CAB Bits & Pieces September 2019

Good Day CAB Nation!

We hope your September is great. We’re certainly upon busy season in the industry. Many of us will be in Orlando for the MCIEF in early October. We will have a table at the conference and we encourage you to come by and visit. We’ll have some fabulous gifts and prizes. We hope to see you there!

Later on this month Jean will be presenting at the IMUA Southeast Regional Meeting on current issues with cargo exposures. Come on by –Click here to learn more about the program:

Follow us at: CAB LinkedIn Page CAB Facebook Page

Have a great month!

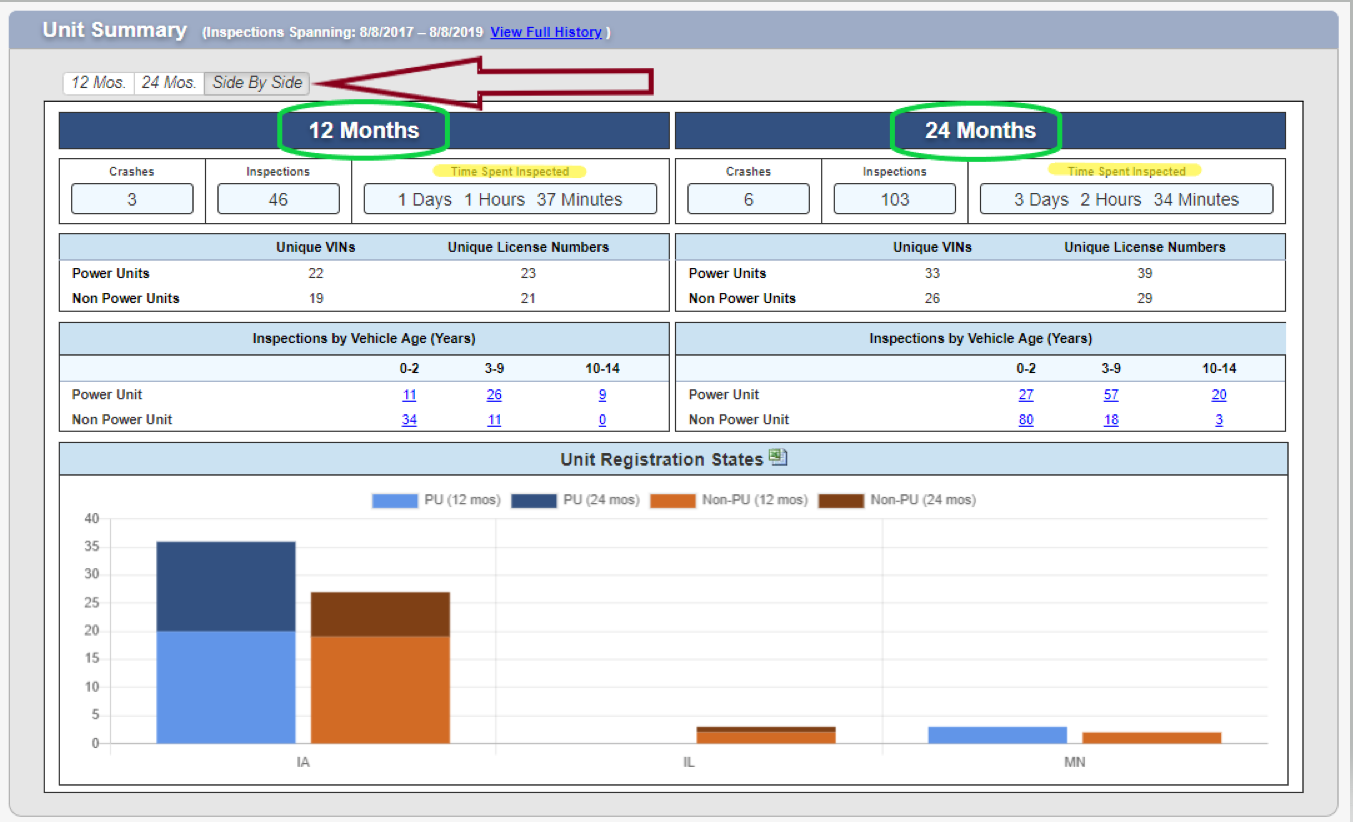

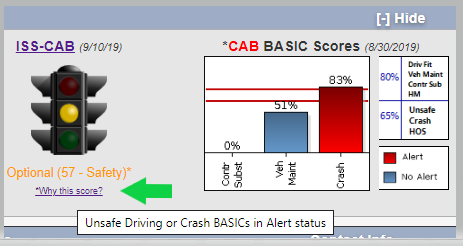

CAB’s Tips & Tricks: This month’s tip is located in the CAB Report® on the General Tab. Some of you may have already discovered it, but is serves an important purpose to help understand the ISS-CAB value. Have you ever wondered why a motor carrier has been assigned a specific ISS-CAB color, be it red, yellow or green? Well, we have a quick way to figure it out.

We know CAB-ISS values and colors are based on different CAB BASIC Scores being in or out of Alert level. Certain BASICs Categories are best addressed at the roadside via intervention. Users have wondered why is the ISS-CAB color yellow instead of red or the like. In order to find that out, I encourage you to hover (don’t click) over the words *Why this score? (Green arrow). As the image below shows, a box will appear that will tell you the reason for the score.

There are numerous variations of CAB BASICs scores that create the ISS-CAB numerical value. Next time you’re reviewing a CAB Report® make sure to hover over *Why this score? to better understand why a motor carrier has been assigned a certain value and color.

