Big news from CAB!

As many of you are aware, Central Analysis Bureau is now part of the Randall-Reilly family. The new relationship will provide benefits to CAB’s customers well into the future. The complete CAB team has made the transition including Jean, Shuie and our exceptional business and development teams. You can look forward to the same positive customer service interaction you’ve always experienced with CAB. We are all very excited about working with Randall-Reilly as their focus is on data relating to trucking, construction, agriculture, and other industrial markets. The Randall-Reilly and CAB combination reinforces our commitment to client responsiveness and continued product enhancements.

We hope you’re as excited about this new chapter in CAB’s history as we are! Have a great month!

CAB Live Training Sessions

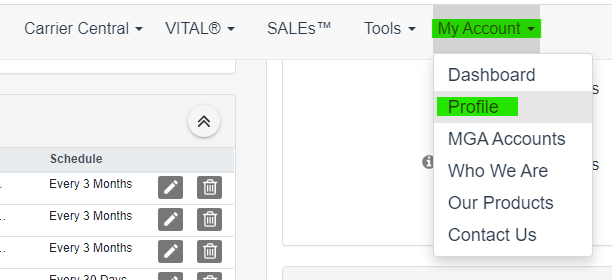

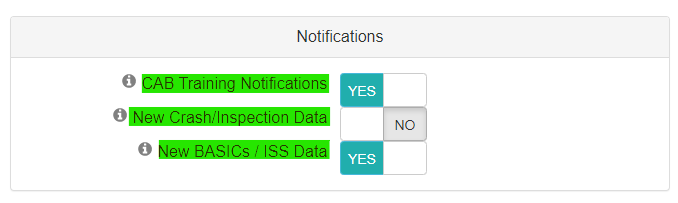

Just a quick reminder that last month’s sessions, CAB Customization and Chameleon Carriers and Interrelated Entities were both recorded and are available for viewing at your leisure. They are available at the link below. Additionally, our complete library of recorded webinars is available in the Tools menu under Webinars or by clicking here. If you have a new associate or someone who wants to learn more or needs a refresher, we encourage you to point them in the direction of our pre-recorded webinars.

This month we will present two new live training sessions:

Tuesday, April 13th @ 12p EST: Sean Gardner will present an overview of CAB’s MC Advantage resource including the MC Dashboard, CAB report, BASICs Calculator, & Customized Alerts. This is a tool provided directly to motor carriers via our insurance carrier partners. For the first time, motor carriers can directly access their motor carrier data through CAB. Don’t miss out on this opportunity to learn about this powerful software. Click here to register.

Tuesday, April 20th @ 12p EST: Chad Krueger will present, CAB for Agents & Brokers. Learn about enhancements to the CAB ecosystem that can help drive growth and save time. Identify ways to use CAB data to change the conversation with markets and advocate for fleet customers and prospects. Use CAB List™ to monitor customers and ‘drive the wedge’ with prospects. Learn tips on how to leverage the BASICs Calculator™ and CAB’s Lead Generation tool, SALEs™. Click here to register.

CAB subscribers can register for either or both sessions from our Webinars page or by logging in and clicking the link below. https://subscriber.cabadvantage.com/webinars.cfm

We are looking forward to connecting with you during these sessions so don’t hesitate to ask questions!

Follow us at CAB Linkedin Page CAB Facebook Page

CAB’s Tips & Tricks: Merging of DOT Numbers

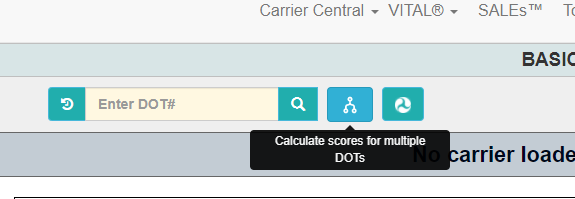

This month we take this opportunity to discuss a function that was developed previously but has been asked about a number of times recently. That functionality question is: Does CAB have a tool that will allow the merging of multiple DOT numbers to get a clearer picture of the overall history of the entities? The answer is a resounding yes and it can be found in the upper left hand corner of the BASICs Calculator and is pictured in the screenshot below.

