Hello Everyone,

Summer is ending quickly as unofficially identified by the school buses back out, conference schedule filling up, and Labor Day! Hopefully you get some time off with cooperating weather.

In standard CAB fashion, users asked, and we listened. We’ve expanded our audience to provide a more robust motor carrier offering. Motor carriers came to us asking for more capabilities. Thus, we created our MCA, Motor Carrier Advantage solution. We do have two recorded webinars where the platform was introduced by Chad Krueger and Mike Sevret. Find these in our Webinar Library. Plus, join Mike on September 19 when he highlights the Brokerage module, one of the current three systems.

With back to school and the end of summer comes conference season. Next month we will be at:

- MCIEF Annual Conference in Orlando, October 4-6. Chad is speaking with other presenters on “CSA / Safety Fitness Determination Revisions”. Check the agenda at: mcief.org and see Chad’s conference promo with John Love.

Visit our table, schedule a meeting, or flag us down to catch up!

Until next time.

Chad Krueger and Pam Jones

CAB Live Training Sessions

Tuesday, September 12th | 12p EST

Grow Your Business with SALEs – Targeted Leads

Target companies within your specific appetite with over 100+ filters. Search by insurance renewals, fleet size, commodities, and many other options.

Tuesday, September 19th | 12p EST

MC Brokerage

Check out our brand new platform for brokerage operations and logistics companies. Discover new carriers, evaluate them, and maintain within our system.

To register for the webinars, sign into your CAB account. Then click live training at the top of the page to access the webinar registration.

Explore all of our previously recorded live webinar sessions in our webinar library.

Follow us on the CAB LinkedIn page and Facebook.

CAB’s Tips & Tricks

Did you know you could customize your CAB view? Yes, you can!

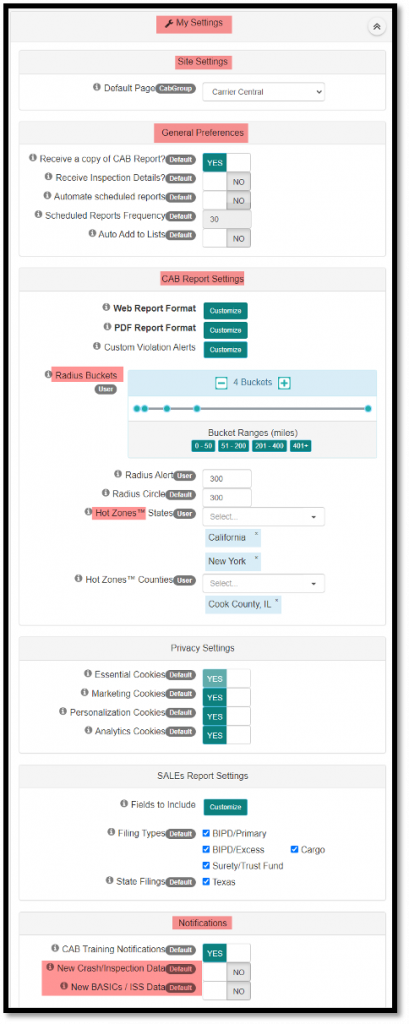

Under My Account, choose Profile. Once in the settings, you can decide various options to activate or deactivate. You can also customize the radius buckets and Hot ZonesTM. Tailor these various options to meet your needs including the notifications at the bottom so you are receiving new entry notifications on crash, inspection, BASICs, and ISS activity.

THIS MONTH WE REPORT

The American Transportation Research Institute launched its 2023 Top Industry Issues Survey which will remain open through September 29, 2023. The annual survey asks stakeholders to rank the top issues of concern along with potential strategies for addressing each issue. Read more…

FMCSA details new truck driver detention time survey. This research study will collect data on commercial motor vehicle driver detention time, analyze that data to determine the frequency and severity of detention time, and assess the solutions to measure detention time. Read more…

PepsiCo praises Tesla Semi’s performance on long-haul, regional loads. “Out of our 21 assets of the Tesla Semis that we have here, three of them are dedicated to the long haul, over-the-road routes,” Dejan Antunovic, PepsiCo’s electrification program manager. Read more…

