We hope everyone had a great Halloween!

We want to thank everyone that took the time to meet up with Mike Sevret and myself at the MCIEF annual meeting in Orlando earlier this month. We love seeing everyone in person and we appreciate all the great feedback. Our team constantly strives to provide the best tools and resources in the industry, and we could not do it without you!

A quick shout out to the winner of the MCIEF iPad giveaway, Gerren Mardis of Auto Owners. We hope you enjoy it! Thank you to everyone who touched base with us and provided your business card to be included in the drawing.

We have a couple of great webinar sessions this month. On November 15th, Jean Gardner will make a special guest appearance to discuss specific inland marine exposures. Don’t forget to register!

It’s hard to believe Thanksgiving is less than a month away and then the holidays will be in full swing. Time flies when you’re having fun!

Have a great November!

CAB Live Training Sessions

Please Note! We have transitioned our web meeting resource from Go to Webinar to Zoom. Due to this switch, we encourage you to sign into the webinar a little earlier than normal to ensure there are no connectivity issues.

Tuesday, November 8th, 12p EST: Chad Krueger and Jay Weinberg will provide a focused webinar our unique “Scheduled Vehicle Auditor” tool. This tool is available to our Premium, Insurance Carrier Subscribers and is designed to allow users to audit scheduled policies to identify unreported usage by identifying additional vehicles that have been inspected during the term of the policy. This tool has been around a few years but was created when our users reached out needing this solution. We’ve had several users reach out regarding this feature recently, so this will be a good time to learn about its capabilities.

Tuesday, November 15th, 12p EST: Sean Gardner and special guest presenter Jean Gardner will present on CAB for Inland Marine. Learn how you can use CAB data across multiple Inland Marine lines of coverages. Understand how the safety operations of motor carriers & brokers, contractors, construction, crane operators, and others can impact your risk assessment during the underwriting and claims process.

To register for the webinars, click here to sign into your CAB account. Then click live training at the top of the page to access the webinar registration.

You can explore all of our previously recorded live webinar sessions by visiting our webinar library.

Follow us on the CAB LinkedIn page and Facebook.

CAB’s Tips & Tricks: Interesting Statistics & APIs

At CAB we are more than just the data! We keep our finger on the pulse of the industry and are constantly analyzing the data to find meaningful trends and insights to share with our users.

Our soon to be released CAB Stats tool was built to give our users the power to visualize these data points from different angles and to answer commonly asked questions about the direction of the market, industry and safety. Here’s a preview of some of the statistics that will be made available.

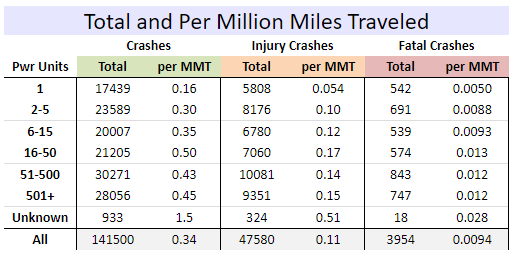

Crashes per Million Miles Traveled:

This table shows the total number of different types of federally reportable crashes, grouped by fleet size and the associated rate per million miles traveled. Crashes include those that occurred during the 12-month period prior to September 30, 2022. Only motor carriers that were active during the past 12 months are included.

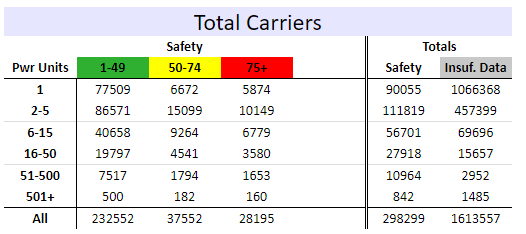

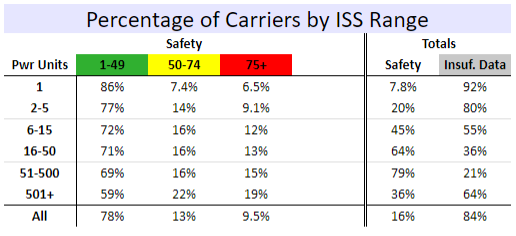

Inspection Selection System (ISS-CAB)

The first table shows the number of motor carriers with ISS-CAB Safety Scores in the Green (Pass), Yellow (Optional), and Red (Inspect) ranges, and a breakdown of how many total carriers are assigned ISS-CAB scores based on the Safety or Insufficient Data methodologies grouped by fleet size. The second table shows the same data as a percentage of the total. ISS-CAB scores are as of the snapshot date of October 12, 2022.

