Welcome to the unofficial start to summer!

As a veteran, Memorial Day holds a special place in my heart, as I’m sure it does with many of you. I hope everyone was able to enjoy some time with loved ones and took a few moments to appreciate and acknowledge the sacrifices of those who gave their life for our country. Even amid the issues and concerns of the current day, I was glad to see many Memorial Day events were able to be held with social distancing considerations taken into account. Please continue to take precautions to remain safe and healthy during this time. Hopefully, we’re getting to the end of it and we can return to some semblance of normal in the near future.

Live Training Sessions

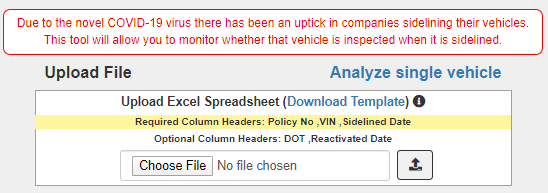

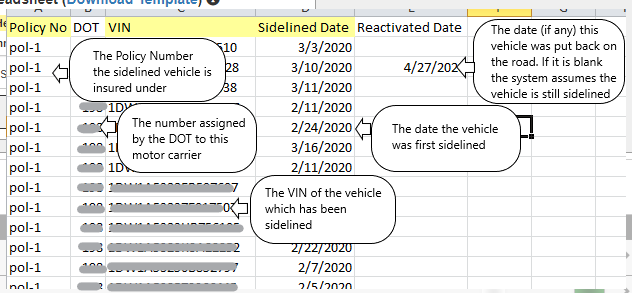

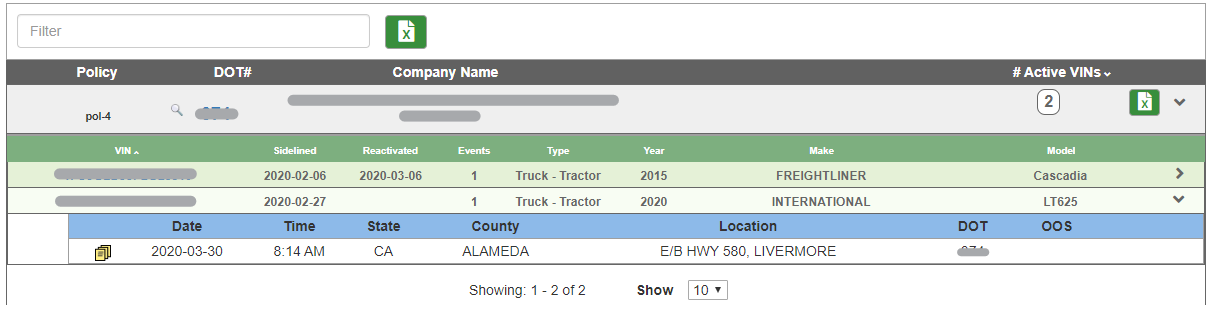

Our live training continues to have a great response from our users. Last month we previewed our New Sidelined Vehicle Auditor in the Bits & Pieces. The response to the Sidelined Vehicle Auditor has been fantastic and has seen in depth use by our insurance carrier subscribers. If you missed the webinar, it is available in the Tools menu under Webinars or by clicking here. This month we will present two new live trainings:

Tuesday, June 9th @ 12p EST: Chad Krueger & Jay Weinberg will provide a focused training session, hot topic: FMCSA’s New Crash Preventability Determination Program: Providing Clarity Using CAB’s BASICs Calculator™. The session will discuss the FMCSA’s new Crash Preventability Determination Program and how using the BASICs Calculator™, users can understand how removing eligible DOT Reportable Crashes will adjust a motor carrier’s Crash BASIC score.

Tuesday, June 16th @ 12p EST: Mike Severt will present on our reimagined SALEs™: Targeted Leads Generator. Some of you may have noticed that SALEs™ has recently sported an updated look. Don’t worry, everything you know and love is still there, but we’ve incorporated some new features as well.

Our focused training will be shorter and last 30 minutes, as we know your time is important. CAB subscribers can register for either session from our Webinars page or by logging in and clicking this link https://subscriber.cabadvantage.com/webinars.cfm

Please feel free to suggest focused training topics that you would like to see. We are looking forward to connecting with you during these sessions. Do not hesitate to ask questions!

