Hello and Happy New Year Everyone!

Hopefully you all had the opportunity to relax, enjoy family and friends, and recharge as we closed out 2023. I know the CAB team is ready to take on 2024 with you!

The end of one year and the beginning of another gives us the chance to keep moving forward and to continue supporting our client base. Please keep the ideas coming for platform enhancements and data requests. On that note, see the upcoming webinars for recent enhancements and additions to the system. Remember, we can also help streamline your processes with automation through our integration and API capabilities.

Best wishes for a great 2024!

Chad Krueger and Pam Jones

CAB Live Training Sessions

Tuesday, January 9th | 12p EST – CAB Program New Offerings and Enhancements

Join us for a recap of various updates we’ve made to the system over the last year like Express Reports, Salesforce integrations, and API capabilities. Plus, hear the advancements we’ve made on the MC Advantage platform. We will also cover CAB’s response to FMCSA’s MFA, multi-factor authentication.

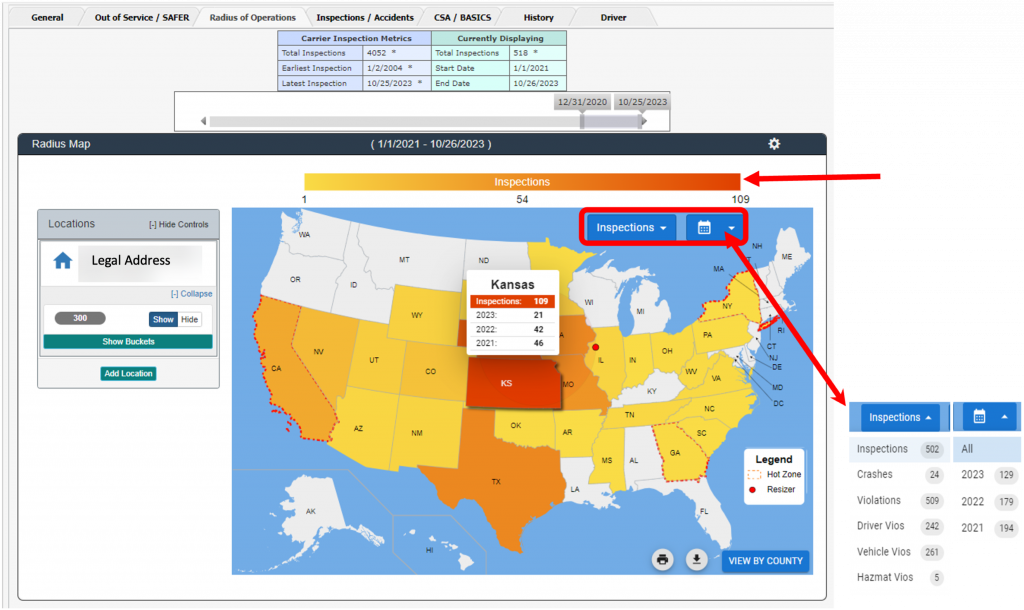

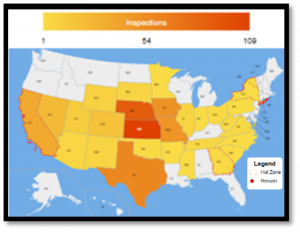

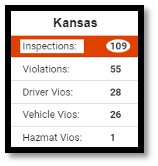

Tuesday, January 16th | 12p EST – New Heat Map

We recently released a new heat map on the CAB Report’s Radius of Operations. This webinar will cover details of this new mapping feature.

