Happy February!

As you may be aware, February is known as “Love Month” due to Valentine’s Day landing on the 14th. Britannica describes the day as: “A holiday when lovers express their affection with greetings and gifts. It is also called St. Valentine’s Day. The holiday has expanded to express affection between relatives and friends.”

It should come as no surprise, but we at CAB love what we do, and we love our users. Over the years, many of you have become friends and we appreciate each time you reach out to us with questions, ideas or just to let us know how using CAB’s tools and resources have helped you create opportunities or better understand of your clients and prospects. We look forward to continuing to grow those relationships now and into the future.

Have a great February and Happy Valentine’s Day!

Chad Krueger

CAB Live Training Sessions

Tuesday, February 14th, 12p EST

Sean Gardner will present an overview of CAB’s MC Advantage resource. During this presentation, he will review and discuss the various tools specifically available to motor carriers. This CAB offering is picking up steam and we encourage you to learn about it by attending this session.

Tuesday, February 21st,12p EST

Mike Sevret will present on Introduction to CAB: Flow and Navigation. This is a great session for new users or folks looking for a refresher. Mike will provide an overview of the basic flow and navigation of the overall CAB environment. Don’t miss out on this opportunity to learn about this powerful CAB feature.

To register for the webinars, click here to sign into your CAB account. Then click live training at the top of the page to access the webinar registration.

You can explore all of our previously recorded live webinar sessions by visiting our webinar library.

Follow us on the CAB LinkedIn page and Facebook.

CAB’s Tips & Tricks: Updating Motor Carrier Data

As this question comes up regularly, we thought it best to share the link for live webinar we did about a year ago. That webinar is titled “How to Update Motor Carrier Data”. The question is, how does one update motor carrier data that might be incorrect. This is a regular topic, and we get questions related to this frequently.

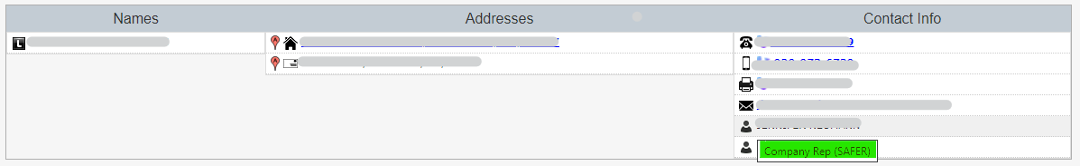

As Mike Sevret, Senior Account Manager, noted during the webinar, we are often approached regarding how to go about updating motor carrier information like business/mailing addresses, legal/dba names, company representatives, and the like.

By hovering over the icons next to the information, we are able to tell you where that information is coming from. Examples could be SAFER, Licensing & Insurance, etc. If the information needs to be updated, we’re able to share with you which government entity or entities the information should be updated with.

As Mike noted, when the data is updated, the changes are not immediate in the CAB Report®. There is a deliberate lag in place, and I encourage you to watch the video to understand the reason for the lag.

If you’ve come across these situations or are intrigued by this topic, I encourage you to review and share internally this quick 22-minute video to learn more about this topic.

THIS MONTH WE REPORT

The Economy

The economy: Why the U.S. economy will avoid a recession, but freight will slow in 2023. Read more

Is the worst over? CCJ Chief Editor Jason Cannon looks at inflation, the supply chain, and its overall impact on trucking. Read more

Employment is up. The US Department of Labor says the trucking industry gained 2100 jobs in December. Get the details

Market report: Price Digests reports on fleet sizes, trucking jobs and salaries. Get the details

Politics, Rules & Regulations

Truck brokers may need more skin in the game, as the FMCSA proposes new $75K rules for truck broker financial backing. Read more

Congress steps up: New House bill calls for retention incentives and grants to truck drivers, while looking for improvements in safety and shipping capacity. Read more

AB 5 is still being challenged in California. The California Trucking Association has renewed its request for a preliminary injunction against the law aimed at reclassifying some drivers as employees. Read more on CCJ

As more states loosen regulations on marijuana use, more truckers have tested positive. FMCSA data shows that 41,000 truck drivers tested positive in 2022, a 32% increase from 2021. Read more

More

Infographic: The largest trucking companies that went bankrupt. Check it out

Cargo theft was up in 2022 according to theft recording firm CargoNet. The average value of cargo stolen in an event was $214,104. Read more

Guilty: Former FMCSA investigator admits to extortion by not reporting safety violations that could have led to fines…then demanding money from the company. Read more

February 2023 CAB Case Summaries

These case summaries are prepared by Robert “Rocky” C. Rogers, a Partner at Moseley Marcinack Law Group LLP.