Follow us at: CAB Linkedin Page CAB Facebook Page

CAB’s Tips & Tricks: Crash Preventability Determination Program (CPDP) Resources

Many are aware that the FMCSA recently released the updated Crash Preventability Determination Program (more below). A number of our users have reached out to better understand how CAB will be addressing Crashes that have been determined to be not-preventable once submitted via DataQ and reviewed. Ultimately, CAB’s data and user interface will adjust to reflect the crash determinations when they come through.

We’ve also had people ask us if CAB can determine what a motor carrier’s Crash BASIC would be if specific crashes were removed. This is of interest because it can help underwriters, agents, safety services and motor carriers understand the value in completing DataQs for crashes that fit within the 16 criteria eligible under the CPDP.

The CAB Report within the “Out of Service /SAFER” tab has included a Crash Determination column in the Accident Details for many months. With the CPDP, crashes occurring August 1, 2019 or later (and falling within the 15 criteria) are eligible for a non-preventable determination. CAB’s BASICs Calculator will allow you to remove potentially eligible crashes and recalculate what the Crash BASIC’s score would be based on the current 24 months of data. This is a great tool to get a clear understanding of what submitting a CPDP DataQ could do to adjust a motor Carrier’s Crash BASIC.

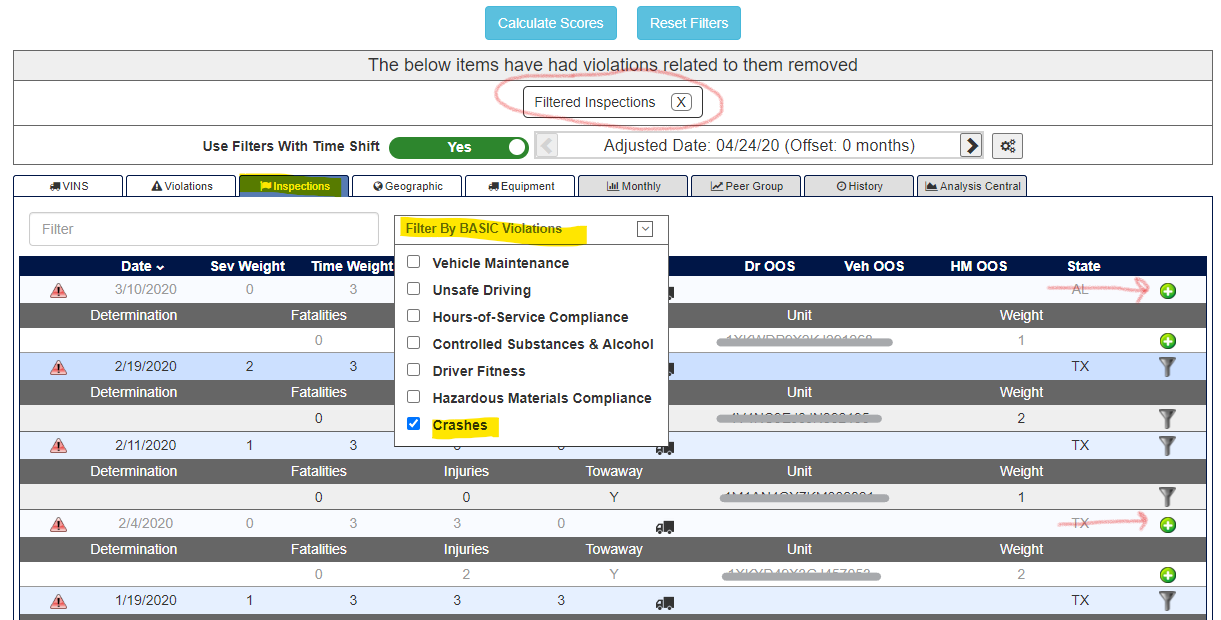

Using the BASICs Calculator™, proceed to the “Inspections Tab” and click the “Filter By BASIC Violations” dropdown and then check “Crashes.” You will now see only the Crashes for the motor carrier starting with the most recent crash. From there you can click on the filter icons to the far right to remove the crashes deemed by you to be eligible for the CPDP. Click “Calculate Scores” and the adjusted BASIC scores will appear above.

The FMCSA’s Crash Preventability Determination Program is a potential game changer for motor carrier Crash BASICs. We encourage you to use CAB’s BASIC Calculator™ to provide you and your motor carrier clients clarity regarding what removing non-preventable crashes will do to Crash BASICs Scores. If you don’t have access to the BASICs Calculator™, or if you have questions regarding the tool’s features, please feel free to reach out to CAB.