We at CAB are constantly striving to improve our tools and resources to create value for our subscribers. Please feel free to contact us directly if you have any suggestions as to how we can enhance our services. We are a customer driven company and our goal is to help you Make Better Decisions!

This month we report:

Driver Detention Study Shows Negative Effect on Productivity & Regulatory Compliance: American Transportation Research Institute (ATRI) recently released a study that delved into the relationship between shipper detention time and what happens on the road. It was found that detention has a significant impact on drivers’ ability to comply with Hours of Service (HOS) regulations. Both frequency and time has increased from 2014-2018. These increased detention times can frustrate drivers and put them behind schedule. Additionally, this situation could result in the driver taking additional risks to get the load delivered on time. The study also noted that women drivers are even more affected than men. The report noted that women were 83% more likely to be delayed six hours or more compared to men. CAB also reports on the amount of time that a motor carrier actually spends being inspected – another negative impact on productivity. If you’d like additional information on the ATRI study, please click here.

Trucking Company Failures Continue in 2019: Thus far in 2019, well over 600 motor carriers have failed. That number is more than double all of 2018, which were just over 300 companies. The blame seems to fall on the reduction of spot rates and a hangover from one of the greatest years in trucking, 2018. Other contributors included are tariffs and increased driver pay. The pain will likely continue as pricing will likely struggle into the near future.