AUTO

Miller v. Silvarole Trucking, Inc., 211 A.D.3d 1544 (N.Y. App. Div. Dec. 23, 2022). In this appeal, the New York appellate court affirmed the trial court’s grant of summary judgment to a pedestrian struck by a tractor-trailer on his simple negligence claim and further affirmed the trial court’s denial of the defendants’ motion for summary judgment on the issue of gross negligence, the pedestrian’s alleged comparative negligence, and the denial of summary judgment on punitive damages against the driver of the tractor-trailer. However, the court found there was no basis for punitive damages against the motor carrier under the facts of the loss and because punitive damages are rarely available based solely on vicarious liability; accordingly, the court reversed the trial court on this issue. In so holding, the court rejected that the sudden emergency doctrine applied as a matter of law. With respect to the issue of the pedestrian’s comparative negligence, the appellate court found it “invariably raises a factual issue for resolution by the trier of fact.”

Popp v. Sharco Express, LLC, 2022 WL 17960848, C.A. No. 2:22-cv-120 (E.D. K.Y. Dec. 27, 2022). Citing a 2013 Kentucky Supreme Court ruling, the Kentucky federal court held that a tort plaintiff may simultaneously maintain claims for negligent hiring, retention, and supervision, even where the motor carrier admits vicarious liability for the alleged negligence of the driver. However, the court found the operative complaint merely contained a formulaic recitation of the elements of each of these direct causes of action, and accordingly dismissed those claims subject to the plaintiff’s right to amend. Similarly, the court found the operative complaint did not allege sufficient facts to support punitive damages under Kentucky’s standard, and accordingly dismissed that claim, again subject to the plaintiff’s right to amend.

Cameron Int’l Corp. v. Martinez, 2022 WL 17998214, No. 21-0614 (Tex. Dec. 30, 2022). The Supreme Court of Texas held the “special-mission exception” to the general rule that an employer is not vicariously liable for an employee’s negligence during travel to and from work did not apply to automobile accident that occurred as an oilfield worker drove toward an oilfield drilling site upon completing personal errands. The facts established neither worker’s alleged employer nor its supervisory personnel directed worker to travel to a city 60 miles away or to purchase food, water, or fuel for other workers or for worksite generally, and worker decided for himself to travel to city on his own time to have dinner and to restock his personal groceries and fuel, even though worker occasionally shared water that he purchased with coworkers and employer paid worker a $250 transportation allowance. In so ruling, the court was careful to note that cases interpreting “course and scope of employment” for purposes of workers’ compensation are distinguishable from those addressing vicarious liability of an employer. The court therefore reversed the lower appellate court and reinstated summary judgment in favor of the employer of the tortfeasor.

Mack v. Old Dominion Freight Line, Inc., 2023 WL 158903, C.A. No. 5:21-cv-00118 (M.D. Ga. Jan. 11, 2023). This case presents several important pre-trial rulings. The trial court rejected a plaintiff’s motions for sanctions premised upon a driver’s failure to submit to post-accident drug and alcohol testing. First, the trial judge explained that spoliation only exists where evidence must first exist, but “[a] party “does not commit spoliation by failing to create evidence, but only by destroying, altering, or concealing it.” Insofar as there was no evidence to suggest there was ever drug/alcohol testing that was destroyed, altered, or concealed, the court rejected the sanctions motion on this ground. Moreover, the court held the FMCSRs do not provide an independent ground for a spoliation instruction. Last, the court found there was no duty upon the motor carrier under the FMCSRs to obtain a post-accident drug/alcohol test under the facts of the accident. As such, the court refused sanctions against either the driver or the motor carrier and refused to give a negative inference instruction to the jury at trial. Separately, the court held that Georgia’s statutory cap on punitive damages applied. In so holding, the court noted the lack of evidence of “specific intent to cause harm” and the complete lack of any evidence of intoxication by the motor carrier driver. Finally, the court granted the motor carrier and its driver’s motion for partial summary judgment that plaintiff committed negligence per se by traveling 67 mph in a posted 55 mph zone prior to entering the intersection where the accident occurred.

Pellerin v. Foster Farms, LLC, 2023 WL 151366, No. 54,829-CA (La. Ct. App. Jan. 11, 2023). The Louisiana appellate court affirmed the trial court’s grant of summary judgment to a motor carrier and its driver in a personal injury suit arising from a tire blowout. The appellate court agreed with the lower court that the plaintiff had failed to present evidence that the driver/motor carrier failed to properly maintain the tire and such failure was the cause-in-fact of the blowout and plaintiff’s injuries.