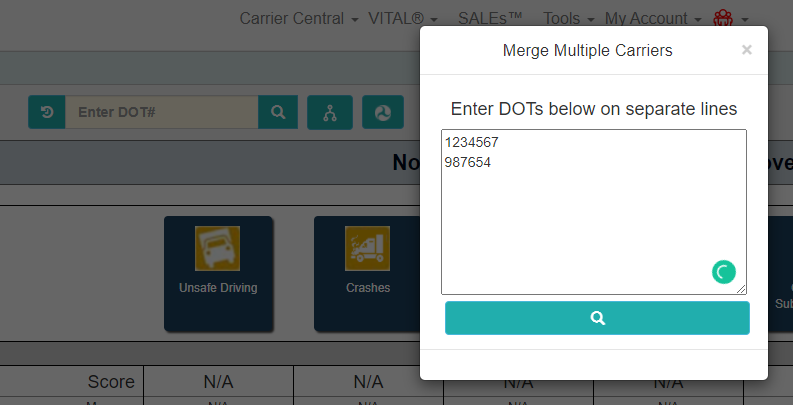

When you click that button, it opens the box below and you are free to enter multiple DOT numbers to merge the entities VINs, Inspections, Violations, and the like. You will also be able to see a combined geographic and equipment breakdown. It should be noted that CAB-BASIC scores are not generated for Crash and Unsafe Driving. The reason for this is due to the fact that unit count and vehicle miles traveled are part of the calculation and we don’t know the overlap of those units and vehicle miles traveled.

This is an important function when it comes to getting the true picture of an overall organization that might be operating multiple DOT numbers. Our users have told us on numerous occasions that their customers appreciate the combined view of their operations and we’re happy to provide this tool in the BASICs Calculator.

That being said, there are other situations, like the following case, which Jean reviews in the cases below, from the United States Court of Appeals, Tenth Circuit. KP TRUCKING LLC, Petitioner, v. UNITED STATES DEPARTMENT OF TRANSPORTATION; Federal Motor Carrier Safety Administration (FMCSA), Respondents. No. 20-9508.

The 10th Cir ruled that it is appropriate for the DOT to combine violations for two companies when it looked like they are a chameleon operation. Basically, under the regulations, safety violations by two companies can be combined when one of the companies changes its name or structure to skirt the consequences of prior violations. 49 C.F.R. § 386.73(b). Invoking this authority, federal regulators suspended a trucking company, Eagle Iron & Metal. When Eagle was suspended, another entity (KP Trucking, LLC) expanded its operations. Regulators viewed KP’s expansion as an effort to continue Eagle’s operations in order to bypass penalties and start anew on a fresh slate.

The above is an important situation to take note of and reminds us of the importance of CAB’s Chameleon Carrier alert. You may find it interesting to look up the motor carriers involved in the case via Carrier Central. In all cases, strive to understand the potential of the Chameleon Carrier exposure as much as possible prior to working with an organization.

As with all of our tools & enhancements, we strive to present the information in a manner that will help provide clarity and ease of use. The CAB Team is continually striving to improve our tools and resources to create value and efficiency for our users. Please feel free to contact us directly if you have any suggestions as to how we can enhance our services. We are customer-driven. Our goal is to help you Make Better Decisions!

THIS MONTH WE REPORT:

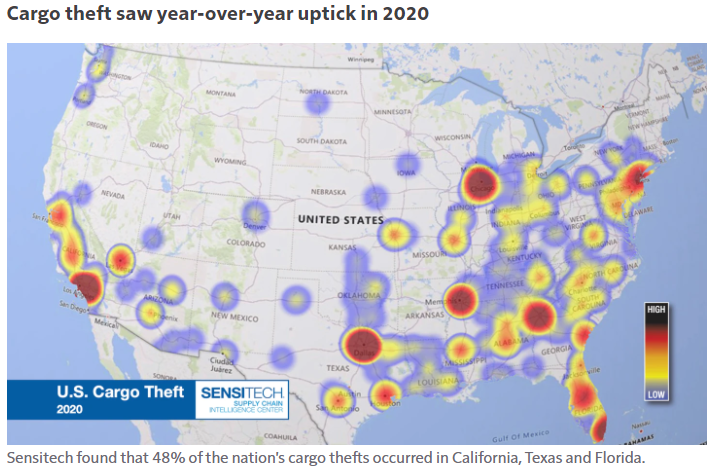

Cargo theft volumes, average values increased in 2020 Cargo theft volumes and values in the U.S. increased in 2020 over the previous year and also hit a five-year high, according to cargo theft recording firm Sensitech’s annual report. The firm notes that its data is an indirect representation of the overall cargo theft footprint and not a direct reflection. It uses data from transportation security councils, insurance companies and law enforcement organizations, which may not represent 100% of all thefts but does provide a cross-section of thefts to identify trends, the firm notes. Sensitech recorded 870 cargo thefts throughout the U.S. in 2020 – 222 in the first quarter, 230 in the second quarter, 185 in the third quarter and 233 in the fourth quarter. The average value of 2020 thefts was $166,854. For additional information on this topic, click here.

Senators Reintroduce Under 21 Interstate Driver Bill: The Developing Responsible Individuals for a Vibrant Economy Act, known as the DRIVE-Safe Act, would allow CDL drivers under age 21 to haul interstate loads in some circumstances. The regulation would apply to drivers who have completed, or are participating in, an apprenticeship program, according to the bill text. Such a program must include a 120-hour probationary period in which the driver proves competency in more basic driving maneuvers, followed by a 280-hour probationary period in which the driver proves competency in more advanced maneuvers. The DRIVE-Safe Act was introduced in the Senate in February 2019 and referred to committee, but no further action was taken. It is interesting to note that the trucking industry is split when it comes to lowering the age for interstate operations. The American Trucking Associations supports these efforts, while the Owner-Operator Independent Drivers Association is in opposition. For more information on the bill, click here.

Truck inspections expected to rebound in 2021 following significant COVID-caused sag: As COVID-related restrictions ease around the country, law enforcement officials anticipate a truck inspection rebound in 2021 from last year’s sharp decline. According to the Federal Motor Carrier Safety Administration’s (FMCSA) Motor Carrier Management Information System, roadside truck inspections dropped 23% from 3.5 million in 2019 to 2.7 million in 2020. Since then, COVID vaccinations have rolled out in growing numbers and states have continued to relax coronavirus rules which, according to FMCSA, may eventually lead to a return to higher pre-COVID inspection numbers. “We do expect the number of inspections in 2021 to outpace 2020, although it is too early to tell due to the uncertainty of the COVID-19 national health emergency,” FMCSA’s public affairs representative Duane DeBruyne said in a statement to CCJ. Please click here to review the complete article.

From ELD and HOS violation trends to self-driving trucks’ job displacement, major takeaways from FMCSA’s Analysis, Research & Technology forum:

Remote/offsite safety audits of motor carriers are here to stay. CCJ documented the surge in offsite/remote safety audits and compliance reviews over the past year. That trend is here to stay, said Joe DeLorenzo, FMCSA head of enforcement. The agency so far has “felt good about how [offsite audits] worked and how the agency was able to transition” quickly to those remote audits, he said. That was somewhat out of necessity when the pandemic hit, but it was also a stroke of good luck on the agency’s timing, he said.

HOS violations haven’t moved much since regs overhaul. Comparing the four months prior to the Sept. 29 change-over date in federal hours of service regulations to the four months after, total hours of service violations did drop some, but not in the manner FMCSA had hoped, said DeLorenzo. While total hours-of-service violations fell from 11,227 in the June 2020 to September 2020 time frame, before the new HOS regulations took effect, to 9,989 total violations in the four months from October 2020 through January 2021, the decline was due in large part to a dip in 30-minute break violations. Those dropped from 3,597 to 1,712.

