Hello All,

Crazy how school supplies have been out in stores for a few weeks now which reiterates that summer is flying by! Hope you all are getting a chance to enjoy the sun, festivals, activities and other summer fun.

As you may have seen in an earlier Bits & Pieces, Pam Jones made a career detour and joined the CAB Team recently! She will be assisting me with some projects like these monthly newsletters.

Here’s a comment from Pam:

Hello All! Looking forward to meeting you if we haven’t already crossed paths! I’ve been a CAB user and love the system. Now, I am seeing even more ways the platform supports the industry, for instance with claims management. Those that know me, know I’m passionate about getting every driver home from every trip while protecting the traveling public. If you aren’t utilizing your platform to the fullest capabilities, check out our archived webinars or let’s talk and get some training scheduled.

Now, let’s check out what’s currently up at CAB so you can get to those glue sticks and pencils before inventories run out.

Happy rest of summer!

Chad Krueger and Pam Jones

CAB Live Training Sessions

Tuesday, August 8th | 12p EST

Pam Jones will be hosting the monthly live webinar covering The CAB Report. Join us to hear more as we provide a detailed page by page overview of the CAB Report®, the data contained within, and the features available. This is a great session for newer and experienced users.

Tuesday, August 15th | 12p EST Mike Sevret will be covering the Motor Carrier Advantage Safety Module demo. Check this session out to hear more features we’ve implemented into the fleets’ version as requested by clients. Check out the Tips & Tricks section for more details.

To register for the webinars, sign into your CAB account. Then click live training at the top of the page to access the webinar registration.

Explore all of our previously recorded live webinar sessions in our webinar library.

Follow us on the CAB LinkedIn page and Facebook.

CAB’s Tips & Tricks: Motor Carrier Advantage Enterprise Service

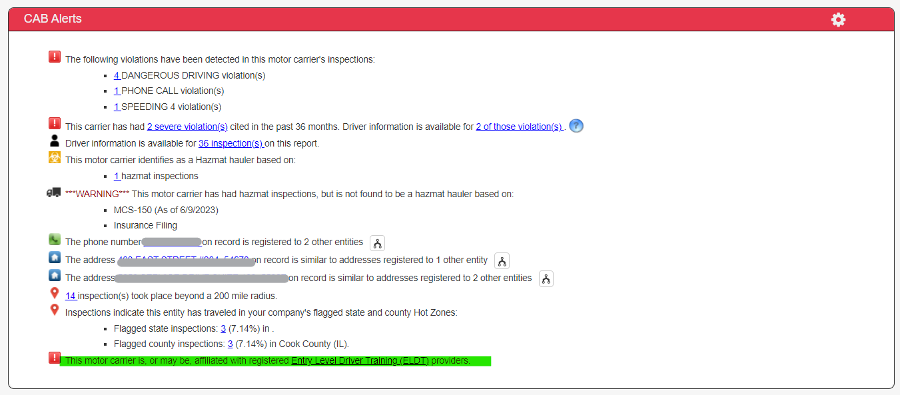

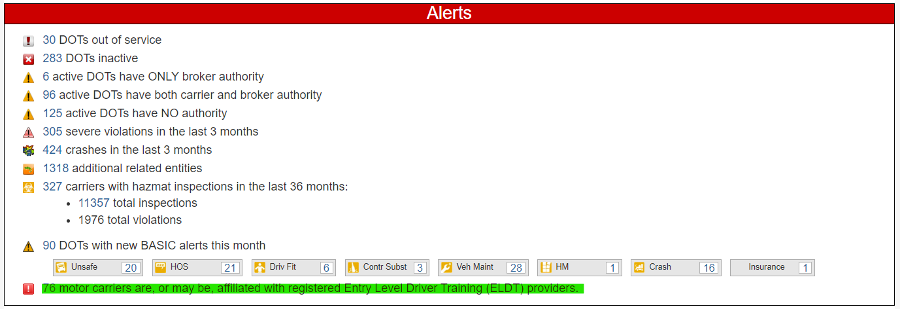

Many are aware of our initial version of Motor Carrier Advantage. The initial version of the resource has been available for over a year. Our users have asked for expanded capabilities and our development team responded with their typical excellence. Therefore, we’ve expanded Motor Carrier Advantage Safety Resource to include things like: Express Report, Safety Plan and additional Alerts.

