Hello All,

What weather anomalies we’ve seen of late! Hope you are safe, dry, and minimally affected.

It’s month 2 of 2024 and crazy schedules are already underway. We here at CAB along with the rest of our sister companies and parent entity have been working furiously and the change has come to fruition. Perhaps you have seen the news already. CAB, Central Analysis Bureau, is now CAB by Fusable. However, in a strategic separation, CAB and other Randall Reilly data and media entities have transitioned over to our new company, Fusable. The Talent division remains identified under the Randall Reilly name.

Our system, service, and people remain unchanged. We are still here to help you “Make Better Decisions.” The News section below includes the official press release. Feel free to check out our new Fusable website or reach out to your rep with any questions. Common question: invoices remain the same.

Thank you,

Chad Krueger and Pam Jones

CAB Live Training Sessions

Tuesday, February 13th | 12p EST – CAB for Underwriting

Sean Gardner will review our platform from an underwriter’s standpoint. He’ll share tips on how the system supports the decision makers role of the fleet’s exposure.

Tuesday, February 20th | 12p EST – How to Update Motor Carrier Data

Mike Sevret will cover the steps to update motor carrier data including company names, power units, DataQs, and much more!

To register for the webinars, sign into your CAB account. Then click live training at the top of the page to access the webinar registration.

Explore all of our previously recorded live webinar sessions in our webinar library.

Follow us on the CAB LinkedIn page and Facebook.

CAB’s Tips & Tricks

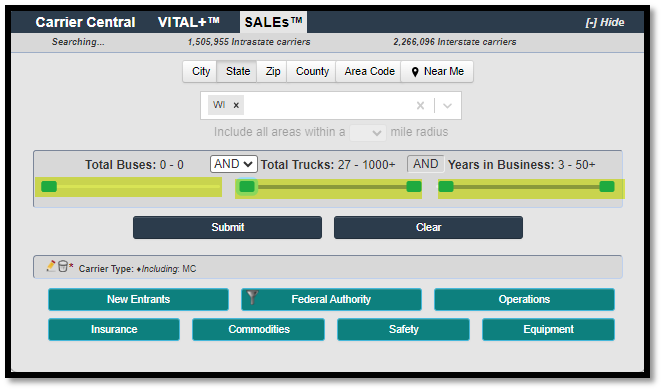

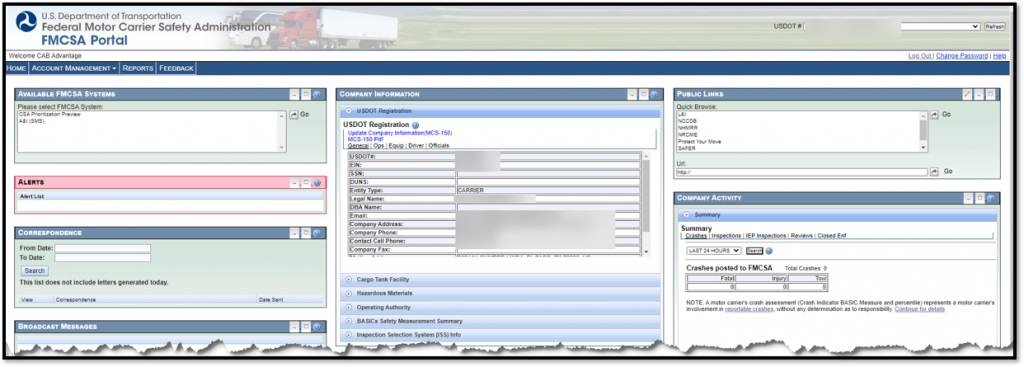

The necessary and important government MFA, multi-factor authentication, came out and CAB’s solution allows our users to continue to access their clients’ government details. The government expanded the use of the login.gov application for accessing the FMCSA’s Portal.

Pre-FMCSA’s MFA implementation, users could access the motor carrier’s SMS through the CSA site with the fleet’s PIN. This is no longer an option. The user now needs to access data through the FMCSA portal (see image below). Many CAB clients only utilize the CAB platform to see motor carrier activity, and this remains the same. Your clients will need to set up their login.gov and FMCSA portal correctly so that CAB should be able to access it.

