Why do we celebrate Labor Day? According to the U. S. Department of Labor, “Observed the first Monday in September, Labor Day is an annual celebration of the social and economic achievements of American workers. The holiday is rooted in the late nineteenth century, when labor activists pushed for a federal holiday to recognize the many contributions workers have made to America’s strength, prosperity, and well-being.”

Both the United States and Canada will be celebrating Labor Day on Monday, September 5th. We hope everyone enjoys this break as we head into the last part of the year.

For CAB, September starts an active stretch as we will be attending InsurTech Connect the week of September 18th in Las Vegas, and a couple weeks later we’ll be at the Motor Carrier Insurance Education Foundation (MCIEF) annual Seminar in Orlando. We look forward to seeing many of you at these shows and conferences. We always love meeting up with our users. Please feel free to reach out if you would like to connect at these events.

CAB is excited to be a Gold Sponsor of this year’s MCIEF Annual Conference. If you have never attended an MCIEF event, I would encourage you to look into it. Information can be found at the link here. We hope to see you there!

Have a great September!

CAB Live Training Sessions

Please Note! We have transitioned our web meeting resource to Zoom. We previously used Go to Webinar. Due to this switch, we encourage you to sign onto the webinar a little earlier than normal to ensure there are no connectivity issues.

Tuesday, September 13th, 12p EST: Chad Krueger will present on CAB’s very new CAB Express report. The Express report was released for trial in April and May of this year. Since then, a number of organizations have taken advantage of the report. This session will provide details on the CAB Express report, company specific trial periods, and discuss other potential unique customized reports for individual organizations. Do not miss out on this opportunity to learn about this powerful CAB feature. Click here to register.

Tuesday, September 20th, 12p EST: Mike Sevret will present on Introduction to CAB: Flow and Navigation. This is a great session for new users or folks looking for a refresher. Mike will provide an overview of the basic flow and navigation of the overall CAB environment. Do not miss out on this opportunity to learn the ins and outs of CAB. Click here to register.

You can explore all of our previously recorded live webinar sessions by visiting our webinar library.

Follow us on the CAB LinkedIn page and Facebook.

CAB’s Tips & Tricks: How to find the Chameleon Carrier® Report

A Chameleon Carrier® is a very important part of understanding a motor carrier and its associated risk. As it relates to Central Analysis Bureau resources, a Chameleon Carrier® is a company that is related to another entity that used the carrier’s vehicles and shares a phone (landline, cell, or fax), address (physical or PO Box), email, or representative.

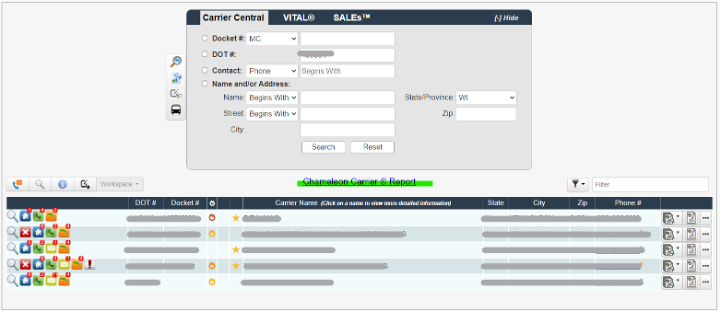

Occasionally, when reviewing a motor carrier and its associated entities, a CAB user might be subject to a bit of information overload. That is where the Chameleon Carrier® Report can provide clarity. Once you have done your search in Carrier Central and an orange and green Chameleon Carrier® icon appears. You can click on that icon and you will be taken to another page where the associated motor carriers will appear.