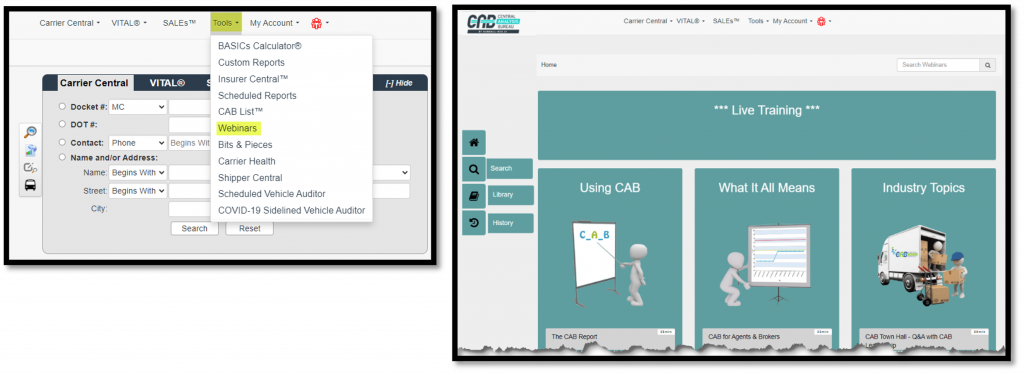

To register for the webinars, sign into your CAB account. Then click live training at the top of the page to access the webinar registration.

Explore all of our previously recorded live webinar sessions in our webinar library.

Follow us on the CAB LinkedIn page and Facebook.

FMCSA Adding Multi-Factor Authentication

FMCSA is implementing more stringent security protocol by adding multi-factor authentication. We saw the change in late December ahead of the originally released January 1 effective date.

The FMCSA shared that users will no longer have access to SMS, System Measurement System, with their FMCSA Portal user ID & password or US DOT number & PIN.

Users will need to set up a Login.gov account. Set-up steps can be found on the Agency website at FMCSA website, along with additional details.

CAB has developed a streamlined solution to continue supporting motor carrier analytics that integrates directly with login.gov.

The CAB team is here to help! Reach out to us here and we will help you through this transition.

CAB’s Tips & Tricks

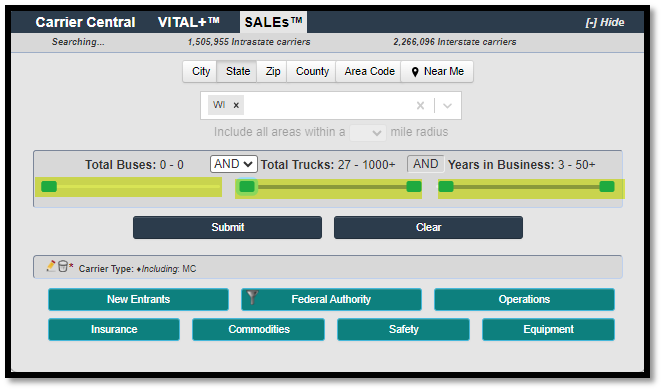

SALES Lead Generation Tool

Our SALES tool allows users to search the U.S. (and Canadian motor carriers operating in U.S.) universe of motor carriers including or excluding specific filters to support your growth initiatives.

There are sometimes little nuances missed when utilizing different systems. It appears that is the one of those cases is within the SALES tool.

Users have the option to use the keyboard’s up and down keys can get a search dialed in tighter than the quantity sliders can. While any of the sliders are “active” by clicking on it, use keystrokes to get to the desired number if the sliders aren’t getting the count you want.

Not a SALES user today? Reach out to learn more. You can also view our previous demo on this tool.

THIS MONTH WE REPORT

CVSA Urges Launch of Beyond Compliance Safety Program. The Commercial Vehicle Safety Alliance is asking the Federal Motor Carrier Safety Administration to move forward on Beyond Compliance. The passage of the Fixing America’s Surface Transportation (FAST) Act in late 2015 outlined the Beyond Compliance program and required FMCSA to establish the program within 18 months. Read more…

CARB extends reporting deadline for Clean Truck Check emissions program. The California Air Resources Board is extending the Clean Truck Check reporting deadline to Jan. 31 to allow vehicle owners additional time to complete their initial fleet reporting and pay the $30 2023 compliance fee. Read more…

California and Washington Meal and Rest Break Rules: Petitions for Waiver of Preemption Determinations. FMCSA requests comments on petitions requesting waivers of the Agency’s decisions preempting the State of California’s Meal and Rest Break and decision preempting the State of Washington’s MRB rules for certain drivers of property-carrying CMVs. Read more…

Trucking bankruptcies expected to continue in the foreseeable future. The Yellow bankruptcy is widely known, but it isn’t the only carrier that has closed its doors recently, and it won’t be the last. Industry bankruptcy experts say financial distress at the hands of multiple factors has caused an uptick in bankruptcy cases among trucking and logistics companies of all sizes. Read more…

