Hello Friends,

Happy Spring! What interesting experiences Mother Nature is throwing our way as we continue through convention season.

We wanted to remind you of an interesting upcoming industry event. The annual International Roadcheck inspection blitz is coming up May 14 – 16 at a weigh facility for portable inspection site near you! Commercial Vehicle Safety Alliance, CVSA, hosts this annual 72-hour event across Canada, the U.S., and Mexico to shed light on commercial vehicle inspections and each year have a different special emphasis of focus.

This year’s special emphasis is tractor protection systems and alcohol and controlled substances possession. The QR code below brings you to a CVSA bulletin on tractor protection systems.

We are out quite a bit lately. Hopefully, we can connect with you live at an event soon.

Chad Krueger and Pam Jones

CAB Live Training Sessions

Tuesday, April 9th | 12p EST MC Safety – Take Control of Your Data

Mike Sevret will take a deep dive into CAB’s MC Safety, a module within our motor carrier platform, MCA suite of tools.

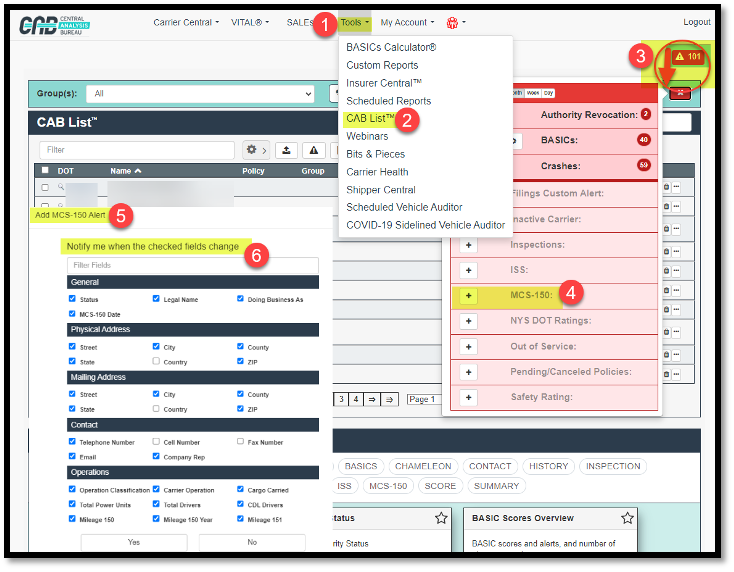

Tuesday, April 16th | 12p EST CAB List – Monitoring, Carrier Health, Summary Reports

Learn how best to utilize the CAB List® to monitor your book of business. Chad Krueger will talk about triggered alerts, analyze the health of your motor carriers and so much more.

CAB Events

- Georgia Motor Truck Association – Pam Jones & Mike Sevret are presenting “Maximizing Fleet Safety and Profitability through Data” to GMTA’s Safety Management Council 4/11 12P, Atlanta GA.

- International Marine Underwriters Association, IMUA, – 4/22-23 Sean Gardner and Dan Smith are attending.

- National Interstate & Vanliner Safety Summit – 4/22-23 Pam Jones & Mike Sevret are attending.

- ATA Safety Security & Human Resources Conference – 4/25 – 27 Pam Jones, Chad Krueger, and David Elliott are attending. Chad is presenting along with Rob Moseley of Moseley Marcinak Law Group LLP.

- MCIEF – 4/30-5/2 – Chad Krueger, Brian Stamper, and Dan Smith are attending.

To register for the webinars, sign into your CAB account. Then click live training at the top of the page to access the webinar registration.

Explore all of our previously recorded live webinar sessions in our webinar library.

Follow us on the CAB LinkedIn page and Facebook.

CAB’s Tips & Tricks

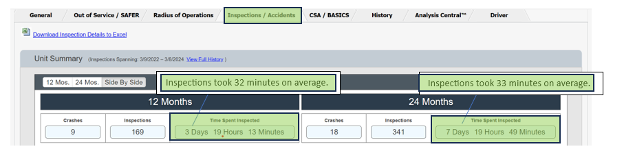

CAB includes inspection times on the CAB Report® in different ways. On the insurance platform, both time spent inspected in the last 12 months and 24 months is shared. Plus, if you hover over each of those breakdowns, you can see average inspection time for the specific time frames.

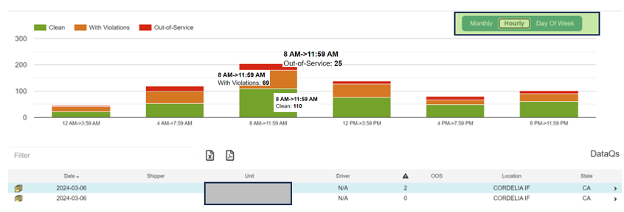

The MC Advantage Safety module also breakdown the inspection times but a little differently. Here you can break the data by the month, hour range, or day of the week. In addition, hovering over the different timeframes, offers the counts per timeframe.