Our amazing development team created a solution that meets FMCSA’s security requirements and continues to allow our users access to driver data. In order for CAB to continue to integrate driver data, users need to be able to access the FMCSA data through the motor carrier’s FMCSA Portal account.In short, the motor carrier needs to be able access this site.

Refer to the January 9th webinar titled “New Enhancements – Changes to FMCSA Portal Login.gov” where we covered our solution for the MFA enhancement.

THIS MONTH WE REPORT

Randall Reilly Launches New Business, Fusable, in Strategic Separation from Talent Acquisition Business. Randall Reilly LLC is strategically separating its talent acquisition business and its industrial data business with its accompanying services. The talent acquisition side will be doing business as Randall Reilly, while the data business is launching as a new brand, doing business as Fusable. The move positions Fusable, with its best-in-class data products such as EDA, Central Analysis Bureau, EquipmentWatch, Iron Solutions, RigDig BI Price Digests and Fusable Digital, to leverage data-driven solutions for industrial sectors, fostering its growth as a standalone entity. Fusable will also retain the media brands such as Commercial Carrier Journal (CCJ), Overdrive, and Equipment World, renowned for their industry expertise and thought leadership. Read more….

Freight cycle poised for new stage in ’24: ACT Research. The nation’s freight cycle fundamentals will improve in 2024, according to the latest release of the Freight Forecast, U.S. Rate and Volume OUTLOOK report. Freight demand is below trend, but starting to recover, as post-pandemic effects fade, both real disposable incomes and retail sales are accelerating, and disruptions in ocean shipping are likely catalyzing the end of the 18-month destock. Read more…

Bill Introduced to Keep CFPB Out of State Insurance Regulation: The Business of Insurance Regulatory Reform Act of 2024 from senators Tim Scott, R-S.C., and Joe Manchin, D-W.V., was referred to the U.S. Senate’s Committee on Banking, Housing, and Urban Affairs to make sure the Consumer Financial Protection Bureau (CFPB) “does not overstep their statutory authority.” Read more…

New Rules on Independent Contractors Could Affect Trucking’s Owner-Operator Model: Is that driver an employee or an owner-operator? Complex new rules from the U.S. Department of Labor set out a multi-factor approach to determining when a worker is an independent contractor.The department has adopted a “totality of the circumstances” analysis, so no single factor should make or break an IC determination, and additional factors may be considered. Read more…

FMCSA Weighs Carrier Fitness Determination Rewrite: The Federal Motor Carrier Safety Administration is reviewing six research papers as it weighs revision of its motor carrier safety fitness determination rules, the agency said. “As FMCSA pursues the development of a new methodology to determine when a motor carrier is unfit to operate, the agency must avoid relying on the Compliance, Safety, Accountability and Safety Measurement System programs,” the Owner-Operator Independent Drivers Association wrote. Read more…

FMCSA Administrator Robin Hutcheson to resign: Nation’s top truck safety regulator, Robin Hutcheson, will step down Jan. 26, according to DOT. Sue Lawless, FMCSA’s assistant administrator, will head the agency in an acting administrator role after Hutcheson’s departure. Lawless also serves as the agency’s executive director and chief safety officer. Read more…

February 2024 CAB Case Summaries

These case summaries are prepared by Robert “Rocky” C. Rogers, a Partner at Moseley Marcinack Law Group LLP.

