Autumn, here we come…

It’s officially Fall and one of my favorite seasons. I tend to prefer the cooler weather and enjoy the changing colors of the season. This is also the season where, under normal circumstances, CAB staff (and many of you) would be attending numerous fall conferences. I, for one, will very much miss those conferences where we were able to connect with old friends and meet new friends. I encourage you to take advantage of attending those same conferences if the virtual option is available. It may not be the same, but you will be supporting the organization and helping ensure the long term viability of that organization. I’ve had the opportunity to present and attend a couple of these, and they were certainly worth the time.

That being said, as the baseball season heads into the playoffs and we head into the home stretch of 2020, I encourage you to indulge in pumpkin-spice something (coffee, candles, beer, etc.), embrace the cooler temperatures, and enjoy what the season has to offer. There are many things to look forward to as the year winds down. Thanksgiving, the holiday season…the end of 2020. Don’t forget, 2021, and the promise of better things to come, is just around the corner!

The Motor Carrier Insurance Education Foundation (MCIEF) continues final planning for the 2020 virtual conference scheduled for November 9th through the 12th. The registration link is now available via the MCIEF.com website. The times each day are 12:30-4:40p EST.

MCIEF knows committing 4 hours for 4 consecutive days is difficult in our current environment so they will be airing a repeat of each four-hour session post-conference on the following dates: Session 1 – Tuesday November 17, Session 2 – Monday November 23 (Thanksgiving Week), Session 3 – Tuesday December 1 and Session 4 – Tuesday December 8

Anyone interested in registering or getting information on registration can contact Beth Medina at Beth@mcief.org or by phone at 239-997-4084.