THIS MONTH WE REPORT

Bill seeks to remove cost, redundancy from TWIC, hazmat certification. “Subjecting essential supply chain workers to the same exact background check multiple times in order to receive different credentials from the same agency does nothing to enhance security,” said American Trucking Associations (ATA) President and CEO Chris Spear. Read more…

EV charging for the U.S. freight trucking market is starting to scale. One of the first EV charging stations of scale for freight trucks is opening near the major ports of Los Angeles and Long Beach, California, as the trucking market takes some limited, but significant steps to build the infrastructure required for a long-term transition to EV trucking and net-zero shipping. Read more…

How owner-operators still standing have weathered big rates drops through the present. ATBS Vice President Mike Hosted and Overdrive contributor and trucking business coach Gary Buchs recently presented on the recently released MATS Partners in Business Owner-Operator Business Handbook. They reviewed average owner-operator numbers from 2023 and offered additional strategies for surviving the down market. Read more…

A trucking and rail strategy that boomed during pandemic shocks is heating up again. A push of freight cargo back to the West Coast ports has increased the use of “transloading,” a truck-to-rail or rail-to-truck strategy that was popular during the Covid supply chain shocks and some supply chain experts say is here to stay. Read more…

Population shift will soon drive trucking tidal wave, expert says. A freight trough that has plagued trucking since emerging from the COVID-19 pandemic is temporary, and recovery will be spurred by the largest housing, construction and consuming market in U.S. history, said author, demographer and generational marketer Ken Gronbach in his recent keynote address at the Truckload Carriers Association convention in Nashville. Read more…

House committee passes resolution to repeal Biden DOL contractor rule. Congress debated last week a Congressional Review Act (CRA) resolution that seeks to overturn the Department of Labor’s (DOL) final worker classification rule that upended how trucking and other industries classify independent contractors. Read more…

Congress Strengthens Truck Driver Apprenticeship Program. “We thank House and Senate appropriators for their bipartisan work to restore the Safe Driver Apprenticeship Pilot program to its original intent,” said Mark S. Allen, President and CEO of the International Foodservice Distributors Association. Read more…

Electrifying US trucking could cost nearly $1 trillion: study. Fleets and charger operators would have to invest $620 billion on infrastructure, and utilities would have to spend $370 billion to upgrade grid networks for commercial vehicles, per the study. Read more…

Bill seeks to remove cost, redundancy from TWIC, hazmat certification. A bill making its way through the Senate Thursday with bi-partisan support would eliminate redundant fees and background checks for transportation workers. Read more…

ATRI Issues Call for Truck Drivers to Participate in Detention Survey. American Transportation Research Institute today issued a call for truck drivers to provide data on their detention experiences at customer facilities. “Drivers routinely rank detention/delay at customer facilities among their top industry concerns,” said ATRI President Rebecca Brewster. Read more…

April 2024 CAB Case Summaries

These case summaries are prepared by Robert “Rocky” C. Rogers, a Partner at Moseley Marcinak Law Group LLP.

AUTO

Torres v. Minnaar, 2024 WL 778383, No. 4:23-CV-486 (E.D. Tex. Feb. 26, 2024). In this personal injury action arising from a collision between tractor-trailer and a passenger vehicle that resulted in the death of the plaintiffs’ decedent, the Texas District Court remanded the case back to Texas state court, finding that the FAAAA did not provide federal subject matter jurisdiction over the action. The plaintiffs filed suit, alleging the commercial driver entered the oncoming lane of travel and struck their son’s vehicle head on, resulting in his death. One of the logistics company defendants, the purported broker, removed the action to federal court on the basis that all claims were preempted under FAAAA and under the Grable doctrine on the basis that certain federal question issues were implicated. The court rejected these claims, finding that, while the FAAAA might afford a preemption defense to the logistics company, it could not create a federal question to provide the federal court with jurisdiction, as the act’s preemptive effects related to pricing, routing, and service of a carrier, broker, or freight forwarder did not constitute “complete preemption.” Because the “complete preemption” requirement was not met, the court could not exercise jurisdiction over the matter. As for the Grable argument, the court found that only a small number of claims premised upon federal law could be maintained under this doctrine, and it found that there was no such claim here, as the FAAAA did not implicate Grable. Thus, the Court remanded the case back to state court for further proceedings.

Trujillo v. Moore Bros., Inc., 2024 U.S. Dist. LEXIS 51355 (D. Colo. 2024). In this lawsuit stemming from a motor vehicle accident, Defendants, an owner-operator/owner of the involved tractor and motor carrier/owner of the involved trailer, moved to dismiss Plaintiff’s claims for (1) negligent hiring, retention, training, monitoring, supervising, and entrustment and (2) negligent selection of an independent contractor. The Plaintiff alleged that a faulty trailer was a proximate cause of the Accident. In the magistrate’s Report and Recommendation, the Court found that Plaintiff failed to allege facts that support a reasonable inference that (1) the involved tractor-trailer driver was incompetent at the time he was hired or (2) the Defendants failed to reasonably investigate when they hired the driver. Critically, for the negligent hiring claim, the court explained that while the operative pleading alleged the driver was incompetent on the date of the Accident, the pleading failed to allege facts supporting that he was incompetent to operate a CMV when hired. Similarly, the court found the pleading failed to allege sufficient facts establishing how the Defendants allegedly failed to investigate the driver before hiring him. As such, the allegations in the Complaint with respect to the negligent hiring claim were found to be nothing more than conclusory allegations, which is insufficient to survive a motion to dismiss under the federal standard. As for the negligent retention claim, the court found such a standalone cause of action was not recognized under Colorado law, separate and distinct from the negligent supervision claim. For the negligent supervision, retention, and training claim, the court stressed the relevant standard under Colorado law requires the plaintiff to allege facts supporting that the employer knew or should have known the employee’s conduct would subject third parties to an unreasonable risk of harm. Viewing the operative pleading under this standard, the court found that the well-pleaded facts permitted the court to reasonably to infer that Defendants knew before the accident that it was the driver’s usual practice to do cursory vehicle inspections on equipment, or his pre-trip inspection of the trailer on the morning of the accident was cursory. As such, these claims survived the motion to dismiss. For the same reasons, the negligent entrustment cause of action survived Defendants’ motion to dismiss. Last, the Court held that in Colorado, claims for the negligent selection of contractors are treated as analogous to the negligent hiring claim; as such, the Magistrate recommended dismissal of the negligent selection of an independent contractor cause of action for the same reasons as the negligent hiring claim.