Graham v. Lewis, 2023 WL 138923, C.A. No. 3:21-cv-1274 (N.D. Tex. Jan. 9, 2023). The court dismissed claims for negligent hiring, retention, entrustment, and all other derivative claims against the motor carrier/employer, where the motor carrier/employer stipulated it was vicariously liable for the negligence of its driver.

Gay v. Alabama Motor Express, 2023 WL 123512, C.A. No. SA-21-cv-00255 (W.D. Tex. Jan. 6, 2023). The court dismissed claims for negligent hiring, retention, entrustment, and all other derivative claims against the motor carrier/employer, where the motor carrier/employer stipulated it was vicariously liable for the negligence of its driver.

United Parcel Service of America v. Whitlock, 2023 WL 412462 (Ga. Ct. App. Jan. 26, 2023). The Georgia Court of Appeals ruled that South Carolina law on punitive damages applied to wrongful death and survival actions brought by the Estates of two decedents killed in a multi-vehicle accident on I-85 in South Carolina. The plaintiffs/decedents were all Georgia residents; TeamOne, a defendant, is a Georgia corporation; UPS, another defendant, is a Delaware corporation, but is headquartered in Georgia; and Liberty Mutual, a defendant under Georgia’s direct-action statute, is authorized to transact business and has a registered agent in Georgia. Thus, suit was brought in Georgia and jurisdiction was proper in Georgia. In determining choice of law, the court noted “[i]n the instant cases, South Carolina law permits the recovery of punitive damages in wrongful death claims when Georgia does not, and South Carolina allows the recovery of a greater amount of punitive damages under certain circumstances. These facts alone do not demonstrate that South Carolina law is “radically dissimilar” from Georgia law.” The court likewise held the differences between South Carolina and Georgia’s treatment of apportionment were not so “radically dissimilar” to preclude application of South Carolina law.

Bertram v. Progressive Southeastern Ins. et al., 2023 WL 417438, C.A. No. 2:19-cv-01478 (W.D. La. Jan. 25, 2023). A shipper was denied summary judgment in a personal injury action arising from an accident involving a tractor-trailer carrying a load of its products. The shipper had contracted with a warehouseman to providing warehousing and other services for its products. The warehouse agreement provided that the warehousemen would be responsible for loading/unloading the freight, in addition to storing it. The shipper hired a broker, who then hired a motor carrier to transport a load of the shipper’s product from the warehouse to the shipper’s customer. The evidence established that the shipper never provided the warehouseman with any instructions on how to properly load/secure the freight (paper rolls). The tort suit alleged that the freight shifted while the motor carrier was underway, leading to a tire blowout and ultimately causing the fatal accident. Despite the shipper not exercising control over the warehouseman operations, including load securement, the court found a fact issue existed as to whether the shipper retained the right to control sufficient to give rise to an agent/principal relationship as opposed to independent contractor relationship between the shipper and the warehousemen. Accordingly, the court denied summary judgment to the shipper.

Johnson v. Reeme, 2023 WL 421151, C.A. No. 18 C 3587 (N.D. Ill. Jan. 26, 2023). A motor carrier was granted partial summary judgment on a plaintiff’s lost earning capacity claim. The court found the evidence, which included: (i) testimony from the plaintiff that there was nothing she could no longer do after the accident, she had regained full range of motion, and that she worked full-time as a painter post-accident, and (ii) she did not reapply for her previous job once released to full duty, was insufficient to establish lost earning capacity or that the accident resulted in her being terminated from her previous job.

Thorpe v. AutoZone, Inc., 2023 WL 3800300, C.A. No. 2021-008210 (N.Y. App. Div. Jan. 25, 2023). The New York appellate court affirmed a denial of a motion to dismiss premised upon the Graves Amendment. While it found that an affidavit submitted by the company in support of the motion to dismiss established it was the owner of the vehicle and was in the business of leasing automobiles, the claims of direct negligence—negligent maintenance and mechanical malfunction—were not covered by the Graves Amendment and the affidavit was insufficient to overcome the factual allegations of the pleading as to these claims.

BROKER

McCarter v. Ziyar Express, Inc., 2023 WL 144844, C.A. No. 3:21-cv-2390 (N.D. Ohio Jan. 10, 2023). The Northern District of Ohio dismissed various tort claims against freight brokerage entities based on FAAAA preemption. In so holding, the court cited to prior decisions of the same court upholding FAAAA preemption in personal injury cases and finding the safety exception to FAAAA preemption inapplicable. The court also dismissed claims against other various entities for whom the court found the plaintiff had not sufficiently plead a causal connection to the transportation and/or accident.