Yellow Trucking’s bankruptcy filing spurs run-up in transport stocks. An in-depth interview with SAIA CEO Frederick Holzgrefe details the Yellow trucking bankruptcy, redistribution of freight lines across competitors, and holiday demand projections suggesting a freight recession recovery. Read more…

Safety groups urge Congress to oppose efforts to block speed limiters. A number of highway safety groups joined forces to voice their opposition to legislation in both the U.S. House and Senate that, if passed, would block the Federal Motor Carrier Safety Administration from mandating speed limiters on heavy-duty trucks. Read more…

Federal Motor Carrier Safety Administration (FMCSA) Request for Comments on Safety Fitness Determinations. FMCSA is interested in developing a new methodology to determine when a motor carrier is not fit to operate commercial motor vehicles (CMVs) in or affecting interstate commerce and is requesting public comments. Read more…

New dash cam uses AI to coach drivers in real time. The fully connected camera uses sensors and video AI to review every minute of drive time and understand behavior. Read more…

FMCSA Removes Four Devices from List of Registered ELDs. FMCSA has removed ALL TRUCKERS ELD, GOLDEN ELD, PRIMELD, and SECURE ELD devices from the list of registered Electronic Logging Devices (ELD). Read more…

September 2023 CAB Case Summaries

These case summaries are prepared by Robert “Rocky” C. Rogers, a Partner at Moseley Marcinack Law Group LLP.

AUTO

Inzunza v. Naranjo, 2023 Cal.App. LEXIS 631, C.A. No. B318956 (Cal. Ct. App. Aug. 21, 2023). The California appellate court reversed a $7.6 million verdict entered against a motor carrier in a wrongful death case arising from a motor vehicle accident. Specifically, the appellate court held the trial court erred in applying deemed admissions from the motor carrier’s drivers as binding against the motor carrier and in preventing the motor carrier from presenting facts defending against liability for the accident. The appellate court reiterated the rule that an agent’s deemed admissions do not bind the principal codefendant, even when the basis for the action against the principal codefendant is vicarious liability arising from the acts of the agent. Accordingly, the court reversed and remanded the matter for a new trial.

Garcia v. Zimmerman, 2023 U.S. Dist. LEXIS 150994, C.A. No. 1:21-cv-01063 (W.D. Tex. Aug. 28, 2023). A motor carrier and its driver were granted partial summary judgment on certain causes of action in a personal injury trial arising from a motor vehicle accident involving a commercial motor vehicle. The court found the allegations raised nothing more than “garden variety” negligence and, as such, dismissed the gross negligence cause of action against the driver. With respect to the negligent hiring, retention, training, and supervision claims against the motor carrier, the court granted summary judgment to the motor carrier finding the plaintiff had not come forward with sufficient evidence to support each claim and, in fact, the evidence of the record refuted the claims that the motor carrier did not properly vet the driver before hiring or continued to employ him after being placed on notice of his unfitness to operate a commercial motor vehicle.

Davidsen v. Buschert, 2023 U.S. Dist. LEXIS 143239, C.A. No. 1:21-cv-374 (N.D. Ind. Aug. 16, 2023). In this personal injury action, the court dismissed punitive/exemplary damages counts against the driver and motor carrier. With respect to the driver, the court found there was no evidence to support that the driver acted with the requisite mental state to support a punitive damages award. Rather, at most, it suggests inattention which, at most, suggests negligence. With respect to the punitive damages claim against the motor carrier, the court first dispatched with the theory under vicarious liability, having previously ruled there was no basis for punitive damages against the driver. With respect to the negligent hiring/training/retention theory as a basis of imposing punitive damages, the court found there was nothing so significant in the driver’s record/driving history as to put the carrier on notice that the driver was unfit to operate the tractor. Specifically, the court explained that the driver’s limited prior incidents/violations had no causal relation to the nature of the involved accident either. Accordingly, all punitive damages causes of action were dismissed.