CAB Live Training Sessions

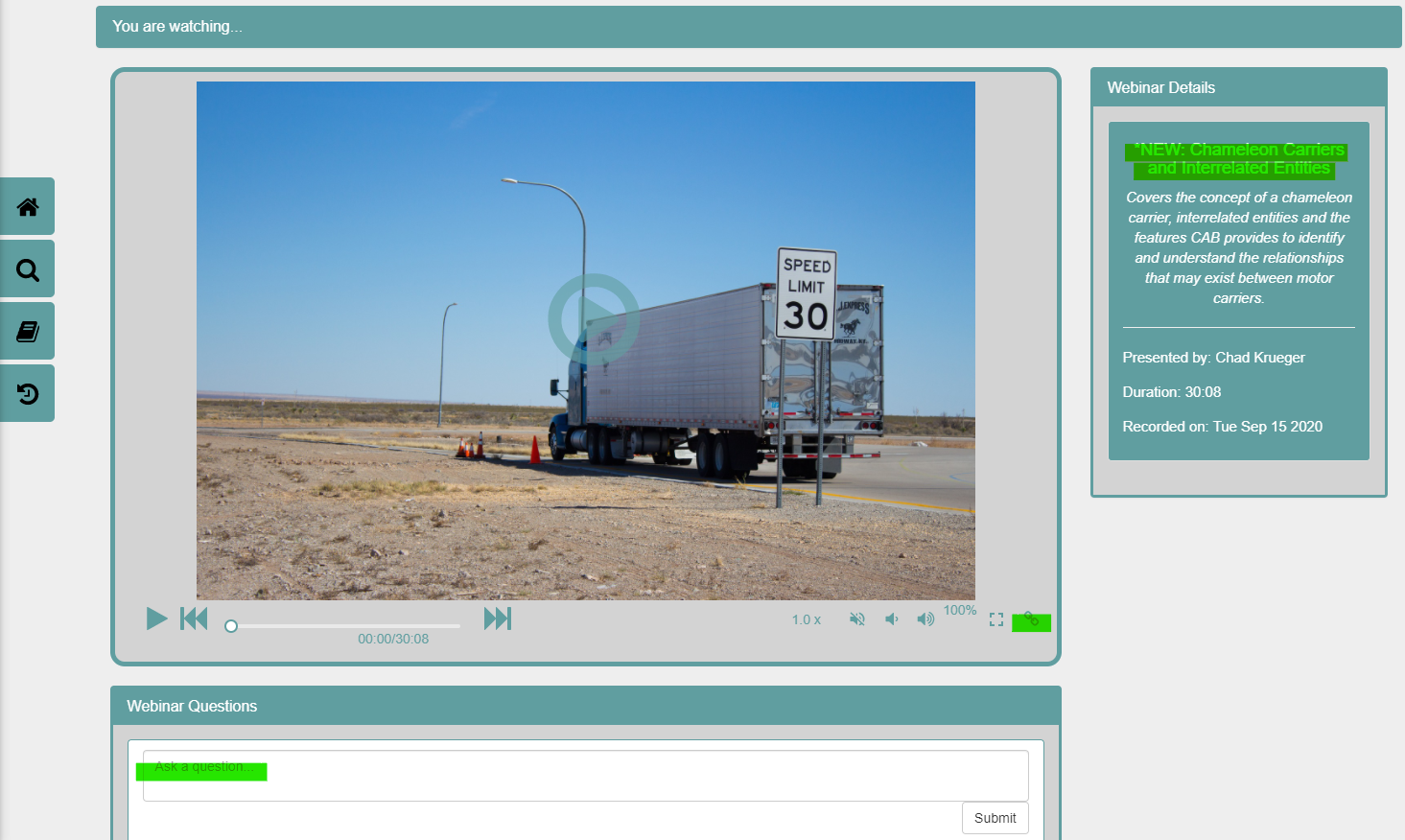

Our live training sessions continue to garner great interest from our users. If you missed either of these webinars, they are available in the Tools menu under Webinars or by clicking here. This month we will present two new live training sessions:

Tuesday, October 13th @ 12p EST: Chad Krueger will present CAB for Underwriting. This is a popular session we’ve done in the past. The session will be an overview of tools, resources and enhancements. As the title suggests, it will be geared towards underwriting, although many of our other users find this session very informative.

Tuesday, October 20th @ 12p EST: Mike Sevret will be providing additional insight during our focused training, Understanding the Data and Where it Comes From. Mike will provide a brief overview of the depth and breadth of the numerous data sets CAB access and then provides to our users to help them understand relevant details about the motor carriers they are evaluating. CAB’s ultimate goal is to help our users “Make Better Decisions!”

Our focused training will be shorter and last 30 minutes, as we know your time is important. CAB subscribers can register for either or both sessions from our Webinars page or by logging in and clicking the link below. https://subscriber.cabadvantage.com/webinars.cfm

Please feel free to suggest focused training topics that you would like to see. We are looking forward to connecting with you during these sessions so don’t hesitate to ask questions!

Follow us at: CAB Linkedin Page CAB Facebook Page

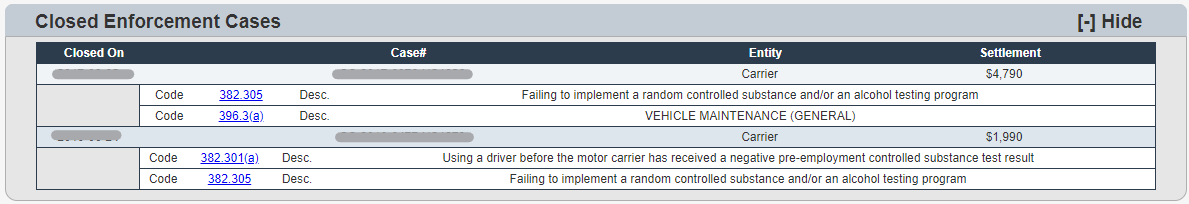

CAB’s Tips & Tricks: Closed Enforcement Cases Added

This month’s tip is focused on our webinar library. We often get asked if we have training resources for new or seasoned employees. The answer is a resounding yes and we do our best via our Live Training sessions to provide and update the webinar library based on what our users are requesting. Keep in mind, if you or a team member miss a Live Training, that session will be uploaded and available on our website within a day or two.

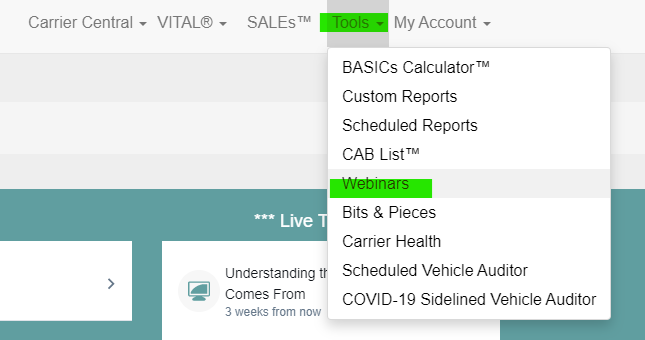

Another common question is where can I find the webinars/training resources? CAB’s Webinar library is easily accessible under the “Tools” menu at the top of every CAB page. All CAB users have access. From there click on “Webinars”. From there you will be able to see and register for our upcoming live training that is referenced above.