Gold v. Carter, 2024 U.S. Dist. LEXIS 43968 (W.D. Pa. 2024). This lawsuit stems from a motor vehicle accident between a tractor trailer and four vehicles stopped in traffic from another accident. Immediately prior to the accident at hand, a nearby CMV driver warned the defendant driver, who was operating the involved tractor trailer, via CB radio to reduce his speed for an upcoming accident. Plaintiffs asserted the Defendant driver violated FMCSA regulations as he was traveling at an excessive rate of speed, despite the radio warning, and much faster than was prudent for the heavy rainfall. Plaintiffs also allege that Defendant Motor Carrier knew or had reason to know of the driver’s incompetency or inexperience. Defendants moved to dismiss the claims for punitive damages and strike certain allegations that reference “recklessness,” “intentional conduct,” “wanton conduct” and “other averments which would form the basis for punitive damages.” The District Court for the Western District of Pennsylvania explained that a “punitive damages claim must be supported by evidence sufficient to establish that (1) a defendant had a subject appreciation of the risk of harm to which the plaintiff was exposed and that (2) he acted, or failed to act, as the case may be, in conscious disregard of that risk.” Further, a principal may be held vicariously liable for punitive damages if the actions of its agent were “clearly outrageous, were committed during and within the scope of the agent’s duties and were done with the intent to further the principal’s interests.” Under this standard, the Court found that Plaintiffs’ allegations plausibly support a remedy of punitive damages based on the following: (1) the Driver operating the truck at a high rate of speed given the location and circumstances; (2) the Driver violated FMCSA regulations; and (3) the Driver was warned by a fellow driver to reduce speed. Further, Defendants failed to show how they suffered harm from the references to averments supporting punitive damages claims. As such the Court denied both the Motion to Dismiss and Motion to Strike.

Carter v. C&S Canopy, Inc., 2024 Miss. App. LEXIS 95 (2024). In this appeal of a trial court’s order granting summary judgment to the motor carrier and its driver, the Mississippi Court of Appeals upheld the summary judgment. At or around 3:30 p.m., the driver began to experience engine trouble with the CMV “running sluggish” before losing power. The driver pulled the inoperable CMV onto the shoulder of the interstate and placed out three warning triangles at intervals leading up to the disabled truck. The driver took a photograph of the triangles leading up to the vehicle and sent that to the motor carrier before departing for a nearby hotel. The following morning, around 1:30 a.m., another tractor-trailer approached the disabled vehicle and for reasons unknown, veered off the roadway and sideswiped the parked CMV. The plaintiff was asleep in the sleeper berth at the time of the collision and allegedly sustained injuries. Thereafter, the plaintiff filed suit against the motor carrier and driver. When the motor carrier and driver moved for summary judgment, the plaintiff opposed the motion by submitting an affidavit from Adam Grill, of the Legacy Corporation. The affidavit made various allegations of negligence by the driver, including: (1) the driver violated the Federal Motor Carrier Safety Regulations, state statute and industry standards when he parked and left unattended the truck on the paved portion of the highway; (2) the driver should have moved the truck to the nearest place where repairs could safely be effected; and (3) the driver incorrectly placed the warning devices behind the truck. As for the claims against the motor carrier, the affidavit alleged: (1) it violated state and federal law and industry standards by allowing the driver to park and leave unattended the truck on the paved portion of the highway; and (2) that the motor carrier failed to properly train or instruct the driver regarding the placement of the reflective triangles. The trial court granted summary judgment to the Defendants, finding there was no genuine issue of material fact, no evidence that the Defendants breached any duty, and no evidence that any alleged breach proximately caused the crash. The circuit court specifically found that dashcam video from the second tractor-trailer showed the triangle warning devices were in place and there was nothing in the record, including the affidavit, establishing how the placement of the triangles failed to comply with any applicable requirements. Further, the trial noted the analytical gap between any purported violation with respect to the placement of the triangles and establishing proximate cause of the Accident. Last, the trial court struck Grill’s affidavit in full, finding he did not address causation, his “opinions were not scientifically reliable,” and his opinions were not “helpful” to the extent he merely interpreted the video of the crash, but also noted that even without striking the affidavit there was no genuine issue of material fact. On appeal, plaintiffs raised additional grounds why the trial court allegedly should not have granted summary judgment, including that the driver negligently continued to drive a “sluggish” truck down the interstate rather than exiting; that the motor carrier negligently failed to have the truck towed sooner; that the driver violated Federal Motor Carrier Safety Regulations by placing emergency reflective triangles at incorrect distances behind his truck; that the driver broke the law by parking the disabled truck on the shoulder of the interstate; that the motor carrier lacked authority to operate as a “for-hire motor carrier”; that the motor carrier failed to train the driver; and that these various acts or omissions caused the Accident. The appellate court addressed each in turn, ultimately finding none of the additional arguments were sufficient to avoid summary judgment. The court found the record provided no evidence of how long the truck was “sluggish” before it became operable or that the driver failed to take advantage of an earlier opportunity to exit the interstate. Similarly, the court found that the record contained no evidence that the truck could have been towed sooner or that the motor carrier was somehow negligent in its attempts to get the truck towed sooner. As for the claims about improper placement of triangles, the court noted there was no evidence in the record to support the alleged distance between the warning triangle(s) and the vehicle or the distance alleged by plaintiffs. Further, the court noted that the plaintiffs’ alleged required distance misstated the applicable regulation because the involved roadway was a “divided highway” for which there were different standards. Further, even assuming arguendo any alleged negligent placement of the triangles, the court found any such failure was not the proximate cause of the Accident insofar as the driver of the second tractor-trailer, in which the plaintiff was an occupant, left his lane of travel to cause the Accident. The court applied a “reasonable and workable” interpretation of the state statute prohibiting operators from leaving vehicles on the paved part of a roadway, finding that a strict application would be unworkable and further that the evidence of the record established that the driver moved the disabled CMV as far off the roadway as was practicable under the circumstances. It further noted an exception in the statute for a disabled vehicle. As for the argument that the driver and motor carrier violated the law by not being a registered “for hire motor carrier” the court noted the driver held a valid CMV license and the motor carrier was licensed with FMCSA as a private carrier. Since the record evidence established that the driver was in the process of installing awnings for the motor carrier company at the time of the Accident, there was no support that a for-hire license/regulation was required. Further, the court noted the lack of a causal link between any alleged failure to have “for hire” licensure and the Accident. For the same reasons, the court found there was no support of negligent training of the driver. As such, the appellate court affirmed the trial court’s grant of summary judgment to the motor carrier and driver on all counts.