THIS MONTH WE REPORT:

Technology

FMCSA intends to proceed with a motor carrier-based speed limiter rulemaking. This important topic is covered in two stories: Land Line | CCJ

In-cab technology isn’t enough to prevent all accidents. Multiple studies have shown that, more often than not, the passenger vehicle is at-fault in a truck-involved collision. Read more on CCJ

The American Transportation Research Institute (ATRI) released an updated Crash Predictor Model, identifying more than 25 different violations and convictions that increased the likelihood of future crashes.Read more from ATRI

Market & Economy

ACT Research has a new report out on the state of economics, transportation, and commercial vehicles. Fleet Equipment analyzes the good and the bad. Read more

Fuel costs are dropping, but they are still at the top of the list of trucking industry issues, according to the American Transportation Research Institute. Read more

The driver shortage is improving, but American Trucking Association Chief Economist Bob Costello says it is still short 78,000 drivers. Jason Cannon reports in CCJ.

Legal

Arrests have been made in an alleged scheme related to workers’ compensation insurance fraud. Investigators say a Fresno, CA company paid out more than $5 million in employee payroll, but reported only about half. The tip came from an employee who was denied benefits. Read more

California’s AB 5 law regarding classification of employees vs. independent contractors continues to upend the trucking industry, with no easy answers in sight. Gregory Feary, managing partner in an Indiana law firm, told session-goers at the American Trucking Association’s MCE conference that there have been no instances of prosecution yet, but that some carriers not doing things right will have targets on their backs. Read more

Safety

An unannounced 5-day inspection initiative inspects more than 6,000 vehicles carrying hazardous materials and/or dangerous goods. Here’s the report

As electric vehicles hit the roads in greater numbers, potential battery fires bring new challenges and lessons for firefighters. CCJ reports

November 2022 CAB Case Summaries

These case summaries are prepared by Robert “Rocky” C. Rogers, a Partner at Moseley Marcinack Law Group LLP.

AUTO

White v. Scotty’s Constr. & Stone, LLC, 2022 U.S. Dist. LEXIS 177300, C.A. No. 1:21-cv-00161 (W.D.K.Y. Sep. 29, 2022). In this personal injury lawsuit arising from a truck accident, the federal court remanded the case to state court, finding no federal question was presented and no complete diversity between the parties. The court rejected that an FAAAA defense to the tort claims was sufficient to create federal question jurisdiction and FAAAA does not create complete preemption.

Battle v. Johnny Thomas et al., 2022 U.S. Dist. LEXIS 180212, C.A. No. 1:21-cv-2332 (N.D. Ga. Aug. 18, 2022). In this personal injury action, the motor carrier and its driver were granted summary judgment on plaintiff’s claim for punitive damages against each. Plaintiff’s theory of punitive damages was based upon various alleged violations of the FMCSRs. The court held the plaintiff failed to present evidence of a pattern or policy of unsafe driving and the facts of the accident did not include any aggravating circumstances (intoxication, driving too fast for conditions, distraction, violation of HOS regulations), which might otherwise support submitting punitive damages to the jury under Georgia law. With respect to the alleged negligent hiring, training, and supervision theories against the carrier, the court noted there was no evidence to suggest that had the carrier properly conducted background/MVR checks and/or maintained a driver qualification file on the driver such would have suggested he was an unsafe driver. To the contrary, the evidence indicated the driver had minimal moving violations. With respect to the other alleged violations of the FMCSRs, the court found there was no evidence to suggest a causal connection between the alleged failures and the accident, and accordingly this created no basis for punitive damages. Citing prior precedent, the court concluded “violations of FMCSRs governing motor carriers — standing on their own – cannot be considered wanton or reckless and [are] therefore insufficient to meet the clear and convincing standard for punitive damages.”

Muncy v. BJT Express, Inc., 2022 Ind. App. Unpub. LEXIS 1156, C.A. No. 22A-CT-310 (Ind. Ct. App. Oct. 3, 2022). The Court of Appeals of Indiana upheld summary judgment in favor of a motor carrier. The facts established that around 3:00 a.m. the carrier’s driver pulled onto the shoulder of an interstate after hearing rumbling sounds that he interpreted as a flat tire. The driver activated his four-way flashers prior to entering the shoulder and kept them activated. Within a minute of entering the shoulder, his tractor-trailer was rear-ended from behind. The court affirmed the lower court’s determination there was no evidence to support negligence by the driver or motor carrier under these facts. The appellate court also held the carrier had not spoliated evidence in discarding the driver’s logs because it did not anticipate litigation because the insurer of the other driver who rear-ended the tractor-trailer admitted liability and made a payment to the carrier for the damage to the tractor-trailer.