Millam v. Northern Freight, LLC, 2023 WL 423114, C.A. No. 20-cv-00797 (S.D. Ill. Jan. 26, 2023). FedEx Custom Critical, Inc. (“FedEx”) was granted summary judgment in a personal injury action arising out of a load that FedEx brokered to a carrier, who then double-brokered the load to another carrier whose driver was involved in the fatal accident with plaintiff’s decedent. The agreement between FedEx and the initial carrier prohibited double-brokering. Nevertheless, the carrier hired by FedEx did, in fact, double-broker the load to another carrier. It was undisputed that it was the second carrier’s equipment and driver involved in the fatal accident. There was not contract or agreement between FedEx and the second carrier. FedEx was listed on the bill of lading issued by the shipper as the carrier. Under these facts, the court held the second carrier’s employee was not an agent of FedEx. The court cited the lack of any control over the driver by FedEx, suggesting that the fact that he was unauthorized refuted any level of control by FedEx necessary to establish the driver as FedEx’s agent.

CARGO

Poticny v. Movers and Packers Relocation Specialists LLC, 2022 WL 18024218, C.A. No. 3:22-CV-01243 (D. Ore. Dec. 30, 2022). In an unopposed motion for default judgment, the court nevertheless found that certain of the plaintiff’s claims were preempted by the Carmack Amendment and therefore denied plaintiff summary judgment on those claims. Specifically, the court held the plaintiff’s breach of contract, fraud, state consumer protection law claims, and Unfair Trade Practices claims were preempted by the Carmack Amendment, noting each of these claims “arise directly out of Defendant’s shipment of Plaintiff’s goods via interstate commerce” and therefore fall within Carmack’s preemptive scope. The court did grant the plaintiff default judgment on its Carmack claim, however. The court used the Binding Estimate, which itemized the goods to be transported and provided an estimated value for each, as the basis for the damages award, finding it reflected an accurate estimate of the plaintiff’s actual damages that are recoverable under Carmack. Last, the court found the plaintiff was entitled to attorneys’ fees under the regulations applicable to household goods movers, but reduced the amount awarded from that claimed. The decision also includes analysis of personal jurisdiction over a household goods moving company.

Viva Logistics Inc. v. MSC Mediterranean Shipping Co. S.A., 2022 WL 18027623, C.A. No. 22-cv-5857 (S.D.N.Y. Dec. 30, 2022). In this lawsuit arising from a spoiled shipment of oranges from Capetown to New York, the court held the claim was barred by COGSA’s one-year statute of limitation. In so ruling, the court rejected the shipper’s contention that the ocean carrier had voluntarily extended the deadline to file. On June 8, 2022, an attorney acting on behalf of the ocean carrier, sent an email in which he said, with respect to the shipper’s claim, “Time extension will be granted for one month up to and including 8/7/2022 purely based on good will.” The shipper contended that through this email the ocean carrier voluntarily extended the statute of limitations period through August 7, 2022. The court rejected this argument, finding “[t]he unavoidable interpretation is that Mr. Simeoni — a South African lawyer, emailing a German addressee — used the day-month-year convention prevalent in both South Africa and in Germany to enumerate the date and therefore extended the statute of limitations by only the one month indicated in his communiqué, to July 8, 2022. Even when the facts are viewed in a light most favorable to the plaintiff, it is simply not plausible to infer that the statute of limitations period applicable to [shipper’s] claims extended beyond July 8, 2022.” The court therefore dismissed the lawsuit with prejudice.