Oakley v. A.L. Logistics, LLC, 2024 U.S. Dist. LEXIS 45112 (M.D. Ala. 2024). In this lawsuit involving an accident where the decedent drifted into a broken-down tractor trailer parked inches over the fog-line on the shoulder, the decedent’s estate sued under the Alabama Wrongful Death Act asserting negligence and wantonness. Defendant moved for summary judgment, and the District Court for the Middle District of Alabama denied summary judgment on the negligence and wantonness claims, finding that genuine issues of material fact existed concerning foreseeability and proximate cause of the crash. The evidence of the record established that the driver of the tractor-trailer was operating on I-65 when he experienced mechanical issues, with the CMV ultimately breaking down. He parked the disabled CMV on the shoulder, but within inches of the “fog line” and on the rumble strip. The driver and the motor carrier decided to have the CMV repaired on the side of the roadway, rather than having it towed to another location for repairs. Approximately twelve hours later, around 2:15 a.m., plaintiff’s decedent began to veer off the roadway for unknown reasons before ultimately crossing the fog line and striking the rear of the disabled tractor trailer. Evidence of the record established there were no emergency or warning triangles placed behind the rig nor were the disabled tractor-trailers lights illuminated at the time of the Accident. Law enforcement that investigated the Accident determined that the CMV was legally parked but should have been towed to the nearest exit. Plaintiff brought suit against the driver and employer motor carrier alleging negligence and wantonness against both defendants. The defendants moved for summary judgment on all claims, contending that negligence by the plaintiff’s decedent was the proximate and intervening cause of the Accident. The court found that the motor carrier was entitled to summary judgment for the negligence/wantonness claims related to inspection, hiring, training, supervision, and retention, noting the lack of evidence in the record to support such claims. As for the remaining negligence and wantonness claims centered upon the decision to leave the disabled CMV on the roadway overnight, within inches of the lane of travel, and not having it towed, the court found the evidence created a genuine issue of material fact. Noting that proximate and intervening cause is most often an issue of fact, the court found the same held under the facts of the Accident. It noted there was sufficient evidence, if believed by a jury, to establish the driver and motor carrier knew or should have known of the foreseeable risk of injury to the motoring public in leaving the disabled CMV inches from the roadway without any illuminating lights or hazard triangles. The court found it was up to a jury to determine whether the plaintiff’s decedent’s actions were a sufficient intervening cause to overcome potential negligence by the CMV driver and motor carrier. Interestingly, the court’s decision does not address the FMCSR regulations regarding hazard triangles, but it did find the fact that the CMV was legally parked to be insufficient, standing alone, to entitle the driver and motor carrier to summary judgment in light of the other facts of the record. With respect to the heightened standard for wantonness under Alabama law, the court found there was sufficient evidence from which a jury could find that the driver made a “conscious and deliberate decision” to park the CMV where he did, without illuminating lights or hazards, and that the motor carrier’s decision against having the CMV towed, exposed other drivers to an unnecessary and hazardous risk. As such, the court denied summary judgment to defendants on the negligence and wantonness claims directly related to these actions.