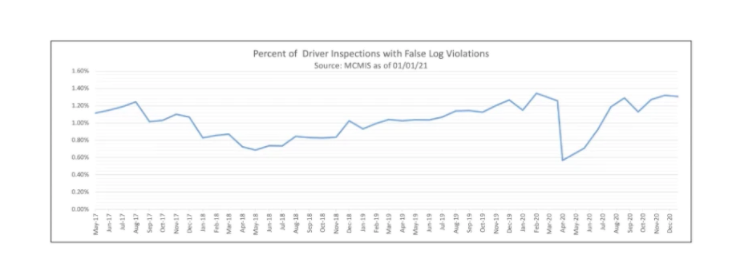

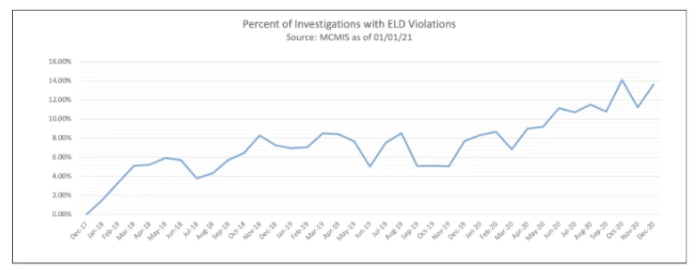

False log violations have trended up under ELDs — and ELD violations have trended up under COVID. False log violations have trended up since hard enforcement of the ELD mandate began in April 2018, said DeLorenzo. “It’s a lot harder to cheat your ELD,” he said. “We’ve seen a slow and steady increase in identifying false log records at roadside.” He called it a “good story on ELDs,” in catching those violations. Also, due to the COVID pandemic and a corresponding greater push by FMCSA and state enforcement partners to conduct offsite audits of motor carriers, the number of safety investigations revealing ELD violations has climbed steadily.

To review the complete article, click here.

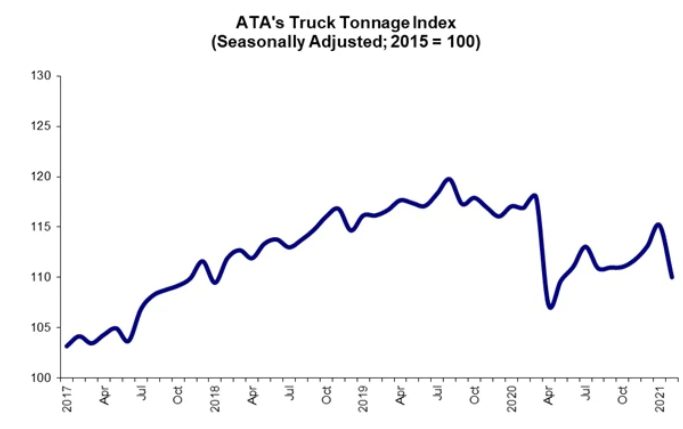

Contract freight market contracted in February: The American Trucking Associations’ advanced seasonally adjusted For-Hire Truck Tonnage Index fell by 4.5% in February after rising almost 2% in January, suggesting a decline in tonnage under contract moved by for-hire carriers amid the weather woes and other disruptions last month. Spot freight and rates on average were up in February in spite of such disruptions, while the “severe weather that impacted much of the country during the month” might well be the single cause for the contract freight’s drop, as represented in the index, said ATA Chief Economist Bob Costello. “Many other economic indicators were also soft in February due to the bad storms, but I continue to expect a nice climb up for the economy and truck freight as economic stimulus checks are spent and more people are vaccinated.” Complete article available, here.

CASES

TRUCKING REGULATIONS

I am putting this case in a separate section so that it is not skipped over. The 10th Circuit considered whether safety violations of two companies can be combined when one of the companies changes its name or structure to avoid the negative violations. The court agreed that they could consolidate the violations when there was factual support that the second company was continuing operations for an improper purpose. Check out the Tips and Tricks section of this report for ways for you to consolidate violations of multiple DOT numbers to get a true picture of a risk. KP Trucking, LLC v U.S. DOT, 2021 WL 868493