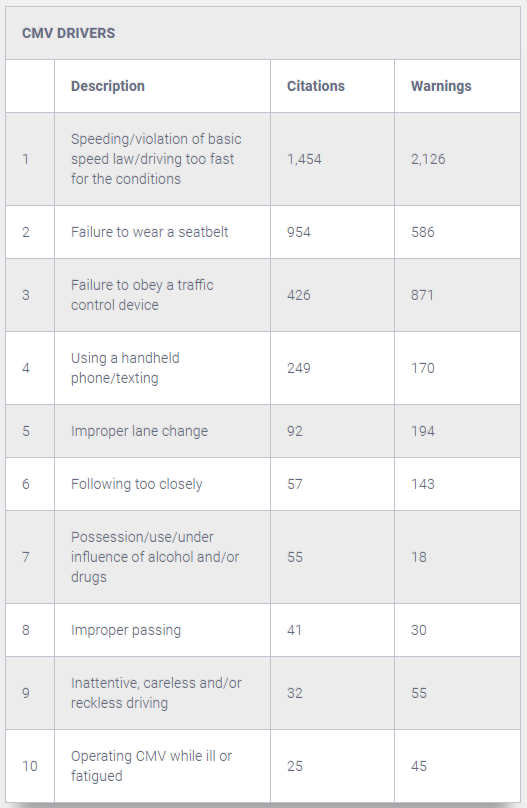

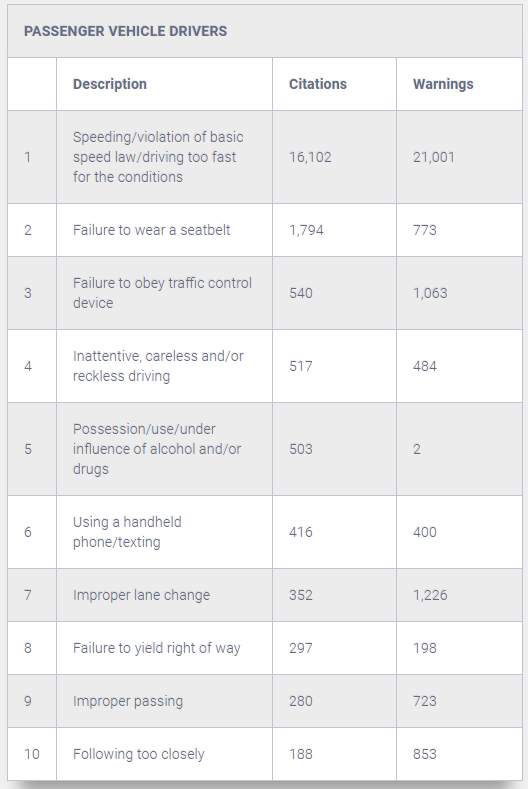

CVSA Releases 2019 Operation Safe Driver Week Results During the Commercial Vehicle Safety Alliance’s (CVSA) Operation Safe Driver Week, July 14-20, 2019, commercial vehicle enforcement personnel in Canada and the United States took to North America’s roadways to identify drivers engaging in unsafe driving behaviors and issue citations and/or warnings. Officers issued 46,752 citations and 87,624 warnings to drivers for traffic enforcement violations, ranging from speeding to failure to wear a seatbelt. Drivers’ actions contribute to 94% of all traffic crashes. The Operation Safe Driver Week enforcement initiative is the commercial motor vehicle (CMV) law enforcement community’s response to this transportation safety issue. Through traffic safety initiatives, such as Operation Safe Driver Week, law enforcement personnel aim to deter negative driver behaviors and reduce the number of crashes involving large trucks, motorcoaches and passenger vehicles by identifying and citing drivers exhibiting risky driving behaviors and tendencies.

During this year’s Operation Safe Driver Week, passenger vehicle drivers received 16,050 state/local driver citations and 29,145 warnings, and CMV drivers received state/local driver 6,170 citations and 27,163 warnings. For more information on the results, click here.