BROKER

Green v. RXO Last Mile, Inc., 2023 U.S. Dist. LEXIS 148956, C.A. No. 3:19-cv-1896 (D. Conn. Aug. 24, 2023). A last-mile freight broker was granted summary judgment in a Connecticut misclassification class action. The plaintiffs argued the broker was unjustly enriched and committed impermissible wage withholding by virtue of its misclassifying them as independent contractors as opposed to employees. With respect to the wage deduction claim, the court stressed prior Connecticut and Second Circuit precedent establishing “when an employee has agreed to a specific formula for the calculation of . . . wages, the part of the formula that allows deductions does not constitute a deduction from earned wages.” Noting that the agreement with the plaintiffs/contracted Delivery Service Providers (DSPs) specifically set forth the process by which revenue earned under the agreement is reconciled with the various deductions at issue before monies were paid out to the DSPs, the court held there was no impermissible wage withholding under the established precedent. The plaintiffs premised their unjust enrichment claim on the broker requiring the DSPs to procure workers compensation benefits, which the plaintiffs argued unjustly enriched the broker by allowing it to avoid state-mandated workers compensation coverage. However, in rejecting the unjust enrichment claim, the court pointed out that the plaintiffs failed to show that this arrangement required the plaintiffs themselves—as opposed to the DSP/contract carriers with whom the broker contracted—to pay the premiums for workers compensation coverage and that they failed to meet the high burden to rely upon an indirect unjust enrichment theory of liability against the broker. As such, the court granted summary judgment to the freight broker and denied summary judgment to the plaintiffs, resulting in the dismissal of the entirety of plaintiffs’ case.

Gutierrez v. UNI Trans, LLC, 2023 U.S. Dist. LEXIS 139261, C.A. No. 1:21-cv-00073 (D.N.M. Aug. 9, 2023). In this wrongful death action, a freight broker was awarded summary judgment on all claims. In this instance, CEVA Logistics entered into a Broker-Carrier Agreement with UNI Trans. The Agreement provided that CEVA was a licensed property broker and UNI Trans was a carrier and independent contractor, and, therefore, UNI Trans was wholly responsible in every way for such persons that UNI Trans hires or employs in connection with its performance under the Agreement. CEVA undertook a review of all potential motor carriers, which included verifying the carriers’ motor carrier authority and safety score. Carriers had to verify that they did not have an unsatisfactory safety score and that they would notify CEVA of any incident that would likely result in the carrier receiving an unsatisfactory safety score. CEVA also employed an automated system that monitored the carriers’ MC number and safety rating. If the carrier falls out of compliance with the Carrier Agreement, such as lapse on insurance or unsatisfactory safety rating, the automated system blocks the carrier from receiving dispatches for transportation. A UNI Trans driver fell asleep while undertaking a load brokered to UNI Trans by CEVA and was involved in a motor vehicle accident. The Load and Rate Confirmation listed UNI Trans as the Carrier. The Bill of Lading signed on March 30, 2020, listed CEVA as the carrier, the shipper, and the consignee. CEVA was not the owner of the tractor or trailer utilized in the shipment. The UNI Trans driver met the minimum requirements for safe driving, had no FMCSA reportable crashes, and had 5-6 years driving experience. Under these facts, the court found CEVA and UNI Trans were not partners such that CEVA could be held liable for any actions of UNI Trans. The court next rejected that CEVA retained the necessary level of control over UNI Trans or the driver to hold CEVA vicariously liable for either’s negligence. The court specifically highlighted that the Agreement provided it was an independent contractor relationship and made clear UNI Trans was solely responsible for the manner in which its employees/agents/independent contractors performed the transportation services contemplated under the Agreement. The limited control CEVA retained related to the transportation was not sufficient “operational control” over UNI Trans to create an employer-employee relationship. The court further found there was no fact issue of whether CEVA was the motor carrier on the shipment that might otherwise subject it to liability under a statutory employment/vicarious liability theory. It found the record devoid of any evidence CEVA accepted legal responsibility to transport the shipment. With respect to the Bill of Lading listing CEVA as the carrier, the court pointed to language in the Agreement that provided “[d]ocuments for each Shipment shall name [CEVA] as third party payor of all freight charges and [Uni Trans] as the carrier of record. If there is a wrongly worded document, the parties will treat it as if it showed [CEVA] as ‘third party payor’ and [Uni Trans] as ‘carrier.’” The fact that another CEVA entity also held motor carrier authority was of no consequence, with the court stressing it mattered only what role CEVA played in this particular shipment. Last, the court rejected the negligent selection theory of liability. While reiterating that “[a]n employer is liable for physical harm to third persons caused by its failure to use reasonable care to select a competent and careful contractor (a) to perform work that will involve a risk of physical harm unless it is skillfully and carefully done or (b) to perform any duty that the employer owes to third persons,” the court found no reasonable jury could conclude that CEVA did not have a process for vetting approved carriers or that CEVA knew or should have known any UNI Trans driver was unfit. As such, it granted summary judgment to CEVA on all causes of action.