Adams v. Javina Transp. LLC, 2022 U.S. Dist. LEXIS 185529, C.A. No. 3:22-cv-24 (E.D. Tenn. Oct. 11, 2022). A Tennessee federal court surmised that Tennessee would “likely follow” the “majority preemption rule” and dismiss direct negligence claims against a motor carrier where the motor carrier admits vicarious liability for any negligence of its driver. Accordingly, the direct negligence causes of action against the carrier were dismissed.

Waters v. Express Container Servs. of Pittsburgh, 2022 Pa. Super. LEXIS 432, No. 94 WDA 2022 (Pa. Super. Ct. Oct. 18, 2022). The plaintiff entered into an equipment lease and transportation agreement with a motor carrier (“Miller”) whereby he leased a truck tractor he owned to Miller and used it to transport loads for Miller. The plaintiff was injured when he fell from the catwalk on the top of a tanker-trailer that he was inspecting. The trucking terminal was owned by an entity other than Miller. Following the Accident, the plaintiff sued Miller and others for personal injuries. The equipment lease and transportation agreement between plaintiff and Miller contained a broad arbitration provision, requiring all controversies or claims arising out of or relating to the Agreement be arbitrated. Miller thereafter sought to have the complaint dismissed and compel arbitration of plaintiff’s claims against Miller. Finding that the personal injury claims fell within the scope of the Agreement, and citing strong public policy in favor of arbitration, the court dismissed the complaint against Miller.

Pearson v. Doe, 2022 U.S. App. LEXIS 28578, No. 21-14470 (11th Cir. Oct. 14, 2022). The Eleventh Circuit Court of Appeals affirmed summary judgment in favor of Werner Enterprises where the plaintiffs could not affirmatively establish ownership of a tractor-trailer that allegedly struck plaintiffs while they were riding a motorcycle on I-75. The plaintiffs and three eyewitnesses reported that the trailer bore the Dollar General logo with one witness reporting that the tractor was “dark blue” with “white writing.” One of the plaintiffs testified he knew it was a Werner truck because he often saw Werner trucks transporting Dollar General trailers in the area of the accident. In response, Werner submitted a declaration from its director of safety averring that all Werner trucks were equipped with electronic tracking and the electronic tracking indicated no Werner truck was in the area of the accident at the time of the accident. The director of safety also indicated only seven Werner trucks were hauling Dollar General trailers on the day of the accident and their GPS locations established they were far away from the site of the accident at the time of the accident. The manager for Dollar General testified that numerous motor carriers hauled Dollar General trailers. Applying Georgia’s insignia rule, which holds “the mere presence of lettering or a logo on the side of a vehicle, without more, is insufficient to establish liability”, the court affirmed summary judgment in favor of Werner. It explained, “it is too great an inferential leap to presume ownership or agency based merely on the visual observation of a company’s name or distinctive insignia on a vehicle. A plaintiff must “‘point to specific evidence giving rise to a triable issue’ on whether [the company] owned the [vehicle] that [caused the accident] . . . and whether the driver of the [vehicle] was an employee or agent of [the company] and was driving the vehicle in the course and scope of his employment.” Faced with this record, the court found the plaintiffs had failed their burden and accordingly affirmed summary judgment in favor of Werner.