All of the pre-recorded webinars are available. We make it a point to continually update topics so the training remains fresh as we’re continually enhancing CAB’s tools and resources. The main webinars page provides the most recent webinars and their length for reference. There is a library and search functionality on the left side to find additional topics. Keep in mind, if you’d like to share a webinar with a team member, you can click the “Copy Link to Clipboard” icon and share the webinar. The individual webinar pages also provide a brief description of the webinar and there is an area at the bottom where you can submit a question. If you submit a question, we will reach out to you with the answer as soon as possible.

Our goal is to provide you with updated training resources to help you and your team make the most of your CAB service. If you have questions about the webinars or if you’d like to suggest a topic, please do not hesitate to reach out to us.

As with all of our tools & enhancements, we strive to present the data in a manner that will help provide additional clarity. We at CAB are constantly striving to improve our tools and resources to create value for our users. Please feel free to contact us directly if you have any suggestions as to how we can enhance our services. We are customer driven. Our goal is to help you Make Better Decisions!

THIS MONTH WE REPORT:

2020 Operation Safe Driver Week Results are in: Law enforcement personnel observed 66,421 drivers engaging in unsafe driver behaviors on roadways and issued 71,343 warnings and citations as part of Operation Safe Driver Week, a driver-focused safety initiative aimed at curbing dangerous driver behaviors through interactions with law enforcement. Operation Safe Driver Week took place July 12-18, 2020.

Officers issued a total of 71,343 warnings and citations throughout the week, comprised of 42,857 traffic enforcement violations and 28,486 other state/local driver violations. Commercial motor vehicle drivers were issued 10,736 warnings and citations for traffic enforcement violations. That’s 4,659 citations and 6,077 warnings. Passenger vehicle drivers received 17,329 citations and 14,792 warnings for traffic enforcement violations, totaling 32,121 warnings and citations. The top five traffic enforcement citations given to commercial motor vehicle drivers were: Speeding/violation of basic speed law/driving too fast for the conditions – 2,339, Failure to use seat belt while operating commercial motor vehicle – 1,003, Failure to obey traffic control device – 617, Using a hand-held phone/texting – 269 and Improper lane change – 122. For additional information, click here.

FMCSA Proposes Rule for Food Traceability: The FDA is proposing to establish additional traceability recordkeeping requirements (beyond what is already required in existing regulations) for persons who manufacture, process, pack, or hold foods the Agency has designated for inclusion on the Food Traceability List. The proposed rule, is a key component of the FDA’s New Era of Smarter Food Safety Blueprint and would implement Section 204(d) of the FDA Food Safety Modernization Act (FSMA). The proposed requirements would help the FDA rapidly and effectively identify recipients of those foods to prevent or mitigate foodborne illness outbreaks and address credible threats of serious adverse health consequences or death. At the core of this proposal is a requirement for those who manufacture, process, pack or hold foods on the Food Traceability List (FTL) to establish and maintain records containing Key Data Elements (KDEs) associated with different Critical Tracking Events (CTEs). The proposed rule will be available for public comment for 120 days following publication in the Federal Register. For additional information, click here.

CVSA Releases Short Video on the Future of Commercial Vehicle Safety and Enforcement: The Commercial Vehicle Safety Alliance (CVSA) released a new stop-motion video envisioning the future of commercial motor vehicle safety technology, inspections, and enforcement. This four-minute video takes the viewer to a future – near and far – that’s safer for all road users. The “Welcome to the Future of Commercial Vehicle Safety and Enforcement” video provides a clear and easy-to-understand visual presentation of today’s challenges and the solutions to those challenges, such as the deployment of proven safety technologies that improve transportation safety and prevent crashes. The informative video can be reviewed here.

U.S. Department of Transportation Requests Public Comment on a Pilot Program for Additional Hours of Service Flexibility: The FMCSA announced that it is seeking public comment on a pilot program to allow additional hours of service regulatory relief by allowing participating drivers to pause their on-duty driving period with one off-duty period up to three hours. FMCSA requests public comments on a new pilot program to allow drivers one off-duty break of at least 30 minutes, but not more than three hours, that would pause a truck driver’s 14-hour driving window, provided the driver takes 10 consecutive hours off-duty at the end of the work shift. The comment period will be open for 60 days. To review the proposed pilot program, click here.