As with all of our tools & enhancements, we strive to present the data in a manner that will help provide additional clarity. We at CAB are constantly striving to improve our tools and resources to create value for our users. Please feel free to contact us directly if you have any suggestions as to how we can enhance our services. We are customer driven. Our goal is to help you Make Better Decisions!

THIS MONTH WE REPORT:

Impact of COVID-19 on Inspections and Violations: This month we have a guest contributor, Dovid Ribiat, our Senior Data Wizard, who is providing us with some insight on what effect COVID-19 is having on inspections.

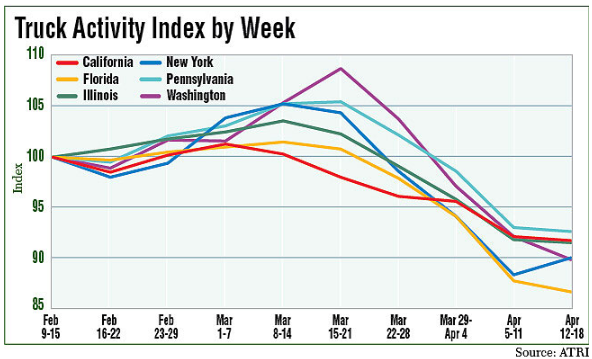

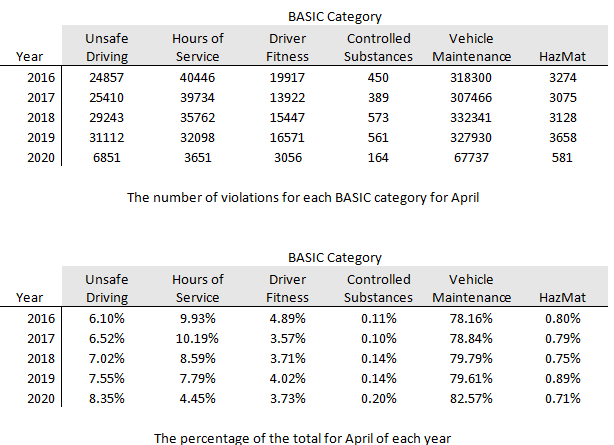

Whether due to a decrease in traffic or enforcement, we have seen an appreciable reduction in the number of inspections during the COVID-19 outbreak. Compared to the same months from last year, this March has seen around 33% fewer inspections and violations, while April has seen an even more drastic reduction of 77% for inspections and 80% for violations. For March, the violation rate (violations per inspection) remained about the same but for April it dropped from 1.39 to 1.21 (-13%). There is certainly variability between states; for example, while California inspections in April were down only 43% compared to last year and Minnesota was actually up 18%, Louisiana went from 3405 inspections down to 3 (-99.9%) and Hawaii went from 207 to 0.

Additionally, the reductions in violations from different BASICs were not the same. While Unsafe Driving, Driver Fitness, Vehicle Maintenance, and HazMat were all within a few points of the overall decrease (of 80%), Hours of Service was down 89% and Controlled Substances was down 71%. Looking at it from a different perspective, the proportion of Hours of Service violations out of all violations was 43% smaller than it was last April, while the proportion of Controlled Substances violations was 46% greater.

What does this all mean for the data? The good news is the system is designed to adjust for fluctuations and variations in the data through its methodology via the BASICs Percentiles. The tables below show the distribution of violations of the BASICs Categories for the last five years (for April).

FMCSA revises the hours of service (HOS) regulations to provide greater flexibility for drivers: The final rule was announced Thursday, May 14th and will go into effect 120 days after they’re published in the Federal Register, perhaps as soon as September 15th. The Agency: (1) expands the short-haul exception to 150 air-miles and allows a 14-hour work shift to take place as part of the exception; (2) expands the driving window during adverse driving conditions by up to an additional 2 hours; (3) requires a 30-minute break after 8 hours of driving time (instead of on-duty time) and allows an on-duty/not driving period to qualify as the required break; and (4) modifies the sleeper berth exception to allow a driver to meet the 10-hour minimum off-duty requirement by spending at least 7, rather than at least 8 hours of that period in the berth and a minimum off-duty period of at least 2 hours spent inside or outside of the berth, provided the two periods total at least 10 hours, and that neither qualifying period counts against the 14-hour driving window. For more information, click here.