Below is a brief description of the three modules that are available in the new Motor Carrier Advantage Enterprise Service.

We’re currently offering a free trial of the Motor Carrier Advantage Safety module! Learn more at www.themcadvantage.com or reach out to Mike Severt.

THIS MONTH WE REPORT

Brake Check Safety Week is Aug. 20-26. The Commercial Vehicle Safety Alliance (CVSA) will be focusing on brake lining/pad violations during this year’s Brake Safety Week. Read more…

CVSA Releases 2023 International Roadcheck Results. In May, 59,429 commercial motor vehicles were inspected in Canada, Mexico and the U.S. as part of the Commercial Vehicle Safety Alliance’s (CVSA) 72-hour International Roadcheck inspection. Eighty-one percent of the commercial motor vehicles and 94.5% of the commercial motor vehicle drivers inspected did not have any out-of-service violations. Read more…

US trucking firm Yellow shuts ops, to file for bankruptcy, Teamsters say. Cash-strapped U.S. trucking company Yellow Corp has ceased operations and is filing for bankruptcy after failing to reorganize and refinance over a billion dollars in debt, the Teamsters Union said. Read more…

New federal fines for Hours of Service, ELDs, range from $300 to $2,000. Truck drivers and carriers face 60 new federal fines for Hours-of-Service violations – including those specific to mandated electronic logging devices (ELDs). Read more…

Enforcement and awareness campaign aims to teach safe driving practices around commercial vehicles. Together, We Make I-81 Safer campaign is a multistate initiative helping to “discourage unsafe driving behaviors” that lead to crashes with commercial motor vehicles. The three-month campaign, which began in June and runs through August, will see “extra patrols and proactive traffic enforcement” along the entirety of the I-81 corridor. Read more…

Researchers say urine testing misses about 90% of actual drug use. Researchers at the University of Central Arkansas concluded that urinalysis, the primary means of Department of Transportation (DOT) truck driver drug screenings, misses about 90% of actual drug use. Read more…

Digital transformation in carrier safety: Striking a balance between tech & financial security. CCJ provides an overview of the principal technologies driving digital transformation in the commercial carrier industry from IoT to AI-powered predictive maintenance. Read more…

Gaming out crash preventability: An Opinion Piece by David Heller from the Truckload Carriers Association. “Professional truck drivers have earned the title of “most well-trained driver on our roads today,” but they often are placed in situations where nothing could have been done to prevent accidents. According to data and RDR submissions by motor carriers, this scenario has occurred nearly 28,000 times over the past three years…it is the responsibility of each carrier to provide information on the crashes that are being investigated. If FMCSA is unaware of the preventability question, it cannot possibly make a determination, another version of the you-can’t-win-if-you-don’t-play mentality.” Read more…

August 2023 CAB Case Summaries

These case summaries are prepared by Robert “Rocky” C. Rogers, a Partner at Moseley Marcinack Law Group LLP.