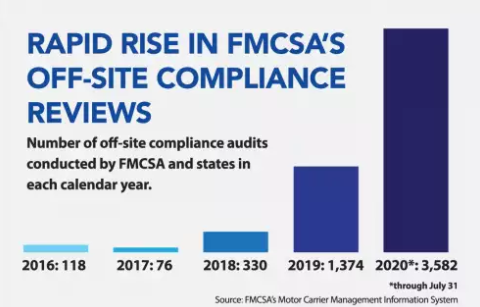

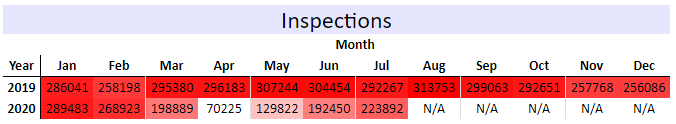

The Number of Inspections Continues to Increase: The number of roadside inspections continues to increase every month since the beginning of the COVID-19 pandemic. The number of inspections conducted in July of 2020 was just under 224,000 after hitting a low of just over 70,000 in April. The last full month of inspections would have been February which had a total of 269,000 inspections. The average number of inspections from the prior 11 years was just under 285,000. Therefore, even with Emergency Declarations continuing through the end of the year, inspections sit at about 80% of the prior 11 year average.

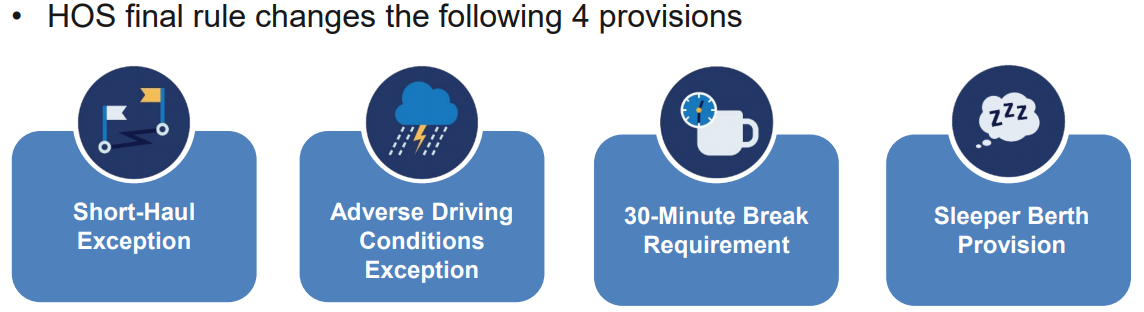

New Hours of Service Rules take effect September 29, 2020: On June 1, 2020, the Federal Motor Carrier Safety Administration (FMCSA) published the Hours of Service final rule that revises the HOS regulations in 49 CFR Part 395, which prescribe driving limits for commercial motor vehicle (CMV) drivers. The rule includes four changes designed to offer drivers greater flexibility, while maintaining the highest safety standards on our Nation’s roads, and was developed based on extensive public and industry input. The HOS Final Rule Fact Sheet is available here. Not surprisingly a lawsuit has been filed to invalidate the rules. Stay tuned.

FMCSA Proposes Under 21 Driver Pilot Program: The Federal Motor Carrier Safety Administration (FMCSA) wants public comment on a pilot program allowing drivers ages 18-20 to haul interstate commercial freight. “This action will allow the Agency to carefully examine the safety, feasibility and possible economic benefits of allowing 18-to 20-year-old drivers to operate in interstate commerce,” said FMCSA Deputy Administrator Wiley Deck in announcing the proposed pilot project Friday. “Safety is always FMCSA’s top priority, so we encourage drivers, motor carriers and interested citizens to review this proposed new pilot program and share their thoughts and opinions.” The proposed program allows drivers falling within one of two categories to participate: Eighteen-to 20-year-old CDL holders who operate a commercial motor vehicle (CMV) in interstate commerce while taking part in a 120-hour probationary period and a subsequent 280-hour probationary period under an apprenticeship program established by an employer, or Nineteen-and 20-year-old commercial drivers who have operated CMVs in intrastate commerce for a minimum of one year and 25,000 miles. For more information, click here.