BROKER

Carter v. Khayrullaev, 2022 U.S. Dist. 189000, C.A. No. 4:20-cv-00670 (E.D. Miss. Oct. 17, 2022). In this personal injury and wrongful death action, a freight broker was granted partial summary judgment on the plaintiff’s claims. At issue were causes of action for negligence, negligence per se, and negligent entrustment against the broker. The broker had internal guidelines and policies for qualification of a third-party motor carrier to haul loads for the broker. It included examination of the carrier’s safety rating and BASIC scores, with thresholds for each. The involved carrier had a BASIC score that exceeded the broker’s internal threshold for qualification, though the broker did not disqualify the carrier. The court first rejected the broker’s argument that the causes of action against it were preempted under FAAAA, noting Miller v. C.H. Robinson and the “safety exception.” As for the negligent entrustment cause of action, the court noted that the broker did not directly entrust the driver with the tractor-trailer, but nevertheless could be held liable under this theory if the broker was liable for the motor carrier’s decision to entrust the tractor-trailer to the driver and the motor carrier’s entrustment decision was, in fact, negligent. The court then addressed the requirements for establishing the negligent hiring of an independent contractor, which are like those for establishing negligent entrustment. Plaintiff must show that (i) the broker knew or should have known that the carrier it brokered the load to was incompetent to carry its load, and (ii) that this negligence proximately caused Plaintiff’s injuries. Citing the broker’s own internal guidelines and the fact the carrier did not meet the broker’s internal guidelines, the court held there was a question of fact of whether the carrier was liable for negligent entrustment. The court then held the broker was entitled to summary judgment on any theory premised upon joint venture/joint liability (though this appears to have been the result of an agreement by the parties to dismiss this cause). However, the court denied summary judgment for the broker on any theory of liability premised upon the driver being an agent of the broker. Specifically, the court found there were questions of fact as to the level of control the freight broker exerted over the driver.

Nicholas Meat, LLC v. Pittsburgh Logistics Sys., 2022 Pa. Super. Unpub. LEXIS 2350, No. 1398 WDA 2021 (Pa. Super. Ct. Oct. 4, 2022). In this appeal, the appellate court affirmed the trial court’s ruling in favor of a shipper on its breach of contract cause of action against the broker. The shipper alleged the broker breached the contract provision requiring the broker to only contract with carriers having a certain level of cargo insurance. The court held the freight broker operated as such, not a motor carrier, and accordingly Carmack did not apply to preempt the breach of contract cause of action against it because Carmack does not extend to freight broker operations.

CARGO

Scotlynn USA Div., Inc. v. Titan Trans Corp., 2022 U.S. Dist. LEXIS 173700 (M.D. Fla. Sep. 26, 2022). In this case, a transportation company who successfully defended itself against a breach of contract and Carmack claim sought recovery of its attorneys’ fees and costs pursuant to Florida’s fee-shifting statute allowing for recovery of fees/costs to the prevailing party in a contract action, provided the contract provides for reciprocal recovery of fees/costs to the prevailing party. The transportation company successfully defeated the breach of contract cause of action, with the court agreeing it was preempted by the Carmack Amendment. It then prevailed on the Carmack claim following a bench trial on the basis that the plaintiff failed to make a prima facie showing of entitlement to damages under the Carmack Amendment and even if it did, the carrier established shipper negligence and that the carrier was free from negligence. The court partially granted the request, holding that the carrier was entitled to its fees and costs incurred in defending itself against the breach of contract action, but not with respect to the defense of the Carmack claim. In particular, the court found that even had the plaintiff/claimant prevailed on the Carmack claim, it would not have been entitled to attorneys’ fees under Carmack and therefore the reciprocal requirement for application of Florida’s fee-shifting statute was absent. Thus, the court denied the carrier’s request for recovery of fees/costs incurred in defending the Carmack claim. In so holding, the court rejected the plaintiff/claimant’s argument that the Florida fee-shifting statute was preempted by or otherwise ran afoul of FAAAA or Carmack.

Starr Indem. & Liab. Co. a/s/o Cessna Aircraft Co. v. YRC, Inc., 2022 U.S. Dist. LEXIS 178051, C.A. No. 15-cv-6902 (N.D. Ill. Sep. 29, 2022). In this case arising from damage to two jet engines resulting in repair costs of approximately $2 million, the court held, via an extensive order, the carrier had not satisfied its burden to establish, as a matter of law, it had limited its liability under the Carmack Amendment. The carrier pointed to two documents as the basis for its limitation of liability—1.) the bill of lading; and 2.) a Schneider Transportation Schedule. The court applied the four-part Hughes test in determining whether the carrier validly limited its liability under Carmack. Under Hughes, a carrier must take the following four steps to limit its liability: (1) maintain a tariff within the prescribed guidelines of the Interstate Commerce Commission [ICC]; (2) obtain the shipper’s agreement as to a choice of liability; (3) give the shipper a reasonable opportunity to choose between two or more levels of liability; and (4) issue a receipt or bill of lading prior to moving the shipment if that value would be reasonable under the circumstances surrounding the transportation. The court held that it could not find, as a matter of law, the applicable bill of lading offered the shipper a choice of rates or that the carrier put the shipper or shipper’s intermediary on notice of the choice of rates. With respect to the Schneider Transportation Schedule, which the carrier argued was incorporated by reference into the bill of lading, the court found it could not hold as a matter of law the schedule offered a choice of rates—noting that it seemingly provided the shipper only a single rate option. In a win for the carrier, the court rejected the shipper’s argument that the carrier was required to offer full liability and where it has failed to do so the carrier’s liability for the full amount of repairs or replacement.