BROKER

Milne v. Move Freight Trucking, 2024 WL 762373, No. 7:23-cv-432 (W.D. Va. Feb. 20, 2024) and Crawford v Move Freight Trucking, LLC, 2024 WL 762377, No 7:23-cv-433 (W.D. Va. Feb. 20, 2024). In these consolidated cases arising from the same accident on I-81 in Virginia, the District Court granted motions to dismiss claims for negligent entrustment, hiring, and retention; denied motions to dismiss by a shipper and broker on the ground of FAAAA preemption, among other defenses, and ordered jurisdictional discovery to determine whether it had jurisdiction over the shipper and broker. The accident occurred after the driver of a passenger vehicle allegedly fell asleep and struck a tractor-trailer parked on the shoulder of the interstate. The estate of the deceased passenger and the special conservator of another passenger in the passenger vehicle filed suit against the driver of the passenger vehicle, the driver of the tractor-trailer, the carrier, the purported broker, and the purported shipper, alleging the foregoing causes of action. The Defendants moved to dismiss on a number of grounds. The court granted the motor carrier’s motion to dismiss the plaintiffs’ negligent entrustment, hiring, and retention claims, finding that there were no allegations in the complaints to support any assertion that the carrier should have known its driver posed an unreasonable risk of harm to others. As for the negligent training and supervision claims, the court noted that Virginia did not recognize such claims. The shipper and broker also moved to dismiss all claims alleged against them, arguing that they were not subject to the court’s personal jurisdiction, that the complaints failed to state claims for negligence in the hiring of the carrier or its driver, and that all claims were preempted under FAAAA. As for the personal jurisdiction argument, the court noted that the plaintiffs alleged that the shipper and broker employed the driver and controlled his activities, and it allowed the parties to pursue discovery on the issue before reaching a determination. As for the argument that they were only the shipper and broker and that they could not be liable for any negligent hiring, retention, or respondeat superior claims, the court found that the plaintiffs had plausibly alleged such factual allegations and alleged the claims to survive for the time being. As for the FAAAA preemption arguments, the court outlined the split in authority from the Ninth Circuit’s holding in Miller v C.H. Robinson and the Seventh Circuit’s holding in Ye v. GlobalTranz Enterprises but found that the Fourth Circuit had not opined on the issue. However, the court noted that district courts in the Fourth Circuit had rejected FAAAA preemption, pointing to Mann v. C.H. Robinson, which found that preemption did not apply. Moreover, the court determined that, even if preemption applied, so too did the safety exception to the statute, reasoning “[s]tate law recognizes these tort claims in part to incentivize safe practices in the trucking industry. To preempt such claims would undercut an important tool in the states’ efforts to maintain reasonably safe roadways, a practice expressly shielded by the safety exclusion.” Finally, the court also declined to dismiss the plaintiffs’ punitive damages claims against the shipper and broker at this early stage in the litigation.

Meek v. Toor, 2024 WL 943931, No. 2:21-cv-0324 (E.D. Tex. Mar. 5, 2024). In this broker liability action, the federal magistrate judge denied a broker’s motion for summary judgment, rejecting its argument that the claims were preempted under the FAAAA. The case arose from a motor vehicle accident after a carrier’s driver was involved in a collision with the plaintiff. The plaintiff also sued the broker, arguing it was liable under a theory of negligent hiring of the carrier. The broker argued the plaintiff’s claim was preempted under the FAAAA. However, the court was not convinced, citing to a number of cases which held preemption did not apply to negligent hiring claims, which “bear only a tenuous relationship to ‘services’ provided by brokers…” In the court’s view, it was not convinced that “hiring and oversight of transportation companies is so central to the services of freight brokers that negligent hiring claims would significantly impact the services of a freight broker.” Moreover, the court found that, even if the claim did fall under the purview of the FAAAA’s preemptive effect, the safety exception would apply, finding “negligent hiring is a tort doctrine concerning the safety of the public, and that the safety regulatory exception is to be read broadly[.]” Notably, the court’s decision contained no discussion of Miller or Ye. The court also rejected the broker’s motion for summary judgment as to the plaintiff’s negligence-based claims, finding that the evidence could support liability against the broker.

CARGO

K&M Handling, LLC v. Seaboard Marina, Ltd., Inc., 2024 WL 985072, No. 23-cv-23180 (S.D. Fla. Mar. 7, 2024). In this cargo claim brought by a forwarding agent against an ocean carrier, the court denied the ocean carrier’s motion for a judgment on the pleadings and instead allowed the forwarding agent’s COGSA and breach of contract claims to proceed. The claims arose after a non-party, Orange Flowers, had contracted with the carrier to deliver two shipments of flowers from Colombia to Miami. The flowers were to be stored in refrigerated containers and kept at a certain temperature during the shipment. The forwarding agent alleged that the carrier failed to keep the flowers in the refrigerated containers, thus rendering them unusable, and it brought claims for breach of contract and under COGSA. The forwarding agent alleged that Orange Flowers had transferred its right to collect for the loss of the flowers and cited to a transfer of rights which referenced applicable bills of lading for the shipments. The ocean carrier sought dismissal of the claims, arguing the forwarding agent lacked standing to assert the claims as it was not the real party in interest. The carrier pointed to the forwarding agent not being included on the bills of lading to support its argument, but the forwarding agent pointed to the transfer of rights as allowing it to be the real party in interest. The court agreed with the forwarding agent, finding that the ocean carrier had failed to cite to any authority invalidating the assignment of the claim. The court noted that COGSA applied to the scenario but that it was silent as to whether the causes of action were assignable. However, because there was no authority prohibiting the assignment, the Court allowed the claims to proceed, also finding that the forwarding agent had standing to bring the suit.