AUTO

Davenport v. Bonini, 2024 WL 69062, No. 1:22-CV-469 (E.D. Tex. Jan. 4, 2024). In this personal injury action, the court granted in part and denied in part a motion for summary judgment by the CMV driver and motor carrier. The plaintiff filed suit against a trucking company and its driver following a collision with a tractor trailer. The plaintiff brought a negligence claim against the driver and negligent hiring, training, entrustment, supervision, retention, and monitoring claims against the company. It does not appear the plaintiff maintained a vicarious liability-style claim against the company premised upon the alleged negligence of the driver. The driver and company alleged that unknown motorists caused the collision and later moved for summary judgment, arguing that the plaintiff could not present any admissible evidence to support her claims. The plaintiff did not specifically respond the motion of the company seeking dismissal of the negligent hiring, training, entrustment, supervision, retention, and monitoring claims, and accordingly the court deemed those claims against the company abandoned and granted summary judgment in favor of the company. With respect to the negligence claim against the driver, however, the court found the driver’s testimony, specifically that he had potentially allowed himself to become boxed in by other vehicles and possibly not slowed down at the time of the collision, could possibly support a jury conclusion the driver was driving negligently at the time of the collision and was a proximate cause of the plaintiff’s injuries. Accordingly, the driver’s summary judgment motion was denied.

Dong v. Cruz-Marte, 2024 WL 117238, No. 2023-02016 (N.Y. App. Div. Jan. 11, 2024). In this personal injury action stemming from a bicycle v. tractor-trailer collision in which the cyclist was killed, the New York appellate court affirmed the lower court’s denial of the defendants’ motion for summary judgment. The plaintiff’s decedent was killed when he rode an electric bicycle around a double-parked vehicle and was struck by a tractor-trailer. The lower court denied the trucking company and driver’s motion for summary judgment, as the driver’s testimony indicated that he did not know how close the bicycle was to his truck before impact and that he did not adjust his operation of the vehicle despite seeing the cyclist three or four car lengths ahead of him before impact. As for the company, the court found that they did not present any evidence to overcome a potential vicarious liability claim. Thus, the denial of summary judgment was affirmed.

Hockaday v. Hessel, 2024 WL 117266, No. 2023-01642 (N.Y. App. Div. Jan. 11, 2024). In this personal injury action stemming from a tractor-trailer v. a wheelchair/motorized scooter, the New York appellate court affirmed the lower court’s grant of partial summary judgment to the plaintiff as to liability and striking of the defendants’ affirmative defenses of culpable conduct and comparative fault. The court found that the plaintiff made a prima facie showing as to her entitlement of judgment as to liability. While the court acknowledged there was some conflicting evidence regarding whether the plaintiff was within the crosswalk at the time of the accident, it nevertheless found that, regardless of this evidence, there was enough evidence to support the truck driver’s failure to exercise due care to avoid colliding with pedestrians.

Guthrie v. Monteagudo, 2024 WL 264075, No. 22-1610 (W.D. Pa. Jan. 24, 2024). In this personal injury action arising from a collision between a passenger vehicle and tractor-trailer, the court awarded sanctions against a trucking company following its failure to cooperate in discovery. The plaintiff sued the truck driver and the trucking company following the accident and, thereafter, propounded discovery upon both. In the court’s view, the defendants were not forthcoming in providing responses to the plaintiff’s discovery requests, and defense counsel was only able to produce limited documentation from the defendants’ insurer, as it could not locate or obtain the cooperation of the driver or trucking company. Following a continued failure to produce information or appear for depositions, the plaintiff filed a motion for sanctions. The court, while noting defense counsel’s continued efforts to try to locate the defendants and obtain their cooperation, it awarded the following as sanctions: (1) all factual averments asserted against the motor carrier in the Complaint were accepted as true, including for purposes of trial; (2) at the trial of this case, the jury will be instructed that it must presume that GPS data and dashcam video from the tractor-trailer, along with the driver’s employment and driver qualification files as well as driver logs, were unfavorable to the motor carrier.