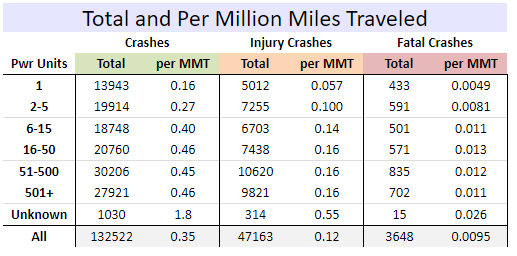

American Transportation Research Institute (ARTI) to Study Non-Nuclear Verdicts: Previously the organization had studied multi-million dollar Nuclear verdicts, but has shifted their main priority to the lesser awards this year. The findings are expected to be published in June according to ATRI President, Rebecca Brewster. Other research priorities for the year include: Rethinking Mileage-Based Safety Metrics, Owner-Operators/Independent Contractors in the Supply Chain, Cost-Benefit Analysis of Vehicle Miles Traveled Taxes and Impacts of Rising Insurance Costs on Industry Operational Costs. For more information on ATRI’s top research priorities for 2020, click here.

FMCSA Announces the Start of the Crash Preventability Determination Program (CPDP): Under this program, if a motor carrier has an eligible crash that occurred on or after August 1, 2019, the motor carrier may submit a Request for Data Review (RDR) with the required police accident report and other supporting documents, photos, or videos through the Agency’s DataQs website. The 16 types of eligible crashes are broken into ten main groups. (listed below).

Struck in the Rear type of crash when the CMV was struck: in the rear; or on the side at the rear.

Wrong Direction or Illegal Turns type of crash when the CMV was struck: by a motorist driving in the wrong direction; or by another motorist in a crash when a driver was operating in the wrong direction; or by a vehicle that was making a U-turn or illegal turn.

Parked or Legally Stopped type of crash when the CMV was struck: while legally stopped at a traffic control device (e.g., stop sign, red light or yield); or while parked, including while the vehicle was unattended.

Failure of the other vehicle to Stop type of crash when the CMV was struck: by a vehicle that did not stop or slow in traffic; or by a vehicle that failed to stop at a traffic control device.

Under the Influence type of crash when the CMV was struck: by an individual under the influence (or related violation, such as operating while intoxicated), according to the legal standard of the jurisdiction where the crash occurred, where the individual was charged or arrested, failed a field sobriety or other test, or refused to test; or by another motorist in a crash where an individual was under the influence (or related violation such as operating while intoxicated), according to the legal standard of the jurisdiction where the crash occurred, where the individual was charged or arrested, failed a field sobriety or other test, or refused to test.

Medical Issues, Falling Asleep or Distracted Driving type of crash when the CMV was struck: by a driver who experienced a medical issue which contributed to the crash; or by a driver who admitted falling asleep or admitted distracted driving (e.g., cellphone, GPS, passengers, other).

Cargo/Equipment/Debris or Infrastructure Failure type of crash when the CMV: was struck by cargo, equipment or debris (e.g., fallen rock, fallen trees, unidentifiable items in the road); or crash was a result of an infrastructure failure.

Animal Strike type of crash when the CMV: struck an animal.

Suicide type of crash when the CMV: struck an individual committing or attempting to commit suicide.

Rare or Unusual type of crash when the CMV: was involved in a crash type that seldom occurs and does not meet another eligible crash type (e.g., being struck by an airplane or skydiver or being struck by a deceased driver).

It is important to note that there are specific steps that need to be taken for the crash determination to be made. It is not an automatic process and the motor carrier will always need to complete a DataQ. Once submitted, the complete process is expected to take 60 days for the crash determination, either non-preventable or preventable, to be posted. The CAB Report® will identify and reflect any CPDP determinations that have been made. Keep in mind that 10 months (since August 1, 2019) of crashes are eligible for the CPDP program, so there is a good amount of crashes that will be eligible for review. The FMCSA has provided some very good resources including CPDP: Eligibility Guide, Submitter Guidel, FAQs, Presentation & Fact Sheet that can be used for internal education and sharing with motor carriers. For more information and resources on the FMCSA’s CPDP, click here.