KG Dongbu USA, Inc. v. Panobulk Logistics, Inc., 2024 WL 1141217, No. 23-27 C/W 23-6912 (E.D. La. Mar. 15, 2024). In this cargo claim involving alleged damage to steel coils, the court granted, in part, and denied, in part, numerous motions related to the enforceability of a limitation of liability provision in a shipping agreement. KG Dongbu shipped 140 steel coils from Korea to New Orleans, with SK Shipping hired as the ocean carrier to transport the coils. KG Dongbu also hired Panobulk as an intermediary forwarder to transport the coils from New Orleans to Illinois and Ohio and Cooper Consolidated via a Barge Transportation Agreement (“BTA”) to transport the coils by barge from New Orleans to Illinois. The specific barge was provided by Marquette Transportation to Cooper under a separate agreement. Panobulk and SK Shipping hired Coastal Cargo to offload the coils from the ocean vessel onto the barge. KG Dongbu then brought suit, alleging that Coastal pierced the hold of the barge while loading the coils, allowing river water to enter the hold and damage the coils, which were rejected by the buyer. KG Dongbu and its subrogated insurer then brought claims for breach of maritime contract, warranty, and bailment against Panobulk. Cooper, Panobulk, Coastal, and Marquette filed a number of counter and crossclaims, including among them arguments for contractual indemnity and raising a number defenses, including asserting that the package limitation clause of the BTA applied. The Cooper BTA provision provided that cargo loss was to be limited to $500 per unit or package and that the carrier would have “no liability for loss or damage to cargo , or for direct or indirect expenses or claims arising from or related to such loss or damage, until proper loading is complete, and the barge has been removed from loading facility by Carrier or its designated carrier. The BTA continued, providing that thereafter, Carrier shall only be liable to Shipper for loss or damage to the cargo which occurs during the voyage and in no event shall Carrier be liable for loss or damage to the cargo caused, in whole or in part, by: shrinkage, expansion, deterioration, or other changes in condition due to temperature changes, atmospheric humidity, or other natural causes; or navigational delays; or any vice or defect in the cargo. The BTA set forth that in the event of such loss or damage for which Carrier is liable, Carrier shall pay for lost cargo based on actual value at time of loss, and damaged cargo based on actual loss in value measured at time such damage occurred, up to a maximum limit of $500.00 per ton on bulk cargo or $500 per unit or package subjected to count….” Panobulk and KG Dongbu argued against BTA on the ground that they were not timely notified of the damage, that it was only between Cooper and Panobulk, that it was ambiguous, and that it applied only in instances of common carriage, among other arguments. Cooper argued the provisions were unambiguous, that they were enforceable, that Panobulk was not entitled to declare a higher value in a private contract pursuant to COGSA, and that Plaintiffs’ and Panobulk’s claims for unseaworthiness and negligence were not relevant to whether the limitation applied. Marquette joined in the argument for the limitation, arguing that the provision was a Himalaya Clause which extended to downstream parties. The court found that the limitation was appliable to Panobulk, as the contract was one for private carriage as opposed to common carriage. Moreover, because the BTA covered the inland shipping of the coils, COGSA did not apply but did not limit the applicability of the provision. As for Panobulk’s argument that it was not given an opportunity to negotiate the value of the limitation, the court disagreed, finding that the parties had included the provision in previous agreements. The court also disagreed that the provision was ambiguous and that Cooper’s alleged negligence prevented the enforceability of the agreement. Thus, the limitation was enforceable as to Panobulk. However, the court disagreed that it was enforceable as to the Plaintiffs, finding that such an extension to downstream parties was limited in the context of common carriage, not private carriage. The court also found that Marquette was not entitled to enforce the limitation for the same reason. Moreover, Marquette was not entitled to enforce it as against Panobulk, as it was not included as a party to the provision. The court reserved any further rulings, as determinations as to liability for the damage to the cargo had not yet been made.

Certain Underwriters v. Guyana Nat’l Indus. Co., Inc., 2024 WL 1174082, No. 23-cv-20172 (S.D. Fla. Mar. 18, 2024). In this claim involving cargo that was destroyed in a fire, the Court granted the defendant carriers’ motion to dismiss. The carriers had delivered the goods from Florida to a warehousing facility in Guyana in good condition. While at the warehousing facility, the goods were destroyed in a fire. The consignee, as subrogee of its insurer, brought claims against the warehousing facility, the carriers, and other related entities for negligence, breach of contract and statutory duty under the Pomerene Act, Breach of Bailment, and under COGSA. The defendants moved to dismiss, arguing that the Plaintiff had failed to state a claim under COGSA or the Pomerene Act, that it failed to state claims for common law negligence or breach of bailment, and on the ground that the court lacked personal jurisdiction over several of the defendants. Plaintiff argued that it had alleged a claim under COGSA because the goods were not delivered in good condition. The defendants argued COGSA did not apply because the loss did not happen until after the cargo was discharged from the vessel. The court agreed, finding that the agreement between the parties did not extend to the time that the shipment was stored at the warehousing facility and that, even if the bills of lading had done so, the plaintiff had failed to allege how the carrier defendants would be liable. As for the claim under the Pomerene Act, the court found that the plaintiff had cited it improperly in the complaint and that it should be dismissed and that, even if it had properly alleged the claim, it had failed to allege that the cargo was delivered to the wrong person, and, thus, the claim would fail. The court then declined to exercise jurisdiction over the remaining state law claims.

Zierke v. Am. Van Lines, Inc., 2024 WL 982587, No. 23-cv-00475 (D. Colo. Feb. 16, 2024). In this claim alleging certain failures in the delivery of the plaintiff’s goods, the federal magistrate judge recommended granting the defendants’ motion to dismiss on the basis of Carmack preemption. Plaintiff hired AVL to transport her belongings from California to Colorado. AVL then sent an affiliated company, Next Stop, to transport the goods. Plaintiff alleged Next Stop doubled the price and failed to timely deliver the goods. Plaintiff then filed suit against both entities, alleging a violation of the Colorado Consumer Protection Act (“CCPA”), conspiracy to violate the Colorado Organized Crime Control Act (“COCCA”), fraudulent misrepresentation in inducement to contract, breach of contract, Unjust Enrichment, and breach of the implied covenant of good faith and fair dealing. The defendants moved to dismiss, arguing that all the claims were preempted under the Carmack Amendment. Plaintiff alleged that it was not entirely clear whether AVL was operating as a carrier or a broker, but the court rejected this argument, finding that the Plaintiff had plainly asserted that AVL was acting as a carrier. Finally, the court cited a number of cases which held that each of the foregoing claims were preempted under the Carmack Amendment. Therefore, the court dismissed all claims.