Finaldi v. Knight, 2024 WL 26712, No. A-0315-22 (N.J. Super. Ct. App. Div. Jan. 3, 2024). In this personal injury action, the New Jersey appellate court affirmed the lower court’s grant of summary judgment in favor of a Delivery Service Provider, Cornucopia Logistics, and Amazon Logistics, Inc./Amazon Fulfillment Services, Inc. (collectively “Amazon”). At the time of the accident, Cornucopia had an agreement with Amazon to deliver groceries ordered through Amazon Fresh as an independent contractor. Per the terms of the Agreement, Cornucopia had exclusive responsibility for its personnel and exclusive control over its policies relating to wages, hours, working conditions, and other employment conditions. Cornucopia Delivery vans were leased to Cornucopia by EAN Holdings and were stored at Amazon’s facility where Cornucopia also had an office. When vans were not in use, the keys were kept in a cabinet behind a dispatch table at the office, and dispatchers were supposed to lock the cabinet after checking drivers into the facility. One of the dispatchers fell asleep while driving a Cornucopia van that he had stolen, and he ran through a red light and struck the plaintiffs. The plaintiffs sued the driver, EAN, and later Cornucopia as the dispatcher’s employer, and Amazon. Amazon moved for summary judgment as to the plaintiffs’ claims, and the plaintiffs consented to dismissal of the negligent hiring, retention, training, entrustment, and supervision claims against Amazon, as there was no evidence the driver was an Amazon employee. General negligence claims against Amazon remained in the case, however, as the trial court initially found there was enough evidence to support Amazon’s control over Cornucopia, rendering it liable for Cornucopia’s actions. The court later granted Cornucopia summary judgment on all claims, finding that the driver was not working at the time of the accident, that Cornucopia had taken reasonable precautions to prevent theft of its vans, and declining to impose liability on an employer for all senseless and unanticipated actions of employees. Following the grant of summary judgment to Cornucopia, Amazon moved for reconsideration of the denial of its motion for summary judgment, and the court agreed with Amazon, finding that, if no liability could be imposed upon Cornucopia, similarly, no liability could be imposed upon Amazon. On appeal, the appellate court agreed with the dismissal of the claims against Cornucopia and Amazon, finding that the lower court properly found the actions of the driver were unforeseeable.

BROKER

Montgomery v. Caribe Transport II, LLC, 2024 WL 129181, No. 19-CV-1300 (S.D. Ill. Jan. 11, 2024). In this follow up opinion in a case on which we previously reported in November 2023, the United States District Court for the Southern District of Illinois granted the defendants’ motion for judgment on the pleadings, dismissing the plaintiff’s claims against a broker for negligent hiring of a carrier and its driver. This ruling followed the U.S. Supreme Court’s denial of the petition for a writ of certiorari in Ye v. GloablTranz Enters., 74 F.th 453, 456 (7th Cir. 2023), meaning the Seventh Circuit’s holding that the FAAAA preempted such negligent hiring claims will stand—at least within this jurisdiction. The Court in Caribe previously granted the defendants’ motion for summary judgment, dismissing plaintiff’s vicarious liability claim, and it issued some additional procedural rulings in this instant decision, allowing the plaintiff to appeal the vicarious liability claim to the Seventh Circuit.

Carrier v. County Hall Ins. Co., 2024 WL 187709, No. 2:22-CV-00937 (W.D. La. Jan. 17, 2024). In this broker liability action, the Louisiana district court dismissed negligent hiring, training, supervision, and management claims against a freight broker, while allowing other claims to remain pending additional briefing. The action arose following a motor vehicle accident involving a passenger vehicle and a commercial vehicle operated by a driver for the carrier, TDKD. The occupants of the passenger vehicle also sued Covenant Transport, alleging vicarious liability for TDKD and its driver, agent/principal liability, and direct claims for negligent hiring, training, supervision, and management of the TDKD driver. Covenant moved for summary judgment on the ground that it was only the freight broker, that it could not be vicariously liable as it exerted no control over the carrier or its driver, that it relied on the FMCSA and Federal Regulations to select carriers, and that it played no role in hiring, selecting, dispatching, and supervising the carrier’s drivers. The court agreed that Covenant could not be liable for the driver’s actions, as it did not exert any control over him and as the plaintiff failed to provide any evidence to the contrary. Similarly, the court dismissed the negligent hiring, training, supervision, and management claims levied against Covenant related to the driver on the basis that there was no evidence of an employer-employee relationship between the two. As for the claim alleging negligent hiring of TDKD, the court also dismissed it on the basis that TDKD had active operating authority with the FMCSA and sufficient insurance at the time Covenant hired it. As for the negligent training, supervision, and management claims against Covenant as to TDKD, the court temporarily withheld a grant of summary judgment to allow the plaintiff to provide a responsive brief but indicated that it would dismiss these claims without additional proof that Covenant exercised control over TDKD as to how it selected, managed, or supervised its drivers. The court also declined to dismiss claims related to applicable insurance coverage for Covenant to allow the parties additional time to brief the issues. Interestingly, the court’s decision made no mention of FAAAA or preemption as a defense to Covenant.