AGCS Marine Ins. Co. v. Chillicothe Metal Co., Inc., 2023 WL 319810, C.A. No. 20-cv-01388 (C.D. Ill. Jan. 19, 2023). This is a case about a shipment of electrical switchgear that was damaged during transit and who is ultimately responsible for the associated loss exceeding $1.8 million. Plaintiff AGCS Marine Insurance Co. Inc. is standing in the shoes of the original manufacturer of the product (the insured) as it paid out the claim for the loss. AGCS now seeks to recover that $1.8 million from either or both the secondary manufacturer that shipped the product after adding large components to it and the companies involved in the transportation of the product to the end user. Transport Logistics served as the freight broker in the disputed shipment. Transport National was the federally-licensed motor carrier hired to perform the transportation. Each of the quotes generated by the freight broker to ASCO included the following language: Customer is required to declare the value of Cargo prior to shipping otherwise the liability for said property is limited to $.50 per pound, $100,000.00 maximum value, as applicable under 49 U.S.C. 14706(c)(1)(A) and (B) unless specifically agreed to in writing and appropriate rates or charges applied.” The motor carrier services were to be provided pursuant to terms and conditions in Transport Logistics’ quotes that included an agreement whereby the parties waived any and all rights and remedies provided by Part B to Subtitle IV of Title 49 of the U.S. Code to the extent such rights and remedies conflicted with the provisions of the terms and conditions in the quotes provided by Transport Logistics. Ultimately, ASCO accepted the quotes and did not modify or request a change to the limitation of liability provision contained in the quotes. The bills of lading, prepared by the shipper, did not contain any notation of value of the freight. ASCO had, but not provide, to the freight broker or the motor carrier specific instructions for the shipment of such freight. ASCO issued no specific packaging instructions. Due to poor packaging, the freight was damaged while being transported from Illinois to Maryland. First, the court granted summary judgment to Transport Logistics on the sole count—a Carmack claim—alleged against it. The court agreed that Transport Logistics acted solely as a freight broker, and as such, has no liability under the Carmack Amendment. Applying the Nipponkoa three-part test for a carrier to limit its liability: [1] obtain the shipper’s agreement as to a choice of liability; [2] give the shipper a reasonable opportunity to choose between two or more levels of liability; and [3] issue a receipt or bill of lading prior to moving the shipment.”—the court held a fact issue existed as to whether Transport National, vis-à-vis the Transport Logistics quotes and communications between ASCO and Transport Logistics, properly limited its liability. The court also held that which, if any, parties were negligent in relation to the tarping presented a fact issue for the jury.

Michaela Bohemia, LLC v. FedEx Freight, Inc., 2023 WL 318069, C.A. No. 1:21-cv-463 (S.D. Ohio Jan. 19, 2023). This case arises out of failed shipment of goods from Missouri to Florida. The shipper hired TQL to arrange for the shipment. TQL allegedly told the shipper that it had $500K in insurance. The freight value was $671K, but considering TQL’s representation of coverage, the shipper opted against obtaining additional insurance. TQL, in turn, hired FedEx to transport the goods. When the products arrived, some were allegedly lost or damaged, resulting in claimed damages of around $200K. Plaintiff brought claims against both TQL and FedEx for breach of contract, a claim of promissory estoppel against TQL, and a Carmack claim against FedEx. First, the court dismissed the breach of contract claim against FedEx as preempted by the Carmack Amendment. However, it rejected TQL’s bid to have the breach of contract claim against it dismissed under FAAAA, 49 U.S.C. § 14501(c)(1), preemption, finding it is well-established that breach of contract claims against brokers survive FAAAA preemption. Last, the court rejected TQL’s bid to have the promissory estoppel and breach of contract claims against it dismissed, finding the plaintiff had sufficiently plead facts in support of each of those claims to avoid dismissal at the pleading stage.

RDK NY Inc. dba Green Angel CBD v. The City of New York et al., 2023 WL 348467, C.A. No. 21-cv-1529 (E.D.N.Y. Jan. 20, 2023). A company arranged with FedEx to ship hemp plants. Prior to delivery, the FedEx driver turned the plants in to law enforcement, believing them to be marijuana. Law enforcement seized the plants and eventually arrested the consignee when he arrived to inquire about the plants. Evidently, the plants were never released even after determining they were hemp rather than marijuana. The shipper and consignee, individually and on behalf of their company, sued numerous individuals involved in the seizure of the plants, including FedEx. FedEx removed the lawsuit, which alleged various state law claims against FedEx, on the basis of Carmack preemption. The plaintiffs moved to remand, alleging the claims against FedEx did not arise out of the loss or damage to the cargo and that the complained-of actions were “separate and apart from the actual delivery” such that Carmack did not preempt its state law claims. The court disagreed, finding that Carmack covers a range of delivery issues, “embrac[ing] all damages resulting from any failure to discharge a carrier’s duty with respect to any part of the transportation to the agreed destination.” As such, it held all of plaintiff’s claims fell within Carmack’s preemptive scope.

COVERAGE

Erie Ins. Exch. v. Aral Constr. Corp., 2022 IL App (1st) 210628, C.A. No. 1-21-0628 (Ill. Ct. App. Dec. 27, 2022). The Illinois appellate court affirmed the trial court’s grant of summary judgment to a CGL insurer, finding the CGL insurer had no duty to defend or indemnify the insured in relation to an accident arising out of the use of an automobile. The court held the auto exclusion contained within the CGL policy was unambiguous, and the allegations of the operative complaint clearly fell within the confines of the auto exclusion.