AUTO

While an insurer had no coverage under a commercial auto policy for a tractor which was not scheduled on the policy, it could not avoid the impact of the MCS-90. The Southern District of New York agreed with other jurisdictions that a motor carrier could not meet its financial obligations through policies covering other motor carriers involved in the transport. The court held that “It is clear .. that the federally mandated insurance obligations of one carrier cannot be satisfied simply by virtue of the fact that an injured party recovers an award greater than the federal minimum from another party “ Carolina Casualty Insurance Co. v Capital Trucking. 2021 WL 848064

The fact that a declaratory judgement action could hinge on whether the MCS-90 endorsement on the policy of the motor carrier covered liability for an accident was not enough for the Southern District in Florida to conclude that there was a sufficient federal question to warrant exercising the discretionary right to hear the case. It dismissed the insurer’s complaint. National Speciality Insurance Co. v. South Florida Transport, 2021 WL 980948

A motor carrier’s efforts to obtain summary judgment on independent claims for negligence against a motor carrier who had conceded liability for the actions of the driver failed in the Western District of Louisiana. The court held that it would continue to recognize such a claim until a decision was reached by the 5th Circuit and further concluded that there was a question of fact as to whether the driver was improperly trained by the motor carrier. Moreaux v, Clear Blue Insurance Co. 2021 WL 852295. In a related case the court agreed that one excess insurer was not obligated to indemnify the motor carrier for any claim for punitive damages. A second carrier was not as successful as the court held that there was a triable question of fact as to the driver’s intoxication and that the insurer had no exclusion for punitive damages. 2021 WL 855282

Too quick said the 4th Circuit Louisiana Court of Appeals. Summary judgment was reversed in an action against stevedoring service companies alleging that an unknown operator of a yard mule vehicle owned by those companies rear-ended the plaintiff’s vehicle. Too little discovery and the defendant was not afforded an opportunity to figure the claim out. Francois v. Ports America Louisiana, LLC, 2021 WL 911882

The Southern District of New York agreed that neither New York nor New Jersey law permits a plaintiff to pursue a claim of negligent hiring or entrustment where the plaintiff has established a vicarious liability claim which would render the employer liable for the damages caused by the actions of its employee. The direct claims against one trucking company were dismissed. However the motor carrier who initially jackknifed, setting in motion the events leading to plaintiff’s injuries, was not able to get summary judgment as there were too many questions left to be resolved. Martinez v. Harbor Express, LLC 2021 WL 1051623

The Eastern District in Pennsylvania held that independent claims for negligence against a trucking company would not be permitted when the motor carrier accepted vicarious liability for the actions of the driver. Such claims could be pleaded if there was a claim for punitive damages, which the plaintiff could not support. Miller v. M.H. Malueg Trucking Co., Inc. 2021 WL 858456

Adult children of a decedent were not permitted to seek a wrongful death claim against a trucking company following the death of their father. The Northern District in Indiana concluded Indiana law did not permit such a claim when the adult children were not true dependents of the decedent, granting judgment to the motor carrier. Sturgis v. R&L Carriers, Inc., 2021 WL 795665

What does it mean to occupy the vehicle? The Eastern District of Texas concluded the plaintiff’s were occupying a vehicle when they were getting on and off the vehicle to collect debris prior to the accident. The court concluded that the plaintiffs were entitled to underinsured motorist coverage from their commercial auto policy when they moved away from the vehicle to avoid being struck by a second tractor trailer. Maldonado v. Travelers Casualty Insurance Co. of America, 2021 WL 977895

An interesting issue was certified to the Arkansas Supreme Court by the Eastern District in Arkansas arising out of a fatal two vehicle truck accident. One truck driver was killed as a result of the subsequent fire in his vehicle. Under Arkansas law does a motorist who is involved in, but not at fault for a vehicular accident, have a duty to render “reasonable assistance” to the injured driver of the other vehicle and if so, what is reasonable assistance when the vehicle is on fire? Answers remain to be learned. Lovellette v. Lagos, 2021 WK 799090

While the Graves amendment does relieve lessors of liability, the application of the amendment to a particular accident is often a question of fact. The Eastern District of Arkansas concluded that it was premature to dismiss the claim against the leasing company when the plaintiff was alleging alternative facts which would support liability. Travis v. Leyva, 2021 WL 969899