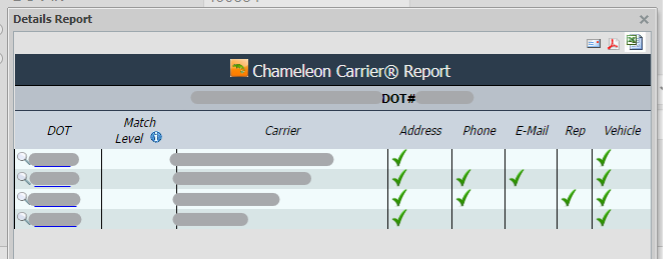

From there, click on the Chameleon Carrier® Report link (green highlight above) and the concise report below will appear, providing a clear view as to the relationship with the additional entities. As we can see below, the carrier we identified had 4 additional related entities. The green checkmarks detail the data points are specifically related.

If you’re looking for additional information on Chameleon Carriers® and Interrelated Entities, feel free to click the webinar link here that covers the concept of a chameleon carrier, interrelated entities and the features CAB provides to identify and understand the relationships that may exist between motor carriers.

THIS MONTH WE REPORT:

Marketplace

More cameras in more places.

The cost of trucking in 2021 increased to its highest level in the 15-year history of the American Transportation Research Institute’s annual Operational Costs of Trucking research. Learn more on Overdrive

More truck models, more electric trucks, and higher MSRP. Price Digests’ lead analyst Jessica Carr examines the changing truck market. Read more

Health & Safety

The NHTSA boss resigns for a California board position and there’s a new medical manual on the horizon for truckers, after the old one was withdrawn in 2015. Learn more in this news roundup

Trucking companies have again asked federal regulators to allow hair testing for drugs to determine if a person is fit to drive — and this time the government has agreed to consider their case. Read more

Slow down out there! Speeding might get a little tougher for those driving heavy duty trucks. Regulators are reviving a proposal to add speed limiters on most heavy duty trucks. Read more

Diversity

Women in Trucking: the numbers are up for leadership, support and driving roles. The Women in Trucking Association says 33.8% of C-suite executives in transportation companies are women, an increase of 1.5%. Read more

Legal

Developing a culture of safety, utilizing data, are ways to reduce the risk of a nuclear verdict. Read more

Should brokers be held liable for the safety outcomes of the motor carriers they utilize? That question is playing out, with owner-operators watching closely. Read more

September 2022 CAB Case Summaries

These case summaries are prepared by Robert “Rocky” C. Rogers, a Partner at Moseley Marcinack Law Group LLP.

AUTO

Coakley v. Cole, 2022 U.S. Dist. LEXIS 130224, C.A. No. 3:22-cv-00251 (N.D. Miss. July 22, 2022). Finding the allegations of a tort complaint “do not plausibly suggest anything more than simple negligence” the court dismissed the punitive damages claim. The court likewise dismissed the negligent hiring/retention/investigation/training/ entrustment/supervision claims because the employer admitted vicarious liability for the negligence of its employee driver.

Est. of Grillo v. Thompson, 2022 U.S. Dist. LEXIS 137048, C.A. No. GLR-21-3132 (D. Md. Aug. 1, 2022). The Maryland federal court granted a motor carrier summary judgment on all counts, finding the decedent was contributorily negligent in causing the accident. The undisputed evidence established the tractor trailer was traveling between 59.5 and 66.5 mph (in excess of the 50-mph speed limit) approximately 1,000 feet from (but almost two minutes before) the Accident; the tractor-trailer entered the intersection while the light was yellow; and the decedent’s vehicle entered the intersection while his light was red. The court rejected what it considered speculative conjecture that the decedent had a sudden medical event, which the Estate argued would prevent assignment of contributory negligence to the decedent. The court likewise rejected that any alleged gross negligence by the operator of the tractor-trailer would preclude the normal application of the contributory negligence rule. Last, the court rejected the Estate’s reliance upon the last clear chance doctrine, finding the Estate failed to show “something new or sequential” that afforded the driver of the tractor-trailer a fresh opportunity (which he failed to avail himself of) to prevent the accident.

