Dear Subscribers

How did we get to Labor Day already? It seems like summer was just starting. Hope you have a great holiday.

We are very excited to introduce you to our newest team member, Chad Krueger, who is joining us as our Senior Vice President. Chad has been a heavy user of CAB over the years and brings a unique loss control perspective to our team. Starting with his years as the Safety Director at a large trucking company, continuing with his years in Loss Control on the agency side and then a Senior Loss Control representative at an insurer he knows what it takes to evaluate, correct and monitor transportation risk to minimize loss and to truly understand the operations of a carrier. I am pretty sure he is going to get us in line too! He will be reaching out to all of you in the coming months and is bringing many new ideas on the services provided to you by CAB. Chad will be attending the Motor Carrier Insurance Education Foundation with me in October and I look forward to introducing him all around. I have not told him yet but he will be taking on some of the role in writing the Bits N Pieces so that you get some other insights. (guess he knows now)

This month we report;

Hours of Service. I am fairly certain that I have been reporting on the Hours of Service for 20 some odd years with no end in sight. The FMCSA is now considering more changes. They recently filed a pre-rule which is a form of an Advanced Notice of Proposed Rulemaking. It will seek input from the industry about possible changes to the current rules. You can view the proposed rulemaking here.

Younger Drivers. A bill had been introduced which will allow 18- to 20-year-olds to drive a commercial motor vehicle in interstate commerce. With the driver turnover rate for large fleets reported at 94 percent in the first quarter of 2018 this may be welcome by the industry. This would rule, if passed, would mirror the move of some states which allow young drivers to operate commercial motor vehicles.

The DRIVE-Safe Act would require drivers under the age of 21 to complete a probationary period of 120 hours followed by 280 hours of on-duty time. Trucks used in the apprenticeship program would require a collision mitigation system, forward-facing video, and a speed limiter that is set at no faster than 65 mph. The apprentice driver would also have to be accompanied in the cab by an experienced driver who is at least 21 years old, has held a CDL for at least two years and hasn’t had a preventable accident or moving violation in the past year.

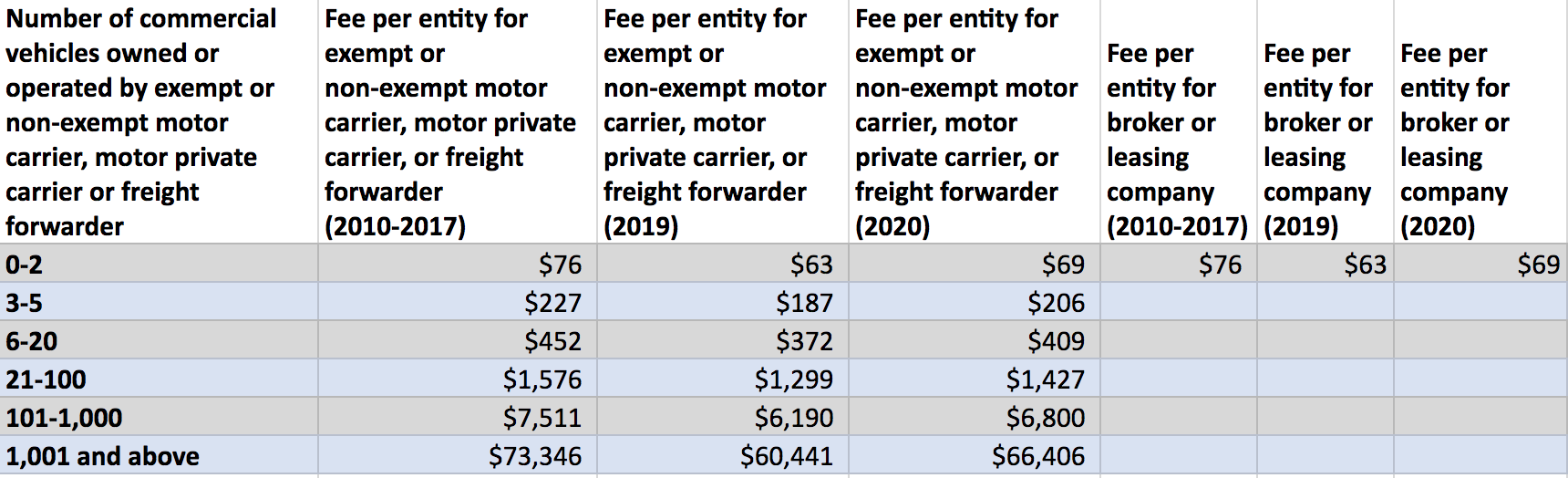

UCR Fees. Fees are on their way down again. Carriers with one and two trucks will pay $63; $187 for three to five trucks; $372 for between six and 20 trucks; $1,299 for carriers with 21-100 trucks; $6,190 for 101-1,000-truck carriers; and $60,441 for fleets with more than 1,000 trucks. Regulations require UCR fee adjustments when annual revenues exceed the maximum allowed ($112 million). Here is the chart.