Cell Deal Inc. v. FedEx Freight, Inc., 2024 WL 884846, No. 21-CV-788 (E.D.N.Y. Feb. 28, 2024). In this claim arising under the Carmack Amendment, the federal magistrate judge recommended that the motor carrier’s motion for summary judgment be denied. Company A hired a broker to arrange for the carrier to pick up a load of cell phones for delivery to Company A’s facility. The broker then hired the carrier, which picked up one pallet of phones, which were signed for and delivered in apparent good condition. However, a claim was later filed against the carrier, alleging the loss of four boxes of phones. The disputed shipment was the subject of an agreement that referenced the carrier’s tariff, which limited the carrier’s liability to 50 cents per pound per package or $10,000 per incident, whichever is lower. Following the incident, Company A sued the carrier under a theory of negligence. The carrier removed the action to federal court and argued for preemption under the Carmack Amendment. The carrier then moved for summary judgment, arguing that its maximum exposure was $153 pursuant to the terms of the bill of lading. Company A cross-moved for summary judgment, arguing for over $100,000 in damages under the Carmack Amendment. The carrier alleged that Company A failed to allege a prima facie showing under the Carmack because the amount of damages was contested and because it offered only inadmissible evidence as to the shipment’s condition before and after delivery. In viewing the evidentiary record, the court determined that the proper value of the claim could be as low as $12,796.50, the original amount of the declared loss by the shipper, or $115,866, the alleged cost of the lost cellphones. Thus, the court denied Company A’s motion for summary judgment. As for the carrier’s motion arguing for the limitation of liability, the court analyzed the claim under Carmack and looked to the agreement between the carrier and the broker, which incorporated the carrier’s tariff, and the bill of lading. In looking at the agreement, the court found that it might not have provided sufficient notice to the broker of the limitation of liability provision contained in the tariff, and that the carrier could not attempt to enforce the limitation of liability provision on this basis. The carrier also argued that the tariff’s limitation would have been communicated to Company A through the bill of lading. While the court acknowledged this was a “closer call,” but found that there was nothing to support that the limitation of liability provision was communicated directly to Company A, only to the broker. Thus, because the carrier did not establish that the agreement to limit its liability was “the result of a fair, open, just, and reasonable agreement” with Company A, the court declined to grant summary judgment to the carrier.

Collicutt Energy Servs. Inc. v. Trinity Logistics, Inc., 2024 WL 920556, No. 2:22-CV-00364 (E.D. Cal. Feb. 29, 2024). In this claim arising from alleged damage to industrial equipment, the court granted, in part, and denied, in part, a logistics company’s motion for summary judgment. The shipper contracted with a logistics company to transport two generators and related equipment from Wisconsin to California. The logistics company then contracted with two carriers to transport the generators. However, during transit, the drivers for the two carriers drove under overpasses that were too low, causing severe damage to the generators. The shipper purchased replacement generators and sought reimbursement from the logistics company, which disclaimed liability and directed the shipper to the carriers. The shipper sued all of the entities under Carmack and, alternatively, for breach of contract and negligence against the logistics company. The logistics company moved for summary judgment, arguing that it was a freight broker and that Carmack did not apply, that there was no evidence it was negligent, and that it did not breach its contract with the shipper. The shipper argued the logistics company held itself out as a carrier during their communications, and the court agreed that the communications created a genuine issue of material fact as to whether the company held itself out as a carrier. However, the court agreed with the logistics company as to the shipper’s negligence claim, finding that the shipper had failed to establish a legal duty in tort to insure the subject loads and confirm their safe delivery. As for the breach of contract claim, the court found that the previously referenced communications between the shipper and logistics company created a genuine issue of material fact with respect to the logistics company’s obligations under the contract. Thus, it denied the company’s motion for summary judgment as to the breach of contract claim.

Baldwin v. Am. Van Lines, Inc., 2024 WL 921396, No. 3:23cv474 (E.D. Va. Mar. 4, 2024). In this action involving claims for damage to household goods, the court dismissed certain claims against a carrier and remanded others to state court for further proceedings. The plaintiffs hired the HHG carrier to move their belongings from Virginia to Georgia. A representative of the company indicated that its workers would disconnect all appliances during the move. The plaintiffs were set to purchase their new residence in Georgia, contingent upon the sale of their residence in Virginia. When the HHG carrier’s workers arrived to begin loading the plaintiffs’ goods, an employee “broke the washing machine water supply pipes,” flooding the house for over an hour and causing the ceiling over the garage to collapse. After the flooding, the plaintiffs requested the moving company transport the goods to a restoration company, but the company’s employee refused the request, insisting that he had to drive the van to North Carolina for the evening and deliver property for a different move, despite the agreement that the plaintiffs’ move was to be the exclusive move. The moving company also allegedly refused to allow the plaintiffs to review and sign the bill of lading. The plaintiffs later recovered a portion of their property damage from their insurer and later sued the moving company, alleging claims for conversion, a violation of the Virginia Consumer Protection Act, breach of contract, fraud, and for punitive damages, seeking a minimum of $41,000. The moving company filed a motion to dismiss, arguing that all claims were preempted under Carmack. The court rejected this argument, finding that the conversion claim was not preempted, as its assertion of $1,500 in damages would not fall under Carmack’s $10,000 threshold. As for the other claims, the court found that each of them were preempted under Carmack, as they all related to the services the company provided as a carrier. The court also found that the plaintiffs had failed to allege support for a punitive damages claim. Thus, the court mostly granted the motion to dismiss and remanded the $1,500 conversion claim to state court.