CARGO

Int’l Cargo Loss Prevention, Inc. v. Mediterranean Shipping Co. (USA) Inc., 2024 WL 37072, No. 23-CV-1312 (S.D.N.Y. Jan. 3, 2024). In this action brought under COGSA by a subrogated insurer of a shipment of frozen shrimp transported by the defendants from India to Chicago, Illinois, the United States District Court for the Southern District of New York granted in part and denied in part the defendants’ motion to dismiss. The defendants, which were common carriers, had contracted to transport the frozen shrimp from India to Chicago, as memorialized in a Sea Waybill. The plaintiff alleged that the defendants delivered the shipment in damaged condition and brought suit under COGSA, further alleging that the defendants had breached their contractual obligations pursuant to the Sea Waybill. The defendants moved to dismiss the action, arguing it was time-barred under COGSA’s statute of limitations and on the ground that one of the defendants, MSC USA, was not a party to the Sea Waybill and could not be liable as an agent for the other defendant, MSC SA. In considering the motion to dismiss, the court rejected the argument that the claim was time-barred and determined a minor delay in the acceptance of the complaint by the clerk’s office due to a technical filing error did not void the initial filing date for purposes of considering the statute of limitations. However, the court did find that the plaintiff failed to state a claim against MSC USA, as it was merely the agent for MSC SA. In considering this argument, the court looked to the Sea Waybill and applied general common law rules of agency to its interpretation, finding that “if an agent executes a contract on behalf of its principal, and if the agent has properly disclosed its principal, then the agent is not itself a party to the contract and is not liable for claims arising out of it.” (Internal citations omitted). Instead, the court found that an agent may be held liable for a breach of contract only if the agent “clearly manifests an intent to be so bound, instead of, or in addition to, its principal.” (Internal citations omitted). Here, the court found that MSC USA’s signature on the Sea Waybill clearly stated that it was signing “as Agent on behalf of the Carrier MSC . . . SA.” The court further found that the plaintiff could not allege any facts to support MSC USA’s manifestation of intent to be bound to the Sea Waybill, and the court granted the motion to dismiss MSC USA. The court further denied the plaintiff’s motion to file a Second Amended Complaint, finding the plaintiff had previously been afforded the opportunity to file an amended pleading in response to MSC USA’s first motion to dismiss, yet the plaintiff “failed to plead any facts to address Defendants’ argument in this regard or indicate in any way that it has facts to support such an allegation.”