Joyce v. Rich, 2022 U.S. Dist. LEXIS 141562, C.A. No. 20-11638 (E.D. Mich. Aug. 9, 2022). In a personal injury case arising from a winter pile-up during a “snowy winter day,” the court held the sudden emergency doctrine applied and granted summary judgment to the driver of tractor-trailer who was unable to stop, resulting in him striking the rear of the tractor-trailer traveling directly in front of him (who also ran off the road to avoid striking the car stopped in front of him). There was no evidence of speeding, distraction, or impairment by either driver. The court likewise granted summary judgment on the related/derivative claims.

Madera v. KTC Express, Inc., 2022 U.S. Dist. LEXIS 131859, C.A. No. 3:19-cv-01516 (N.D. Ohio July 25, 2022). In this case, the tort plaintiff argued he was entitled to summary judgment on his negligence per se claim based upon various alleged violations of state and federal law and regulations. The court held that the alleged violations of the FMCSRs did not give rise to a private right of action and therefore could not support negligence per se. The tort plaintiff’s reliance upon a state statute fared no better because it was a statute of general duty, rather than a “specific duty statute”, and as such it could not form the basis of a negligence per se claim. The only statute sufficient to give rise to summary judgment in favor of the plaintiff on the negligence per se claim was the one providing that drivers stay in their own lanes and only change lanes when safe to do so. Concluding there was no disputed material fact that the Accident was caused by the driver crossing the lane, the court held the tort plaintiff entitled to summary judgment on his negligence per se claim. The court held fact issues precluded summary judgment on the remaining claims for negligence, strict liability, negligent hiring/training/supervision, punitive damages, and veil piercing.

Rattlesnake Ridge Ventures, LLC v. Ortiz, 2022 Tex. App. 5453, C.A. No. 4-22-00004-CV (Tex. Ct. App. Aug. 3, 2022). The Texas Court of Appeals held that a Texas-domiciled tort plaintiff failed to establish personal jurisdiction under Texas’ long-arm statute. The Accident happened in Minnesota. The driver of the alleged at-fault tractor-trailer was not a resident of Texas. The motor carrier was a Wyoming limited liability company. Thus, the only connection to Texas was the citizenship of the tort plaintiff. Under these facts, personal jurisdiction was lacking in Texas.

BROKER

Echo Glob. Logistics, Inc. v. Dep’t of Revenue, 2022 Wash. App. LEXIS 1551, C.A. No. 83548-3-I (Wash. Ct. App. Aug. 1, 2022). The Washington Court of Appeals affirmed the Board of Tax Appeals’ finding that a freight broker did not operate motor vehicles and therefore it was not a motor transportation business subject to a public utility tax under state law. The court found the broker’s work or labor was the coordination and management of the movement of goods, not “the impact on a motor propelled vehicle” that would otherwise qualify it for public utility tax treatment.

Reynolds v. Singh, 2022 U.S. Dist. LEXIS 139552, C.A. No. 2:22-cv-00601 (E.D. Cal. Aug. 5, 2022). This case arises from a fatal auto accident in Oklahoma wherein the driver of a CMV rear-ended another vehicle during a winter storm. The CMV driver and motor carrier removed the state-court tort action, invoking federal question jurisdiction under the Federal Aviation Administration Authorization Act (“FAAAA”). Citing the safety-regulatory carve-out for FAAAA preemption, the court found there was no basis for complete preemption sufficient to give rise to federal question jurisdiction. The court likewise held that the alleged violation of a FMCSR as an element of a state law cause of action was insufficient to give rise to federal question jurisdiction under established precedent. As for possible diversity jurisdiction, the forum defendant rule precluded that basis of federal jurisdiction. Finding there was no legitimate basis for removal, the court granted recovery of fees/costs to the parties seeking remand.