Nat’l Liability & Fire Ins. Co. v. LAD Logistics, Inc., 2023 WL 22124, C.A. No. 20 C 3767 (N.D. Ill. Jan. 3, 2023). In this UIM insurance coverage dispute, the court found in favor of the insurer and ruled the plaintiff was not entitled to UIM coverage under the policy. At the time of the Accident, the insurer insured motor carrier LAD Logistics under a commercial auto liability policy providing $750,000 in UIM coverage. On the day of the accident, Lin was driving a truck owned by his “other employer” Win Win Seafood. Lin obtained $100,000 in damages from the at-fault’s liability coverage, $301,259.90 in workers’ compensation benefits under Win Win Seafood’s workers’ compensation policy, and $672,060.82 in UIM benefits under a Hartford policy issued to Win Win Seafood. Lin thereafter made a claim for UIM benefits under the LAD Logistics/Nat’l Liability policy. There was a factual dispute as to whether the truck Lin was operating was being operated pursuant to Win Win Seafood’s motor carrier authority or that of LAD Logistics. Lin claimed the tractor was a temporary substitute for a tractor insured under the LAD/Nat’l Liability policy, whereas National Liability presented evidence that Lin was working solely for Win Win Seafood at the time of the accident. The Subject Tractor was not scheduled on the LAD Logistics/Nat’l Liability policy. On the record, the court found that plaintiff Lin failed his burden to present evidence that would allow a reasonable factfinder to conclude the Subject Tractor was a temporary substitute for a covered auto under the LAD Logistics/Nat’l Liability policy. As such, it was not covered and therefore the LAD/Nat’l Liability policy did not provide UIM benefits.

McDonald v. Parada, 2023 WL 152237, Dkt. No. A-2494-20 (N.J. Super. Ct. Jan. 11, 2023). The New Jersey appellate court affirmed the trial court’s ruling that an insurer owed a duty to defend and award of attorneys’ fees to the insured under the policy. The insurance dispute arose out of a motor vehicle accident in which the plaintiff was struck by a wheel assembly that separated from the chassis of a passing tractor trailer. TRAC owned the chassis and NRT owned the tractor trailer. TRAC leased its chassis to NRT. On the date of the accident, Parada, an employee of NRT, drove the tractor trailer with the attached chassis. Prior to the accident, TRAC signed a Depot Agreement (Agreement) with AMS to repair, maintain, and periodically inspect TRAC’s chassis. Less than a month before the accident, AMS inspected the chassis that injured plaintiff. AMS agreed to indemnify and hold TRAC harmless for any liability arising out of AMS’s obligations under the Agreement. Further, the Agreement provided AMS was “solely liable for” losses, damages, costs, and legal fees “arising out of [AMS’s] storage, use, repair, or possession of [TRAC’s equipment] and arising out of [AMS’s] performance of th[e] Agreement. The Agreement also required AMS to maintain insurance “covering … all [e]quipment under [AMS’s] control.” AMS agreed to name TRAC as an additional insured under its insurance policy. AMS obtained the required insurance coverage from Darwin and named TRAC as an additional insured under the Darwin policy. The Darwin policy included a provision entitled “Coverage B [-] Contractual Liability Coverage.” Under Coverage B, Darwin agreed to provide coverage for liability arising out of “any oral or written contract or agreement relating to the conduct of [AMS’s] business.” After the accident, TRAC sought coverage under this section of the Darwin policy. The Darwin policy also contained an “Additional Insured” provision. The provision stated: “[a]ny person or organization to whom you become obligated to include as an additional insured under this policy, as a result of any contract or agreement you enter into which requires you to furnish insurance to that person or organization of the type provided by this policy, is an insured, but only with respect to liability arising out of your operations or premises owned by or rented to you.” Additionally, the Darwin policy included an endorsement, which specified its insurance was primary if the following conditions were met: 1) the liability arose out of work performed by AMS, and 2) the policy “is required of the insured by a written contract to provide coverage on a primary basis.” In the personal injury action, plaintiff asserted negligence claims against NRT, TRAC, and AMS. TRAC demanded that Darwin defend and indemnify it as an additional insured under the Darwin policy. Darwin refused. TRAC then filed a third-party complaint against Darwin asserting the Darwin policy afforded it insurance coverage for the personal injury claims. Under these facts, the court found TRAC was entitled to defense and indemnification under the Darwin policy. First, the court explained the Agreement specifically required AMS to indemnify TRAC “against any and all liability” related to AMS’s performance under the Agreement, which included inspection of TRAC’s chassis. Nowhere in the Agreement, or in the Darwin policy, was there any reciprocal indemnification requirement for TRAC to indemnify AMS. As such, the court rejected Darwin’s argument that for TRAC to qualify as an “insured” it must likewise have undertaken indemnification obligations in favor of AMS. Similarly, the court found TRAC qualified as an additional insured by endorsement, wherein the Darwin policy specifically named TRAC as an “additional insured” for “liability arising out of [AMS’s] operations,” which included servicing and inspecting TRAC’s chassis.