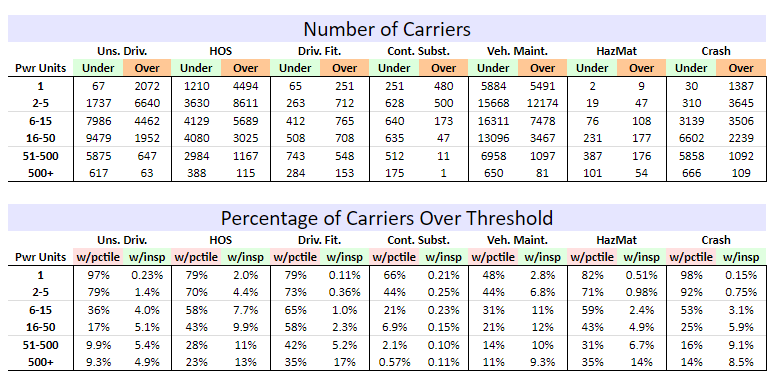

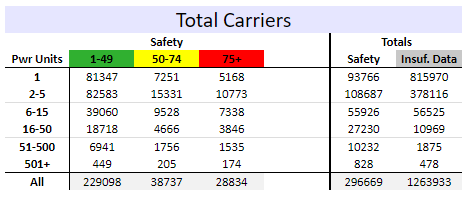

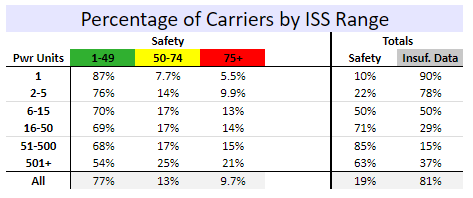

CAB Calculates Inspection Selection System (ISS)-CAB Ranges Based on Power Units: The first table shows, for each power unit range; the number of carriers with “safety” scores in the green, yellow, and red ranges, and the total number of carriers with a “safety” score or an “insufficient data” score. The second table shows the data as percentages, out of carriers with “safety” scores or out of all carriers as appropriate. ISS scores are as of the snapshot date of 9/10/19. A carrier’s number of power units is from the most recent data we have for that carrier. Carriers with no or unknown number of power units are not included.

U.S. DOT Awards over $77 Million in Grants to Improve Commercial Vehicle Safety: The grants were awarded to states and educational institutions.

$43.3 million in High Priority (HP) grants was awarded to enhance states’ commercial motor vehicle safety efforts, as well as to advance technological capability within states. FMCSA’s High Priority (HP) grant program is designed to provide financial assistance to state commercial vehicle safety efforts, while HP-ITD grants provide financial assistance to advance the technological capability and promote the deployment of intelligent transportation system applications for CMV operations. A full list of this year’s HP grant awardees can be found here.

$32 million in Commercial Driver’s License Program Implementation (CDLPI) grants to enhance efforts by states to improve the national commercial driver’s license (CDL) program. This program provides financial assistance to states to achieve compliance with FMCSA regulations concerning driver’s license standards and programs. A full listing of this year’s CDLPI grant awardees can be found here.

$2 million in Commercial Motor Vehicle Operator Safety Training grants to sixteen education institutions to help train veterans for jobs as commercial bus and truck drivers. FMCSA’s Commercial Motor Vehicle Operator Safety Training grant program awards grants to a variety of educational institutions that provide commercial truck and bus driving training. A full listing of this year’s grant awardees can be found here.