Girardeau v. Hobbs, 2023 U.S. Dist. LEXIS 146196, C.A. No. 4:21-cv-01265 (E.D. Mo. Aug. 21, 2023). Accepting the reasoning in the recent Seventh Circuit Court of Appeals decision in Ye v. GlobalTranz Enterprises, Inc., 74 F.4th 453 (7th Cir. 2023), the court dismissed a negligent hiring/selection count against a freight broker who brokered the load to the motor carrier involved in motor vehicle accident. However, it found the allegations of the complaint, accepted as true, plausibly alleged a claim against the broker for vicarious liability. The court thus found the complaint contained factual allegations (unspecified in the opinion) that the broker performed actions beyond those typical of a mere broker. As such, it denied the motion to dismiss the vicarious liability cause of action against the broker.

CARGO

Hoffman Logistics, Inc. v. Loup Logistics Co., LLC, 2023 U.S. Dist. LEXIS 148907, C.A. No. H-23-1384 (S.D. Tex. Aug. 24, 2023). The court held that a shipper’s state law causes of action against a transloader were preempted by the Carmack Amendment. In January 2022, Hoffman Logistics Co. contracted with Loup Logistics Co., LLC to have onions shipped from Idaho to Texas. On January 25, 2022, Partners Produce Inc. inspected the onions and found “a minimal standard roughly 2% decay.” The bill of lading Loup issued included “parameters for the method of transportation” as well as the optimum temperature for the Load. The onions arrived at their rail destination on February 16, 2022. The transloader, Southern Gulf, did not pick the load up for several days. Southern Gulf was to deliver the onions to their final destination via tractor-trailer. On February 22, 2022, the onions were offloaded, and the United States Department of Agriculture completed an arrival inspection. This inspection revealed decay of up to 31%, showed that the temperature of the transport unit was higher than the temperature listed in the bill of lading, and determined that the onions were “largely spoiled and unusable.” Hoffman thereafter sued Loup and Southern Gulf for breach of contract and under the Carmack Amendment. Southern Gulf argued the Carmack Amendment preempted Hoffman’s claims against it, and the court agreed. However, with respect to Southern Gulf’s challenge to the Carmack claim based upon lack of privity between itself and Hoffman, the court explained “[l]iability under the Carmack Amendment is not limited to the carrier issuing a bill of lading. Liability can extend to a carrier that delivers the property if the transportation was by motor carrier and between states.” Insofar as it was alleged Southern Gulf was the delivering carrier (and transloader), it could be liable under Carmack. Therefore, the court denied Southern Gulf’s 12(b)(6) motion on the Carmack claim.

Starceski v. United Van Lines, LLC, 2023 U.S. Dist. LEXIS 147532, C.A. No. 8:22-cv-962 (M.D. Fla. Aug. 22, 2023). In this cargo damage case, the court upheld the household goods mover’s limitation of liability. On September 1, 2021, Mr. Starceski contracted with United to transport his household goods from California to Florida. United subsequently issued Mr. Starceski “Order for Service/Bill of Lading U0187-00402-1” (the “Bill of Lading”) and set the weight of Mr. Starceski’s load at 13,499 pounds. Instead of purchasing full replacement value protection, Mr. Starceski opted to accept United’s free-of-charge base shipment protection of $0.60 per pound. Citing prior 11th Circuit precedent, the court explained “to properly [limit liability], a carrier must show that it: 1) maintained a tariff within the prescribed guidelines of the Interstate Commerce Commission; 2) gave the shipper a reasonable opportunity to choose between multiple levels of liability protection; 3) obtained the shipper’s agreement as to liability protection; and 4) issued a receipt or bill of lading prior to moving the shipment.” With respect to the first prong, the court explained that, since the abolishment of the ICC, carriers are merely required to provide shippers with a copy of the tariff upon request. The court found the evidence of the record established Mr. Staceski did not request a copy of United’s tariff until after he had signed the bill of lading—the binding contract under which he agreed to pay less for the shipment in exchange for the lower $.60 per pound limitation of liability. The court further noted the bill of lading and required pamphlet that United provided him set forth instructions on how he could have accessed the tariff prior to signing the bill of lading. Furthermore, the applicable bill of lading expressly valued the shipment at $81,000 and gave Mr. Staceski an opportunity to choose a higher level of liability in exchange for a higher shipping rate. With this option, he chose the cheaper shipping rate and lesser $.60 per pound rather than full replacement value. As such, the court rejected the argument that United failed to advise him of his options or afford him a reasonable opportunity to choose between the multiple levels of liability protection. Thus, the court enforced the $.60 per pound limitation of liability, holding United’s liability was capped at $8,099.40.