Fines for FMCSA regs violations increased. The Department of Transportation on Thursday published a final rule announcing increased fines for its agencies, including the Federal Motor Carrier Safety Administration. The new fines were calculated according to the YOY difference in the Consumer Price Index for All Urban Consumers—that percentage change is 1.03241. Read more…

Truck parking issue ‘circling the lot’ in DC as some states pick up the reins. A lack of adequate, safe truck parking hangs over the trucking industry like a dark, rain-soaked cloud that just won’t give way to sunny skies. “The trucking industry must continue to send this message to the nation: There simply are not enough parking spaces for big rigs,” Dave Heller, SVP for the Truckload Carriers Association. Read more…

Into the Surge in High-Stakes Verdicts: A Deep Dive Into Nuclear Verdicts. In recent years, the insurance industry has been grappling with a growing concern: the surge in what is now termed “nuclear verdicts.” These verdicts are particularly high jury awards that exceed a “reasonable amount” that judges would normally award based on precedent. Read more…

January 2024 CAB Case Summaries

These case summaries are prepared by Robert “Rocky” C. Rogers, a Partner at Moseley Marcinack Law Group LLP.

AUTO

Landry v. Nat’l Union Fire Ins. Co. of Pittsburgh, et al, 2023 WL 8615799, C.A. No. 22-593 (La.App. 5 Cir., Dec. 13, 2023). In this personal injury action, a trucking company (CEVA) and its driver (Rodney) appealed a verdict awarding the plaintiff $10 million in exemplary damages against Rodney and vicariously imposing the damages award on CEVA. The Louisiana Court of Appeal reversed, reducing the award of exemplary damages to $1.5 million and reversing the imposition of vicarious liability for the exemplary damages to CEVA. The jury reached its decision in the trial, finding that Rodney was at fault for colliding with the plaintiff, that he was intoxicated while operating the commercial vehicle, that he acted with wanton or reckless disregard for the rights and safety of others, and that CEVA contributed to or could have prevented Rodney from driving while impaired. The jury awarded $2,468,784.65 in compensatory damages and $10 million in exemplary damages. CEVA and Rodney moved for a judgment notwithstanding the judgment as to the exemplary damages award, but the trial court found that it was appropriate and did not shock the conscience. On appeal, the appellate court found that CEVA had thoroughly vetted Rodney prior to his hiring in accordance with applicable FMCSRs, that Rodney did not have any drug or alcohol related incidents during his time driving for CEVA, that Rodney did not disclose the use of certain drugs to CEVA, and that Rodney had escalating personal problems in the immediate weeks leading up to the accident. Rodney did fail a field sobriety test following the accident and tested positive for Xanax, Paxil, and cocaine. However, CEVA argued that it could not be vicariously liable for the exemplary damages award, that the plaintiff’s counsel’s remarks to the jury were inflammatory, and that the jury’s finding that CEVA contributed to or might have prevented Rodney from driving while intoxicated was without evidentiary support. The appellate court found that Rodney acted with wanton and reckless disregard based upon his impairment while driving the commercial vehicle. It also found that the plaintiff’s counsel’s remarks were not inflammatory as to Rodney. However, it found that the trial court’s jury instructions regarding vicarious liability for exemplary damages were erroneous and that the plaintiff’s counsel’s remarks to the jury, which appealed to elicited prejudice against trucking companies like CEVA, were prejudicial to CEVA. The court further found that there was no evidence that CEVA contributed to or could have prevented Rodney from driving while impaired, as it did not have any knowledge of his immediate drug usage and, thus, the imposition of vicarious liability for the exemplary damages award against CEVA was not warranted. Finally, the court reduced the exemplary damages award against Rodney from $10 million to $1.5 million after considering the reprehensibility of the conduct, the ratio of the exemplary damages to the actual or potential damages, the potential penalties for comparable misconduct, and the wealth of the defendant.