Russ v. XPO Logistics, LLC, 2022 U.S. Dist. LEXIS 145938, C.A. No. 19-2719 (D. Minn. Aug. 16, 2022). In this wide-ranging opinion, the court was faced with numerous summary judgment motions by various individuals and entities involved in some capacity in the shipment of a load that was involved in a fatal accident. XPO served as the freight broker in connection with the shipment. It brokered the load to Ecklund Logistics (“Ecklund”). Ecklund, in turn, leased equipment from KLE. KLE and Ecklund operated out of the same location and shared common ownership. Ecklund hired a driver, who had previously worked for multiple other carriers. However, Ecklund’s inquiry with the prior employers was limited to determining whether the driver complied with drug and alcohol testing regulations. Ultimately, while on his first trip for Ecklund, the driver was involved in a fatal accident while transporting a load of freight brokered to Ecklund by XPO. XPO’s onboarding process involved checking Ecklund’s SAFER rating—which was “Satisfactory”—the highest available. The rating was six years old at the time of the Accident, during which time Ecklund had never been re-rated. XPO also utilized Carrier411 to monitor carriers. XPO also verified Ecklund had the required insurance coverages. Finding no red flags during onboarding, Eckluch was added to XPO’s database of carriers. Despite Ecklund having a satisfactory rating, the evidence showed it had a history of insurance claims in the five years preceding onboarding, including 104 property damage claims, 44 collision claims, and 20 bodily injury claims. XPO did not investigate or consider the insurance claims prior to adding Ecklund to its database. The Broker-Carrier agreement between XPO and Ecklund specified Ecklund must immediately notify XPO if its rating was downgraded to conditional or unsatisfactory and develop and provide to XPO a corrective action plan for any safety or safety rating issues. The Agreement further required Ecklund’s drivers be fully trained, screened by a criminal background check, complete substance abuse testing procedures, and conduct themselves in a courteous and professional manner. Under these facts, the court denied XPO summary judgment on the claim it negligently selected Ecklund as a carrier. The court found a reasonable juror could conclude that additional precautions/investigation were necessary. Specifically, the court noted that Ecklund’s safety rating was over six years old at the time of the Accident and XPO never attempted to investigate Ecklund’s financial status “despite evidence that such information is directly tied to a carrier’s safety.” Further the court noted there was some evidence suggesting Ecklund had inadequate safety management controls as evidenced by its high number of incidents and insurance claims. XPO was granted summary judgment on the claims alleging it was a motor carrier and that it was vicariously liable for the negligence of the driver under various agency, joint enterprise, and aiding and abetting theories. XPO’s claim for indemnification from Ecklund was deemed premature given that a great number of the claims alleged XPO’s direct negligence, for which it could not be entitled to indemnification. The court also granted summary judgment to XPO and all defendants on the claim alleging violations of the FMCSRs, finding the regulations did not create any private right of action. KLE was granted summary judgment for the claims alleging joint venture and alter ego with Ecklund. KLE was likewise granted summary judgment under the Graves Amendment for the claims alleging vicarious liability for the negligence of the driver but was denied summary judgment on the claim it negligently entrusted its equipment to Ecklund, which would not be covered under the Graves Amendment. Ecklund was denied summary judgment on the claim alleging it negligently hired the driver, but the court granted Ecklund summary judgment on the negligent retention and supervision claims.