Edwards v. FedEx Ground, 2023 U.S. Dist. LEXIS 138726, C.A. No. 4:23-cv-839 (E.D. Mo. Aug. 9, 2023). A pro se plaintiff’s complaint against “FedEx Ground,” “FedEx Express,” and “FedEx Ground Drivers” was dismissed for failure to state a claim. In the Complaint, the plaintiff claimed that, from about 2015 into the present within the City of St. Louis and elsewhere, Defendants used “sophisticated means” to “Stalk and Harass” him, “deprive [him] of his Civil right, retarded the movement of packages Via the Post Office, UPS and FedEx Ground, intentionally damage[d] packages,” and “deliver[ed] packages in a Manor to inflic[t] emotional stress on [him].” Plaintiff alleged three descriptions sounding in tort under Missouri law: “Intentional Infliction of Emotional Distress,” “Violation of Missouri Tampering with a Computer User Law,” and “Violation of Missouri Prohibition Against malicious Trespass to Personalty.” The court, after viewing the allegations, determined all were either conclusory or outright legal conclusions, and accordingly granted Defendants’ motion to dismiss.

Montaze Broz., LLC v. Global Ocean Line, Inc., 2023 U.S. Dist. LEXIS 136004, C.A. No. 23-cv-21788 (S.D. Fla. Aug. 4, 2023). This negligence and admiralty action arose from a stolen Ford Raptor truck. Plaintiff alleged Defendant is a for-profit company engaged in transporting goods for hire by water, and/or operating as a non-vessel operating common carrier. The Complaint alleged that, on November 11, 2022, Plaintiff delivered its Cargo to Defendant for Defendant to transport the same from Florida to Germany. Plaintiff further alleged Defendant issued a Booking Confirmation which did not refer to any terms and conditions and Defendant did not provide Plaintiff, at any time, with any other document to which the parties agreed to any terms or conditions incident to the transport of the F-150. It appeared that the truck was stolen while in storage and under the exclusive control and possession of Defendant. Global Ocean Lines moved to dismiss the Complaint under the Economic Loss Rule under general admiralty law and sought to limit its liability to $500 under COGSA. In support of the motion, Defendant attached its Terms and Conditions, which provided COGSA applied to the shipment and specifically included the $500 limitation of liability unless the customer declared a higher value. Responding to plaintiff’s “four corners” argument and applying 11th Circuit precedent, the court explained it may properly consider a document attached to a motion to dismiss without convertingthe motion into one for summary judgment if the attached document is (1) central to the plaintiff’s claim and (2) undisputed, meaning that the authenticity of the document is not challenged. The court determined, based upon the allegations of the Complaint, that the Terms and Conditions were central to plaintiff’s claim and may, therefore, be considered. However, it found that the Complaint also alleged the Terms and Conditions were not incorporated or provided and the parties were not in contractual privity because it appeared undisputed that Defendant did not issue a bill of lading to Plaintiff prior to transport. As such, the court could not find, at this stage, that the parties were in contractual privity and, therefore, could not find—again, at this stage—that the alleged negligent conduct fell within the purview of the Terms and Conditions. It, therefore, denied the motion.