Scott v. Waste Connections US, Inc., 2023 WL 8628333, C.A. No. 3:23-cv-00142 (W.D.N.C. Dec. 13, 2023). In this personal injury action arising from an accident involving a train and a garbage truck, the court addressed a motion to compel filed by the plaintiff seeking production of four years’ worth of the defendant motor carrier’s accident registers. The motor carrier argued the registers were subject to statutory privilege under 49 C.F.R. § 504(f). In addressing the dispute, the court found 49 C.F.R. § 390.15 requires motor carriers to maintain an accident register for 3 years following an accident. The court then examined the language of 49 U.S.C. § 504(f), which provides that “[n]o part of a report of an accident occurring in operations of a motor carrier, motor carrier of migrant workers, or motor private carrier . . . and no part of a report of an investigation of the accident . . . may be admitted into evidence or used in a civil action for damages related to a matter mentioned in the report or investigation.” In reading this statutory provision in conjunction with court rulings across the country, the court determined that the defendants did not have to produce the accident register, as the statute disallowed not only the admission of the accident register but also any “use” of the register in a civil action. The court also declined to compel production of any documents used by the defendants to support their affirmative defenses, finding that such production would invade defense counsel’s mental impressions and work product protection.

Blackburn v. Right Way Auto Transp., Inc., et al, 2023 WL 9051263, C.A. No. 1:23-cv-250 (E.D. Tex. Dec. 29, 2023). In this personal injury action arising from a motor vehicle collision between a tractor-trailer, a cargo van, and several passenger vehicles, the Texas District Court denied the Plaintiff’s motion to remand the case back to state court, finding that one of the defendants was improperly joined solely to defeat federal court diversity jurisdiction. The plaintiff alleged that she and her minor child were passengers in a Honda CR-V which was struck by a Right Way tractor-trailer driver. The CR-V then moved to an inside lane and struck a Ford F-150. The plaintiff filed suit against Right Way, the Right Way driver, and the CR-V driver. The plaintiff and the CR-V driver were both citizens of Louisiana while the Right Way driver and Right Way were citizens of a different state. Right Way removed the case from Texas state court to Texas federal court, but the plaintiff moved to remand the case back to state court on the ground that the parties were not completely diverse. Right Way opposed the remand, arguing the CR-V driver could not be deemed liable for the accident. The court found that the only allegation against the CR-V driver was that he “moved” to the inside lane and struck the Ford F-150 after first being struck by the tractor-trailer. The court also considered the dashcam video from the tractor-trailer and found that it was only the impact from the tractor-trailer that caused the CR-V to collide with the F-150. Thus, the court found the undisputed evidence supported the conclusion that the CR-V driver was not negligent, dismissed him from the suit, and denied the plaintiff’s motion to remand the case back to state court.

BROKER

Tischauser v. Donnelly Transp., Inc., 2023 U.S. Dist. LEXIS 215815, Nos. 20-C-1291; 20-C-1917; 21-C-220; 21-C-965; 23-C-538; 23-C-539; 23-C-556 (E.D. Wis. Dec. 5, 2023). In this action arising out of a motor vehicle accident, Defendants moved to dismiss claims of (1) negligent selection/hiring, training or supervision; (2) agency/vicarious liability; (3) joint enterprise/venture; and (4) loss of consortium on the grounds that these claims are preempted by the Federal Aviation Administration Authorization Act (FAAAA). In its opinion, the Wisconsin Eastern District Court applied the recent Seventh Circuit case, Ye v. GlobalTranz Enterprises, Inc., 74 F.4th 453 (7th Cir. 2023), which held that the FAAAA, specifically 49 U.S.C. § 14501(c), preempted a claim against a freight broker to recover for negligent hiring of a motor vehicle carrier whose employee was driving a truck involved in an accident that resulted in the death of the plaintiff’s husband. In Ye, the Seventh Circuit found that state tort law governing negligence actions against brokers is preempted by the FAAAA because those laws significantly impact the price and cost, as well as the regulation, of interstate trucking and interstate transportation. The court stressed that the party seeking to establish preemption must show both that a state enacted or attempted to enforce a law and that the state law relates to broker rates, routes, or services either by expressly referring to them, or by having a significant economic effect on them. Ye only involved negligent hiring and vicarious liability claims under Illinois’ common law brought against a broker. In contrast, the instant case involved various Wisconsin common law tort law claims against a broker including negligent hiring and vicarious liability claims as well as tort claims for joint enterprise/venture. Nonetheless, the Court found that, like the negligent hiring claim in Ye, each claim here would have a significant economic effect on broker services. Therefore, the claims were held to be preempted by the FAAAA and the district court granted Defendant’s Motion to Dismiss.