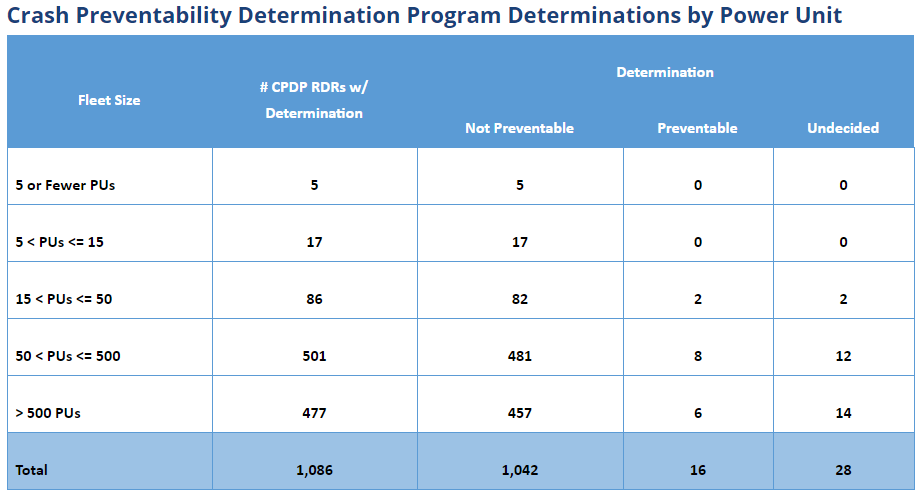

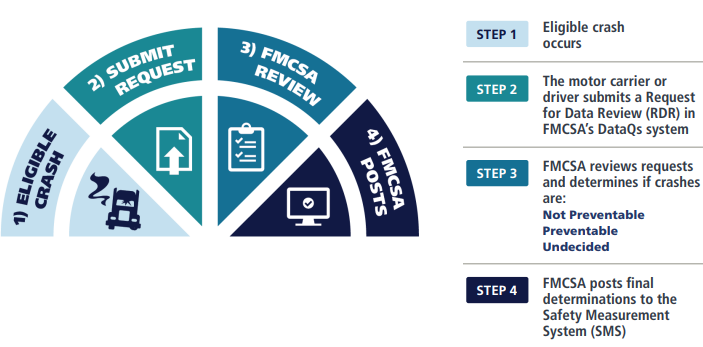

Don’t Forget to tell your Customers about the Crash Prevention Determination Program: The CPDP allows carriers and drivers to submit evidence that an eligible crash was not preventable. If FMCSA determines the crash was not preventable, it will be listed on the Safety Measurement System (SMS), but not included when calculating a carrier’s Crash Indicator Behavior Analysis and Safety Improvement Category (BASIC) measure in SMS. Additionally, the not preventable determinations will be noted on a driver’s Pre-Employment Screening Program (PSP) report. CAB’s BASICs and ISS calculations will reflect these DataQs. The program allows for crashes back to August 1, 2019 to be eligible. The CPDP program is very important for the industry as removing non-preventable crashes from the Crash BASIC’s calculation could lower the percentile. Click this link to watch CAB’s recent BASICs Calculator™ & FMCSA’s New Crash Preventability Determination Program webinar. The BASICs Calculator™ and the CPDP are two very powerful tools that can help your customer’s overall risk profile.

Freight Volumes Expected to Grow 36% Between 2020 and 2031: The American Trucking Associations released its latest Freight Transportation Forecast: 2020 to 2031, which is conducted annually by IHS Markit, showing that despite contraction in 2020, the long-term trend for both trucking and overall freight shipments is still positive. Among the findings in this year’s Forecast: +Total freight volumes in 2020 are likely to collapse by 10.6% to 14.6 billion tons, although truck freight volumes falls a smaller 8.8%. +Trucking volumes are expected to rebound in 2021, rising 4.9% next year and then growing 3.2% per year on average through 2026. +Overall freight revenues in 2020 will total $879 billion, rising to $1.435 trillion in 2031. ATA Freight Transportation Forecast: 2020 to 2031 is available via ATA Business Solutions.

CASES

AUTO

Interested in how plaintiff’s attorneys use words to create nuclear verdicts? The Court of Appeals in Texas reversed, on all issues, a judgment of $26,311,337.09 in actual damages and exemplary damages in the amount of $5,371,674.18 for what was essentially a minor impact accident where the truck driver tested positive for marijuana and other drugs. The court concluded that while liability existed the damages were unreasonable. Interesting read on how the arguments are made to convince the jury that excessive verdicts are warranted. FTS International Services, LLC v. Patterson, 2020 WL 5047913

Diversity was lost and a case remanded back to Cook County, Illinois by the Northern District in Illinois when the plaintiff brought in the third party company who provided the motor carrier with the driver. While the motor carrier conceded its vicarious liability for the actions of the driver the contract between the two companies raised questions as to who controlled the driver. Plaintiff was allowed to amend and add the non-diverse party and get the case back to the original venue. Vargas v. Lava Transport, 2020 WL 5440011

Plaintiff’s failure to properly identify an allegedly crucial witness, who would have testified that the tractor was in disrepair before a fatal truck accident, resulted in his inability to have the witness testify at trial. The Missouri Court of Appeals upheld the defense verdict. Tate v. Dierks, 2020 WL 5637620

Impairment while operating a commercial vehicle was an issue in the Southern District of Illinois. While the driver’s post-accident drug test was subject to discovery as the driver had released the results to his employer and the DOT, the same was not true for his general medical records. The court concluded that the driver only defended himself against Plaintiffs’ allegations that he was intoxicated and he never affirmatively placed his medical condition at issue. Accordingly he was entitled to continue to assert his medical privilege Thompson v. Crisp Container Company, 2020 WL 5292043