COVERAGE

Scottsdale Ins. Co. v. Am. English, LLC, 2023 U.S. Dist. LEXIS 146167, C.A. No. 23-C-28 (N.D. Ill. Aug. 21, 2023). A CGL insurer was held to have no contractual obligations under the policy for personal injury claims arising from an accident in which the tort plaintiff was injured when she was allegedly struck by a cart/wheeled trunk and/or the operator of the cart while it was being unloaded from a van owned by Defendant. The CGL policy’s auto exclusion excluded from coverage “[b]odily injury” . . . arising out of the ownership, maintenance, use or entrustment to others of any . . . “auto” . . . owned or operated by or rented or loaned to any insured. Use included operation and “loading and unloading”. “Loading and unloading” was further defined as the handling of property: a. After it is moved from the place where it is accepted for movement into or onto an . . . “auto”; b. While it is in or on an . . . “auto”; or c. While it is being moved from an . . . “auto” to the place where it is finally delivered; but “loading or unloading” does not include the movement of property by means of a mechanical device, other than a hand truck, that is not attached to the . . . “auto”. The CGL policy further provided the exclusion applied even if the claims against any insured “allege negligence or other wrongdoing in the supervision, hiring, employment, training or monitoring of others by that insured, if the ‘occurrence’ which caused the ‘bodily injury’ . . . involved the ownership, maintenance, use or entrustment to others of any . . . ‘auto’ . . . that is owned or operated by or rented or loaned to any insured.” The court found this exclusion applied under the facts of the accident because the use of the vehicle was central, not merely incidental, to the tort plaintiff’s alleged injuries.

O’Donnell v. Avis Rent A Car Sys., LLC, 2023 U.S. App. LEXIS 21301, C.A. No. 22-10997 (5th Cir. Aug. 15, 2023). The Fifth Circuit Court of Appeals held Avis and Avis’s insurer were not responsible for any judgment entered in connection with a motor vehicle accident involving an Avis-owned rental car. A Spanish citizen in the United States on business rented a vehicle from Avis in Texas, selected and paid for the optional $2 million Additional Liability Insurance (“ALI”) coverage beyond the $30,000 minimum coverage provided by the Rental Agreement, and was involved in a motor vehicle accident against the tort plaintiff. The tort plaintiff sued the Spanish citizen but was initially unable to effect service upon the Spanish citizen. The tort plaintiff later joined Avis as a defendant in the tort action, but Avis prevailed on summary judgment. Thereafter, the tort plaintiff was able to serve the Spanish citizen by email as provided for under a Court Order. The Spanish citizen never filed a responsive pleading, and the trial court in the tort action entered default judgment against him for $2 million. The tort plaintiff took by assignment any rights the Spanish citizen had under the Rental Agreement or the ALI policy issued in connection with the Avis rental. The tort plaintiff then filed a separate action to collect on the judgment from Avis or its insurer. The court found the separate ALI policy prevailed over any inconsistent terms in the Rental Agreement. The ALI policy included a provision that “[n]o action shall lie against the company unless as a condition precedent thereto, the Insured shall have fully complied with all the terms of this Policy.” Included within those provisions was a “Notice of Loss” section requiring “[w]hen an event causing injury or damage takes place which is reasonable [sic] likely to give rise to a claim under this Policy, written notice shall be given as soon as practicable by or on behalf of the Insured to [ACE] or any of its authorized agents in addition to any obligation the Insured may have under the Underlying Protection or any other insurance. Such notice shall contain particulars sufficient to identify the Insured and reasonably obtainable information concerning the time, place and circumstances of such event and pertinent details. The Insured’s [sic] shall give like notice of any claim or suit on account of such event and shall immediately forward to [ACE] every demand, notice, summons or other process received by him or his representative, together with copies of reports or investigations made by the Insured with respect to such claim or suit.” The court interpreted this provision as containing two conditions precedent to coverage: (1) the insured, or someone on his behalf, give notice to the insurer of an event causing injury that is reasonably likely to lead to a claim; and (2) the insured give notice of a claim, demand, action, or lawsuit to the insurer. The court found that, even assuming that someone on behalf of the insured could give notice of suit to the insurer, Avis’s notice of the underlying tort action to the insurer did not suffice because the evidence established Avis was operating in its own interests in connection with the underlying tort action at that time. The court went on to find that the added requirement for a denial of coverage due to lack of notice—prejudice to the insurer—was met under the circumstances. The court interpreted Texas law to mean even where an insurer is on notice of a suit against its putative insured, the failure of the insured itself to give notice to the insurer of the suit results in prejudice sufficient to deny coverage.