Wesco Ins. Co. v. Rich, 2023 WL 166418, C.A. No. 22-60283 (5th Cir. Jan. 12, 2023). In this case, the Fifth Circuit explained the distinction between coverage afforded under an insurance policy as compared with the surety obligation upon the insurer under a MCS 90 endorsement. It affirmed the lower court’s ruling that the insurer’s maximum liability under the MCS 90 endorsement was the stated limit in the endorsement of $750,000, not the $1,000,000 in coverage afforded under the policy (which did not apply under the circumstances).

Fielder v. Superior Mason Products, LLC, 2023 WL 146236, C.A. No. 5:21-cv-00432 (M.D. Ga. Jan. 10, 2023). The court held the tort plaintiff presented sufficient evidence to proceed with its claims against the motor carrier’s insurer under Georgia’s direct-action statute. The court found that the motor carrier defendants spoliated evidence, including trip documents, that would have established if the insured motor carrier was acting as such at the time of the loss. Accordingly, the court rejected the defendants’ arguments that the plaintiff would be unable to establish the putative motor carrier was operating as such at the time of the accident as required to trigger Georgia’s direct-action statute. It further noted that the putative motor carrier defendant owned commercial motor vehicles regulated by the FMCSRs and transported goods for hire. Thus, this was enough to proceed against the commercial auto liability insurer under Georgia’s direct-action statute.

BITCO Gen. Ins. Corp. v. Smith, 2022 WL 18229608, C.A. No. 20-00961 (W.D. Mo. Dec. 14, 2022). BITCO issued a commercial auto liability policy to KAT Excavation, which provided insurance to KAT and “anyone else while using with KAT’s permission a covered auto you hire or borrow.” KAT was the general contractor on a project at an airport, which included procuring and transporting a significant amount of rock. KAT arranged for the rock to be supplied by E&S. KAT transported some of the rock from E&S in its own trucks, driven by its own employees, but it had insufficient trucks to meet all its needs for the project. KAT therefore retained trucking companies to also haul rock for the project. One of the trucking companies that KAT hired was CWC, though no written contract was ever entered. The oral agreement provided CWC would be paid by KAT based upon the amount of rock hauled. KAT lacked control over the specific operation of the CWC truck or its driver, with its control limited to the place of pickup and delivery. An accident occurred while a CWC driver was operating a CWC truck en route to the airport while hauling rocks for the project. The coverage issues in dispute were whether the CWC truck was “hired” as defined under the BITCO policy and whether the CWC truck was being operated with the permission of KAT. Noting the lack of “control” over the CWC truck and its driver, the court found KAT had not “hired” the truck or driver. As such, the BITCO policy provided no coverage for the CWC truck or the accident.

Century Surety Co. v. Popelino’s Transp., Inc., 2023 WL 225630, C.A. No. 5:21-cv-01987 (C.D. Cal. Jan. 4, 2023). A CGL insurer was permitted to rescind an insurance policy it had issued based upon misrepresentations in the insured’s application for insurance. In the application, the insured, PTI, through its owner, indicated PTI’s business was “trucking company hauling construction building materials.” The insurance policy contained a Classification Limitation Endorsement, which strictly limited coverage to the classification and codes listed in the policy. The policy included only the Truckers classification code. Despite this, the owner of PTI evidently operated a separate green-waste recycling business (GWR) out of the same location. A fire broke out at the property, which spread to adjacent properties. The owners of the adjacent properties sued the owner and PTI for their damages. Citing California statutes, the court held an intentional or unintentional misrepresentation entitles an insurer to rescind an insurance policy provided that concealment is material—i.e., whether the concealed fact could reasonably influence the insurer in deciding whether to issue the policy, in evaluating the degree of the risk, or in calculating the appropriate premium. The court held that the record established PTI and GWR’s businesses worked together as one company from the same location. The court found the owner failed to disclose the recycling aspect of the business when he applied for insurance. The insurer offered evidence from an underwriter that had the true nature of the business been disclosed, it would not have issued the policy or would have charged additional premium. Faced with this, the court found the materiality element was met and the insurer was therefore entitled to rescind the policy and therefore owed no duty to defend or indemnify any individual or entity in connection with the fire or resulting lawsuits. The court also allowed the insurer to recoup its defense costs incurred while defending under a reservation of rights.

