after it received a $850,000 demand—approximately two months after the plaintiff’s deposition, missed its opportunity for timely removal.

Grady v. Rothwell, 2022 U.S. Dist. LEXIS 203694, C.A. No. 4:22-cv-00428 (M.D. Pa. Nov. 8, 2022). In this personal injury action arising out of a Virginia accident, the defendants were successful in having the action dismissed for lack of personal jurisdiction in Pennsylvania. The court noted that the driver of the tractor-trailer was not a resident of Pennsylvania, and the motor carrier was neither incorporated nor kept its principal place of business in Pennsylvania. The court rejected that the mere fact that the motor carrier “conducts business throughout the United States, including the Commonwealth of Pennsylvania” was not sufficient under Pennsylvania’s long-arm statute to confer personal jurisdiction.

Estate of Ross v. Eldridge, 2022 U.S. Dist. LEXIS 210302, C.A. No. 3:22-cv-660 (S.D. Miss. Nov. 21, 2022). A Mississippi federal court refused to remand a case to state court, despite the removal occurring almost three years after suit was filed. At the initiation of the lawsuit, the tort plaintiffs named both the motor carrier and the driver. The driver’s residence defeated diversity and therefore prevented removal. While the driver was named, he was never served. On the eve of trial, during a pre-trial motions hearing, counsel for the tort plaintiffs indicated their intention to forego any claims against the driver. The motor carrier thereafter immediately removed the matter to federal court. The tort plaintiffs sought remand. In addressing the motion to remand, the court first held that the mere fact that the driver had been named, though not served, was enough to prevent removal. It explained that the citizenship of the parties who are named, not those who have been served, is determinative of whether an action is removable. Next, the court noted that the one-year timeframe for removal under § 1446(b) did not preclude removal where there was no evidence that the tort plaintiffs ever seriously considered pursuing a claim against the driver, though it did note there was “not much evidence” of bad faith by the tort plaintiffs. Last, the court held the motor carrier did not waive its right to remove. As such, the case remained pending in federal court.

BROKER

Wardingley v. Ecovyst Catalyst Techs., LLC, 2022 U.S. Dist. LEXIS 201265, C.A. No. 2:22-cv-115 (N.D. Ind. Nov. 4, 2022). The federal court denied a freight broker’s motion to dismiss negligence causes of action alleged against it, rejecting the broker’s argument that the negligence claims were preempted by FAAAA. Noting the disparate treatment by different courts, the court ultimately found that Congress did not intend to preempt generally applicable negligence causes of action against brokers, even though enforcement of such actions might have an impact upon the broker’s services and rates. Going further, the court found that even if such actions fell within the scope of FAAAA preemption, the safety exception would remove a personal injury negligence action from the preemptive scope.

Lee v. Werner Enters., Inc., 2022 U.S. Dist. LEXIS 200848, C.A. No. 3:22-cv-91 (N.D. Ohio Nov. 3, 2022). In another case addressing the scope of FAAAA preemption, the Northern District of Ohio held that personal injury negligence causes of action against a freight broker and shipper arising out a motor vehicle accident were preempted by the FAAAA and that the safety exception did not otherwise apply to save the claims from dismissal. Citing other recent cases from this jurisdiction, the court dismissed all the claims against the shipper and the freight broker.

CARGO

Bereli, Inc. v. R&L Carriers, Inc., 2022 U.S. Dist. LEXIS 196684, C.A. No. 1:21-cv-22943 (S.D. Fla. Oct. 28, 2022). In this case involving alleged damages over an interstate shipment, the shipper was granted summary judgment on whether the carrier properly limited its liability. The shipment was a “flat rate” shipment with “full value declared.” Citing the four-part test for a carrier to limit liability: (1) maintain a tariff within ICC guidelines; (2) give the shipper a reasonable opportunity to choose between two or more levels of liability; (3) obtain the shipper’s agreement as to the choice of liability; and (4) issue a receipt or bill of lading prior to the moving the shipment—the court held the carrier failed its obligation for a valid limitation of liability. Specifically, a carrier representative testified that the carrier prepared the bill of lading, but its employee, failed to provide it to shipper through its “value shipment program,” which was a breach of company policy. The same representative further testified that the carrier does not quote anything but flat rate shipments. Faced with this evidence, the court found the carrier did not offer the shipper a choice of rates. The court went on to hold that plaintiff established a prima facie case for Carmack liability. The carrier was successful in getting the breach of contract claim dismissed under Carmack preemption. With respect to the carrier’s last defense—that the shipper failed to provide proper notice—the court likewise ruled against the carrier. First, the court found that an email sent to the carrier 11 days after the loss was sufficient to meet the claim requirements under the regulations. It also rejected carrier’s argument that the notice being provided to one subsidiary—as opposed to the correct entity—was insufficient notice where all of the shipper’s communications were with the same entity to whom it submitted the notice of claim, despite another operating entity issuing the bill of lading and performing the transportation of the shipment. The court also pointed out that the carrier representative could not say whether they ever notified the shipper that one entity was the subsidiary of the other.