AUTO

Baker v. Amazon Logistics, Inc., 2023 U.S. Dist. LEXIS 129651, C.A. No. 23-2078 (July 26, 2023). In this multiple-defendant personal injury action arising from a motor vehicle accident involving a tractor-trailer, the case was remanded to state court due to procedural deficiencies with the removal. Plaintiff sued approximately ten different defendants. Amazon removed the case to federal court on June 13, 2023, based upon alleged diversity of citizenship. One insurer defendant, Lancer, filed a consent to removal on June 26, 2023. Another set of defendants filed a consent to removal on June 27, 2023. According to Fifth Circuit precedent, the “rule of unanimity” required for removal requires that each served defendant join in the notice of removal or that there be a “timely filed written indication from each served defendant, or from some person or entity purporting to formally act on its behalf in this respect and to have authority to do so, that it has actually consented to such action.” The court found that several defendants had been properly served yet failed to either join in Amazon’s removal or file notices of consent within the 30-day period for removal. The court rejected that emails between counsel for Amazon and counsel for those defendants indicating consent to removal was sufficient to meet the requirement and further noted that the emails were not placed into the court’s record within the 30-day period for removal. As such, the court remanded the case to state court.

BROKER

Ye v. GlobalTranz Enters., 2023 U.S. App. LEXIS 181137, C.A. No. 22-1805 (7th Cir. July 18, 2023). The Seventh Circuit Court of Appeals affirmed the lower trial court’s ruling that a tort plaintiff’s wrongful death claim against a freight broker alleging negligent selection of a motor carrier was expressly preempted by the Federal Aviation Administration Authorization Act, 49 U.S.C § 14501(c)(1) (“FAAAA”). The court specifically rejected that the safety exception to preemption provided in subsection 14501(c)(2) precluded preemption because Congress required motor carriers—not brokers—to bear responsibility for motor vehicle accidents. The court found the nature of the allegations struck at the core of the services provided by a freight broker—selling, providing, or arranging for, transportation by motor carrier for compensation—because the allegations challenged the adequacy of care the broker took or failed to take in hiring the motor carrier. The court found that enforcing such a claim via private cause of action would have a significant—not tenuous, remote, or peripheral—economic effect on broker services. In so holding, the court rejected the Ninth Circuit’s analysis in Miller v. C.H. Robinson Worldwide, Inc., 976 F.3d 1016 (9th Cir. 2020), which held the safety exception to FAAAA operated to prevent preemption of such claims. The safety exception under FAAAA provides that laws within a state’s “safety regulatory authority . . . with respect to motor vehicles” are not preempted. The court did not focus upon whether a state tort law is part of its “safety regulatory authority”, noting several other courts had found that to be the case, but instead based its ruling on the finding that a common law negligence claim enforced against a freight broker is not a law that is “with respect to motor vehicles.” Drawing from Congress’s definition of “motor vehicles”, the court concluded that the exception requires a direct link between a state’s law and motor vehicle safety and further found there was no such “direct link” between negligent hiring claims against brokers and motor vehicle safety. It further contrasted the specific mention of broker services in subsection 14501(c)(1)—providing for preemption, with the complete lack of mention of broker services in the safety exception contained within subsection 14501(c)(2), thereby finding the omission was intentional. Last, the court emphasized the overarching goal of Title 49 and related regulations is to regulate motor vehicle safety and the limited mention of brokers therein relating to records retention, advertising, and avoiding conflicts with shippers further enforces that the FMCSA “imposes safety standards on broker hiring or otherwise recognizes a relationship between brokers and motor vehicles.” The court concluded by pointing out three possible explanations for the differing ruling by the 9th Circuit in Miller and explaining why the 9th Circuit’s analysis on each of those points was, in the 7th Circuit’s opinion, flawed. The conflicting rulings from different Circuit Court of Appeals may weigh in favor of the Supreme Court now taking up the issue, which it had previously declined to do on appeal from the 9th Circuit decision in Miller.

Pruitt v. Hansen & Adkins, Inc., 2023 U.S. Dist. LEXIS 119608, 2023 WL 4494192, C.A. No. 2:23-cv-167 (M.D. Ala. July 12, 2023). The federal court remanded a personal injury action against a freight broker alleging negligent hiring of a motor carrier to state court, finding that FAAAA, even if it preempted the state law causes of action, did not confer federal question jurisdiction before the federal court under the rare “complete preemption” doctrine. In so holding, the court distinguished between complete preemption and ordinary preemption. It explained that a case may not be removed to federal court premised upon a federal question defense, including the defense of preemption (i.e., ordinary preemption).