CSA. The FMCSA has filed its report with Congress regarding the proposed changes to CSA. The changes include replacing the existing CSA Safety Measurement System with a new scoring system, working to improve the quality of data used to score carriers, making it easier for carriers to understand and calculate their safety scores and evaluating adding an absolute scoring system. A copy of the report can be reviewed here.

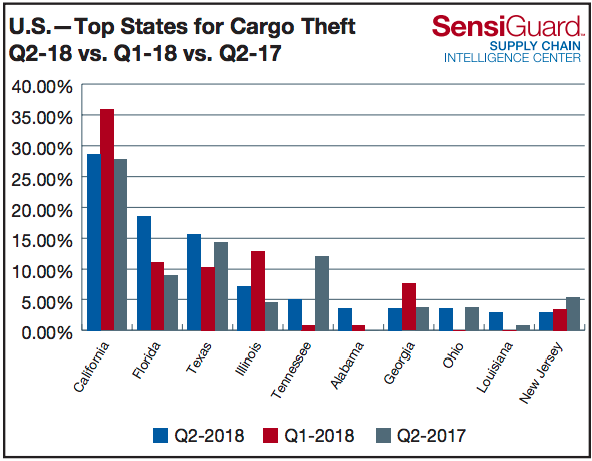

Cargo Theft. Sensiguard has released its report on cargo theft for the second quarter. They reported 144 cargo theft incidents during the quarter with an average loss value of $178,273 – an 8 percent increase in volume and 28 percent increase in value when compared to the second quarter of 2017.

California, Florida and Texas were home to the most cargo thefts in 2018’s second quarter with building and industrial materials leading the way, followed by electronics. Most of the thefts were truck loads.

Cases

Auto

There is always an increased exposure when there are multiple entities owned by the same people. The Southern District of Ohio addressed the interrelationship between multiple motor carriers and its principles, concluding that the principles of the two companies had no individual liability for a truck accident. The Court also concluded that a single enterprise argument would fail, and that violations of regulations did not justify a cause of action for negligence per se. It should be noted that the Court did allow for a punitive damages claim to proceed as there was evidence that the motor carrier knew the driver was unfit. More importantly the court held that a punitive damages claim could stand against the shipper because the public records on the violations should have made them aware of the problems. The shipper was not permitted to rely on the fact that the motor carrier was licensed. Parker v. Miller, 2018 U.S. Dist LEXIS 132577

A verdict of bad faith against an insurer was upheld in the Court of Appeals in Washington. The insurer of a truck driver settled a large claim for policy limits on a multivehicle accident. The court held that the insurer acted in its best interest and not the interest of the insured who would have wanted to preserve his right to a defense. The insurer was obligated to indemnify the insured for its costs in settling a claim above the policy limits, as well as additional damages for his own damages as well as attorney’s fees. Singh v Zurich American Insurance Co., 2018 WL 3844372

If your policy requires payment of the first premium installment before attachment the insurer is not required to give notice of cancellation The Middle District of Pennsylvania granted summary judgment to one truck insurer. However, a second insurer, who denied coverage based upon a material misrepresentation regarding the number of vehicles being operated by the insured was denied summary judgment when there were questions of fact as to whether the motor carrier has gotten the report of an inspection involving the additional vehicle removed from its SMS inspections before the cancellation. Sunday v. Berkshire Hathaway Homestate Ins. Co. 2018 U.S. Dist. LEXIS 127329

A motor carrier operating equipment under lease from another company was entitled to pursue a claim against a second trucker for the value of the property destroyed in a truck accident. The 6th Circuit concluded that as the lessee had a contractual obligation to pay the lessor for the damages it was entitled to pursue equitable subrogation. Central Transport v. Balram Trucking 2018 WL 3995658

An insurer in Delaware was unsuccessful in having its declaratory judgment action considered in the Superior Court in Delaware. The court held that a first-filed personal injury action was a prior pending action for forum non conveniens purposes. In view of the overlapping factual issues between the two actions, the risk of inconsistent judgments, and the fact Delaware law was not implicated in the loss the Court concluded that the prior filed New Jersey action should precede first. Progressive Casualty Insurance Co. v. Bowman, 2018 WL 3853875

A driver estate’s action against a consignee for injuries suffered when cargo fell on him during unloading was not permitted to proceed in Texas when the loss occurred in Oregon. The Court of Appeals in Texas held that the consignee did not have minimum contacts with the state. The fact that it purchased goods from a Texas company would not give rise to jurisdiction. Wilco v. Carter, 2018 3625434