CARGO

Creative Lifting Servs. v. Steam Logistics, LLC, 2022 U.S. Dist. LEXIS 136158, C.A. No. 1:20-cv-337 (E.D. Tenn. Aug. 1, 2022). The plaintiff contracted with the defendant to ship a crane from Italy to Houston, but when the shipment arrived at the Port of Houston it was rejected because the wood utilized to support the crane during shipment was allegedly infested with insects. The entire shipment had to be shipped back to Italy to be fumigated before being re-shipped to Houston. The plaintiff sued the defendant under various theories based upon the professed expertise in shipping arrangements contained on defendant’s website. The court denied the defendant’s motion to dismiss the Tennessee Consumer Protection Act claim, finding the operative pleading contained sufficient allegations to make out a viable claim. The court found, with respect to the negligent misrepresentation claim, the “essential element” of how or why defendant failed to use reasonable care in communicating the alleged misrepresentations on its website, was lacking. However, the court granted the plaintiff the opportunity to amend the pleading to correct the deficiency. With respect to the breach of contract claim, which the court had previously permitted the plaintiff to amend, the court found it still lacked the necessary allegations to support this cause of action. As such, this claim was dismissed. Last, with respect to the negligence claim, which the plaintiff had also previously been allowed to amend, the court found the plaintiff still pled all obligations/duties arose pursuant to contract (bill of lading), and therefore the court was required to dismiss the negligence action because any violation of the contractual duties sounds solely in contract, not tort.

D&J Distrib. & Mft. Co. v. Bella+Canvas Retail, LLC, 2022 U.S. Dist. LEXIS 143919, C.A. No. 3:22-cv-599 (N.D. Ohio Aug. 11, 2022). The plaintiff alleged the motor carrier inexplicably delivered goods that were intended for plaintiff’s customer to another location (“recipient”). The plaintiff alleged the recipient kept the goods and would not return them. In turn, the plaintiff filed suit against the recipient and the motor carrier. The claims against the motor carrier included: (1) breach of contract/ unjust enrichment; (2) specific performance/constructive trust; (3) theft /conversion; and (4) negligence. The carrier successfully moved to dismiss all claims under Carmack preemption.

Stewart v. Fed. Express Corp., 2022 U.S. Dist. LEXIS 138114, C.A. No. 21-2478 (D.D.C. Aug. 3, 2022). The court dismissed, without prejudice, a pro se plaintiff’s complaint alleging losses related to stolen packages delivered to her residence by the motor carrier. Noting the deferential standard applied to pro se pleadings, the court held the complaint, as pled, was not sufficiently definite to establish standing of the claimant to sue under Carmack. However, in so holding, the court rejected the motor carrier’s argument that only shippers are entitled to recovery under the Carmack Amendment, and thus the court allowed the pro se plaintiff to file a second amended complaint.

COVERAGE

Koch v. Progressive Direct Ins. Co., 2022 Pa. Super. LEXIS 327, C.A. No. 1302 MDA 2021 (Pa. Super. Ct. Aug. 4, 2022). The Pennsylvania Superior Court (intermediate appellate court) overturned a trial court’s decision in favor of an insured holding he was entitled to UIM benefits. At policy inception, eleven years before the Accident, the insured executed a UIM rejection form. However, nine months prior to the Accident, the insured had telephonic conversation with a representative of Progressive during which the insured requested to purchase additional coverage for the involved motorcycle. During the conversation, the Progressive representative discussed the availability of uninsured motorist coverage, but not underinsured motorist coverage. Following the call, the insured purchased $300,000 in UM coverage (but no UIM coverage). The insured argued if the representative had discussed the availability of UIM coverage during the call, he would have purchased that as well. The court held that the 2004 UIM rejection form remained valid and met the state’s statutory requirements for rejection of UIM benefits. Additionally, the court stressed that Progressive routinely mailed the insured declarations pages showing he had rejected UIM coverage, including after the phone call in which he added additional UM coverage. The applicable statutes provided once an insured executes a UM/UIM rejection form, the rejection is presumed to be in effect throughout the life of the policy unless affirmatively changed by the insured. They also provided that an insured having completed a UM/UIM rejection form cannot claim liability of any based upon inadequate information. Based upon this, the appellate court held Progressive was not required to inform the insured about the availability of UIM coverage or obtain a new UIM rejection form in response to the call seeking additional coverage. As such, the appellate court held the insured was not entitled to UIM benefits in connection with the Accident.