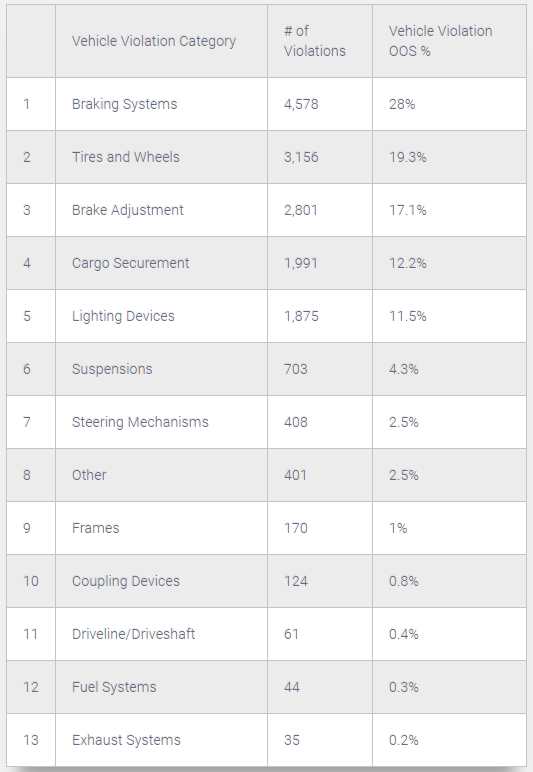

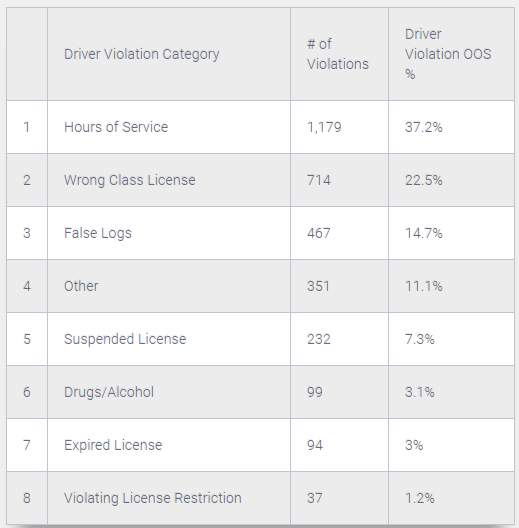

CVSA Releases Results from 2019 International Roadcheck: On June 4-6, 2019, inspectors conducted 67,072 inspections on commercial motor vehicles in Canada and the U.S. as part of the Commercial Vehicle Safety Alliance’s (CVSA) International Roadcheck. During those three days, 12,019 vehicles were removed from roadways due to critical vehicle inspection item violations and 2,784 drivers were placed out of service for driver-related violations. That’s a 17.9% overall vehicle out-of-service rate and a 4.2% driver out-of-service rate.

- 45,568 Level I Inspections were conducted; 21.5% (9,817) of those inspected vehicles were placed out of service.

- There were 60,058 Level I, II and III Inspections conducted in the U.S.

- There were 7,014 Level I, II and III Inspections conducted in Canada.

- The total vehicle out-of-service rate in the U.S. was 17.7%.

- The total vehicle out-of-service rate in Canada was 19.9%.

- 4.4% of drivers inspected in the U.S. were placed out of service.

- 2% of drivers inspected in Canada were placed out of service.

Vehicle and driver out-of-service conditions were as follows:

Inspectors also discovered 748 seat belt violations. According to FMCSA’s latest Seat Belt Usage by Commercial Motor Vehicle Drivers Survey, the overall safety belt usage rate for drivers of medium- and heavy-duty trucks and motorcoaches was 86% in 2016. You can read the complete CVSA release, here.

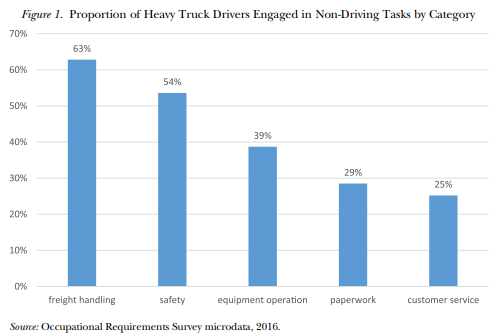

Truck Driving Jobs: Are they Headed for Rapid Elimination? A recent study released by Maury Gittlemen and Kristen Monaco of the Bureau of Labor Statistics conclude media stories predicting the imminent loss of truck driving jobs is overstated. Main factors include:

- The number of truckers is “inflated due to a misunderstanding of the occupational classification system used in federal statistics.”

- Truckers’ skills other than driving will always be in demand.

- Some trucking segments will be more difficult to automate than others.

That’s the good news for truckers in general. However, there is some bad news for long-haul truckers. “Long-haul trucking (which constitutes a minority of jobs) will be much easier to automate than will short-haul trucking (or the last mile), in which the bulk of employment lies,” the reports states.

The study surmises that thousands, not millions, of trucking jobs may be at a limited risk as a result of automation. One of the key points raised is that there’s more to trucking than driving as the graph above shows. If you’d like more information on the study, click here.

FMCSA has extended Hours of Service Public Comment Period: Based on the requests of the American Trucking Associations, the Commercial Vehicle Safety Alliance, and the International Brotherhood of Teamsters, the commend period has been extended two additional weeks to October 21, 2019. Thousands of comments have already been submitted. The five proposed changes are:

- Changing the short-haul exception from certain commercial motor vehicle drivers from 12 to 14 hours and extending the distance limit from 100 air-miles to 150 air-miles.