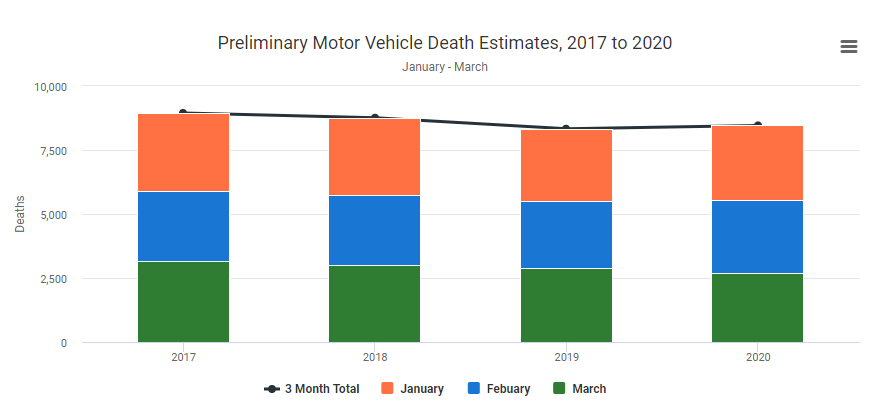

National Safety Council Calculates Monthly Preliminary Motor Vehicle Fatality Estimates: Because of COVID-19 related impacts, the number of miles driven in the first three months of 2020 decreased 5.4% compared to 2019. The number of miles driven in March 2020 decreased 18.6% compared to March 2019. Deaths for 2020 to date total 8,460. This preliminary estimate is up 2% compared to the first three months of 2019. Motor-vehicle deaths in March 2020 totaled 2,690. This preliminary estimate is down 8% from March 2019. However, because of the large decrease in miles driven, the monthly mileage death rates increased 14% compared to March 2019. This increase is in spite of the 8% decrease in deaths. The mileage death rate per 100 million vehicle miles driven for March 2020 is 1.22, compared to 1.07 in 2019. For more information on the NSC study, click here.

FMCSA’s Emergency Declaration Extended: As of May 13th, the FMCSA has extended the emergency declaration through June 15, 2020. This declaration applies to all fifty States and the District of Columbia and was originally issued on March 8th, 2020. The extension continues the exemption granted from Parts 390 through 399 of the Federal Motor Carrier Safety Regulations (FMCSRs) for drivers and trucks providing direct assistance in support of emergency relief efforts related to COVID-19 outbreaks. The complete declaration can be found here.

FMCSA Expands Remote Safety Compliance Reviews due to the COVID-19 Pandemic: In new guidance issued May 20, the agency said the off-site compliance reviews will “leverage all available technology to access information and records and thus limit exposure risk for the regulated community and safety investigators.” The expanded guidance is intended to provide clarity to motor carriers, FMCSA said. According to the agency, it will remain in effect until the revocation of the presidentially declared COVID-19 national emergency. The long and short of it is that Compliance Reviews are still being during the pandemic and perhaps even more efficiently. For more information on this Guidance, click here.

CASES

AUTO

Who is responsible for injuries incurred when the bands holding the cargo break, causing a shipment of pipe to fall on the driver in the middle of the night? The Eastern District of Pennsylvania considered that issue, concluding that summary judgment was not to be granted to the manufacturer, the shipper, the packing company, or the trucking company as too many questions remained to be resolved. The court did hold that there was no basis for a claim of punitive damages against the manufacturer of the bands or the trucking company that engaged the owner operator. Shipman v. Aquatherm, L.P., 2020 WIL 1984903

Similar questions were raised in the 10th District Court of Appeals in Ohio when a driver was involved in a one vehicle accident he claimed was caused because the shipper failed to lock the pins in the rear tandem axle. The court held that there were questions of fact as to the obligations of the shipper, reversing the trial court on that issue. As to the motor carrier who tendered the load to the defendant it was entitled to summary judgment. The court held that the vehicle was operated independently and was not placarded with the motor carriers information and therefore Ohio law did not recognize a cause of action against that motor carrier. Buroker v. Pratt Industries, 2020 WL 2216203

Believing that damages are in excess of the minimum required for diversity jurisdiction was not enough to allow a trucking company to keep a case in federal court. The Middle District of Florida remanded a personal injury action back to state court when the defendant could claim only that the plaintiff’s age and claim of permanent injury had to support a claim for damages in excess of $75,000. Willingham v. Callaway, 2020 WL 2466191

The Western District of Louisiana denied a motor carrier’s request for a new trial after it was hit with a jury verdict in the amount of $4,375,017.62. The court held that the jury was not improperly swayed by sympathy for the plaintiff and that the damages were reasonable in light of similar cases which reached similar verdicts. Hall v. Landstar Ranger, 2020 WL 2616241