One trucking company was successful in having its summary judgment upheld in an action seeking damages for liability arising from a truck accident. When the facts supported that the plaintiff improperly entered the motor carrier’s lane of traffic the motor carrier was held not liable for a fatal collision. The Court of Appeals in Michigan held that the motor carrier could not reasonably foresee such actions. Pasho v. McCowan, 2018 Mich. App. LEXIS 2885

The Superior Court in Connecticut denied most of a motor carrier’s motion to dismiss claims for negligent supervision, training, hiring and retention. The court held that the motor carrier’s constructive knowledge of the driving propensities of the driver, by failing to check his history before allowing him to drive supported claims for negligent hiring, training and supervision but not retention. Beardsley v. Jamark Constr., LLC 2018 Conn. Super LEXIS 1498

When a personal injury action was brought in the District Court in New Jersey for a truck accident which happened in Florida the court denied the motor carrier’s motion to dismiss the case for lack of jurisdiction but did transfer the case to Florida. The fact that the national carrier had a presence in the state of New Jersey was insufficient to support jurisdiction. Griggs v. Swift Transportation 2018 WL 3966304

The Appellate Division in New Jersey reversed the dismissal of a plaintiff’s complaint for failure to appear at depositions. The trucking company defendants had been granted dismissal by the trial court. The Appellate Division determined that the sanction was excessive and remanded the case back for reinstatement of the complaint. Ortiz v. Benkius, 2018 WL 3625162

A split decision on a motion to strike causes of action in a complaint was rendered in the District Court of Minnesota. The court granted a motion to dismiss claims for negligent hiring and retention when there was no evidence of an intentional act by the motor carrier. However the claims for negligent selection, supervision, and entrustment were permitted to remain because genuine disputes of material fact remain with respect to those claims. Soto v. Shealey, 2018 WL 3677920

The Court of Appeals in Indiana reversed a lower court decision and granted summary judgment to an insurance agent who was sued for allegedly providing improper information to a motor carrier’s insurer and to the DOT regarding an entities prior connection to a predecessor trucking company. The court held that the agent owed no duty to the injured plaintiffs and that the plaintiffs failed to allege a tort for conspiring to aid and abet a motor carrier to become a chameleon carrier. ONB ins. Grp. v. Estate of Megal, 2018 Ind. App LEXIS 260

Try as they might to get a case over quickly a rail carrier was not entitled for summary judgment on the claim for more than 5 million in damages suffered when a truck got stuck on the rail line. The Western District in Louisiana held that there were just too many questions remaining to be resolved. Union Pac. RR Co. v. Taylor Truck Line, Inc. 2018 U.S. Dist. LEXIS 140159

We generally do not report on decisions on discovery disputes between parties because they are so fact specific but sometimes the decisions are worth reviewing for thoughts on discovery in other cases for claims and defense counsel. The Western District of Kentucky addressed a motor carrier’s obligations to produce many of its business records, including crash prevention information, insurance limits, vehicle maintenance and driver information. Worth a review to see what is out there. Merriweather v. UPS, 2018 U.S.Dist. LEXIS 124383

A personal injury action against a truck broker was dismissed for lack of jurisdiction in the Eastern District of Pennsylvania. The court held that the connection between the broker and the motor carrier did not give rise to sufficient facts to support jurisdiction in the state. Pineda v. Chromiak, 2018 U.S. Dist. LEXIS 125803.

Great Dane was granted summary judgment against the plaintiff in an action seeking damages for design defect which plaintiff alleged contributed to a side-underride accident. The court held that the plaintiff failed to establish that a alternative design, a “telescoping side guard” would have prevented the accident. Wilden v. Laury Transp., 2018 U.S. App. 23776.

The Supreme Court in Alaska upheld a defense verdict in a subrogation action by the plaintiff seeking recovery for 3.5 million in oil spill mediation costs arising from two truck accident. The Court affirmed the finding that the second carrier was not negligent in causing the accident. HDI-Gerling America Ins. Co. v. Carlile Transportation Systems 2018 WL 4040363

In an evidence case the Western District of Kentucky held that a motor carrier could introduce an animation prepared by an accident reconstruction company, and testimony regarding the sleep habits of the plaintiff and human factors which contributed to an accident. The defense was seeking to use this evidence to show that the plaintiff was inattentive and bore some culpability for the fatal accident. White v. Transp. Servs., 2018 U.S. Dist LEXIS 142667

The Southern District of Mississippi granted a motor carrier’s motion in limine precluding plaintiff’s efforts to introduce evidence that the drivers were not proficient in the English language. The Court also held that the plaintiff could not submit evidence of safety rules which were not relevant to the loss. McCon v. Perez, 2018 U.S. Dist. LEXIS 140449

A truck driver was precluded from recovering from a shipper in the District Court in Maryland. As the driver was contributorily negligent in failing to adhere to safety rules he was not entitled to seek damages from others. Childress v. Goodloe Marine, Inc. 2018 U.S. Dist LEXIS 135050.