- Extending the adverse driving conditions exception by two hours.

- Requiring a minimum 30-minute break before eight consecutive hours of driving time occurs. The break would be for at least 30 minutes and could be satisfied with on-duty, not driving time, or off-duty time, rather than just off-duty time.

- Modifying the sleeper-berth exception to allow drivers to split their required 10 hours off-duty time into two periods of at least seven consecutive hours in one period and not less than two consecutive hours either off-duty or in-the-sleeper berth.

- Allowing one off-duty break of at least 30 minutes, but not more than three hours, that would pause a truck driver’s 14-hour driving window, provided the driver takes 10 consecutive hours off-duty at the end of the work shift.

If you’d like to comment or review the comments, click here.

In addition, the FMCSA has published its rulemaking removing the restrictions on the restart provisions. The restrictions limited its use to once every 168 hours and required that a restart include 2 periods between 1 a.m. and 5 a.m.

Trucking Organizations ask Congress to Defeat Four Bills: Groups argue bills would harm trucking and have no positive impact on safety. The Owner-Operators Independent Drivers Association (OOIDA) has taken the lead but has generated support from 31 other organizations. A letter has been sent to the leaders of the congressional committees overseeing the surface transportation reauthorization legislation. The four bills being opposed are:

H.R. 1511/S. 665, the Stop Underrides Act pertains to requiring the installation of front, side and rear underride guards on all trailers over 10,000 pounds.

S. 2033, the Cullum Owings Large Truck Safe Operating Speed Act of 2019 pertains to 65 m.p.h. speed limiters for all Commercial Motor Vehicles over 26,000 pounds.

H.R. 3773, the Safe Roads Act pertains to mandating that all new CMVs be equipped with and utilize an automatic emergency braking (AEB) system.

H.R. 3781, the INSURANCE Act pertains to raising the minimum liability coverage for motor carriers from $750,000 to over $4.9 million.

If you’d like the review organizations open letter, please click here.

Interesting Tidbits:

Former Cal DMV Worker Sentenced to Federal Prison: Aaron Gilliam pleaded guilty to conspiracy to commit bribery, identity fraud and unauthorized access of a computer in U.S. District Court for the Eastern District of California in Sacramento. He was sentenced to 22 months in federal prison for his part in a fraudulent commercial driver’s license scheme. Prosecutors alleged that Gilliam, who processed applications for CDLs, accessed the DMV’s database altered records to show that they had passed the written examination when, they had not passed. Some applicants had not even taken the test. At least 57 fraudulent CDLs and permits were issued by Gilliam in exchange for money between April 2016 and July 2017. Court documents said that Gilliam worked with two co-conspirators, who were owners of truck driving schools in Southern California. Truck driving students would pay money to the two co-conspirators, who, in turn, would pay Gilliam and other DMV employees, to receive their CDL licenses without “having to take or pass the written and behind-the-wheel driving examinations.” Gilliam has been ordered to report to prison on Oct. 25. He will also serve three years of supervised release and pay a $100 special assessment fee.

CASES

Auto

A motor carrier’s efforts to have a punitive damages claim dismissed early in the litigation failed in the Middle District in Pennsylvania. The court held that where the defendants are alleged to have violated Federal Motor Carrier Safety Regulation 395 “dealing with hours of service” and Regulation 383 “dealing with required knowledge and skill” without regard to the safety of other motorists the plaintiff sufficiently alleged facts to support a punitive damages claim. Shelton v. Gure, 2019 WL 4168868

The Supreme Court in Alabama refused to transfer a wrongful death case filed against a trucking company to a different Alabama county. The court held that both counties were proper. The court held that the defendants did not establish that their selected county was a significantly more convenient forum. Ex Parte KKE, LLC. 2019 WL 4385803

A driver and his trucking company employer were successful in having punitive damages claims dismissed in the Northern District of Mississippi. The court held that while there was an accident there were insufficient allegations which would support a punitive damages claim. The court also held that the employer could not be liable for punitive damages if the only claim against the employer was based upon vicarious liability. Rasdon v. E3 Trucking, 2019 WL 434657