CARGO

Landstar Ranger, Inc. v. Triple M Logistics, Inc., 2023 U.S. Dist. LEXIS 129554, C.A. No. 3:22-cv-00056-HES-LLL (M.D. Fla. June 28, 2023). In this stolen freight dispute, the court refused to allow a downstream motor carrier to benefit from limitations of liability contained in upstream contracts, finding that the motor carrier itself had affirmatively agreed to a higher limitation of liability. The case involved a stolen load of 28 pallets of computers. Acer contracted with Expeditors for distribution services from Texas to Florida. The Acer-Expeditors agreement limited Expeditors’ liability to .50 cents per pound, absent a higher declaration of value by Acer. The Acer-Expeditors agreement allowed Expeditors to subcontract its obligations. Expeditors tendered the shipment to Landstar Ranger, another property broker. The Expeditors-Landstar agreement limited Landstar Ranger’s liability to $250,000. Landstar Ranger, in turn, contracted with Triple M as the for-hire motor carrier. The Landstar-Triple M agreement limited Triple M’s liability to $1,000,000 and further contained an integration clause confirming it constituted the entire agreement between Landstar Ranger and Triple M. The computers ultimately went missing while under Triple M’s exclusive control, and the total value of the missing cargo was determined to be $760,290.72. Expeditors paid Acer $160,000 (i.e., more than provided for under the limitation of liability in the Expeditors-Acer contract), and Landstar Ranger subsequently reimbursed Expeditors in that amount. Acer assigned Landstar Ranger its rights against Triple M, and Landstar Ranger subsequently filed suit against Triple M for $160,000. In defense, Triple M claimed it was entitled to the $.50 per pound limitation of liability contained in the Acer-Expeditors contract, meaning its liability would only total $8,685.00. Triple M argued that Landstar Ranger, as a freight broker, only had standing to bring a Carmack claim against it by virtue of the assignment from Acer and, as such, would be subject to the $.50 per pound limitation of liability that Acer accepted via the Acer-Expeditors agreement. In response, Landstar Ranger claimed it should be treated as a motor carrier entitled to pursue apportionment/contribution from Triple M—another motor carrier—pursuant to 49 U.S.C. § 14706(b) because Landstar Ranger “took legal responsibility for the computers” and, therefore, the Landstar-Triple M agreement with its $1 million limitation of liability applied. The court acknowledged Carmack does not apply to brokers but, relying upon statutory definitions and case authorities, explained that any entity that “agree[s] with the shipper to accept legal responsibility for that shipment” is not a broker. Looking to the Expeditors-Landstar agreement, the court found Landstar Ranger accepted responsibility for claims for loss or damage to cargo, and, therefore, constituted a motor carrier, not a broker, in connection with the shipment. In determining which of the various agreements and corresponding limitations of liability applied, the court relied upon the Eleventh Circuit’s decision in UPS Supply Chain Sols. Inc. v. Megatrux Transp., Inc., 750 F.3d 1282 (11th Cir. 2014), which the court found established downstream carriers cannot benefit from upstream contracts when the carrier itself negotiates for greater liability and does not participate in negotiating the upstream contracts. Applying the Megatrux rule, the court found that, because Triple M was not involved in negotiations for any of the “upstream” contracts, it could not benefit from any limitations of liability contained therein. Moreover, since Triple M directly participated in negotiating the Landstar-Triple M agreement, with its $1,000,000 limitation of liability, it was bound by the terms of that agreement. The court, therefore, granted summary judgment in favor of Landstar Ranger in the amount of $160,000.