HMD America, Inc. v. Q1, LLC, 2024 WL 167374, No. 23-21865 (S.D. Fla. Jan. 16, 2024). In this action involving the alleged theft of over $3 million worth of cellphones, the United States District Court for the Southern District of Florida granted a defendant logistics company’s motion to dismiss. The plaintiff, HMD, owned and stored merchandise at the defendant Q1’s warehouse in Orlando. The parties also had an agreement whereby Q1 would perform various logistics services on behalf of HMD pursuant to a written contract. Pursuant to this agreement, HMD asked Q1 to arrange and transport a shipment of twenty pallets of cellphones from the Orlando warehouse to a consignee in Indiana. Q1, in turn, “subcontracted” with a broker, World Wide Express, to arrange for the transport of the shipment, and World Wide contracted with Aldon Mega, to transport the load. Aldon Mega then “subcontracted” with another entity, RPM, which was to actually transport the load. While the shipment was picked up in Orlando, it never made it to Indiana and was apparently stolen in transit. HMD filed suit on behalf of its insurer against Q1 and Aldon Mega, alleging breach of contract and negligence-based claims against Q1. Q1 moved to dismiss on the basis of FAAAA preemption and on the basis of failure to state a claim. HMD countered, arguing FAAAA only applied to intrastate, not interstate, transportation and that it also did not apply to Q1, as it was only a shipper, not a licensed broker. The court rejected the preemption argument as to the breach of contract claim against Q1, finding that prevailing caselaw rejected preemption over such contract-based claims. However, the court did find that the negligence claim was preempted, rejecting HMD’s argument that FAAAA applied only to intrastate transportation, as it found that FAAAA had “been broadly and repeatedly applied to preempt state-law claims related to interstate transportation of property.” The court also rejected HMD’s argument that FAAAA did not apply to Q1 as the shipper, instead agreeing with Q1 that it applied as Q1 was involved in arranging for the transportation of the cargo. In revisiting the breach of contract claim on Q1’s argument that HMD failed to state a claim, the court agreed, finding that the allegations were too conclusory and vague to support a breach of contract claim under Florida law. In alleging the claim, HMD had cited to two provisions of the agreement, one labeled “Liability” and another labeled “Transport Concept.” HMD also alleged, without citing to the agreement, that Q1 “was responsible for and had the risk of loss of the subject cargo” from the moment it received the goods at its warehouse. The court found these allegations too conclusory to set forth a viable cause of action, rejecting the notion that the claim could survive simply because the cargo was stolen. Finding that HMD failed to “connect the[] dots” between the theft and the contract, and finding that HMD’s allegations had mischaracterized the contract, the court granted Q1’s motion to dismiss the breach of contract claim.

Vegas Fab & Finish v. AMG Freight LLC, 2024 WL 166759, No. 2:23-cv-01336 (D. Nev. Jan. 16, 2024). In this action involving alleged damage to a shipment of pieces of brass door inlay, the United States District Corut for the District of Nevada granted the plaintiff’s motion to remand the case to state court for further proceedings, rejecting the defendant’s argument that removal to federal court was proper on the basis of Carmack preemption. The plaintiff, VFF, contracted with AMG to ship the pieces of brass door inlay to its client in Canada. Upon delivery of the shipment, the client informed VFF that the shipment was damaged. VFF learned that AMG had apparently subcontracted with another entity, ABF, to deliver the freight, and AMG denied being responsible for the damage to the shipment. VFF then filed suit in Nevada state court, alleging breach of contract, breach of the covenant of good faith and fair dealing, and negligence against AMG. AMG then removed the action to federal court on the basis that all of VFF’s claims were preempted by the Carmack Amendment. In arguing against VFF’s motion to remand, AMG also argued that the FAAAA and ICCTA preempted VFF’s claims. The court disagreed with AMG, finding that it had failed to establish federal jurisdiction under Carmack. The court found, and the parties acknowledged, that VFF had not presented a well-pleaded federal claim in its complaint. However, in addressing AMG’s argument that Carmack still preempted the claims, it analyzed whether AMG should be characterized as a carrier or a broker. AMG argued that, accepting the allegations of the complaint as true, it had to be classified as a carrier, but VFF argued AMG should be classified as a broker, as it never alleged that AMG was a carrier in the complaint. The court found that, when looking to the four corners of the complaint, AMG could not be considered a carrier and, moreover, that AMG had not adequately supported its assertion that it must be considered a carrier. Instead, the court found that AMG, its motion to dismiss, had expressly denied that it was the carrier for VFF’s shipment. Thus, the court rejected AMG’s Carmack preemption argument. Next turning to the FAAAA and ICCTA preemption argument, the court rejected AMG’s claim that they conferred exclusive federal subject matter jurisdiction, finding instead that each was an “ordinary preemption” affirmative defense that must be considered at the state court level following remand.