A driver was not permitted to collect uninsured medical benefits under policies issued to the motor carrier to whom he had leased his vehicle. The First Circuit Court in Louisiana reversed a trial court ruling and concluded that the motor carrier had properly rejected the coverage so it was not available to the driver. Barras v. Jackson, 2020 WL 5592702

A meeting of the minds was not present when the parties were discussing settlement and therefore there was insufficient evidence that the settlement was finalized. The Northern District in Mississippi held that the adjuster for the motor carrier’s insurer had not established that the parties intended the negotiations to have culminated in settlement and denied a request to enforce a settlement. Brown v H&H Transportation. 2020 WL 5666705

A leasing company’s efforts to file an interpleader with the amount of insurance afforded to the lessee under the lease could not be used by the leasing company to compel all claims for direct liability to be asserted in that interpleader. The District Court in Arizona agreed that the interpleader strategy was not an appropriate use of the federal interpleader statute when potential tort claimants would prefer to proceed elsewhere. The case was permitted to proceed only on the issue of who was entitled to the insurance proceeds afforded to the leasee. U-Haul Company of Arizona v. Lee, 2020 WL 5645189

A person cannot be an employee and independent contractor of the same entity at the same time. However, being an independent contractor of one entity does not preclude a person from simultaneously being an employee of another entity, which can include one’s self. The Court of Appeals in Michigan held that the truck driver was not an employee of the trucking company who was leasing the vehicle, he was an employee of himself. However, as the motor carrier insured the vehicle, it was determined to be the insurer of highest priority. The trial court decision was overturned. Miclea v. Cherokee Insurance Co., 2020 WL 5580140

The First District in Florida reversed a directed verdict in favor of the plaintiff for just over $8 million and remanded the case back for a new trial. The court held that whether the plaintiff was at fault for the truck accident, due to his inattention, was a question of fact which was within the province of the jury. Vitro America, Inc. v. NGA, 2020 WL 5627114

The date that a vehicle became an owned vehicle for the purposes of coverage under a policy remained a question of fact in the District Court in Ohio. The court denied summary judgment on that issue, but did grant partial summary judgment that the insurer owes a duty of indemnification under the MCS-90 Endorsement only for actual judgments against the trucking company, and no other party, up to the endorsement’s $750,000 limit. Artisan & Truckers Casualty Co. v. Miller, 2020 WL 5203478

Round and round it goes. The Court of Appeals in Kentucky reversed the summary judgment granted to the motor carrier who claimed that there was circuitous indemnity. The motor carrier claimed a right of indemnity against a settling defendant and the plaintiff has agreed to indemnify the settling defendant against claims by other parties. The court held that the respective liabilities of the settling and non-settling defendants were not plain in either case. Therefore, it could not be said as a matter of law that the settling defendant and non-settling defendants were not in pari delicto, so the non-settling defendants were not entitled to summary judgment based upon circular indemnity. The court also held that summary judgment was even less appropriate because of the heightened FMCSR duties imposed upon the carrier and driver and the evidence from which a reasonable jury could conclude they failed to satisfy those duties. McGuffey v. Hamilton, 2020 WL 2038044

Make sure you assert venue defenses or run the risk of waiving them. The Court of Appeals in Indiana addressed whether the location of a registered agent was enough to establish a basis for venue. While the Indiana legislature had concluded that it is not, and applied the rule retroactively, the defendant’s failure to raise the issue initially was determined by the court to be a waiver of the venue defense. Hammond v. Gillespie, 2020 WL 5241241

An insurer was unsuccessful in keeping its declaratory judgement action in place against a trucker in Texas. As the issue arose out of a policy which was issued to a Michigan motor carrier the fact that the accident occurred in Texas was not enough to confer jurisdiction. The Northern District in Texas also agreed that having an agent for service of process in Texas was not enough. While the drivers could remain as defendants, the named insured was dismissed from the suit. Nat’l Cas. Co. v. KT2, LLC, 2020 U.S. Dist. LEXIS 169223

Efforts by an intervening insurer to remove a case to federal court failed in the Western District of Missouri. When the truck broker had not timely removed the personal injury accident filed against it, its insurers would not get a second bite at the apple when they intervened in the case. Rothrock v. Capital Logistics, 2020 U.S. Dist. LEXIS 168178

A successful summary judgment for a motor carrier in the Southern District of West Virginia. The court agreed that there were no facts to support a claim for punitive damages or negligent training, supervision, and retention. Negligent infliction of emotional distress for a spouse would also not stand when the spouse was not present at the accident scene. Roush v. Schneider National Carriers, Inc., 2020 WL 5031998