Nat’l Cas. Co. v. Eagle Eye Truck Lines, LLC, 2022 U.S. Dist. LEXIS 133124, C.A. No. 22-cv-147 (N.D. Ok. July 27, 2022). A federal court entered a stay in the federal insurance coverage declaratory judgment action, citing disputes over choice of law, which it determined needed to first be decided in the underlying state court tort action.

Pierson v. White Pine Ins. Co., 2022-Ohio-2702, C.A. No. 21CA3 (Ohio Ct. App. July 28, 2022). In this insurance coverage declaratory judgment action, the court was tasked with addressing the scope of a towing-transporting-autos exclusion. The exclusion excluded from coverage bodily injury or property damage “arising out the ownership, operation, maintenance or use of any ‘auto’ that is not identified in ITEM SEVEN in the Auto Dealer Declarations used to move, tow, haul or carry ‘autos.’” The policy separately defined “auto” as “a land motor vehicle, ‘trailer’ or semitrailer.” ITEM SEVEN was a schedule of covered autos and only listed one vehicle—a 1999 International Rollback. The Accident involved a 1999 Freightliner hauling load of inoperable cars being transported on a trailer. First, the court held the policy provisions were not ambiguous. It stressed that the mere fact that provisions cross-referenced other provisions was not alone sufficient to render it ambiguous. The court next held the 1999 Freightliner was not listed in Item Seven. Further, it found the trailer itself constituted an “auto” under the policy definition, which specifically included trailers. As such, the court concluded a vehicle not identified in Item Seven was being used to move, tow, haul or carry an auto (i.e. the trailer). The court held that under these circumstances, the exclusion applied. It further rejected the policy provided illusory coverage, noting that had the 1999 Freightliner simply been listed in ITEM SEVEN, there would have been coverage. As such, it reversed the trial court’s decision that the insurer had the duty to defend and indemnify in connection with the Accident.

Progressive Cas. Ins. Co. v. Jason Boire, 2022 U.S. Dist. LEXIS 141120, C.A. No. 8:21-cv-0666 (N.D.N.Y. Aug. 9, 2022). The New York federal court dismissed a declaratory judgment insurance coverage action, subject to the right to file an amended complaint, where it found the operative pleading failed to allege a case or controversy. In particular, the court found the declaratory judgment complaint failed to allege that the underlying tort action sought recovery from the plaintiff insurer or any party was claiming coverage under the at-issue policy. As such, the court concluded there was merely a “hypothetical dispute” and the case or controversy requirement was not satisfied.

Travelers Prop. Cas. Co. of Am. v. H.E. Sutton Forwarding Co., 2022 U.S. Dist. LEXIS 140768, C.A. No. 2:21-cv-719 (M.D. Fla. Aug. 8, 2022). In this insurance coverage declaratory judgment action, the excess insurer sought declaratory judgment it had no duty to defend or indemnify an entity in connection with claims arising from an accident, occurring on an airfield, in which the plaintiff collided with the wing of an aircraft that the putative insured had rented in connection with its aircraft charter business. The excess policy excluded from coverage “[d]amages arising out of the ownership, maintenance, use or entrustment to others of any aircraft owned or operated by or rented or loaned to any insured.” In response to the putative insured’s demand for coverage, the excess insurer reserved its rights but advised the insured there was no coverage on account of the aircraft exclusions. The insurer then filed the declaratory judgment coverage action before moving for summary judgment that it had no duty to defend or indemnify the putative insured. First, the court dispatched with the putative insured’s claim the action was not ripe, noting that the insured had requested coverage that had been denied. Under Florida law, the court held the demand for coverage was sufficient to constitute a justiciable controversy. As for the policy exclusions, the court noted the broad language used in the exclusion, explaining ‘arising out of’ is broader in meaning than the term “’caused by’ and means ‘originating from,’ ‘having its origin in,’ ‘growing out of,’ ‘flowing from,’ ‘incident to’ or ‘having a connection with.'” Insofar as the underlying tort complaint alleged damages allegedly originating out of the use/rental of an aircraft by the putative insured, the court found the aircraft exclusion applied to bar coverage. However, the court held the insurer had not met its burden to establish, for purposes of summary judgment, that the policy did not provide illusory coverage. The putative insured argued application of the aircraft exclusion would nullify all coverage since all of its business involved the use of an aircraft. Accordingly, this issue was left to be decided and the insurer’s motion for summary judgment was denied.