The District Court in North Dakota dismissed an insurer’s claim that it has no obligation to defend a personal injury action involving a vehicle not listed in the policy. The court concluded that the tractor at issue was owned by an employee and used in the insured’s business and therefore was covered under the extension for non owned autos. The court stayed resolution of the issue of indemnity pending resolution of the state court litigation. United Financial Casualty Company v. Fila Mar Energy, 2020 WL 24755581

The passenger of a truck was not liable for injuries to the plaintiff when he stepped out of the vehicle to direct the tractor into a private driver and plaintiff ran into the trailer. The Eastern District of North Carolina also dismissed the punitive damages claim against the driver. Riley v. Cephas, 2020 WL 2441416

A truck rental company sought a declaration that, under the terms of its rental agreement, it only owned the driver and trucking company $20,000 in liability coverage and not the $750,000 financial responsibility required under Connecticut regulations which match the MCS-90. The District Court in Connecticut refused to read motor carrier obligations into the rental agreement, siding with the rental company. Penske Truck Leasing v. Safeco Insurance Co., 2020 WL 2615499

Plaintiff’s request to add a claim of punitive damages against a trucking company was permitted by the Eastern District of Pennsylvania. Plaintiff was able to support the amendment by claiming that the driver was operating outside of his permitted hours of operation which was alleged to be a practice condoned by the motor carrier. Gonzalez v. Seashore Fruit & Produce 2020 WL 2571101

The Northern District of Oklahoma granted summary judgment to a motor vehicle on a claim of negligent entrustment and also dismissed punitive damage claims against the motor carrier and the driver. The court held that the driver was not operating the vehicle outside hours and that his diabetes did not render him unable to operate a vehicle. Rimes v. MVT Services, 2020 WL 2559942

Under Alabama law, the torts of negligent hiring, training, and supervision all require a plaintiff to show that the employee was incompetent to operate a commercial vehicle and that the employer knew, or should have known, of this incompetence. The Northern District of Alabama held that a plaintiff had failed to meet that obligation when all facts pointed to his being a capable driver. Those causes of action were dismissed, although claims of negligence, wantonness and respondeat superior were permitted to proceed. Shows v. Redline Trucking, 2020 WL 2527105

The Court of Appeals in Michigan upheld the grant of summary judgment to a truck driver who suffered a black out, losing control of his vehicle and striking another truck, injuring that driver. The court agreed that the sudden emergency doctrine protected the driver. The fact that he had a pre existing heart condition was not relevant as he had received the appropriate certification to driver a semi. Price v. Austin, 2020 WL 2095993

Removal is still permissible when at least one of the defendants filed the petition in a timely manner. The Eastern District in Missouri held removal was proper when the first served defendant, the trucking company, consented to the removal subsequently filed by the driver. The court also held that the motor carrier was diverse from the plaintiff, despite plaintiff’s arguments that the motor carrier had significant contacts in plaintiff’s state of residence. Knop v. Salyers, 2020 WL 2556906

A trucking company was granted summary judgment on a claim for damages stemming from a fatal truck accident when the plaintiff could not establish a legal right to assert a wrongful death claim on behalf of the decedent.. Blue v. Hill, 2020 WL 2441417

Rebuttal experts are not there to address new issues so be careful to make sure you get the right info in at the start. In the Eastern District of Kentucky the court struck all of plaintiff’s rebuttal experts on medical issues On the trucking side the rebuttal experts were not permitted to address cell phone usage or failure to follow or adhere to relevant driver’s license safety practices as they were not addressed by the trucker’s direct expert. Aung v. State Farm Fire & Casualty Co., 2020 WL 2089823

You may recall last month that we reported on a decision in which the District Court in Indiana refused to allow a plaintiff to ask hypothetical questions of a driver. The plaintiff filed for reconsideration of the court’s decision, seeking to be able to ask hypothetical questions. The court denied the request again! Estate of McNamara v. Navar, 2020 WL 2214569

A plaintiff’s request to set aside a jury verdict was denied in the Third Division Appellate Court in New York. The jury had concluded that while a truck driver and its company were negligent, the negligence was not a substantial factor in causing the collision. The truck was struck by a vehicle which caused the driver to lose control, cross the median and get involved in another accident with the plaintiff. Holownia v. Caruso, 2020 WL 2477595