Another jury verdict was upheld in a two truck accident in the Middle District in North Carolina. The court found that the Plaintiff was entitled to compensatory damages for future disability, medical expenses, and pain and suffering in the amount of $116,897.91 — $30,297.91 for past medical treatment, $16,000.00 for lost wages, $55,000.00 for past pain and suffering, and $15,600.00 for future medical expenses, disability, and pain and suffering. Graciano v. Blue Sky Logistics, LLC. 2019 WL 4393381

Plaintiff was permitted to pursue claims against anyone involved in a transportation accident which resulted in yet another multi-truck accident. When the court had already ruled that the defendants would stay in the case when deciding the initial motion to dismiss the court held that the supplemental complaint filed by an intervening insurance carrier would also stand as no new reasons for dismissal were proffered by the defendant. Burrell v. Duhon, 2019 WL 4316871

Plaintiff was stuck with a $10,000 settlement from a multi-truck accident (noticing a pattern this month?) which he claimed he had not agreed to. The Southern District in Ohio held that the plaintiff had agreed to the settlement in exchange for a general release. The defendant motor carrier was not, however, successful in recovering attorney’s fees for the motion. Qureshi v. Indian River Transport, 2019 WL 4345697

The Supreme Court in South Dakota upheld a jury verdict in favor of one trucker against another trucker in an action arising out of a multi-truck accident. The court held that the circuit court did not abuse its discretion when it allowed plaintiff’s treating providers to testify about the permanency of his injuries, and its decision to allow undisclosed opinions about the impact of the injuries did not create prejudice sufficient to warrant reversal. The verdict of almost one millions was held not to be the result of passion or prejudice. Weber v. Rains, 2019 WL 4197109

A shipper was unsuccessful in its efforts to be removed from a personal injury action on the basis that it had sold the business before the loss. The Eastern District in Tennessee held that questions of fact remained as to the assignment of the logistics agreement. Bass v. Kodirov, 2019 U.S. Dist. LEXIS 161599

And yet another multi-truck accident decision! The District Court in New Mexico held that while it might have been advisable for the plaintiff to maintain his vehicle in the damaged condition before filing suit, the facts did not warrant an outright dismissal of the complaint or an adverse instruction regarding the evidence. The court denied the motion to dismiss for spoliation of evidence. Hernandez Concrete Pumping, Inc. v. Duquette, 2019 WL 4303323

The verdict against a trucking company for property damage when the vehicle collided with the plaintiff’s property was upheld in the Court of Appeals in Tennessee. The court agreed that while there was a negligence claim there was no evidence to support the claim for trespass or gross negligence or punitive damages. The court did allow for prejudgment interest. Twenty Holdings, LLC v. Land South TN, LLC, 2019 WL 4200970

A truck driver was successful in getting summary judgment on a negligence claim filed by a plaintiff following a truck accident. The Appellate Division in New York concluded that there was no material question of fact and agreed that the accident was caused by the driver of the passenger vehicle and not the truck driver. Nunez v. Nunez, 2019 WL 4418882

Same result for another driver and his employer in the Court of Appeals in Indiana. The driver had a fatal heart attack while operating his vehicle causing it to leave the roadway and damage property of the plaintiff. Even if the driver was statistically at an elevated risk for sudden death due to cardiac disease, and had three out of thirteen medical conditions that put him at a statistically higher risk of a vehicle crash he had a medical examiner’s certificate, had never had a heart attack and there was no way for anyone to anticipate the heart attack. Alexander v. Djuric, 2019 WL 4562408

The Northern District in West Virginia dismissed a third party complaint filed by a trucking company against the truck rental company. Under West Virginia’s current statutory scheme the third party plaintiff needed to allege sufficient facts to implicate the exception to the “several liability” now in place. Clovis v. JB Hunt, 2019 U.S. Dist. LEXIS 160359