Williamsburg Nat’l Ins. Co. v. New York Marine & Gen. Ins. Co., 2022 U.S. Dist. LEXIS 144658, C.A. No. 21-04377 (C.D. Ca. Aug. 12, 2022). In this dispute between insurers over defense and indemnification obligations for various individuals and entities in connection with a motor vehicle accident, the court granted in part and denied in part the parties’ respective summary judgment motions. Williamsburg issued a motor carrier liability policy with $1,000,000 limits and that included a MCS 90 endorsement to DLR Express (“Williamsburg Policy”). New York Marine issued a motor carrier liability policy with $1,000,000 limits to Intermodal Contractor’s Association of North America, which also included a MCS 90 endorsement (“New York Marine Policy”). Arthur Trimble was later added as a certificate holder to the New York Marine Policy. DLR leased a tractor with attached trailer to Trimble under an equipment lease agreement and sub-haul agreement. The Agreement provided Trimble would indemnify and release DLR against any liability arising out of Trimble’s use of the equipment. Pursuant to the Agreement, Trimble also added DLR as an additional insured to the New York Marine Policy. While using the leased tractor, Trimble was involved in an accident with Foster. Foster filed a complaint against Trimble in California State Court (“Foster Litigation”). DLR was later added as a defendant to the Foster Litigation. New York Marine provided a defense to Trimble in the Foster Litigation. All claims against Trimble in the Foster Litigation were resolved for $155,000. It appears DLR never requested a defense and neither New York Marine nor Williamsburg provided a defense to DLR in the Foster Litigation. A default judgment for over $6,000,000 was entered against DLR in the Foster Litigation. After unsuccessfully moving to set aside the default judgment, DLR tendered its defense to Williamsburg, who agreed to defend DLR in the Foster Litigation pursuant to a full reservation of rights. A month later, DLR tendered its defense and made a request for indemnification as an additional insured to New York Marine. The Foster plaintiffs then agreed to settle all claims against DLR for $1,000,000. DLR and Williamsburg demanded New York Marine tender the remaining $845K in available limits under the New York Marine Policy to settle the claim, but New York Marine refused. Ultimately, Williamsburg paid the entire $1,000,000 demanded to settle the claim against DLR and then instituted suit against New York Marine seeking recoupment of those amounts. The court held under these facts New York Marine had sufficient notice of a potential contribution claim from Williamsburg based upon the involvement of DLR in the Foster Litigation. Even assuming DLR had not provided notice to New York Marine or demanded a defense, the court explained “an insured’s lack of tender or compliance with a policy provision is not fatal to a coinsurer’s right of equitable contribution; rather adequate notice of the potential for contribution and the opportunity for the investigation and participation in the defense of the underlying litigation will suffice.” It therefore found New York Marine had sufficient notice of a possible contribution claim to preclude dismissal of the contribution claim. While the court determined it need not reach the impact of the MCS 90 endorsement in light of its other ruling, it went on to explain that the MCS 90 endorsement only applies to injuries to the public and does not apply to disputes as between co-insurers. With respect to the remaining claims of negligence and tort of another by Williamsburg against New York Marine, the court held New York Marine was entitled to dismissal of those claims because those were premised upon a viable claim by DLR for which Williamsburg was subrogated and since DLR did not provide adequate notice to New York Marine of its request for defense/indemnification in connection with the Foster Litigation, DLR had no assignable cause of action.

WORKERS COMPENSATION

No cases of note to report this month.