Federal Ins. Co. v. Kelton Wrecker, 2024 WL 85875, No. 4:22-cv-00083 (N.D. Ala. Jan. 8, 2024). In this action between the subrogated insurer of a motor carrier and a towing company, the court denied the towing company’s motion for summary judgment. The motor carrier, carrying 40,000 pounds of carpet, ran off an Alabama highway, and the towing company was called to the scene by law enforcement, as it was a member of law enforcement’s wrecker rotation list. The motor carrier specifically inquired of the towing company whether it had the necessary equipment to adequately perform “the recovery,” which the towing company responded that it did. The towing company began towing the tractor-trailer back toward the highway, but in the process the trailer began falling apart. In response, the towing company unloaded half of the carpet with a track hoe. The motor carrier’s employees asserted there was no damage to the trailer before the towing company began its work and that the carpet was unlikely to be damaged in the accident, as it was packed tightly within the trailer. The motor carrier’s employees also testified that “plenty” of towing companies had equipment necessary to haul the vehicle back to the roadway without having to unload the carpet. The towing company’s employees testified the trailer was damaged in at least three places prior to their arrival and that, once they started pulling the trailer, the prior damage caused it to start falling apart, necessitating the removal of the carpet. The towing company’s employees also testified that no other wrecker would have been able to pull the trailer without unloading the carpet. Following the incident, the subrogee insurer of the motor carrier brought claims for negligence and breach of contract against the towing company. As to the negligence claim, the insurer argued the towing company was negligent in damaging the carpet while the towing company denied owing a duty to the carrier, and, even if it did owe a duty, it did not breach the duty because its conduct was reasonable. The court denied the towing company’s motion for summary judgment on this claim, finding that a reasonable jury could conclude the towing company undertook a duty to recover the trailer, that damage to the cargo was foreseeable, and that the towing company did not exercise reasonable care by attempting to remove the carpet with a pole hyster as opposed to a track hoe. As to the breach of contract claim, the court found that a reasonable jury could conclude that the motor carrier entered into an oral contract with the towing company to remove all carpet from the trailer without causing damage to the carpet and that the towing company breached the agreement by damaging the carpet. Thus, the court denied the towing company’s motion for summary judgment.

COVERAGE

Great West Cas. Co. v. Nationwide Agribusiness Ins. Co., 2024 WL 98402, No. 23 C 2178 (N.D. Ill. Jan. 9, 2024). In this coverage matter involving two insurers, the court entered a declaratory judgment, finding both insurers were excess insurers and allocating costs and liability on a pro rata basis. The matter was filed following a fatal collision between a commercial vehicle and a passenger vehicle. The commercial driver’s employer, DFS, owned the tractor and leased it to a related entity, DFT2. The trailer was owned by an unrelated entity, Conserv, and also leased to DFT2. The driver of the passenger vehicle died after the DFS driver allegedly failed to stop at a stop sign. Great West provided liability insurance to DFT2, and Nationwide provided liability insurance to Conserv. Both Great West and Nationwide agreed that, based on the language of the Nationwide policy, Nationwide’s coverage was “excess” insurance, as the covered auto, the trailer, was connected to another vehicle, the tractor, which Conserv did not own. The dispute arose as to the extent of Great West’s coverage. Under the Great West policy, which was governed under Illinois law, a “covered ‘auto’” was one “hired or borrowed by [DFT2] from another ‘motor carrier.’” Additionally, Great West provided primary coverage for a covered auto for a “written agreement between the other ‘motor carrier’ as the lessor and [DFT2] as the lessee [if the agreement] does not require the lessor to hold [DFT2] harmless, and then only while the covered ‘auto’ is used exclusively in [DFT2’s] business as a ’motor carrier’ for hire.” However, Great West’s coverage would be excess, and not primary, for “any other collectible insurance if a written agreement between the other ‘motor carrier’ as the lessor and [DFT2] as the lessee require the lessor to hold [DFT2] harmless.” Additionally, the policy provided that Great West would provide “primary insurance for any covered ‘auto’ [DFT2] own[s] and excess insurance for any covered ‘auto’ [DFT2] do[es] not own.” First, the court determined that the tractor was a covered auto under the Great West Policy, as it was hired or borrowed by DFT2 from “another motor carrier”—DFS. The court found the language “hired or borrowed” broad enough to encompass the leasing of the tractor. The court also rejected the argument that “borrowed” did not equate to “leased” dismissing the argument that something “borrowed” did not have to be repaid. Nationwide and the passenger vehicle driver’s estate also argued that DFS was not a “motor carrier” within the meaning of the Great West policy because it did not meet the USDOT definition of a motor carrier. The court rejected this argument as well, finding that the Great West Policy itself defined a motor carrier as “a person or organization providing transportation by ‘auto’ in the furtherance of a commercial enterprise” and that DFS met this definition. Next, the court concluded that Great West’s coverage was excess, not primary, because there was a hold harmless agreement between DFS and DFT2 within the lease between the parties. Specifically, DFS was required to “defend, indemnify, and hold [DFT2] harmless from and against any and all injuries (including death), claims . . .” The court also rejected the argument that an interchange agreement between Conserv and DFT2 constituted an “insured contract” under the Great West Policy requiring it to provide primary coverage, as any liability that DFT2 assumed under the interchange agreement would be its own liability, not another entity’s liability. Finding that both Great West and Nationwide provided excess coverage for the incident, the court next determined that Great West’s coverage was not “super excess” coverage beyond Nationwide’s, rather that both insurers provided joint excess coverage. In splitting costs, the court looked to a portion of the Great West Policy which provided that Great West’s share of coverage “is the proportion that the Limit of Insurance of our Coverage Form bears to the total of the limits of all the Coverage Forms, policies and self-insurance covering on the same basis.” The Nationwide Policy stated exactly the same thing. Because Great West’s limit was $1 million and Nationwide’s was $2 million, the court determined the two insurers had to split costs and liability proportionately to these respective limits.