The Court of Appeals in Houston disagreed with the trial court’s decision to enter a JNOV and apportion all liability for an accident to the pilot car which was supposed to have made sure the truck could travel under wires. The court held that the driver of the truck did have a duty to the public and did in fact bear liability for the loss. The jury verdict apportioning liability was reinstated. Gator Gone Safety Pilots v. Holt, 2021 WL 865239

Speaking of pilot cars, the District Court in Kansas considered the application of a general liability policy to a claim against a pilot company for failing to insure that the escorted truck traveled along the correct roadways. The truck struck a bridge causing serious damage. The court rejected the motion to dismiss filed by the pilot company in the declaratory judgement action, concluding that the language in the Policy’s auto exclusion endorsement, as supplemented by the definition of “auto,” was unambiguous and the suit properly pled that plaintiff had no duty to defend or indemnify. Penn-Star Insurance Company v. J&J Pilot, 2021 WL 1089418

Piercing the corporate veil to get upstream companies is difficult as the plaintiff found out in the Western District of New York. Plaintiff’s efforts to seek recovery from the parent company of a Canadian subsidiary for injuries suffered in a truck accident failed when plaintiff could not meet the necessary requirements to show that the parent company exercised the requisite control over the subsidiary. The plaintiff was, however, given permission to amend the complaint to try to allege an agency relationship. Looking for additional party defendants is often a key and understanding the potential exposure for that auto risk is important. Giarla v. The Coca Cola Company, 2021 WL 1110397

Ignore that suit for recovery of remediation damages at your peril. The Court of Appeals in Texas upheld the entry of default against a trucking company for the $127,237 plus interest bill for remediation of a spill after a truck accident. These can be big bills. Roberts v. Jay Fuller Enterprises, 2021 WL 1047052

Plaintiff files a timely suit in Texas which is transferred to Louisiana for lack of jurisdiction. In Louisiana the question is whether the suit is timely because it was filed initially in an improper court. By the time it got to Louisiana the statute of limitations had expired. The 5th Circuit overturned the lower court decision dismissing the case. The Court held that the suit against the trucker should relate back to the Texas filing date and was therefore timely. Franco v. Mabe Trucking Co., 2021 WL 1035958

The Middle District of Louisiana agreed that claims for negligence in the hiring, training, supervision, and retention of a driver would not stand when the motor carrier accepted vicarious liability. Motes v. Knight Speciality Insurance Co., 2021 WL 833946. The Western District of Oklahoma held the same in Sykes v. Bergerhouse, 2021 WL 966036

While the individual manager of a trucking company was granted summary judgment when plaintiff failed to produce any evidence that the manager negligently trained the driver, the remaining defendants were not as successful The Southern District of California concluded that there were too many questions of fact as to their liability for a truck/bike accident even though plaintiff could not establish exactly which of the defendant trucking companies was at fault for the accident. Gibson v Beach, 2021 WL 931178

Forum shopping is always an issue. The Superior Court in Pennsylvania vacated a trial court’s decision to dismiss an action brought in Philadelphia County (a judicial hellhole) seeking damages for an accident which occurred as a FedEx facility in Maryland when a truck driver was injured. At least the court remanded the case to determine whether moving it out of Philadelphia to another Pennsylvania venue may be more appropriate. Failor v. FEDEX Ground Package System, Inc., 2021 WL 1016776

Too soon says the District Court in Maryland. While the truck driver pled guilty to criminally negligent manslaughter following a truck accident, that fact alone would not permit judgment for the plaintiff on liability. In addition, whether the broker was actually the carrier for the road (“the duck rule” for those who have listened to me for years) was still a question of fact and the court would not rule that the dendantant carrier/broker was liable for the actions of the driver as a matter of law. Ortiz v. Ben Strong Trucking, 2021 WL 927423