Interesting case in Florida involving a multi injury accident. The trucker’s excess insurer sought to intervene in the defense case when it only had $10.00 left for indemnity payments under the policy, seeking to tender that remaining amount. The Appellate Court held that the trial court did not abuse its discretion in not allowing the intervention. The court agreed that the insurers interest, namely to be done with the case, was not appropriate for intervention. Lexington Insurance Co. v. James, 2020 WL 2299946

The Western District in Texas held that personal injury claims against truck brokers are preempted under FAAAA. The court held that “claims such as Plaintiff’s, which seek “to enforce a duty of care related to how [the broker] arranged for a motor carrier to transport the shipment” and arise out of “a broker hiring a motor carrier (and any related investigations of that motor carrier)” are indeed claims “relating to … services of any … broker” and are thus preempted.” Zamorano v. Zyna, LLC, 2020 WL 2316061

On the other hand the Northern District of Texas remanded a case back to state court when a negligent hiring claim was asserted against a broker. The Court held that section 14501(c)(1) of FAAA did not preempt Plaintiffs’ negligence claim against the broker. The Court held that the safety regulation preemption exception in section 14501(c)(2) applies to negligent-hiring claims against brokers. With no preemption there was no federal court jurisdiction and the case went back to the state court. Lopez v. Amazon Logistics, Inc. 2020 WL 2065624

CARGO

The duty to defend is always an issue in cargo policies The Court of Appeals in Minnesota held that the option to defend was ambiguous and therefore would be held against the insurer. Pay attention to this decision as it is addressing common provisions under an industry MTC form. Miss. Welders Supply Co. v. Crane, 2020 Minn. App. Unpub. LEXIS 389

It is not often that we see cases addressing the venue provisions of the Carmack Amendment. This month the District Court in New Jersey dissected the statute, concluding that New Jersey was an improper venue for a rail shipment in New York. The court also concluded that the damages occurred in New York, not in the plaintiff’s business office, which was in NJ. The court also held that the plaintiff likely failed to comply with the claim notice requirements of the Carmack Amendment. In re Lizza Equipment Leasing, LLC, 2020 WL 2465284

A limitation of liability was upheld in the Southern District of Florida. Once again there was a chain of truck brokers before it finally got to the motor carrier. The last broker had a contract with the motor carrier which contained a limitation of liability. The court held that the contract was a waiver of the Carmack Amendment and that the shipper was bound by the contract entered into by the broker. Central Jersey Transport, LLC v. Global Aeroleasing, 2020 wl 2617897

We also rarely see cases on the suit clause under the Carmack Amendment. The Southern District in Texas denied a carrier’s claim that the suit was not filed within 2 years and one day of the written declination The court held that the denial was a contingent denial, not the clear, final, and unequivocal type of denial required to commence the limitations period. Be careful to make sure that your denial is explicit. JA Solar USA v. EP Expedited Transport, 2020 WL 2113616

Are you insuring Juran Express? The Eastern District in California granted a default judgment to the plaintiff for the nondelivery of a shipment of wine, including fees and interest. USA Truck, Inc v. Jugan Express, Inc. 2020 WL 2128386

WORKERS COMPENSATION

A worker’s compensation insurer was denied the right to intervene in a personal injury action in New Mexico for payments made under California worker’s compensation rules. The court held that the right to seek recovery for payments could only be asserted directly against the insured truck driver and not against the third party tortfeasor. Carrillo v. Central Trucking, Inc., 2020 WL 2112068

The Commonwealth Court of Pennsylvania upheld the denial of worker’s compensation benefits to an owner operator. The court agreed that the worker’s compensation judge correctly determined that the owner operator was not an employee of the motor carrier and the carrier did not exercise substantial control over his operations. Balczarek v. Workers Compensation Appeal Board (Evans Delivery), 2020 WL 2314972

A farm worker was unsuccessful in seeking worker’s compensation under a trucking operations policy in the Court of Appeals in Mississippi. The court held that the trucking company was not an alter ego of the farm where the petitioner worked and there was no other evidence that waived the farm labor exemption under Mississippi law. Yates v. Triple D, Inc., 2020 WL 2126829

Generally we see cases where the insurer is seeking increased premium after an audit. This month the District Court in Minnesota was considering discovery issues arising from the motor carrier’s claim that it was improperly charged because the insurer improperly applied debits. Good read to see how the process works and what information the court will allow released to the insurer to support its rate calculation. Stan Koch & Sons Trucking, Inc. v. American Interstate Ins. Co., 2020 WL 2111349