A claim of gross negligence was dismissed against a trucker who backed into a plaintiff’s vehicle. The Southern District in Texas held that there was no issue of material fact to be resolved and the actions of the driver did not create an extreme risk of serious injury that rose above mere carelessness. Rollins v. Calderon, 2019 U.S. Dist. LEXIS 160577

While defendants, the driver and motor carrier, were unsuccessful in obtaining dismissal of a wantonness claim they were able to have claims of negligent hiring, training, supervision and entrustment dismissed. The Northern District in Alabama held that the allegations that the driver was not maintaining a safe distance, was not looking ahead, was driving at a dangerous speed, was distracted by electronic devices, and was fatigued from working more hours than permitted by the Federal Motor Carrier Safety Regulations was enough to support the wantonness claim. Laney v. Malone 2019 WL 4538520

A truck broker was successful in getting a personal injury action dismissed, leaving the plaintiff to pursue only a claim against the motor carrier. The Western District in Oklahoma that reading the safety exception under FAAAA to include a negligence claim alleging that the broker overlooked a r’s “conditional” rating and selected an unsafe motor carrier that used incompetent or careless drivers and entrusted its vehicles to such drivers would be an unwarranted extension of the exception to encompass a safety regulation concerning motor carriers rather than one concerning motor vehicles. Loyd. v. Salazar, 2019 U.S. Dist. 160694

Removal under diversity is not automatic when the plaintiff fails to allege that the damages suffered are under the $75,000 minimum jurisdictional requirement. The Middle District of Louisiana concluded that the defendant needed to specifically introduce evidence that the damages were in excess of the minimum. Chestnut v. Hodges, 2019 U.S. Dist. LEXIS 160725

Cargo

A motor carrier’s request for dismissal of state law claims under the doctrine of Carmack Amendment preemption failed in the Southern District of New York The court held that a contract which provides“[t]his contract service is designed to meet the distinct needs of the customer and the parties expressly waive all rights and obligations allowed by 49 U.S.C. 14101 to the extent they conflict with the terms of this contract” is an express waiver of the Carmack Amendment as the exclusive remedy. The court held that there was no need to specifically reference a waiver of ICTA. Aviva Trucking Special Lines v. Ashe, 2019 WL 4387339

In another decision the same court held that a motor carrier was liable only under the Carmack Amendment for damage which occurred when goods were transported from the pier in New Jersey to Connecticut. The court further held that the plaintiff did not establish a basis for jurisdiction in New York and agreed that a BOC-3 filing will not confer jurisdiction alone. Hartford Fire Ins. Co. v. Maersk Lines, 2019 WL 4450639.

Is a motor carrier liable for damages when it fails to pick up a shipment which is then damaged because it sat around too long in warm temperatures? The Southern District of Florida held that the motor carrier could be liable for breach of contract, but not negligence. The court held that contractual liability could arise before physical acceptance of the load. Underwriters at Interest v. All Logistics Grp, 2019 U.S. Dist. LEXIS 160033

Worker’s Compensation

The Court of Appeals in Illinois confirmed that the Illinois Guaranty Fund was not responsible for worker’s compensation benefits for an insurer in liquidation. The court concluded that the driver was legally employed by a trucking company who was actually insured by a solvent carrier. Worker’s compensation benefits were due from that insurer and not the Fund. The confusion over mergers of trucking operations is detailed in this decision, showing once again how critical it is to Know Your Insured. Illinois Insurance Guaranty Fund v. Priority Transportation, Inc. 2019 Il App (1st) 181454

The Missouri Court of Appeals affirmed a decision of Labor and Industrial Relations Commission to award workers’ compensation benefits to the plaintiff, an over-the-road truck driver who was diagnosed with post-traumatic stress disorder (PTSD) after his truck overturned on the interstate, after finding claimant had suffered permanent and total disability, and to award compensation for claimant’s wife’s past nursing services. Reynolds v. Wilcox Truck Line, Inc. 2019 WL 4418285

Thanks for joining us,

Jean & Chad