Total Quality Logistics, LLC v. All Pro Logistics, LLC, 2024 WL 911933, Nos. CA2022-11-078 and CA2022-12-082 (Ohio Ct. App. Mar. 4, 2024). In this action filed by a broker against a motor carrier, the Ohio Court of Appeals affirmed, in part, and reversed, in part, a trial court’s grant of summary judgment and motion to dismiss. The broker filed suit after it arranged for the carrier to transport a load of blueberries from New Jersey to Michigan. The carrier picked up the blueberries, signed the bill of lading, and delivered them to a grocery facility in Michigan. However, the blueberries were rejected because they were frozen and in damaged condition. The broker then reimbursed its client and directed the carrier to transport the blueberries to a third party for potential salvage. The broker later filed suit against the carrier, alleging breach of contract claims. It also received an assignment from its customer and asserted additional claims, including under the Carmack Amendment. The broker obtained a default judgment against the carrier, but the carrier was later allowed out of default. The broker later obtained summary judgment on its Carmack claim and on the carrier’s counterclaim for recoupment of the funds seized by the previous garnishment. The trial court denied summary judgment as to the broker’s other claims, and the broker appealed. In reviewing the appeal, the appellate court noted that it was unclear why the trial court determined the broker’s claims were so limited, but it found that a broker carrier agreement superseded the common law right to indemnification from a carrier for monies that it paid a customer for cargo loss. Given that the broker carrier agreement here contained multiple provisions as to indemnification and financial responsibility for cargo loss, the court reversed the denial of summary judgment on those claims. In considering the carrier’s cross-appeal of the trial court’s grant of summary judgment in favor of the broker as to the Carmack claim, the court found that the lower court correctly found that the broker had asserted a prima facie case under Carmack following the assignment by its customer.

COVERAGE

Ocean Reef Charters, LLC v. Travelers Prop. Cas. Co. of Am., 2024 WL 776026, No. 23-CV-81222 (S.D. Fla. Feb. 26, 2024). In this bad faith action, a Florida federal magistrate judge recommended that punitive damages claim against an insurer over its alleged failure to properly investigate a damaged yacht claim should be dismissed. The court ruled that the allegations did not support the higher standard needed to show malicious behavior or reckless disregard by the insurance company. In so ruling, the court found that the insured’s claim excluded the equally plausible conclusion that the insurer had acted negligently rather than with the higher mens rea needed for punitive damages. The Eleventh Circuit had previously upheld a more than $2 million award to the insured stemming from an insurance claim after Hurricane Irma damaged the yacht and caused it to sink. In ruling that punitive damages must be proven by clear and convincing evidence, the court said that allegations of “similar bad faith conduct” is a legal conclusion, not a fact, and that the allegation that an insurer failed to properly investigate a claim, standing alone, does not necessarily imply willful, wanton, or malicious behavior, or reckless disregard for the rights of its insureds. Moreover, the court found that two other instances of conduct are not sufficient to plausibly allege a general business practice.

Markuson v. State Farm Mut. Auto Ins. Co., 2024 WL 817545, No. 2D21-2443 (Fla. Dist. Ct. App. Feb. 28, 2024). A Florida appeals court clarified a prior ruling reviving bad faith claims against an insurer for rejecting an offer to settle a car crash injury suit that led to a $3 million verdict. The dispute stemmed from a 2006 car crash involving the plaintiff and a permissive driver of the insured, who was driving a vehicle owned by his father. The plaintiff sued the father and son (“Tort Defendants”) for damages for his injuries caused by the crash. The Tort Defendants’ insurance policy with State Farm had a $300,000 limit against liability for bodily injuries sustained in a crash, and the insurer made a settlement offer that was rejected by the plaintiff, who later made two settlement counteroffers that would have required the insurer to tender the $300,000 policy limits, authorize a consent judgment of $1.9 million, and authorize the Tort Defendants to assign their rights in any claims against their insurance agent. The insurer rejected those proposals, and, at trial, a jury returned a verdict of more than $3 million for the plaintiff. The plaintiff and the Tort Defendants sued the insurer, claiming the insurer acted in bad faith when it failed to settle the personal injury action. The insurer asked for summary judgment, arguing that it did not act in bad faith because the proposals for settlement included consent judgments above the policy limits and it owed no duty to the insured(s) to enter into such a settlement. The court found that the insurer could still have acted in bad faith in handling the settlement offer even if it had no obligation to accept it. The appellate court ruled that while the trial court correctly determined that the insurer did not have a duty to enter a consent judgment in excess of the policy limits, and therefore could not have committed bad faith in rejecting the settlement counteroffers, the trial court nevertheless should not have granted the insurer summary judgment on the bad faith claims because the suit alleged other theories of bad faith as well. As such, the appeals court reversed the trial court’s summary judgment and remanded the case for consideration of the remaining possible theories of bad faith. In expounding on the decision, the appeals court said its decision is limited to the theory of bad faith under a 2015 Eleventh Circuit decision that held an insurer has no duty under Florida law to enter a consent judgment that exceeds the limits of its policy. However, the insurer could still face other types of bad faith claims, including theories governed by a 1980 Florida Supreme Court ruling, which says an insurer “has a duty to use the same degree of care and diligence as a person of ordinary care and prudence should exercise in the management of his own business.”

WORKERS COMPENSATION

No cases of note to report this month.