A motor carrier was unsuccessful in striking a claim for punitive damages or obtaining a more definite statement on negligence. The Southern District in West Virginia held that allegations that the driver was operating the vehicle improperly while driving a tractor-trailer loaded with steel down a residential street, allegedly failing to maintain a lookout, driving too fast, and losing control of his vehicle supported a plausible claim that the driver consciously disregarded that his conduct would “probably result in injury to another.” Barker v. Meador, 2021 WL 849231

One for the trucker! The Middle District in Tennessee granted summary judgment to a motor carrier following a fatal accident where the plaintiff hit the rear of the motor carrier’s vehicle. The court held that the claim of negligence was unsupported when the plaintiff was intoxicated and there was no evidence to support claims for negligent hiring, supervision, and training. the plaintiff could not even establish the elements of a negligence claim, to say nothing of the additional element that the employer knew of the employee’s unfitness for the job. Humphrey v. Yobonta, 2021 WL 780731

The Court in the Eastern District of Kentucky agreed with the plaintiff that the trucking company should have ascertained that the damages were greater than $75,000 when reading the complaint for a fatal truck accident. The carrier failed to timely remove the action and so back to state court it went. Hall v M&T Trucking Expediting, LLC, 2021 WL 816908

In the Northern District of Alabama the defendant could not meet its burden that the plaintiff’s damages could exceed $75,000. Back to state court it went. Jones v. DeLeon, 2021 WL 1115279. However the same was not true in the Northern Division in Alabama where the defendant served admissions that the damages were more than $75,000 and the plaintiff failed to respond. Goosby v. Briggs, 2021 WL1032295

Back to state court it goes. The Western District in Texas held that a plaintiffs’ state common law claims against a truck broker for hiring a trucking company involved in the accident were not preempted under the FAAAA because the safety regulation exception applied. There was no federal question and therefore no jurisdiction so the court sent it back. Popal v. Reliable Cargo Delivery, 2021 WL 1100097

Over in the Eastern District in Missouri the motor carrier could not meet its burden that the plaintiff’s damages could exceed $75,000 when cargo tipped during transport. Apparently intra-state transport as the grounds for removal was diversity and not Carmack. Back to state court it went. Cane Creek Quarry v. Equipment Transport, 2021 WL 765287

Dashboard cameras can really help figure out who is responsible for a loss. The Western District in Louisiana granted summary judgment to a motor carrier sued by another commercial driver who slammed into the back of the defendant’s truck. The dashboard cameras showed that the plaintiff was not attentive and that the first driver did not negligently create a hazard. Reed v. Security First Insurance Co, 2021 WL 1032410

A motor carrier was partially successful in its request for summary judgment on claims arising from a truck accident. The Southern District of Alabama held a claim for negligent or wanton entrustment was unsupported when the driver was an owner operator and therefore could not entrust the vehicle to himself. In addition there was insufficient evidence to support a claim of wanton operation of the vehicle. However the plaintiff was permitted to proceed with a claim of wanton failure to place conspicuous markings on the trailer, which might have reduced the risk of loss. Waters v. Hall, 2021 WL 770415

Going to the jury! The Northern District in Alabama concluded that neither plaintiff or the motor carrier was entitled to summary judgment on claims of negligent and wanton hiring, training supervision, retention, dispatch and entrustment following a serious truck accident in which the truck driver lost control of the vehicle. The driver history is an interesting read and apparently was enough to create questions of fact on the cause of the loss. Hobbs v. U.S. Express, Inc., 2021 WL 913398

CARGO

Broker or carrier? Carmack or negligence? The District Court in Connecticut concluded that a complaint which alleged alternative theories of liability would not be subject to dismissal. The court concluded that plaintiff alleged facts to support liability against the defendant as a carrier under Carmack. In addition, the court concluded that even if the defendant was a broker the plaintiff could allege a claim for negligence, which would not be expressly preempted under FAAAA or subject to implied preemption under the Carmack Amendment. Covenant Imaging, LLC v. Viking Rigging & Logistics, 2021 WL 973385

Just a reminder that attorney’s fees are recoverable for household goods claims asserted under the Carmack Amendment. The Southern District of California afforded plaintiff more than $40,000 in fees. Inigo v. Express Movers, Inc., 2021 WL 948795

Thanks for joining us,

Jean & Chad