Ecuadorian Rainforest, LLC v. TForce Freight, Inc., 2022 U.S. Dist. LEXIS 186358, C.A. No. 22-cv-01856 (D.N.J. Oct. 12, 2022). A shipper’s state law causes of action against a motor carrier for 1.) breach of contract; 2.) breach of the covenant of good faith and fair dealing; 3.) breach of bailment; and 4.) negligence, all related to an alleged delay in delivering its freight prior to a trade show, were held to be preempted by the Carmack Amendment. Accordingly, the court dismissed all causes of action but allowed the shipper/plaintiff the right to amend the complaint to add a Carmack cause of action.

COVERAGE

New S. Ins. Co. v. Capital City Movers, LLC, 2022 U.S. Dist. LEXIS 175337, C.A. No. 20-Civ-4087 (S.D.N.Y. Sep. 27, 2022). In this declaratory judgment action, the New York federal court interpreted an insurer’s obligations pursuant to a Form F endorsement on the policy. The shipment in question traveled wholly intrastate within New York. The at-issue insurance policy had CSL limits of $750,000, but the involved vehicle was not listed on the policy and did not otherwise qualify as an “insured auto” under the policy. The insurance policy contained the mandatory Form F endorsement and Form E certification certifying that the policy met New York’s financial responsibility requirements for intrastate motor carriers, which was $100,000 per person. The most recent Form E on file with the New York Department of Transportation at the time of the accident reflected the policy provided liability coverage for bodily injury up to $100,000 per person. The Form E did not match up with the $750,000 CSL limits, but instead referred to liability limits under a previous version of the policy. After holding there was not coverage under the policy because the vehicle was not an insured auto, the court then determined the insurer’s obligations under the Form F endorsement and Form E certification. Noting that the Form E certification merely certifies that the policy provides liability coverage up to the state’s minimum financial responsibility requirements for motor carriers, the court agreed with the insurer that its indemnification/surety obligation under the Form E/Form F was capped at $100,000—the financial responsibility requirement set by New York law/regulations—not the higher $750,000 in CSL coverage provided under the policy at the time of the accident. Last, the court sided with the insurer finding it had no duty to defend because any such duty arises under the insuring agreement—i.e., the insurance policy—not by virtue of the Form F endorsement or Form E certification. In so holding, the court distinguished a Georgia Court of Appeals, explaining any such obligation upon the insurer under the Form F/E is non-contractual and therefore does not create any duty to defend.

Cnty. Hall Ins. Co. v. Lowe, 2022 U.S. Dist. LEXIS 187095, C.A. No. 21-cv-171 (D. Wyo. Aug. 18, 2022). This declaratory judgment action arose out of a two-truck accident. The tort plaintiffs alleged the owner of the tractor (“Harvey”), who also drove the tractor, was negligent in maintaining the tractor and said negligence caused an accident. Joseph, an employee of Harvey and team-driver with Harvey, had been driving the truck but pulled to the side of the roadway when the truck began to rumble before becoming disabled altogether. Not knowing what happened, Harvey jumped behind the wheel and tried to re-start the tractor-trailer. While Harvey was sitting in the driver seat of the disabled truck, another tractor-trailer struck Harvey’s tractor-trailer in the rear. The policy included a scheduled driver endorsement, which purported to exclude coverage for any accident wherein the vehicle was being “operated or in control of” someone not listed on the endorsement. At the time of the Accident, Harvey was listed on the scheduled driver endorsement but Joseph was not. Accordingly, the insurer argued any obligation with respect to the Accident should be limited to $750,000 under the MCS 90 and not the full $1,000,000 coverage under the policy. The court disagreed, finding that Harvey, not Joseph, was “operating” and “in control” of the tractor at the time of the Accident, despite not being able to move it, such that the scheduled driver endorsement did not exclude coverage.