Allen v. Foxway Transp., Inc., 2023 WL 8478015, No. 4:21-cv-00156 (M.D. Pa. Dec. 7, 2023). The District Court granted and denied, in part, competing motions for summary judgment in this action instituted by the Estate of two deceased children against a motor carrier, a broker, and a shipper following a motor vehicle accident. The accident involved the mother of the two children hitting a deer, resulting in the disabling of their vehicle in front of the path of a tractor trailer driven by an employee of Foxway, the carrier. Gateway, a broker, had retained Foxway to deliver a shipment for Tempel Steel, the shipper. Tragically, the two children were killed, and the plaintiff, the administrator of the children’s estate, sought to hold Foxway, Gateway, and Tempel Steel liable. In alleging liability against Gateway as the broker, the plaintiff brought causes of action for vicarious liability for the actions of Foxway; claims for negligent hiring, supervision, retention, selection, and entrustment; joint venture liability; and claims under Pennsylvania’s wrongful death and survival statutes. The plaintiff moved for summary judgment asking the court to find that there was no question that Gateway should be held liable under the vicarious liability and negligent hiring claims, and Gateway moved for summary judgment seeking dismissal of all claims against it. The court held that the threshold matter was whether Foxway’s driver was liable for the accident. In response to the court’s directive to file supplemental briefing on that issue, the plaintiffs cited to an undisclosed expert’s opinion, which opined that the Foxway driver reported fog at the time of the accident and that he was operating the Foxway vehicle on cruise control at an “unsafe speed” of 64.5 mph. The court declined to consider the opinion, finding that the plaintiff had failed to timely disclose the expert after repeated warnings for untimely disclosures of other experts. However, the court also found that the record was insufficient to determine whether the conditions present at the time of the accident were severe enough to require the Foxway driver to reduce his speed. Next, turning to the vicarious liability claim, the court considered the plaintiff’s argument that Gateway functioned as the de facto motor carrier and statutory employer of the Foxway driver. The court rejected this argument, finding that Gateway did not promise to personally perform the transport and that it only held itself out to the shipper as a broker. The evidence showed that Gateway did not handle the routing, the packing of the product, or any other portion of the delivery process. The evidence also showed that the shipper, Tempel, knew that Gateway was not delivering the load. Thus, the court denied the plaintiff’s motion for summary judgment as to vicarious liability and granted it as to Gateway. Similarly, the court dismissed the plaintiff’s negligent hiring and selection causes of action since the court found no employee-employer relationship between Gateway and the Foxway driver. The court withheld its ruling on the negligent entrustment cause of action pending the parties’ briefings on their competing experts. Finally, the court dismissed the joint venture claim on the ground that the plaintiff failed to offer any material facts to show that Gateway entered into a joint venture with Foxway and Tempel Steel concerning the Foxway driver and the subject shipment involved in the accident.

Nilles v. DS1 Logistics, Inc., et al, 2023 WL 8718070, No. 2:22-cv-54 (N.D. Ind. Dec. 18, 2023). In this action instituted by the estate of a deceased motorcyclist who was involved in a collision with a tractor trailer, the Indiana District Court dismissed the broker, C.H. Robinson Worldwide (CHRW), from the suit. The motorcyclist was killed following a collision with a tractor-trailer operated by a driver for DS1, the motor carrier. Amazon contracted with CHRW to ship freight, and CHRW subsequently brokered the freight to DS1. The plaintiff alleged that CHRW, by virtue of its contract with Amazon, was vicariously liable for the alleged negligence of DS1 and DS1’s driver and alleged certain claims based in negligence against CHRW. CHRW moved to dismiss, arguing that the plaintiff failed to show that it was liable for the acts and omissions of an independent contractor. The plaintiff argued that she was invoking an exception to the rule where the principal is charged by law or contract with performing a specific nondelegable duty to third party motorists based on CHRW’s contract with Amazon. The plaintiff cited to one provision in the contract in which CHRW agreed to “remain responsible for the full performance of the Services” rendered and another portion in which CHRW agreed to perform “Services” in a professional, competent, and workmanlike manner to comply with all federal, state, and local laws, rules, and regulations. Thus, the plaintiff argued that, because CHRW was contractually charged with performing specific duties, it had a nondelegable duty with respect to liability for DS1 and its driver. The court disagreed, finding that the contractual provisions were silent as to safety, third party motorists, or personal injury accidents. Moreover, none of the provisions provided that CHRW was responsible for the acts and omissions of its independent contractors. Therefore, the court found that the plaintiff had not alleged a viable cause of action for vicarious liability against CHRW and dismissed CHRW from the suit.