Freight Connections, Inc. v. Express Hound, LLC, 2022 U.S. Dist. LEXIS 196775, C.A. No. 22-cv-1668 (D.N.J. Oct. 27, 2022). In this case arising from the total or partial loss of goods transported in interstate commerce, the defendant successfully had all state law causes of action against it dismissed. The shipper contracted with the defendant to transport goods from New Jersey to Texas. It appears defendant initially picked up the freight in New Jersey but thereafter contracted with another motor carrier to transport the goods to Texas. The driver for the carrier contracted to ship the goods to Texas diverted the shipment, during which some or all of the freight was stolen. The shipper and the defendant had entered into a shipper-broker agreement, but nevertheless the court held the defendant could be liable under Carmack as a carrier insofar it held itself out as a carrier or participated in the physical transportation of the freight during a portion of the interstate shipment. Defendant argued the plaintiff’s sole recourse was pursuant to the Carmack Amendment and all state law causes of action—including breach of contract—were preempted. The court agreed, dismissed the lawsuit, reserving to the shipper/plaintiff the right to file an amended complaint alleging only a Carmack claim.

Siaci Saint Honore v. WV Maersk Kowloon, 2022 U.S. Dist. LEXIS 207436, C.A. No. 21-cv-03909 (D.N.J. Nov. 14, 2022). This lawsuit arises from a sealed international shipment of cosmetics that was ultimately determined to be substantially short when the container was checked at its the final delivery location in the United States. The subrogated insurer brought four claims against numerous defendants, which included a customs broker, the ocean carrier, and the motor carrier performing the domestic leg of the shipment from the US port to final destination in the United States. The insurer alleged four counts against the defendants under the allegation that each were “carriers”: (1) breach of contract; (2) negligence; (3) breach of bailment; and (4) conversion. It also brought claims for gross negligence, material deviation, and warehouseman liability against the motor carrier. The ocean carrier also brought crossclaims for indemnification and contribution against the customs broker and the motor carrier. The motor carrier moved to dismiss all of plaintiff’s claims against it—except the breach of contract claim—as well as the crossclaims by the ocean carrier, arguing they were all preempted by FAAAA. Ultimately, the court agreed that under the broad scope of FAAAA preemption, all causes of action against the motor carrier, other than the breach of contract claim, were preempted. The court also held as a matter of law based upon the allegations of the operative complaint that the motor carrier had not acted as a warehouseman, and thus those claims were due to be dismissed as well. In ruling that the crossclaims were likewise preempted by FAAAA, the court rejected that the claims were based upon maritime law/COGSA. Thus, each of the challenged causes of action were dismissed without prejudice.

Lock Logistics, LLC v. Harun Transp., Inc., 2022 U.S. Dist. LEXIS 212386, C.A. No. 2:20-cv-136 (E.D.K.Y. Nov. 23, 2022). In this action arising from alleged damage to “fresh flowers” being transported from Florida to Massachusetts, the court held it lacked subject matter jurisdiction and accordingly dismissed the action without prejudice. First, the court held it lacked jurisdiction under the Carmack Amendment (under which jurisdiction the lawsuit was initially brought) because under the applicable Administrative Ruling, “flowers—growing or cut” are horticultural commodities exempt from the Carmack Amendment. The court similarly rejected that the flowers were “manufactured” so as implicate the “non-exempt manufactured commodities” provision under § 13506(a)(6)(B). The court then found that there was not complete diversity and the parties alleged no other basis for federal jurisdiction. As such, the case was dismissed without prejudice.

COVERAGE

State Farm Mutual Auto. Ins. v. Windam, 2022 WL 16627087, C.A. No. 2020-001693 (S.C. Nov. 2, 2022). In this insurance coverage dispute, the Supreme Court of South Carolina held the applicable policy language was ambiguous, and therefore allowed stacking of underinsured motorists benefits coverage under different policies. The tort plaintiff was injured while operating a rental vehicle that was a temporary substitute auto for her personal vehicle. She attempted to stack coverages from her policies on other “at home” vehicles. South Carolina’s statutory stacking procedure allows Class I insureds—those that have a vehicle involved in the accident—to stack coverage, whereas Class II insureds—those who have no vehicle involved in the accident—cannot stack coverages. The insurer argued that Class I status could not extend to operators of rental vehicles because they are non-owners of vehicles involved in the accident. The court rejected this argument, first noting that “insured’s vehicle” means something less than ownership. Then, turning to the specific definitions of “non-owned car”, “temporary substitute auto” and “your car” provided under the policy, the court noted inconsistencies in how the policy defined “non-owned” and accordingly found ambiguity. As such, it rejected the insurer’s argument that all temporary substitute autos must be treated as non-owned autos for purposes of UIM coverage.