Rice v. Doe, 2024 W: 255510, App. Case No. 2021-000894 (S.C. Jan. 24, 2024). In this appeal involving South Carolina’s “witness affidavit” requirement to file a Uninsured Motorist claim in a John Doe/ “phantom driver” situation, the Supreme Court of South Carolina held the witness affidavit is not a “condition precedent” to filing suit, and the record can later be supplemented with the affidavit following the initiation of litigation, provided the affidavit is “provided promptly upon request.” S.C. Code 38-77-170 provides “there is no right of action or recovery under the uninsured motorist provision, unless … (2) the injury or damage was caused by physical contact with the unknown vehicle, or the accident must have been witnessed by someone other than the owner or operator of the insured vehicle ….” In cases in which there was no “physical contact with the unknown vehicle” subsection 38-77-170(2) requires a “witness must sign an affidavit attesting to the truth of the facts of the accident . . . . .” When the tort plaintiff initially filed suit, the witness affidavit was not attached to the Complaint and it appears had not otherwise been produced to the putative UM insurer or its counsel. The day after the putative UM insurer filed its responsive pleading, which included a motion to dismiss for failure to comply with the requirements of 38-77-170, the tort plaintiff’s counsel produced the affidavit. In addressing the question, the South Carolina Supreme Court focused upon the express language of the statute, noting “[t]here is no requirement in this language or otherwise that the witness affidavit be filed at the same time the action is filed.” With the foregoing said, the court cautioned future litigants from gamesmanship with respect to the affidavit, indicating “[c]ertainly, a John Doe defendant or the relevant insurer is entitled to have the affidavit produced promptly upon request. Our courts will not countenance the use of delay in producing the affidavit as an element of strategy. If a defendant or an insurer requests the affidavit in discovery or otherwise, and if the plaintiff does not provide the affidavit promptly, the defendant or insurer may seek relief through Rule 37(a) of the Rules of Civil Procedure (motion to compel) or, if necessary, even Rule 56(c) (motion for summary judgment).” The decision also included some clarification on what constitutes a “final order” under South Carolina’s system of “rotating judges.”

WORKERS COMPENSATION

No cases of note to report this month.