CARGO

United Granite & Quartz, Inc. v. Emuro Transp., LLC, 2023 U.S. Dist. LEXIS 228662, C.A. No. 23-01673 (D.N.J. Dec. 22, 2023). In this case, a tractor trailer flipped over onto its side and destroyed a load of marble slabs. Plaintiff asserted eight causes of action, including liability under the Carmack Amendment against Total Quality Logistics, LLC (“TQL”), alleging that TQL held itself out as a “carrier.” After removal to federal court, the New Jersey District Court highlighted that the Carmack Amendment differentiates between motor carriers and brokers, and only imposes liability on carriers. To determine whether a party acted as a carrier or broker, courts look to whether the party has legally bound itself to transport goods by accepting responsibility for ensuring the delivery of the goods regardless of whether it conducted the physical transportation. Despite initially maintaining that TQL was a motor carrier, Plaintiff later conceded to TQL being identified as a broker, therefore abandoning its Carmack Amendment claim. After abandoning this claim, the district court found that there was no federal jurisdiction and remanded the case to state court for further proceedings.

Jeanty v. Antillean Marine Shipping, Corp., 2023 U.S. Dist. LEXIS 218594, No. 22-cv-23721 (S.D. Fla. Dec. 8, 2023). This matter arises from a failed shipment of goods from Florida to Haiti. The plaintiff hired defendant, an ocean carrier, to transport a Mack truck from Florida to Haiti. Defendant took possession of the truck in Florida, but it was never delivered to Haiti. The plaintiff initially filed a six-count complaint alleging state law causes of action in Florida state court. Thereafter, defendant removed the action to federal court contending that COGSA applied to the shipment, COGSA preempted all state law causes of action, and accordingly COGSA provided federal question jurisdiction for the dispute. Initially the plaintiff did not contest the removal because he was under the impression the truck was lost in transit. However, in discovery it was determined the truck was sold by defendant prior to it ever being loaded onto the ship; defendant contended the necessary title paperwork was not provided for it to be shipped and it sold the truck after it remained on the lot for approximately a year. It was undisputed that no bill of lading was issued for the shipment of the truck because it was never formally processed for export shipment due to the title and/or payment issues. Rather, only a dock receipt/warehouse receipt was provided by defendant when the truck was delivered to it in Florida. Upon discovering that the truck was never shipped, the plaintiff filed a motion to remand arguing COGSA did not apply and therefore did not provide federal question jurisdiction to support federal subject matter jurisdiction over the dispute. In response, defendant argued the standard terms and conditions contained in its form bill of lading, including a Clause Paramount extending COGSA to the entirety of the shipment, applied to the shipment, even though no bill of lading was issued in this instance. It pointed to language in the dock receipt/warehouse receipt indicating that the shipment was “subject to the terms and conditions contained in the Carrier’s regular form Bill of Lading and Tariff.” Working from the operative pleading the court found it was alleged there was a contract for the shipment of the truck from Florida to Haiti. As for application of COGSA, the court stressed it normally only applies “tackle to tackle” but can be extended by agreement of the parties to the shipping contract. The court then found that by accepting the dock receipt/warehouse receipt, which incorporated the defendant’s standard form bill of lading containing a Clause Paramount extending COGSA beyond “tackle to tackle” and to the entirety of the shipment, COGSA ultimately applied to the dispute and granted the federal court jurisdiction over the matter. The court cited prior rulings holding that the ocean carrier’s standard form bill of lading would apply to shipments, even where a bill of lading was never issued, finding such a rule was “well-settled” within the Eleventh Circuit Court of Appeals.