The Court of Appeals in Texas upheld the grant of summary judgment to a motor carrier when the plaintiff failed to timely submit any opposition to the motion. The court agreed that the trial court did not abuse its discretion in rejecting a request to file a late response. The co-defendant, the owner of another vehicle involved in the crash, also got summary judgment as there was no evidence that the driver, amongst other things, was acting in the course and scope of his employment at the time of the accident. Rosas v. Vela, 2020 WL 5056526

Despite waiting 5 years after the accident to bring claims for willful and wanton conduct in the selection of a truck driver, the Northern District in Illinois held that there was a sufficiently close relationship between Plaintiff’s original negligence claim and his new willful and wanton hiring, entrustment, and retention claims to permit the new causes of action to relate back to the original negligence claims. Plaintiff alleged that the employer knew the driver was unfit to drive a truck commercially based on evaluations and reviews from former employers, the fact that he had failed multiple drug tests while on duty, had several “at fault” automobile accidents while working for the carrier, had been terminated for chronic drug use and then rehired in violation of the motor carrier’s policies, and had repeatedly “ ‘blacked out on the road’ and experienced a ‘loss of consciousness behind the wheel. Kleronomos v. Aim Transfer & Storage 2020 WL 5365976

The Supreme Court in Indiana upheld a jury instruction that a plaintiff failed to mitigate damages after being injured in a truck accident. While seriously injured in the accident, plaintiff’s pre-existing condition worsened after the accident. However it was determined that he took limited steps to mitigate his damages and was ultimately awarded only $40,000 in damages. Humphrey v. Tuck, 2020 WL 5361974

One accident or three? The Southern District of Georgia agreed with the insurer that its payment of policy limits for one accident was enough and that it did not owe a second limit when there were additional impacts. In this case, each of the claimants’ injuries was caused by “repeated exposure”—i.e. repeated collisions—to a single condition—the overturned truck. Milford Casualty Ins. Co. v. Meeks, 2020 WL 5351048

When one insurer pays more than it believes it owes, 2.9 million, what does it need to do in order to get the money back from a second insurer? The Southern District of California is considering that issue. The court rejected efforts by the second insurer to have causes of action for equitable indemnity and contribution dismissed and also considered the impact of an assignment of the first insurer’s claims to the insured. It concluded that all of these causes of action should proceed to be litigated. Skanska USA Civil West California District v. National Interstate Ins Co. 2020 WL 5294713

Target was unable to obtain summary judgment on a suit for injuries arising from an accident possibly involving an unidentified Target trailer. The Western District of Missouri concluded that there were too many questions on whether Target was acting as a motor carrier, or sufficiently controlled the actions of third party carriers, to allow judgment at this stage of the litigation. Trekell v. Target Corp., 2020 U.S. Dist LEXIS 170044

The issue before the Court of Appeals was whether a common-law exception to the vicarious liability doctrine prevented a plaintiff from benefiting from the savings statute when the plaintiff dismissed an action against the motor carrier for the actions of the driver and then refiled against the motor carrier. Generally when the plaintiff’s claim against the driver is procedurally barred by operation of law before the plaintiff asserts the vicarious liability claim against the motor carrier the action will not stand. The court affirmed the denial of the motion to dismiss concluding that the plaintiff was entitled to the benefit of the savings clause. Helyukh v. BuddyHead Livestock & Trucking, Inc., 2020 WL 5092827

Who is responsible when the cargo, bales of cardboard, fall off the trailer when the doors are opened and cause an injury? The Southern District in New York concluded that there were questions of fact and denied judgment to the loader. There remained questions as to whether Defendants’ loading practices created a risk by not following guidelines and, if so, whether that risk was patent to Plaintiff. Uzhca v. Wal-Mart Stores, Inc. 2020 U.S.Dist. LEXIS 167662

These multi-vehicle truck accidents require a road map to figure out who did what. The Eastern District of Louisiana took the time to figure it out and granted summary judgment to one motor carrier. The court held there was no evidence that the truck ever left its lane of traffic and never made contact with the plaintiff’s vehicle. Plaintiff could not show a prima facie claim for recovery. English v. Edmund, 2020 U.S. Dist. LEXIS 170579

Summary judgment was denied to a motor carrier in the Southern District of Illinois. When the plaintiff was fatally injured when he struck a disabled tractor trailer stopped in the lane of traffic the court held that the motor carrier had not established any basis for summary judgment simply because the plaintiff did not break before hitting the tractor. There were clearly questions of fact which remained to be resolved. Archibald v. Orbit Express, 2020 WL 5237095

