The CAB Submission Report™ , available exclusively to CAB Premium Subscribers, is the industry source for the most comprehensive information on any individual motor carrier with the most up to date information regarding a motor carrier’s safety, finances and overall operations. The information contained within the report is aggregated from various government and proprietary data sources including CAB, SAFER, SAFETSTAT and the Licensing and Insurance databases.

The CAB Submission Report™ , available exclusively to CAB Premium Subscribers, is the industry source for the most comprehensive information on any individual motor carrier with the most up to date information regarding a motor carrier’s safety, finances and overall operations. The information contained within the report is aggregated from various government and proprietary data sources including CAB, SAFER, SAFETSTAT and the Licensing and Insurance databases.

Once collected, the latest available data is analyzed by our advanced computer systems and a full report of the analysis including alerts, charts, summaries and details is provided. All of the relevant data from the various government sources is included in the report, with the irrelevant and often confusing information and statistics found on those same sites clarified or omitted to provide you with accurate, useable information. In addition, CAB has worked directly with the motor carrier insurance industry to develop a format that is both comprehensive and intuitive.

In today’s market, time is of the essence, and underwriting properly and quickly can be difficult. With the use of the CAB Submission Report™ an underwriter has access to the necessary information to make an informed choice on whether an account meets the appetite of the underwriter. Easy to read charts and key focal points allow an underwriter to analyze a risk without reviewing additional source material.

In order to enhance the underwriter’s review of the report, the underwriter is immediately directed to an alert section that highlights all of the items that might be problematic for an underwriter. This allows the underwriter to focus quickly on items which should be of immediate concern. For example an underwriter is made aware if the carrier has:

- Both operating and brokerage authorities

- Conditional or Unsatisfactory DOT Safety rating

- HAZMAT inspections / violations

- Inactive authority

- Inadequate insurance for commodities hauled

- Severe violations (see below)

- Power units exceeding the number reported on the MCS-150 (see below)

- Mexican border-zone inspections

- Excessive SEA or ISS-D scores

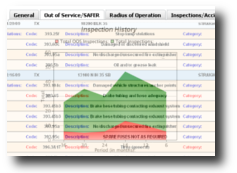

Knowledge is power in underwriting. In addition to the alerts, the detailed sections of the Submission Report™ provide the industry valued CAB financial rating, the DOT Safety rating, as well as the current authorities of the carrier. Our unique program then provides in depth information and analysis of carrier vehicle inspections and accidents. The underwriter can analyze the safety status of the insured, the type of vehicles operated, and most importantly, recent violations cited to the carrier. With help from the motor carrier insurance industry, we have created a category of “Severe violations”, which are those violations that have deemed as critical. Underwriters can skip directly to that category to determine if the applicant has violations which would raise a concern as to the acceptability of the risk.

Whether writing a scheduled vehicle policy or a gross receipts policy it is important to know how many vehicles are being operated. Our program, unlike any other, allows us to calculate all the distinct VIN and license #’s that were inspected under a motor carrier’s authority. This allows an underwriter to quickly verify what has been reported in the application.

Underwriting motor carriers has a special risk uncommon to most other insureds – the filing exposure to an insurer. Our program identifies the current authority and gives the underwriter accurate information as to whether a filing is required. In addition we provide a front page listing of each of the prior insurers, which allows you to determine how often this applicant changes insurers.

SAFER Out-of-Service statistics for Driver, Vehicle and Hazardous material violations are displayed in our report with an additional breakdown of sub-categories within each group to give the underwriter a much clearer synopsis of the carrier’s recent violation history.

Trends are extremely important in determining risk. Our proprietary Historical Out-of-Service Trend section provides charts which visually plot the motor carrier’s out-of-service percentage over a 36 month period, broken down into 6 month increments. Two charts are provided – the first tracks the percentage of time the carrier is placed out of service during inspections and a second which identifies the total number of overall violations as compared to those which were severe enough to place the driver or the vehicle out of service.

We realize that truly understanding the carrier’s radius of operation is critical when determining the premium to be charged. Only in our Radius-of-Operation section can an underwriter get a clear and concise snapshot of all states where the carrier’s vehicles were inspected in the past three years as well as the number of inspections in each state. It is displayed in an interactive map of the United States, a color graph and a number chart, allowing an underwriter to determine whether the application information is accurate.

The formatting of our detailed inspection and accident section, organized by VIN number, allows the underwriter to see a complete list of each vehicle’s inspection and accident history with all associated violations, listed chronologically. This obviates the need to view each inspection and accident separately as on SafeStat in order to obtain a picture of a specific vehicle’s violation history. Links to complete inspection and accident reports are conveniently located adjacent to every record for more comprehensive analysis.

Identifying the shipper is beneficial in ascertaining the type of material the carrier is hauling. This information is not accessible on any of the FMCSA’s websites. When the DOT inspector takes note of the shipper, only CAB provides you with that information.

The CAB Submission Report™ can be and is currently effectively utilized by claims, underwriting, loss control, special investigations, rating and actuarial departments.