Godoy v. Total Quality Logistics, LLC, 2023 Ohio App. LEXIS 4419, 2023-Ohio-4585 (Ct. App. Dec. 18, 2023). In this instance, a trucking company (“Carrier”) contracted with a shipping broker (“Broker”) to transport cargo. Per the broker-carrier agreement, Carrier assumed full responsibility and liability for the cargo until the trailer is unloaded. Broker brokered a load of ice cream to be transported by the Carrier, but the load was ultimately rejected in full by the consignee because the temperature in the trailer was too high. The appellate court agreed with the lower court that Broker was entitled to summary judgment on its breach of contract claim and an award of damages because per the terms of the broker-carrier agreement, Carrier was entirely and solely responsible for the ice cream until the Carrier successfully delivered it to the store, which it did not. The broker-carrier agreement further required Carrier to indemnify Broker for any loss or damage claims arising from shipments subject to the broker-carrier agreement. The Court also found that Broker was entitled to summary judgment on Carrier’s breach of contract claim for nonpayment because it found Broker, under the terms of the broker-carrier agreement, properly offset the amount that it was entitled to under the indemnification provision with amounts that it owed Carrier for prior transportation services.

Certain Interested Underwriters at Lloyd’s v. Total Quality Logistics, LLC, 2023 Ohio App. LEXIS 4287, 2023-Ohio-4470 (Ct. App. Dec. 11, 2023). In this action arising from a stolen shipment of electronics, the appellate court affirmed the lower court’s grant of summary judgment to the freight broker involved in the shipment. Outlook contracted with TQL for TQL to broker shipments of Outlook’s goods for transportation by motor carrier from Florida to New Jersey. The written Outlook-TQL Agreement specifically provided, amongst other things: (1) TQL is a transportation broker only, said role being limited to arranging the transportation of freight by an independent third-party motor carrier; (2) in the event of cargo loss or damage, Outlook must file a claim for the loss with TQL within 9 months of the date of delivery or scheduled delivery date in the case of non-delivery; and (3) motor carriers under contract with TQL are required to maintain $100,000 in cargo loss and damage liability insurance per shipment, that Outlook would not tender any load to TQL having a value of greater than $100,000 without first affording TQL or the motor carrier the opportunity to procure higher cargo loss and liability damage coverage, and failure to provide advance, written notice of excess value will result in loads not being insured beyond $100,000. In connection with this particular shipment, TQL contracted with “Safe Connection”, a motor carrier to perform the transportation, but the goods were stolen in transit. Outlook and its insurer, Lloyds, made demand upon TQL for the value of the stolen goods, which TQL rejected. Outlook/Lloyds thereafter filed suit against TQL for breach of contract, alleging TQL failed to: (1) arrange for transportation and delivery of the shipment “by a motor carrier authorized to perform the transportation at issue,” (2) contract “with a motor carrier maintaining cargo loss and damage liability insurance,” (3) “adequately arrange for delivery” of the electronics shipment to New Jersey as designated by Outlook, and (4) “pay the Claim amount” to Outlook. In addressing these claims, the appellate court first held the Outlook-TQL Agreement contained no requirement that TQL select an “authorized motor carrier.” Rather, that portion of the Outlook-TQL Agreement was held to merely place Outlook on notice that TQL was merely acting as a broker. The court refused to graft the definition of broker under 49 C.F.R. § 371.2(a), defining “broker” as “one who hires authorized motor carriers”, into the Outlook-TQL Agreement. The court next held that the Outlook-TQL Agreement placed no requirement upon TQL to ensure motor carriers with whom it contracted had cargo loss and damage insurance. Rather, the court found those provisions of the Outlook-TQL Agreement instead focused on Outlook’s, not TQL’s, obligations. The court found nowhere in that portion of the Outlook-TQL Agreement did TQL take on responsibility for procuring or ensuring the procurement of cargo insurance. The court, citing reasoning by the lower court, found Outlook/Lloyds did not attempt to argue they were a third-party beneficiary to the contracts between TQL and the independent contractor motor carriers, which presumably required the motor carriers to obtain and maintain $100,000 in cargo loss and damage coverage. Last, the court found there was nothing in the Outlook-TQL Agreement requiring TQL to pay a claim. Rather, it merely provided that if TQL elected to pay a claim, it would be assigned all Outlook’s rights to pursue any other party in connection with the paid amounts. Thus, the court affirmed the lower court’s grant of summary judgment in favor of TQL.