Century-National Ins. Co. v. Frantz, 2023 Fla. App. LEXIS 5669, C.A. No. 2D22-1274 (Fla. Ct. App. Aug. 11, 2023). In this insurance coverage action, the court held that third-party tort plaintiffs were not indispensable parties to the declaratory judgment action under Florida law, and, thus, their non-inclusion was not a basis for ruling in the insured’s favor. In the court’s view, the applicable statute “broadly permits but does not require all persons having or claiming an interest in the declaration to be parties.” Further, the statute “expressly contemplates the existence of persons who are not parties to the declaratory proceedings yet whose rights are implicated therein.This is consistent with settled authorities explaining that ‘[a] declaratory action obtained by an insurer against its insured is not binding on a third-party claimant who was not a party to the declaratory judgment action.’”

Integon Preferred Ins. Co. v. Wilcox, 2023 U.S. Dist. LEXIS 135240, C.A. No. 2:21-cv-1501 (W.D. Wash. Aug. 3, 2023). An insurer was granted summary judgment on claims for bad faith and extra-contractual damages. Integon issued an auto liability policy to Wilcox, who was involved in a pedestrian-on-vehicle accident with Hoff during the pendency of the policy. Wilcox timely reported the incident to Integon, and Integon opened a claim and assigned an adjuster. The adjuster contacted Hoff to obtain information about the incident and his injuries. The adjuster also contacted and obtained a recorded statement from Wilcox. The adjuster issued a letter to Wilcox notifying him that the value of the claim may exceed that provided under the policy and that he had the right to consult with an attorney of his own choosing regarding this potential excess liability. Thereafter, Integon’s adjuster communicated with counsel for Hoff over a period of months. Hoff’s counsel issued a demand for approximately $1.6 million, which Integon forwarded to Wilcox. Within three weeks of the demand, Integon offered its policy limits along with a declaration from the Wilcoxes regarding other insurance and personal assets. Hoff’s counsel acknowledged receipt and indicated she would discuss with her client. Over the next six months, Integon’s adjuster followed up with Hoff’s counsel. Eventually, Hoff’s counsel indicated Hoff was not ready to accept the settlement offer. Integon continued to regularly follow up with Hoff’s counsel regarding the settlement offer. Approximately a year after the “initial rejection” of the settlement offer, Hoff, via counsel, filed a lawsuit against Wilcox. Hoff’s counsel did not provide a courtesy copy of the lawsuit upon Integon or provide notice to Integon of the initiation of the lawsuit. Wilcox was served with the lawsuit. There was some suggestion that Wilcox called Integon several days after being served, but Integon had no record of the phone call and Wilcox was likewise unable to provide proof the call was made. The Wilcoxes retained personal counsel within days of being served, who provided a letter of representation to Integon but in which he did not mention the underlying lawsuit and did not provide a copy of the lawsuit. Integon called the Wilcoxes’ personal counsel in response to the letter, but the recorded transcript of the call also failed to reveal counsel notified Integon of the lawsuit. When no one appeared or filed a responsive pleading in the underlying lawsuit, default judgment of approximately $1.6 million was entered against Wilcox. Hoff’s counsel merely forwarded the default judgment to Integon in response to one of the previous follow ups from Integon regarding the settlement offer of the policy limits of $25,000. Integon hired defense counsel to attempt to vacate the default judgment, but that motion was denied. Integon thereafter instituted a declaratory judgment action seeking a declaration that its liability in connection with the default judgment was capped at $25,000. The Wilcoxes filed numerous counterclaims for bad faith, breach of contract, negligence, and violations of the Washington Consumer Protection Act. The Wilcoxes argued Integon mishandled the claim by: (1) failing to check the docket for the filing of any lawsuit; (2) specifically asking the Wilcoxes if a lawsuit had been filed against them; or (3) requesting proof that a lawsuit had been filed before continuing to attempt to settle the claim with Hoff’s counsel after the statute of limitations had passed. The court rejected this argument, specifically noting “the Wilcoxes fail to cite to any legal authority, Washington or otherwise, that obligates an insurer to check a court docketing system to determine whether a lawsuit has been filed against its insured, or for an insurer to specifically ask its insured if a lawsuit has been filed against it.” The court further explained that accepting the Wilcoxes’ argument would run contrary to the clear language of the policy, placing the burden to provide notice of a lawsuit upon the insured. The court further rejected claims by an expert for the Wilcoxes about how Integon allegedly mishandled the claim, finding his opinions were: (1) inconsistent with matters the court already ruled upon; (2) were contrary to the record evidence; and (3) were merely conclusory statements. The court then dismissed the WCPA claim as not supported by the record evidence. As such, the insurer was granted summary judgment, and the court ruled its liability was capped at $25,000.