Does the MCS-90 apply when the motor carrier is not using the vehicle in a for hire capacity in interstate commerce at the time of the loss? The Middle District of Louisiana concluded that it did not, affording judgment to the insurer on that issue. However, whether the unscheduled vehicle was a temporary substitute for a scheduled vehicle remained a question of fact. Cutrer v. TWT Transport, LLC2020 WL 5441238

The truck broker’s efforts to remove a case to federal court under FAAA failed and the case was remanded by the District of New Mexico. The court held that the absence of an express or implied federal cause of action under the FAAAA indicated that Congress did not intend for the FAAAA to serve as the basis for removal. The court did not consider whether FAAAA preempted claims against brokers as it concluded that it had no jurisdiction to do so. Youngers v. ATF Transp., Inc., 2020 U.S. Dist. LEXIS 165809

Plaintiff’s efforts to keep a litigation in the motor carrier’s home state was unsuccessful. The Court of Appeals in Arizona upheld the dismissal of the suit on the grounds of forum non conveniens when the accident and all other critical facts occurred outside the state. Both public and private factors strongly weighted in favor of dismissal. Garrett v. Swift Transp. Co. of Ariz, LLC, 2020 Ariz. App Unpub LEXIS 946

CARGO

When the fight over a limitation of liability is between two motor carriers it is harder to defeat the limitation asserted by the defendant. The Southern District in Indiana held that the truckload pricing agreement between the parties was valid even when the defendant brokered the load to another carrier, where it was stolen. The court also declined to apply the material deviation doctrine to a Carmack claim to defeat the limitation. Cortrans Logistics v. Landstar Ligon, 2020 WL 5702186

Preemption continues to be an issue. The Western District in North Carolina agreed with the household goods carrier, dismissing all state law claims for damage to household goods. The claim under the Carmack Amendment would proceed. German v. Bekins Van Lines, Inc., 2020 WL 5204046

The same held true in the Southern District in Florida where the court recommended dismissal of all causes of action which were outside of the Carmack Amendment. The cargo insurer’s addition into the suit as a plaintiff, although late, was deemed to relate back to the initial filing and was permitted to proceed. IAG Engine Ctr. Corp. v. Cagney Global Logistics, 2020 U.S. Dist. LEXIS 163499

The truck broker’s forum selection clause was upheld in the Eastern District of Pennsylvania. The court held that regardless of whether the plaintiff claimed the defendant was acting as a broker or a carrier, the parties contractually agreed that suits would be brought in Ohio. The cargo claim against the broker was dismissed. Caulfield v. D&F Transport, LLC., 2020 WL 5076803

While filing a motion to dismiss on preemption grounds convinced the plaintiff to amend the complaint to remove most state causes of action, not all were gone. The Southern District in Georgina held that the remaining breach of contract claim against the motor carrier, which was based upon a third-party beneficiary claim under a different contract, makes a difference for the preemption analysis and allowed that claim to proceed. Caravels v. ATS Logistics Services, 2020 WL 5199263

Unfortunately for a trucker discovery would not be stayed pending its motion to dismiss. The District Court in Connecticut held that even if it later granted the motion to dismiss the defendant would still be subject to non-party discovery on ths cargo claim so delaying the inevitable was not helpful to anyone. Covenant Imaging v. Viking Rigging & Logistics, Inc. 2020 WL 5411484

WORKER’S COMPENSATION

Worker’s compensation was the exclusive remedy for a co-driver under Louisiana law, which required the Middle District of Alabama to dismiss most of the causes of action against the motor carrier employer. However the court did give the plaintiff an opportunity to amend the complaint to assert sufficient facts to support a claim that the actions of the driver, driving while on drugs, constituted an intentional act, removing that claim from the purview of worker’s compensation. Waye v. Flat Creek Transportation, 2020 WL 5031995

MISC

A motor carrier was not permitted to seek recovery from its insurance agent based upon allegations that the COI did not indicate that short term rental vehicles were not covered for collision, especially when the plaintiff had never asked for the coverage. The Court of Appeals in North Carolina held that there was no misrepresentation or reliance made by the agent to the motor carrier. DC Custom Freight, LLC v. Tammy A. Ross & Associates, Inc., 2020 WL 5159972

The Appellate Court in California held a specialized insurance broker to a higher standard of care. The court reversed the trial court decision, holding that evidence of specialization in inland marine creates a presumption that an insurance agent/broker anticipates their clients will rely on their acknowledged expertise and supports imposing an extended duty. Be forewarned. Murray v. UPS Capital Insurance Agency, Inc., 202 Cal. App. LEXIS 866

Thanks for joining us,

Jean & Chad