Coverage

BITCO Gen. Ins. Corp. v. Smith, 2023 WL 8884984, No. 23-1043 (8th Cir. Dec. 26, 2023). In this appeal of a summary judgment finding that the insurer had no duty to defend or indemnify a trucking company or a dump truck driver, the Eighth Circuit Court of Appeals affirmed the lower court’s ruling. The ruling involved the question of whether BITCO, the insurer, was obligated to provide coverage for damages arising from an accident involving a truck driven by a contractor of the insured, KAT. Ultimately, the court upheld the lower court’s ruling that the insurer had no such obligation on the basis that the insured did not hire its contractor’s dump truck driver for purposes of the policy. KAT contracted with CWC, a separate company, to help haul rock to a job site. CWC then contacted a former driver to assist with hauling the rock. The former driver was then involved in an accident while hauling a load of rocks. The insurer filed a declaratory judgment, arguing it had no duty to defend or indemnify CWC or the former driver under KAT’s policy. CWC and the former driver counterclaimed, arguing the insurer was obligated to provide a defense and indemnity under the omnibus clause of the policy. The omnibus clause provided that an insured was “anyone else . . . using with KAT’s permission a covered ‘auto’ KAT owns, hires, or borrows” and provided coverage for “anyone liable for the conduct of an insured.” CWC and the driver argued that the undefined terms “permission” and “hire” were ambiguous, meaning Missouri law required a finding in favor of coverage. The district court disagreed, finding that the term “hire” required KAT to exercise control over the driver’s dump truck and that there was no evidence to support such a finding. In reviewing the ruling, the Eighth Circuit looked to Missouri law, which forbid it from reading any one policy term in isolation from another to create an ambiguity. Here, the court found that the term “hire” was not ambiguous when read in conjunction with the term “permission.” Thus, the term “hire,” as written in the omnibus clause and as read in conjunction with the term “permission,” necessitated some element of control, and, because KAT did not drive or operate the truck, dictate the truck’s route, speed, or any other aspect of its operation, KAT did not control the CWC truck. Because CWC, not KAT, exercised exclusive control over the dump truck, the insurer was not obligated to provide a defense or indemnity.

WORKERS COMPENSATION

Ayala v. Fundamental Labor Strategies, Inc., 2024 WL 13572, No. 1037 C.D. 2022 (Pa. Commw. Ct. Jan. 2, 2024). In this appeal from the Pennsylvania Workers’ Compensation Appeal Board’s review of a workers’ compensation judge’s ruling, the Commonwealth Court of Pennsylvania affirmed the Board’s holding that the claimant was an independent contractor and, therefore, not entitled to workers’ compensation benefits. The claimant, a commercial truck driver, worked for Fundamental Labor Strategies (“FLS”) from 2019 to 2020. The claimant filed a petition seeking workers compensation benefits, alleging he was injured during the course and scope of his employment when he was unloading a window. He then filed a petition for sanctions against FLS, alleging it had failed to file documents accepting or rejecting liability for his work injury. FLS later filed an answer denying it had an employment relationship with the claimant. The claimant testified that FLS was not a motor carrier, that it sent him different driving assignments, and initially said he was permitted to accept or reject assignments from FLS before later stating he did not feel he could decline an assignment. He testified he drove trucks owned by clients and received instructions from a separate entity that was a motor carrier. The claimant admitted he signed an independent contractor agreement and that he was responsible for paying his own taxes. The president of FLS testified that FLS was a broker offering dedicated driver services which private motor carriers used to haul their own goods. The FLS president also testified that FLS offered flex driver brokerage service, matching motor carriers with short term needs for drivers with drivers who wanted to work short-term gigs. The president testified that the claimant was a flex driver receiving flex assignments. Flex drivers like the claimant had to provide proof that they were insured, had the ability to accept or reject loads, and had no repercussions for rejecting assignments. Reviewing the totality of the record, the Workers’ Compensation Judge found that the claimant was an independent contractor and, thus, not entitled to workers’ compensation benefits from FLS. The claimant appealed, arguing that FLS exercised control over his work. The appeal board affirmed the workers’ compensation judge’s ruling, finding that the evidence supported the conclusion that the claimant was an independent contractor because he signed an occupational accident insurance form, did not drive FLS trucks, was not required to wear an FLS uniform, and controlled his own routes and start and end times. The Commonwealth Court agreed, affirming the rulings of the judge and appeal board.