Farid v. Gaskell, 2022 Ga. App. LEXIS 517, C.A. No. A22A0899 (Ga. Ct. App. Nov. 1, 2022). Where a tort plaintiff settled his claim against the motor carrier and the motor carrier’s driver in exchange for a payment under the MCS 90, but for less than the full surety obligation available under the MCS 90, he was held to be precluded from pursuing uninsured/underinsured benefits from his personal policy. The court rejected the tort plaintiff’s argument that the payment under the MCS 90 reflected a surety obligation and therefore did not constitute “a liability insurance obligation” such that the tractor should be deemed uninsured for purposes of application of his own UM coverage. Specifically, the court noted the release included a release of any obligations under either the commercial policy or the MCS 90 endorsement.

Progressive Express Ins. Co. v. Tate Transp. Corp., 2022 U.S. Dist. LEXIS 208183, C.A. No. 2:21-cv-198 (M.D. Fla. Nov. 16, 2022). A non-trucking liability insurer was denied summary judgment in a declaratory judgment action arising from a dump truck on bicycle accident. Despite the seemingly unrefuted fact that the dump truck was being used to transport property (i.e., dirt) at the time of the accident, the court held the NTL insurer still had a duty to defend because the operative complaint alleged causes of action premised upon alleged negligence beyond the trip in question—specifically, the complaint alleged negligent selection of sub-contractors other than in relation to the accident, and negligent brokering. As such, the court held these allegations fell outside of the scope of the trucking use exclusion and therefore the NTL insurer had a duty to defend against them. The court refused to address any duty to indemnify at this stage of the proceedings.

Progressive Cnty. Mut. Ins. Co. v. Caltzonsing, 2022 Tex. App. 8484, 13-21-00209 (Tex. Ct. App. Nov. 17, 2022). This coverage action arises from a motor vehicle accident in which the tort plaintiff was driving his employer’s vehicle when he was struck a vehicle owned by Enterprise Rent-A-Car. The employee recovered from the at-fault tortfeasor’s personal insurance policy, but subsequently pursued UIM benefits through the employer’s policy and his own personal policy. The employer’s policy defined “uninsured vehicle” as excluding any vehicle owned or operated by a self-insurer. The employer’s insurer argued that Enterprise Rent-A-Car was self-insured, thereby triggering the application of the exclusion to UIM coverage. Finding that the Graves Amendment largely shifted away from Enterprise any possibility liability in connection with an accident involving its owned vehicles, the court held it was not “self-insured” for purposes of the exclusion. The court also held that applying the exclusion under such circumstances would run afoul of Texas public policy.

WORKERS COMPENSATION

Padgett v. Cast & Crew Entm’t Servs., 2022 S.C. App. LEXIS 114, Op. No. 5948 (S.C. Ct. App. Oct. 26, 2022). In this workers’ compensation appeal, the appellate court affirmed the award of workers’ compensation benefits. The claimant had previously worked as a truck driver for Cast & Crew before he sustained a compensable injury by accident. Cast & Crew settled the claim and the claimant executed a release and settlement agreement certifying his employment was terminated and he would not seek future employment with the company. Despite this, six years later the claimant began working “through Cast and Crew” as a driver for another company, with his assignment to the company being set through his membership in the Teamsters union, which assigns drivers to various film productions. While in this role, the claimant sustained another work injury. Cast & Crew argued, with respect to the claim for workers’ compensation benefits, that the claimant was not its employee because the prior settlement agreement precluded the employer/employee relationship. The Commission rejected this argument and further rejected Cast & Crew’s argument that the claimant misrepresented his identity when re-applying, noting that the claimant had provided copies of his driver’s license and social security card in connection with the same; and even if so, there was no causal connection between any such misrepresentation and the work injury.

Fulfer v. Sorrento Lactalis, Inc., 2022 Ida. LEXIS 134, Dkt. No. 48853 (Id. Nov. 1, 2022). A truck driver’s premises liability and negligence lawsuit against the facility where he was making a delivery were held to be subject to Idaho’s worker’s compensation exclusivity rule on the basis the premises owner was a statutory employer of the truck driver. Nevertheless, the court likewise held the statutory employer was also subject to the exception to the rule—which permitted tort lawsuits in limited situations such as conscious disregard by the employer of a known hazardous situation. At the motion to dismiss stage, the court held it was improper to dismiss based upon the possible application of the exception to the rule.