Carolina Cas. Ins. Co. v. Liberty Mut. Fire Ins. Co., 2022 U.S. Dist. LEXIS 188973, C.A. No. 2:18-cv-04813 (D.N.J. Oct. 17, 2022). In this dispute between two liability insurers, the court was called upon to interpret various provisions of the insurance policies. Rand-Whitney leased a tractor-trailer from Ryder (the “Subject Vehicle”). Pursuant to a written agreement between Rand-Whitney and APS, APS was to use the Subject Vehicle to haul goods on behalf of Rand-Whitney. An APS employee/driver was involved in an accident while hauling goods using the Subject Vehicle. APS was insured by Carolina Casualty. Rand-Whitney was insured by Liberty Mutual. The issue in dispute was whether APS was insured by both the Carolina Casualty policy and the Liberty Mutual policy, or just the Carolina Casualty policy. The Liberty Policy provided coverage for “you” (i.e., Rand-Whitney) for any covered auto or “anyone else while using with your permission a covered auto you own, hire, or borrow. Neither hire nor borrow were explicitly defined in the Liberty Mutual policy and the court, citing to different provision of the policy, found they were ambiguous. It therefore turned to other decisions interpreting those terms, noting that “the key inquiry regarding whether an automobile will fall within the hired automobiles provision is whether the insured exercised dominion, control or the right to direct the use of the vehicle.” Pointing to the terms of the Transportation Agreement between Rand-Whitney and APS, the court held Rand-Whitney did not exercise the requisite degree of control the Subject Vehicle to qualify as a hired auto. The same analysis was applied with respect to “borrowed auto.” As such, the court held Rand-Whitney could not be said to have hired or borrowed the Subject Vehicle and therefore there was no coverage for APS and its driver under the Liberty Mutual policy.

WORKERS COMPENSATION

CRST Int’l v. Indus. Comm’n of Ariz., 2022 Ariz. App. LEXIS 294, No. 1 CA-IC-21-0049 (Az. Ct. App. Oct. 6, 2022). In this appeal, the Court of Appeals of Arizona affirmed the Commission’s findings of compensability. The injured employee worked as a truck driver and would drive a daily route between several locations, where once at a location, he would use a forklift to load bales of cardboard at retail stores to take for recycling. On the day of the accident, the employee used a forklift to drive to the front of the store to purchase dog treats for his dogs. He had done similarly on other occasions. While doing so, he ran over an object that jostled him in the forklift causing him to strike his head on the forklift cage. The court agreed with the Commission that this fact scenario was not a “substantial deviation” from the employee’s normal job duties, and accordingly the accident occurred within the course and scope of his employment with the carrier and was therefore compensable.

Foley v. Pegasus Transportation/CRST Int’l, 2022 Ky. App. Unpub. LEXIS 577, 2021-CA-0785 (Ky. Ct. App. Oct. 7, 2022). The Court of Appeals of Kentucky, in an unpublished opinion, affirmed the lower courts’ rulings that a prospective truck driver’s injury prior to completing a road test, drug test, and other paperwork, was not compensable. The driver had been notified that he passed the initial qualification requirements, but that he would need to travel to Louisville, KY to perform a road test, pass a drug test, and complete other paperwork, which if completed he would be hired and could start driving for the company immediately. The carrier rented a car for the prospective employee to drive to Louisville such that if he passed the remaining requirements, he could begin driving immediately and not have to leave his personal vehicle in Louisville at the carrier’s location. The accident occurred while the prospective employee was driving the rental vehicle the day before he was supposed to report to the carrier’s Louisville facility for the road test, drug test, and other paperwork. Under these facts, the appellate court agreed that there had not yet been an employment relationship established, citing preceding holding that “injuries that occur during the preliminary aspects of the hiring process are not deemed to have occurred in the course and scope of employment . . . .” As such, the accident was not compensable.

IDI Logistics, Inc. v. Clayton, 2022 Pa. Commw. Lexis 133, No. 514 C.D. 2021 (Pa. Comm. Oct. 18, 2022). An injured truck driver was deemed to be an employee of the motor carrier for purposes of workers’ compensation. At the initiation of the relationship, the driver signed an independent contractor agreement. The carrier owned and insured the truck, which the driver used to deliver all loads for the carrier. The carrier paid for all for all the gas in the truck. The driver could refuse driving assignments and could work for other companies, but he never did. He could not use the carrier’s truck for work for other companies. The driver was paid by the mile and received a 1099. The driver paid for all his own food while on the road and determined his own routes. Noting that there were facts in favor of both independent contractor and employee status, the court affirmed the Commission’s finding the driver was an employee of the carrier. In so holding, it noted the remedial purpose of the workers’ compensation act.