A driver injured when putting chains on his tractor was entitled to UM/UIM coverage from the trucking company’s policy. The District Court in Oregon held that it was related to the auto but rejected plaintiff’s argument that the limits should be hired because the insurer failed to properly noted limits on the coverage endorsement. Nikolaychuk v. Nat’s Cas. Co., 2018 U.S. Dist. LEXIS 138792

A trucking company was granted summary judgment on claims of wantonness, negligent entrustment, training retention and supervision when a plaintiff claimed he was struck by cargo when a pedestrian on the side of the road. While the Northern District of Alabama allowed the negligence action to proceed as there were questions of fact, the plaintiff failed to establish any basis for the additional causes of action, Pickens v. Guy’s Logging Co., 2018 U.S. Dist LEXIS 131925

A Canadian insurer was found to be subject to jurisdiction in the Southern District of Indiana in a declaratory judgment action on primary/excess issues arising from a truck accident. The court held that there were sufficient contacts with the state to obligate the insurer to defend the coverage case in the state of the accident. Leech v. Nat’l Interstate Ins. Co., 2018 U.S. Dist. Lexis 132445

In the Northern District of Alabama the court also granted summary judgment to a motor carrier on claims of negligent entrustment and negligent hiring and retention. However the court did find that there were questions of fact regarding the defendants’ alleged negligence and wantonness in allowing the driver to operate a vehicle where the bumper was strapped onto the truck. It fell off causing the injury. Simpson v. Key Line Solutions, Inc., 2018 U.S. Dist. Lexis 132185

The trial court did not err in giving a sudden emergency jury instruction in the trial of an accident stemming from a collision between two trucks. The Court of Appeals in Texas held that there was evidence that the second truck turned suddenly causing the first truck to either strike the second truck or hit other stopped cars. Dodson v. Munoz, 2018 Tex App. LEXIS 6192.

The statutory definition of employee under the federal rules could not be used by an insurer to deny coverage when an owner operator under lease to the insured was injured by a second owner operator in a truck accident. The Northern District of Illinois held that the definition of employee in the policy was the only thing to consider and liability for actions of owner operators would not be excluded, Nat’l Cont’l Ins. Co. v. Singh, 2018 U.S. Dist. LEXIS 136941

The Court of Appeals in California held that a trucker’s insurer was not obligated to defend and indemnify a shipper who was sued for injuries suffered to a driver when he was retarping a load of hay. In a dispute between two insurers the court held that the driver was not in the process of loading or unloading the truck at the time of the accident when he fell of a hay squeeze while retarping the load. Monteray Ins. Co. v. Peerless Indem. Ins. Co., 2018 Cal App. Unpub LEXIS 5124

Worker’s Compensation

A truck driver was unsuccessful in efforts to recover from the state for injuries suffered as a result of alleged negligent design of a roadway. The Court of Appeals in Oregon held that the state was immune from suit when the driver was entitled to worker’s compensation from his employer. Sitton v. State, 2018 Ore. App. LEXIS 920

When a driver was injured showering at a truck stop he was not entitled to worker’s compensation benefits. The Superior Court in New Jersey held that the act of showering was not in furtherance of his employment. Kamenetti v. Sangillo & Sons, LLC., 2018 N.J. Super Unpub. LEXIS 1883

Cargo

A broker’s claim for breach of contract against a motor carrier for failure to pay for a cargo loss was upheld in the Northern District in Illinois. The Court held that it was not preempted by the Carmack Amendment. The court also noted that reasonable estimates were sufficient to support damages as long as there was a factual basis for the estimates. Transco Lines v. Extra Logistics, 2018 U.S. Dist. LEXIS 141478

It has been a long time since we have seen a case on the commercial zone exemption. The Northern District of Indiana denied the defendant’s motion to dismiss a cause of action claiming Carmack preemption. The court denied the motion, concluding that the transport from Chicago, Il to an adjacent suburb in Indiana was preempted because the transport was within the Chicago commercial zone and therefore not subject to Carmack. Apex Compounding Pharm, LLC v. Best Transp. Services, 2018 U.S. Dist. LEXIS 140595

The 6th Circuit held that a cargo insurer was obligated to indemnify a motor carrier for any liability that it had under a contract, even if the matter did not proceed to judgment. The motor carrier had paid the customer for the value of cargo which was delivered without a seal. The court held that the insurer waived the right to argue the “no payment” clause. Dark Horse Express, LLC v. Lancer Insurance Co. 2018 WL 3738638

Have a marvelous Labor Day! See you next month.