Bunis v. Masha Mobile Moving & Storage, LLC, 2023 U.S. Dist. LEXIS 120012, 2023 WL 4494174, C.A. No. 23-1237 (E.D. Pa. July 12, 2023). In this action arising from alleged lost or damaged household goods, the court dismissed, as preempted by the Carmack Amendment, various state law causes of action. The plaintiff contracted with a household goods carrier to move her personal belongings from Pennsylvania to Illinois. As part of this contract, she purchased a series of premium services for “general packing and unpacking services, disassembly, packing and reassembly of several large furniture items, and specialty packaging and packing services for [her] lawn mowers and tools.” Between July 2021 and August 2022, the carrier packed the plaintiff’s belongings into twelve storage containers. It stored them until November 2022 at which time the plaintiff was completing her move to Illinois. Upon arrival in Illinois, the plaintiff’s goods appeared to have been tampered with, padlocks removed, certain items damaged, and numerous items were missing altogether. After the motor carrier’s insurer denied the claim, the plaintiff filed suit alleging a single claim under the Carmack Amendment, as well as causes of action for breach of contract, conversion, violating the Pennsylvania Unfair Trade Practices and Consumer Protection Law, unjust enrichment, fraud, and negligent infliction of emotional distress. The motor carrier moved to dismiss all causes of action other than the Carmack claim. The plaintiff contended that Carmack preemption did not extend the alleged actions that occurred solely within the geographical boundaries of Pennsylvania and that the intrastate packing, storage, and movement solely within Pennsylvania were independent of the eventual interstate move to Illinois. Ultimately, the court rejected the plaintiff’s argument, finding that under the broad definition of “transportation” all the ancillary services fell within the purview of Carmack preemption. Moreover, it found the “temporary storage” in Pennsylvania was also part of the overall contracted interstate transportation, and, therefore, fell within Carmack preemption.

Cariati Devs., Inc. v. XPO Logistics Freight, Inc., 2023 U.S. Dist. LEXIS 115119, C.A. No. 3:22-cv-0383 (D. Conn. July 5, 2023). In this action, the court held a negligence cause of action against multiple motor carriers was preempted by the Carmack Amendment. The plaintiff attempted to avoid Carmack preemption, arguing that the damages it alleged were separate and distinct from the loss or damage to the goods. Specifically, the plaintiff alleged “loss of a business contract” as well as “money spent on inventory to further perform the contract.” However, the court found “all damages allegedly flowed from the harm to or misdelivery of the [cargo] at issue[]” and, therefore, “[t]he negligence claim is essentially a claim for damages or loss of the goods in disguise.” Since all alleged damages flowed from the defendants’ alleged conduct in transporting the goods and resulting damage to and/or loss of the goods, Carmack preemption applied.

COVERAGE

Allied Premier Ins. v. United Financial Casualty Co., 2023 Cal. LEXIS 4236, 2023 WL 4696261, C.A. No. S267746 (Cal. July 24, 2023). On a certified question from the Ninth Circuit Court of Appeals, the Supreme Court of California held that a commercial auto liability policy did not remain in effect until such time as the insurer cancels the Form E/F filing/endorsement/Certificate of Insurance on file with the California Department of Motor Vehicles as required by the California Motor Carriers of Property Permit Act, but rather, the policy’s cancellation date is determined by that provided under the policy itself. It was undisputed that at least one Certificate of Insurance on file with the CADMV had not been cancelled as of the date of the at-issue accident. The court explained the nuanced holding as follows: “[w]e hold an uncancelled certificate of insurance that remains on file with the DMV does not cause the corresponding insurance policy to remain in effect in perpetuity. But that is not to say that an uncancelled certificate of insurance imposes no obligation of any kind on the responsible insurer. The statutory scheme suggests otherwise.” However, the court did not reach the question of whether an uncancelled Certificate of Insurance would create any surety obligation upon an insurer in such circumstances, specifically noting that the Ninth Circuit had not certified that question to the court.

WORKERS COMPENSATION

No cases of note to report.