Prime Ins. Co. v. Wright, C.A. No. 22-1002 (7th Circ. Jan. 13, 2023). In this insurance coverage dispute, the Seventh Circuit Court of Appeals held the MCS 90 endorsement required the insurer to satisfy a default judgment entered against the motor carrier. Prior to the accident, the driver had begun his trip in South Holland, Illinois before dropping a load in Fort Wayne, Indiana. At the time of the accident, the driver was en route to pick up a load at another location, also in Fort Wayne, Indiana, with the ultimate delivery location being in Illinois. The insurer argued that under the “trip specific” approach, the driver was not presently engaged in interstate commerce at the time of the accident and therefore the MCS 90 was not triggered. In contrast, the tort plaintiff advocated for the “fixed intent of the shipper” or “totality of the circumstances” approach, both of which are broader. Citing the broad definition of transportation under § 13102(23)(B), the court held it was not necessary that the motor carrier actively be transporting freight to be engaged in interstate transportation. The court seemingly looked at the transportation “as a whole” from the beginning trip from Illinois to the ultimate destination, back in Illinois. It held “[t]he brief time that the truck was empty in Indiana is easily described as movement arranging for the interchange of property: loads must be picked up before they can be delivered.” As such, it found the MCS 90 was triggered even though the tractor-trailer was unladen at the precise time of the accident. In so holding, the court rejected adoption of either the “trip specific”, “fixed intent of the shipper” or “totality of the circumstances” approach. In its assessment, the court found “[a]ll we need to know is whether the collision occurred during an interstate journey to deliver freight or one of the steps mentioned in § 13102(23)(B).”

Benevento v. Auto-Owners Ins. Co., 2023 WL 245003, C.A. No. 21-1652 (4th Cir. Jan. 18, 2023). In an unpublished, and therefore non-precedential, ruling, the Fourth Circuit rejected a tort plaintiff’s argument that it was entitled to an additional $1,000,000 in coverage due to the involvement of both a truck and a trailer, both of which were owned by the insured and specifically-described on the insurance policy’s declarations page. The policy provided “The Limit of Insurance applicable to a trailer, non-motorized farm machinery or farm wagon which is connected to an auto covered by this policy shall be the limit of insurance applicable to such auto. The auto and connected trailer, non-motorized farm machinery or farm wagon are considered one auto and do not increase the Limit of Insurance.” The Policy also provided that “[t]he Limit of Insurance for this coverage may not be added to the limits for the same or similar coverage applying to other autos insured by this policy to determine the amount of coverage available for any one accident or covered pollution cost or expense, regardless of the number of … [c]overed autos” or “[v]ehicles involved in the accident.” The court held that when read together, the Policy language was not ambiguous and clearly provides for up to $1,000,000 in coverage for the scheduled Truck if it is involved in an accident; up to $1,000,000 in coverage for the scheduled Trailer if it is involved in an accident (such as disconnecting from a truck or rolling down a hill and causing an accident after it is disconnected and parked); and up to $1,000,000 in coverage if the Trailer is connected to the Truck at the time of the accident. Accordingly, despite the involvement of both the truck and trailer that were individually scheduled on the policy, the court held the plaintiff’s total recovery was only for $1,000,000, not $2,000,000 as plaintiff had argued.

Clear Blue Ins. Co. v. Fernandez, 2023 WL 222239, C.A. No. 1:22-cv-00038 (W.D. Tex. Jan. 17, 2023). In this insurance coverage declaratory judgment action, the court was tasked with deciding whether two related accidents constitute a single accident for purposes of the Limit of Insurance provision. Employees of a motor carrier were attempting to back a tractor-trailer into a private driveway that exited off the highway. As they were doing so, the tractor-trailer was positioned perpendicular to and completely blocking the highway. As this was occurring, a passenger van crashed into the passenger side of the tractor-trailer. While the two motor carrier employees were helping the occupants out of the passenger van, another vehicle struck the opposite side of the tractor-trailer, which still sat askew across the highway. The federal court abstained from reaching the issue, finding it was premature because the underlying state court tort actions remained pending. It noted that the issue of whether the act of blocking the roadway was the sole, proximate, uninterrupted, and continuing cause of both collisions—which would have to be decided in ruling on whether these were one accident or two accidents—had not yet been decided but should be decided in the underlying state court tort actions.

WORKERS COMPENSATION

No decisions to report.