Infinity Select Ins. Co. v. Superior Court, 94 Cal. App. 5th 190 (Ca. Ct. App. 2023). An insurer did not violate the Motor Carriers of Property Permit Act, Veh. Code, § 34600 et seq., by issuing a policy to a carrier with a bodily injury limit lower than the $750,000 minimum coverage amount under Veh. Code, § 34631.5, subd. (a), because the carrier was responsible for satisfying requirements to hold a valid permit under former Veh. Code, §§ 34620, subd. (a), 34621, subd. (b)(6) and could opt to meet financial responsibility requirements under Veh. Code, §§ 34630, 34631, by other means, such as stacking coverage under multiple policies. Moreover, the insurer had no duty to ensure compliance and requiring it to provide greater coverage was unwarranted because there was no conflict requiring the policy be conformed to statutes, nor did the facts show either that the insured requested certification or greater coverage or that the insurer assumed greater obligations.

Am. Highway, Inc. v. The Travelers Cos., 2023 U.S. Dist. LEXIS 141326, C.A. No. 19-C-01660 (N.D. Ill. Aug. 14, 2023). In this insurance coverage action, the court ruled with the insurer that coverage was not afforded under the applicable cargo policy. Kerry Foods contacted freight broker, C.H. Robinson, to ship 19 pallets of a potato-based, food-grade product called ProtaStar from Illinois to California. C.H. Robinson selected American Highway to carry the load. American Highway picked up the load at Kerry’s distribution center in Illinois on November 29, 2017. Kerry sealed the trailer that contained the ProtaStar with a metal identification tag. On the way to California, the trailer experienced a mechanical issue, so American Highway broke the trailer’s seal and moved the ProtaStar to a new trailer with a new seal. Upon delivery, the recipient rejected the load because the original seal had been broken. American Highway issued a “Guaranty” to Kerry that stated, “[American Highway] represents and guarantees to Kerry that during the time the Goods have been in the possession of [American Highway] that such goods have not been tampered, contaminated, adulterated, or otherwise altered.” When the cargo claim was presented to Travelers as the cargo insurer for American Highway, Travelers denied coverage. The court sided with Travelers, finding the policy limited coverage to “direct physical loss of or damage to Covered Property caused by or resulting from a Covered Cause of Loss.” The court found there was no genuine issue of material fact that the ProtaStar did not suffer “direct physical loss” or “direct physical damage.” The only basis for the rejection was the broken seal. The court ruled any potential “diminution of value” by virtue of the “risk of adulteration” is an economic injury, not a direct physical loss or damage to the product. The court further held Travelers had not waived any potential coverage defense.

Travelers Prop. Cas. Co. of Am. v. H.E. Sutton Forwarding Co., LLC, 2023 U.S. Dist. LEXIS 149445, C.A. No. 2:21-cv-719 (M.D. Fla. Aug. 24, 2023). This is a follow up decision to a case previously reported in the August 2022 CAB Case Summaries. That prior ruling left open whether application of the policy’s aircraft exclusion would nullify all coverage since all of its business involved the use of an aircraft, and, therefore, could not be enforceable as illusory coverage. Travelers thereafter sought and was granted supplemental briefing on the illusory coverage issue. The court explained “[t]o render coverage illusory, the exclusion must ‘completely contradict the insuring provisions.’ If an exclusion does not ‘completely swallow’ the insuring provision, the policy is not illusory, even if it is a significant exclusion.” The court found the aircraft exclusion did not swallow every claim under the insuring provision—for example, the policy would cover slip-and-falls at the insured’s leased premises or property damage due to the insured’s negligent maintenance of its leased premises. Thus, the aircraft exclusion did not “swallow up” the insuring provision or “eliminate all or virtually all coverage” under the policy and, accordingly, was not illusory coverage. Therefore, the exclusion could be enforced. Accordingly, the court granted summary judgment in favor of the insurer.

WORKERS COMPENSATION

No cases of note to report.